E*TRADE Study Reveals Childcare Is a Major Retirement Savings Barrier for Parents Amid Pandemic

E*TRADE Study Reveals Childcare Is a Major Retirement Savings Barrier for Parents Amid Pandemic

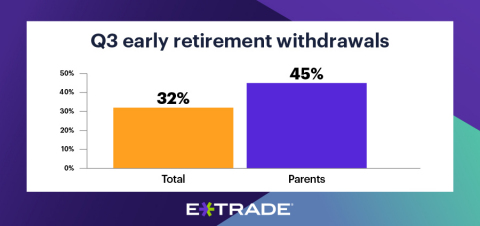

Parents are ~1.4x more likely than the total population to withdraw early from retirement accounts

ARLINGTON, Va.--(BUSINESS WIRE)--E*TRADE Financial Corporation (NASDAQ: ETFC) today announced results from the most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. Results indicate the pandemic may have a significant impact on parents’ retirement savings:

- Childcare is a major barrier to retirement. Nearly half of parents (46%) said childcare is a barrier to retirement—a 6 percentage point increase since Q1, before the pandemic, and 20 percentage points higher than the total population.

- Retirement preparedness dropped among parents. The percentage of parents who feel prepared to retire in the event of an unforeseen circumstance dropped 8 percentage points from the first quarter to 65%.

- And nearly half have made early retirement withdrawals. Almost half of parents (45%) have dipped into their retirement accounts early, compared to just 32% of the total population.

- Amid back to school, education is cited as the top reason to withdraw early. Nearly one in five parents (17%) who have taken early withdrawals from their retirement accounts note education costs as the top reason, compared to just 10% of the total population.

“It’s human nature for a parent to prioritize children over their own financial wellbeing, but in practice they can best help their children’s financial futures when they create a solid financial foundation for themselves,” said Deniz Ozgenc, Executive Director of Financial Product Management at E*TRADE Financial. “As we settle into the new normal, many families face new financial challenges, a lot of unknowns, and plenty to juggle. But retirement planning doesn’t need to take a backseat amid the chaos. Savings may seem like a monumental task but setting a little aside now on a consistent basis can set up a solid financial future for the whole family.”

Ms. Ozgenc offered additional guidance for parents planning for their financial futures:

- Surprise expenses abound—plan ahead. The pandemic may have caused a bump in the road when it comes to budgeting, and children can certainly add to unexpected expenses. Saving a little each week in an emergency fund can help—three to six months of living expenses is a good goal.

- Consider automatic investing. One way to build good financial habits is to set up automatic deposits into a retirement account. While you cannot control the market or your investing returns, you can control how much you add to your account. By enabling automatic investing, you can also reduce risk in your portfolio through dollar-cost averaging—potentially benefiting from the inevitable ups and downs of the market.

- Start saving for education now. The cost of education has skyrocketed in the last few decades, and though the future may be in limbo, history tells us that tuition will likely remain high. Funding a dedicated education account like a Coverdell Education Savings Account for children at a young age can help lessen the burden when the time comes and can potentially provide some tax advantages. And the power of compounding can be a tremendous asset for those with a long-term goal in mind.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from July 1 to July 9 of 2020 among an online US sample of 873 self-directed active investors who manage at least $10,000 in an online brokerage account. The women with children population is made up of 135 respondents this quarter. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.

About E*TRADE Financial and Important Notices

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are national federal savings banks (Members FDIC). More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

Automatic Investing and dollar-cost averaging do not ensure a profit or protect against loss in declining markets. Investors should consider their financial ability to continue their purchases through periods of low price levels.

E*TRADE Financial Corporation and its affiliates do not provide legal, accounting, or tax advice. Always consult your own legal, accounting, and tax advisors.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2020 E*TRADE Financial Corporation. All rights reserved.

E*TRADE Financial Corporation engages Dynata to program, field, and tabulate the study. Dynata provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.dynata.com.

Referenced Data

When it comes to your personal ability to save for retirement, how much of a barrier is each of the following? |

||||

|

TOTAL |

Parents |

||

Q1’20 |

Q3’20 |

Q1’20 |

Q3’20 |

|

Healthcare costs |

50% |

44% |

62% |

59% |

Rent or mortgage |

43% |

40% |

53% |

56% |

Education costs or paying down student loans |

34% |

33% |

54% |

54% |

Living expenses like food or utilities |

40% |

37% |

49% |

53% |

Childcare |

23% |

26% |

40% |

46% |

Retail shopping and/or eating at restaurants |

33% |

31% |

45% |

46% |

Wanting to live for today |

36% |

32% |

47% |

49% |

Having an older child live with you |

23% |

26% |

38% |

40% |

Having a parent live with you |

26% |

25% |

39% |

41% |

If you were forced to retire early for an unforeseen circumstance, how prepared do you feel financially? |

||||

|

TOTAL |

Parents |

||

Q1’20 |

Q3’20 |

Q1’20 |

Q3’20 |

|

Prepared |

75% |

73% |

73% |

65% |

Very prepared |

32% |

33% |

24% |

22% |

Somewhat prepared |

43% |

40% |

49% |

43% |

Neither prepared nor unprepared |

13% |

13% |

15% |

17% |

Somewhat unprepared |

8% |

10% |

8% |

11% |

Very unprepared |

4% |

4% |

4% |

7% |

Unprepared |

12% |

14% |

12% |

18% |

Have you ever taken out money from an IRA or 401(k) before the age of 59.5 and, if so, for what? |

||

|

TOTAL |

Parents |

Q3’20 |

Q3’20 |

|

Yes |

32% |

45% |

No, I have never taken out money from an IRA or 401(k) before the age of 59.5 |

68% |

55% |

Yes, to pay for education |

10% |

17% |

Yes, to make a large purchase |

12% |

15% |

Yes, for a medical emergency |

8% |

14% |

Yes, because I became unemployed |

9% |

12% |

Yes, to simply spend on myself or my family |

7% |

11% |

Yes, to spend on a vacation |

4% |

7% |

Contacts

E*TRADE Media Relations

646-521-4418

mediainq@etrade.com

E*TRADE Investor Relations

646-521-4406

IR@etrade.com