BOSTON--(BUSINESS WIRE)--Fidelity Investments’® 2020 College Savings Indicator Study finds American families continuing to grapple with how to pay for the rising cost of higher education. The study reveals 71% of parents are concerned about COVID-19’s impact on their ability to save for college and nearly one-third (32%) are not even sure what college will cost by the time their children enroll. Despite these hurdles, only 9% of parents plan to decrease contributions to their children’s college savings this year.

“In these challenging times, families are stretched even further to meet day-to-day needs, and many aspects of their lives, including college plans, are thrown into question,” said Melissa Ridolfi, vice president of Retirement and College Leadership at Fidelity Investments. “The pandemic college experience – which may mean learning virtually – is likely not what students and parents initially planned for when they began saving. While this new environment has many reconsidering where and how they use college savings, parents continue to recognize the value of a college education.”

Despite the pandemic, the study finds a record high 78% of parents have already put money away for college, substantially higher than the 58% who had started saving when the study first began in 2007. However, parents still fall short on funding their college savings goals; while parents hope to pay for 65% of their children’s college education, they are only on track to cover 33% of that goal (up from 28% in 2018).

As the Pandemic Reshapes Education, Families Say They Still Believe College is Worth the Cost

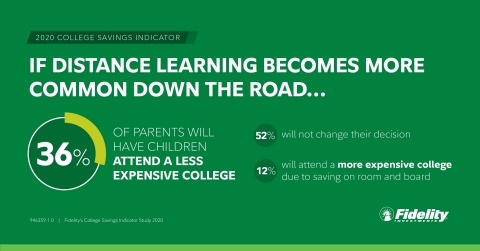

With families across the country coping with disruptions to education, less than one-third (31%) say their children are confident heading into fall 2020, and 20% say their children are “anxious” or “uncertain.” Two-thirds of parents believe that in-person instruction is best for their child’s learning, indicating that the pandemic’s shift to virtual or hybrid models is a concern for many families. If distance learning becomes more common down the road, 36% of parents say they will have their child attend a less expensive college since they would not want to pay full tuition for virtual classes.

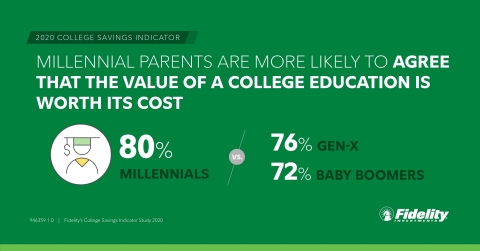

Despite this uncertainty, more than three-quarters (77%) of parents agree college is worth its cost, and 81% of parents believe their children feel this way. More than half (52%) of parents say a shift to distance learning won’t impact college decisions in the long-term.

How Families Can Plan, and Adjust Their Plans, In Times of Crisis

During these uncertain times, having a financial plan to achieve college savings goals is more critical than ever, yet the study reveals only 60% of parents who hope to pay for at least some of their children’s college education currently have a plan in place. Parents who prefer to build a roadmap on their own may consider using online resources, such as Fidelity’s Planning and Guidance Center, which offers a comprehensive financial tool to help families balance saving for the cost of college with other priorities.

For those who prefer input from others in their planning process, financial professionals can play an important role. Approximately eight-in-ten people with a financial advisor say working with a professional provides them greater peace of mind about the college planning process, and 71% say they are closer to their goal thanks to their advisor.

“Whether college is one, five or 10 years from now, it’s important advisors and families work together to create and feel confident about their college saving plans,” said Ron Hazel, senior director of Fidelity Advisor 529 and individual retirement products. “Communication is key in helping families understand their goals and expectations for college, and it’s encouraging to see advisors are helping start the conversation. With many families feeling particularly uncertain about the future at this time, advisors can initiate important discussions with families about what they envision for their college experiences, and how that fits with their college savings plans.”

529 Plans Help Families Prepare for College, Improving Savings Outlook

The study reveals setting aside money in a dedicated 529 savings account is correlated with better outcomes for college savings; in fact, 529 owners are on track to cover 46% of their college savings goals, while those without a 529 are only on track to meet 24% of their goals. Nearly half (48%) of parents surveyed have opened a 529 college savings account, a record high since the study began over a decade ago.

“Without the right tools in place, parents can fall short of their college savings goals,” said Ridolfi. “A 529 college savings account can help parents dedicate dollars to the specific goal of funding their children’s education. Particularly in light of the financial stress facing families today, it is important for parents to know that these plans continue to become more flexible as it relates to what is included in the definition of qualified distributions; recent legislation expanded the definition of a qualified distribution to include certain apprenticeship costs, K-12 education, and student loan repayment up to $10,000.”

Additional Findings and Resources for College Savers:

- Fidelity’s more than 200 nationwide investor centers can provide college planning guidance within the context of your family’s life and financial goals, and dedicated college planning representatives are available at 800-544-1914.

- Among the 9% of parents planning to decrease contributions to college savings this year, COVID-19 concerns, unemployment, and market volatility were top drivers of the change. More on how parents are approaching college savings during the pandemic.

- Nearly three-quarters (73%) of parents identify concerns about student loan debt as a motivating factor in saving for their children’s college education. Yet parents underestimate the student debt children will incur, estimating their children will graduate with an average of $24,900 in student loan debt, while the nationwide average for a student graduating today is 16% higher at $29,0001. To help families understand the true cost of student loan debt, Fidelity offers this free Student Debt Tool: Fidelity.com/studentdebt

- Parents expect their children to have saved a median of $5,000 by the time they graduate high school. Even so, 51% of parents have not yet talked to their children about saving and paying for college. This three-minute video can help start the conversation.

The full study results are available here: go.fidelity.com/csi2020

About the Fidelity Investments 2020 College Savings Indicator Study

As part of the study, Fidelity conducted a survey of parents with college-bound children of all ages. Parents provided data on their current and projected household asset levels including college savings, use of an investment advisor and general expectations and attitudes toward financing their children's college education. Using Fidelity's proprietary asset-liability modeling engine, the company was able to calculate future college savings levels per household against anticipated college costs. The results provided insight into the financial challenges parents face in saving for college. Data for the Indicator (number of children in household, time to matriculation, school type, current savings and expected future contributions) was collected by Boston Research Technologies, an independent research firm, through an online survey from June 5 – July 2, 2020 of 1,790 families nationwide with children aged 18 and younger who are expected to attend college. The survey respondents had household incomes of at least $30,000 a year or more and were the financial decision makers in their household. College costs were sourced from the College Board's Trends in College Pricing 2019. Future assets per household were computed by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser and a Fidelity Investments company. Within Fidelity’s asset-liability model, Monte Carlo simulations were used to estimate future assets at a 75 percent confidence level. The results of the College Savings Indicator may not be representative of all parents and students meeting the same criteria as those surveyed for the study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $9.0 trillion, including discretionary assets of $3.5 trillion as of August 31, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 32 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 45,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online. Read it carefully before you invest or send money.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 0211

946002.1.0

© 2020 FMR LLC. All rights reserved.

1Source: The College Board, Trends in Student Aid 2019