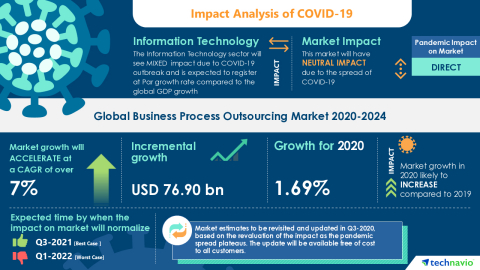

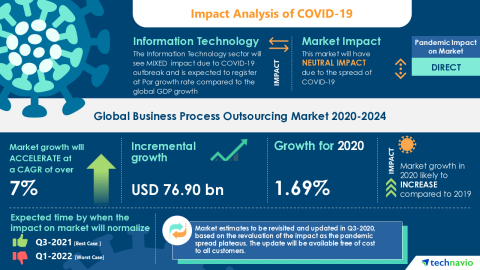

LONDON--(BUSINESS WIRE)--The business process outsourcing market will witness an incremental growth of USD 76.90 billion during 2020-2024, according to the latest pandemic recovery-based research report by Technavio. Factors such as imposition of worldwide lockdowns have partially halted operations and affected supply chains and logistics. This has further impacted economies around the globe, resulting in an overall slowdown during 2020. However, businesses are gradually carving out unique pathways to recover from the COVID-19 crisis. With the exemption of lockdowns, growing incorporation of active social distancing and remote working, and surging entries of players in digital marketplaces, various industry and market conditions are likely to improve by early 2021.

Get Free Business Process Outsourcing Market 2020-2024 Sample!

COVID-19 Highlights

- Information Technology industry will have Mixed impact due to the pandemic

- Business process outsourcing market is expected to witness Neutral growth during 2020-2024

- Information Technology Industry will witness Direct impact during the forecast period

- Business process outsourcing market growth is likely to Increase in 2020 compared to 2019 due to Positive YOY

Markets across the globe have faced the economic wrath of the pandemic and are dealing with uncertainties by banking on the online marketspace to reach out to a wider target audience. This business process outsourcing market research report encompasses all possible factors expected to drive the market growth and create opportunities for all the stakeholders in the supply chain. View detailed business process outsourcing market insights here: https://www.technavio.com/report/business process outsourcing market-industry-analysis

Key Business Process Outsourcing Market Research Findings

- A CAGR of over 7% is expected to be recorded in business process outsourcing market during 2020-2024

- IT and telecommunication will hold the largest market share. The business process outsourcing market share growth by the IT and telecommunication segment will be significant during the forecast period owing to technological advances, fast growth in data traffic, and growing demand for digital content and communication by consumers.

- North America will account for the highest incremental growth. Factors such as the rise in the adoption of advanced technologies such as cloud computing solutions, social media, AI, and RPA will significantly drive business process outsourcing market growth in this region over the forecast period.

- Focus on reducing operational costs will boost the business process outsourcing market growth

- Surging number of BPOs will have a positive impact on the business process outsourcing market

- Data breaches is likely to create hindrance for the business process outsourcing market

For accessing Technavio’s key findings on drivers, restraints, and opportunities shaping markets and industries toward an economic bounce back,

Sign up for 14-Day Free Trial of Technavio’s Subscription Platform

Business Process Outsourcing Market Vendor Participation Scenario

- Market is Fragmented

- Several leading companies in the market are focusing on restoring their economic activity

- Vendors are concentrating on growth prospects from fast-growing segments while retaining their positions in slow-growing segments.

- Prominent business process outsourcing market players are Accenture Plc, Automatic Data Processing Inc., Capgemini Services SAS, Infosys Ltd., International Business Machines Corp., NEC Corp., NTT DATA Corp., Tata Consultancy Services Ltd., Wipro Ltd., and ZTE Corp.

With more companies navigating the pandemic gradually, this research analysis can be personalized to create a recovery path for the market participants. Try out our $1000 Worth Free Report Customization by Speaking to our Analyst or Industry Expert

Key Considerations for Market Forecast

- Products and services used to manage or contain the spread of COVID-19 virus

- Products and services used for the treatment of COVID-19 virus

- Impact of lockdowns, supply chain disruptions, demand destruction, and change in customer behavior

- Optimistic, base case, and pessimistic scenarios for all markets as the impact of pandemic unfolds

- Pre- and post-COVID 19 market estimates

- Quarterly impact analysis as the spread reaches global level and updates on market estimates

Request for a FREE Sample on the Impact of COVID-19

Table of Contents:

Executive Summary

Market Landscape

- Market ecosystem

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019 - 2024

Five Forces Analysis

- Five Forces Analysis

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by End-user

- Market segments

- Comparison by End-user

- IT and telecommunication - Market size and forecast 2019-2024

- BFSI - Market size and forecast 2019-2024

- Retail - Market size and forecast 2019-2024

- Healthcare - Market size and forecast 2019-2024

- Others - Market size and forecast 2019-2024

- Market opportunity by End-user

Customer Landscape

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- North America - Market size and forecast 2019-2024

- Europe - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity by geography

- Volume driver- Demand led growth

- Market challenges

- Market trends

Vendor Landscape

- Vendor landscape

- Landscape disruption

Vendor Analysis

- Vendors covered

- Market positioning of vendors

- Accenture Plc

- Automatic Data Processing Inc.

- Capgemini Services SAS

- Infosys Ltd.

- International Business Machines Corp.

- NEC Corp.

- NTT DATA Corp.

- Tata Consultancy Services Ltd.

- Wipro Ltd.

- ZTE Corp.

Appendix

- Scope of the report

- Currency conversion rates for US$

- Research methodology

- List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.