SIMI VALLEY, Calif.--(BUSINESS WIRE)--AeroVironment, Inc. (NASDAQ: AVAV), a global leader in unmanned aircraft systems (UAS), today reported financial results for its first quarter ended August 1, 2020.

“We are on track to achieve our fiscal year 2021 plans and deliver another year of profitable top line growth, despite the COVID-19 pandemic and its unprecedented impact on the global economy. We delivered $87.5 million in revenue and $0.42 diluted earnings per share in our first quarter, consistent with our plan,” said Wahid Nawabi, AeroVironment president and chief executive officer. “Our outstanding team continues to deliver results and extend our global market leadership position. During the quarter, our team successfully completed the fourth flight test of the Sunglider HAPS system and performed successful demonstrations of our larger Switchblade variant, which is designed to address a much larger segment of the legacy missile market.”

“We remain well positioned to continue creating shareholder value in the near- and long-term. With the unwavering support of our employees and a laser focus on achieving our financial and operational objectives, we are confident we will emerge from this pandemic as an even stronger company,” Mr. Nawabi added.

FISCAL 2021 FIRST QUARTER RESULTS

Revenue for the first quarter of fiscal 2021 was $87.5 million, an increase of 1% from the first quarter of fiscal 2020 revenue of $86.9 million. The increase in revenue was due to an increase in service revenue of $8.0 million, partially offset by a decrease in product sales of $7.5 million.

Gross margin for the first quarter of fiscal 2021 was $35.4 million, a decrease of 14% from the first quarter of fiscal 2020 gross margin of $41.3 million. The decrease in gross margin was primarily due to a decrease in product margin of $9.2 million, partially offset by an increase in service margin of $3.3 million. As a percentage of revenue, gross margin decreased to 40% from 47%. The decrease in gross margin percentage was primarily due to a decrease in the proportion of product sales to total revenue and an unfavorable product mix.

Income from operations for the first quarter of fiscal 2021 was $12.3 million, a decrease of $6.6 million from the first quarter of fiscal 2020 income from operations of $18.9 million. The decrease in income from operations was primarily a result of a decrease in gross margin of $5.9 million and an increase in research and development (“R&D”) expense of $2.4 million, partially offset by a decrease in selling, general and administrative (“SG&A”) expense of $1.7 million.

Other income, net, for the first quarter of fiscal 2021 was $0.2 million, as compared to $1.7 million for the first quarter of fiscal 2020. The decrease in other income, net was primarily due to a decrease in interest income resulting from a decrease in the average interest rates earned on our investment portfolio.

Provision for income taxes for the first quarter of fiscal 2021 was $1.2 million, as compared to $2.1 million for the first quarter of fiscal 2020. The decrease in provision for income taxes was primarily due to the decrease in income before income taxes.

Equity method investment loss, net of tax, for the first quarter of fiscal 2021 was $1.3 million, as compared to $1.3 million for the first quarter of fiscal 2020, and was primarily associated with our investment in the HAPSMobile, Inc. joint venture, formed in December 2017.

Net income attributable to AeroVironment for the first quarter of fiscal 2021 was $10.1 million, as compared to $17.1 million for the first quarter of fiscal 2020.

Earnings per diluted share attributable to AeroVironment for the first quarter of fiscal 2021 was $0.42, as compared to $0.71 for the first quarter of fiscal 2020.

Non-GAAP earnings per diluted share was $0.44 for the first quarter of fiscal 2021, as compared to $0.74 for the first quarter of fiscal 2020.

BACKLOG

As of August 1, 2020, funded backlog (remaining performance obligations under firm orders for which funding is currently appropriated to us under a customer contract) was $154.4 million, as compared to $208.1 million as of April 30, 2020.

FISCAL 2021 — OUTLOOK FOR THE FULL YEAR

For fiscal 2021, the Company continues to expect to generate revenue between $390 million and $410 million, operating margin of between 12% and 12.5%, and earnings per diluted share of $1.65 to $1.85. This financial guidance assumes approximately 7% ownership of the HAPSMobile joint venture. The Company expects non-GAAP earnings per diluted share, which excludes amortization of acquired intangible assets, to be between $1.74 and $1.94.

The foregoing estimates are forward-looking and reflect management's view of current and future market conditions, including certain assumptions with respect to our ability to obtain and retain government contracts, changes in the timing and/or amount of government spending, changes in the demand for our products and services, activities of competitors, changes in the regulatory environment, and general economic and business conditions in the United States and elsewhere in the world. Investors are reminded that actual results may differ materially from these estimates.

CONFERENCE CALL AND PRESENTATION

In conjunction with this release, AeroVironment, Inc. will host a conference call today, Wednesday, September 9, 2020, at 1:30 pm Pacific Time that will be webcast live. Wahid Nawabi, president and chief executive officer, Kevin P. McDonnell, chief financial officer and Steven A. Gitlin, chief marketing officer and vice president of investor relations, will host the call.

4:30 PM ET

3:30 PM CT

2:30 PM MT

1:30 PM PT

Investors may dial into the call by using the following telephone numbers, (877) 561-2749 (U.S.) or (678) 809-1029 (international) and providing the conference ID 7154976 five to ten minutes prior to the start time to allow for registration.

Investors with Internet access may listen to the live audio webcast via the Investor Relations page of the AeroVironment, Inc. website, http://investor.avinc.com. Please allow 15 minutes prior to the call to download and install any necessary audio software.

A supplementary investor presentation for the first fiscal quarter 2021 can be accessed at https://investor.avinc.com/events-and-presentations.

Audio Replay Options

An audio replay of the event will be archived on the Investor Relations page of the company's website, at http://investor.avinc.com. The audio replay will also be available via telephone from Wednesday, September 9, 2020, at approximately 4:30 p.m. Pacific Time through September 16, 2020, at 4:30 p.m. Pacific Time. Dial (855) 859-2056 (U.S.) or (404) 537-3406 (international) and provide the conference ID 7154976.

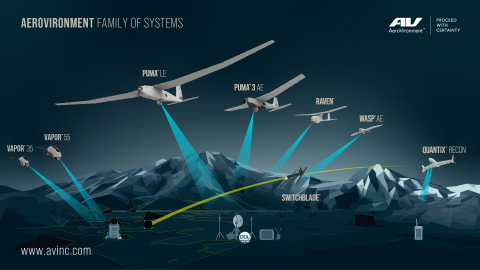

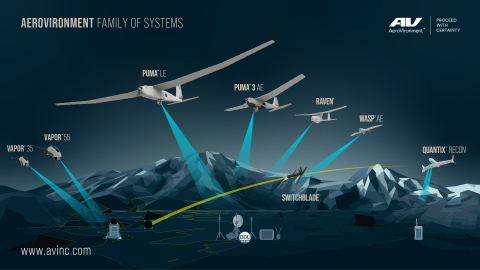

ABOUT AEROVIRONMENT, INC.

AeroVironment (NASDAQ: AVAV) provides technology solutions at the intersection of robotics, sensors, software analytics and connectivity that deliver more actionable intelligence so you can proceed with certainty. Celebrating 50 years of innovation, AeroVironment is a global leader in unmanned aircraft systems and tactical missile systems, and serves defense, government and commercial customers. For more information, visit www.avinc.com.

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” or words or phrases with similar meaning. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements.

Factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, reliance on sales to the U.S. government; availability of U.S. government funding for defense procurement and R&D programs; changes in the timing and/or amount of government spending; our ability to perform under existing contracts and obtain new contracts; risks related to our international business, including compliance with export control laws; potential need for changes in our long-term strategy in response to future developments; the extensive regulatory requirements governing our contracts with the U.S. government and international customers; the consequences to our financial position, business and reputation that could result from failing to comply with such regulatory requirements; unexpected technical and marketing difficulties inherent in major research and product development efforts; the impact of potential security and cyber threats; changes in the supply and/or demand and/or prices for our products and services; the activities of competitors and increased competition; failure of the markets in which we operate to grow; uncertainty in the customer adoption rate of commercial use unmanned aircraft systems; failure to remain a market innovator and create new market opportunities; changes in significant operating expenses, including components and raw materials; failure to develop new products; the extensive regulatory requirements governing our contracts with the U.S. government; risk of litigation, including but not limited to pending litigation arising from the sale of our EES business; the impact of our recent acquisition of Pulse Aerospace, LLC and our ability to successfully integrate it into our operations; product liability, infringement and other claims; changes in the regulatory environment; the impact of the outbreak related to the strain of coronavirus known as COVID-19 on our business operations; and general economic and business conditions in the United States and elsewhere in the world. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise.

NON-GAAP MEASURES

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), this earnings release also contains a non-GAAP financial measure. See in the financial tables below the calculation of this measure, the reasons why we believe this measure provides useful information to investors, and a reconciliation of this measure to the most directly comparable GAAP measures.

AeroVironment, Inc. Consolidated Statements of Operations (Unaudited) (In thousands except share and per share data) |

|||||||||

|

|

|

|

|

|

|

|

||

|

|

Three Months Ended |

|

||||||

|

|

August 1, |

|

July 27, |

|

||||

|

|

2020 |

|

2019 |

|

||||

Revenue: |

|

|

|

|

|

|

|

||

Product sales |

|

$ |

58,357 |

|

|

$ |

65,839 |

|

|

Contract services |

|

|

29,093 |

|

|

|

21,072 |

|

|

|

|

|

87,450 |

|

|

|

86,911 |

|

|

Cost of sales: |

|

|

|

|

|

|

|

||

Product sales |

|

|

32,084 |

|

|

|

30,408 |

|

|

Contract services |

|

|

19,955 |

|

|

|

15,231 |

|

|

|

|

|

52,039 |

|

|

|

45,639 |

|

|

Gross margin: |

|

|

|

|

|

|

|

||

Product sales |

|

|

26,273 |

|

|

|

35,431 |

|

|

Contract services |

|

|

9,138 |

|

|

|

5,841 |

|

|

|

|

|

35,411 |

|

|

|

41,272 |

|

|

Selling, general and administrative |

|

|

12,011 |

|

|

|

13,668 |

|

|

Research and development |

|

|

11,103 |

|

|

|

8,709 |

|

|

Income from operations |

|

|

12,297 |

|

|

|

18,895 |

|

|

Other income: |

|

|

|

|

|

|

|

||

Interest income, net |

|

|

208 |

|

|

|

1,329 |

|

|

Other income, net |

|

|

33 |

|

|

|

355 |

|

|

Income before income taxes |

|

|

12,538 |

|

|

|

20,579 |

|

|

Provision for income taxes |

|

|

1,207 |

|

|

|

2,133 |

|

|

Equity method investment loss, net of tax |

|

|

(1,288 |

) |

|

|

(1,347 |

) |

|

Net income |

|

|

10,043 |

|

|

|

17,099 |

|

|

Net loss attributable to noncontrolling interest |

|

|

37 |

|

|

|

11 |

|

|

Net income attributable to AeroVironment, Inc. |

|

$ |

10,080 |

|

|

$ |

17,110 |

|

|

Net income per share attributable to AeroVironment, Inc. |

|

|

|

|

|

|

|

||

Basic |

|

$ |

0.42 |

|

|

$ |

0.72 |

|

|

Diluted |

|

$ |

0.42 |

|

|

$ |

0.71 |

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

||

Basic |

|

|

23,893,001 |

|

|

|

23,745,199 |

|

|

Diluted |

|

|

24,186,228 |

|

|

|

24,069,933 |

|

|

AeroVironment, Inc. Consolidated Balance Sheets (In thousands except share data) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

August 1, |

|

April 30, |

|

|||

|

|

2020 |

|

2020 |

|

|||

|

|

(Unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

246,839 |

|

|

$ |

255,142 |

|

Short-term investments |

|

|

71,334 |

|

|

|

47,507 |

|

Accounts receivable, net of allowance for doubtful accounts of $1,054 at August 1, 2020 and $1,190 at April 30, 2020 |

|

|

43,357 |

|

|

|

73,660 |

|

Unbilled receivables and retentions |

|

|

73,791 |

|

|

|

75,837 |

|

Inventories |

|

|

45,530 |

|

|

|

45,535 |

|

Prepaid expenses and other current assets |

|

|

5,941 |

|

|

|

6,246 |

|

Total current assets |

|

|

486,792 |

|

|

|

503,927 |

|

Long-term investments |

|

|

20,338 |

|

|

|

15,030 |

|

Property and equipment, net |

|

|

22,907 |

|

|

|

21,694 |

|

Operating lease right-of-use assets |

|

|

13,612 |

|

|

|

8,793 |

|

Deferred income taxes |

|

|

5,262 |

|

|

|

4,928 |

|

Intangibles, net |

|

|

12,928 |

|

|

|

13,637 |

|

Goodwill |

|

|

6,340 |

|

|

|

6,340 |

|

Other assets |

|

|

9,640 |

|

|

|

10,605 |

|

Total assets |

|

$ |

577,819 |

|

|

$ |

584,954 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

11,740 |

|

|

$ |

19,859 |

|

Wages and related accruals |

|

|

13,025 |

|

|

|

23,972 |

|

Customer advances |

|

|

5,725 |

|

|

|

7,899 |

|

Current operating lease liabilities |

|

|

4,478 |

|

|

|

3,380 |

|

Income taxes payable |

|

|

2,620 |

|

|

|

1,065 |

|

Other current liabilities |

|

|

8,735 |

|

|

|

10,778 |

|

Total current liabilities |

|

|

46,323 |

|

|

|

66,953 |

|

Non-current operating lease liabilities |

|

|

10,344 |

|

|

|

6,833 |

|

Other non-current liabilities |

|

|

243 |

|

|

|

250 |

|

Liability for uncertain tax positions |

|

|

1,017 |

|

|

|

1,017 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value: |

|

|

|

|

|

|

|

|

Authorized shares—10,000,000; none issued or outstanding at August 1, 2020 and April 30, 2020 |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value: |

|

|

|

|

|

|

|

|

Authorized shares—100,000,000 |

|

|

|

|

|

|

|

|

Issued and outstanding shares—24,104,564 shares at August 1, 2020 and 24,063,639 shares at April 30, 2020 |

|

|

2 |

|

|

|

2 |

|

Additional paid-in capital |

|

|

181,406 |

|

|

|

181,481 |

|

Accumulated other comprehensive income |

|

|

351 |

|

|

|

328 |

|

Retained earnings |

|

|

338,170 |

|

|

|

328,090 |

|

Total AeroVironment, Inc. stockholders’ equity |

|

|

519,929 |

|

|

|

509,901 |

|

Noncontrolling interest |

|

|

(37 |

) |

|

|

— |

|

Total equity |

|

|

519,892 |

|

|

|

509,901 |

|

Total liabilities and stockholders’ equity |

|

$ |

577,819 |

|

|

$ |

584,954 |

|

AeroVironment, Inc. Consolidated Statements of Cash Flows (Unaudited) (In thousands) |

|||||||||

|

|

|

|

|

|

|

|

||

|

|

Three Months Ended |

|

||||||

|

|

August 1, |

|

July 27, |

|

||||

|

|

2020 |

|

2019 |

|

||||

Operating activities |

|

|

|

|

|

|

|||

Net income |

|

$ |

10,043 |

|

|

$ |

17,099 |

|

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

2,779 |

|

|

|

2,079 |

|

|

Losses from equity method investments |

|

|

1,288 |

|

|

|

1,347 |

|

|

Realized gain from sale of available-for-sale investments |

|

|

(11 |

) |

|

|

— |

|

|

Provision for doubtful accounts |

|

|

(136 |

) |

|

|

11 |

|

|

Other non-cash expense |

|

|

— |

|

|

|

32 |

|

|

Non-cash lease expense (income) |

|

|

1,190 |

|

|

|

(251 |

) |

|

Loss on foreign currency transactions |

|

|

1 |

|

|

|

1 |

|

|

Deferred income taxes |

|

|

(339 |

) |

|

|

(349 |

) |

|

Stock-based compensation |

|

|

1,595 |

|

|

|

1,566 |

|

|

Loss (gain) on sale of property and equipment |

|

|

2 |

|

|

|

(75 |

) |

|

Amortization of debt securities |

|

|

(43 |

) |

|

|

(527 |

) |

|

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

||

Accounts receivable |

|

|

30,439 |

|

|

|

(11,557 |

) |

|

Unbilled receivables and retentions |

|

|

2,046 |

|

|

|

5,112 |

|

|

Inventories |

|

|

5 |

|

|

|

(1,946 |

) |

|

Income tax receivable |

|

|

— |

|

|

|

821 |

|

|

Prepaid expenses and other assets |

|

|

324 |

|

|

|

(616 |

) |

|

Accounts payable |

|

|

(7,338 |

) |

|

|

(5,110 |

) |

|

Other liabilities |

|

|

(15,004 |

) |

|

|

(4,524 |

) |

|

Net cash provided by operating activities |

|

|

26,841 |

|

|

|

3,113 |

|

|

Investing activities |

|

|

|

|

|

|

|

||

Acquisition of property and equipment |

|

|

(4,067 |

) |

|

|

(1,902 |

) |

|

Equity method investments |

|

|

(1,173 |

) |

|

|

(4,569 |

) |

|

Business acquisition, net of cash acquired |

|

|

— |

|

|

|

(18,641 |

) |

|

Proceeds from sale of property and equipment |

|

|

— |

|

|

|

81 |

|

|

Redemptions of held-to-maturity investments |

|

|

— |

|

|

|

65,035 |

|

|

Purchases of held-to-maturity investments |

|

|

— |

|

|

|

(70,463 |

) |

|

Redemptions of available-for-sale investments |

|

|

41,727 |

|

|

|

— |

|

|

Purchases of available-for-sale investments |

|

|

(69,961 |

) |

|

|

(2,693 |

) |

|

Net cash used in investing activities |

|

|

(33,474 |

) |

|

|

(33,152 |

) |

|

Financing activities |

|

|

|

|

|

|

|

||

Tax withholding payment related to net settlement of equity awards |

|

|

(1,756 |

) |

|

|

(668 |

) |

|

Exercise of stock options |

|

|

86 |

|

|

|

93 |

|

|

Net cash used in financing activities |

|

|

(1,670 |

) |

|

|

(575 |

) |

|

Net decrease in cash, cash equivalents, and restricted cash |

|

|

(8,303 |

) |

|

|

(30,614 |

) |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

255,142 |

|

|

|

172,708 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

246,839 |

|

|

$ |

142,094 |

|

|

Supplemental disclosures of cash flow information |

|

|

|

|

|

|

|

||

Cash refunded (paid), net during the period for: |

|

|

|

|

|

|

|

||

Income taxes |

|

$ |

10 |

|

|

$ |

(294 |

) |

|

Non-cash activities |

|

|

|

|

|

|

|

||

Unrealized loss on investments, net of deferred tax expense of $4 for the three months ended August 1, 2020 |

|

$ |

52 |

|

|

$ |

— |

|

|

Change in foreign currency translation adjustments |

|

$ |

75 |

|

|

$ |

169 |

|

|

Acquisitions of property and equipment included in accounts payable |

|

$ |

643 |

|

|

$ |

1,253 |

|

|

AeroVironment, Inc. Reconciliation of non-GAAP Earnings per Diluted Share (Unaudited) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

||

|

|

August 1, 2020 |

|

July 27, 2019 |

||

|

|

|

|

|

|

|

Earnings per diluted share |

|

$ |

0.42 |

|

$ |

0.71 |

Acquisition related expenses |

|

|

— |

|

|

0.01 |

Amortization of acquired intangible assets |

|

|

0.02 |

|

|

0.02 |

Earnings per diluted share as adjusted (Non-GAAP) |

|

$ |

0.44 |

|

$ |

0.74 |

Reconciliation of Forecasted Earnings per Diluted Share (Unaudited) |

|||

|

|

|

|

|

|

|

|

|

|

Fiscal year ending |

|

|

|

April 30, 2021 |

|

Forecasted earnings per diluted share |

|

$ |

1.65 - 1.85 |

Amortization of acquired intangible assets |

|

|

0.09 |

Forecasted earnings per diluted share as adjusted (Non-GAAP) |

|

$ |

1.74 - 1.94 |

Statement Regarding Non-GAAP Measures

The non-GAAP measure set forth above should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies. Management believes that this measure provides useful information to investors by offering additional ways of viewing our results that, when reconciled to the corresponding GAAP measure, help our investors to understand the long-term profitability trends of our business and compare our profitability to prior and future periods and to our peers. In addition, management uses this non-GAAP measure to measure our operating and financial performance.

We exclude the acquisition-related expenses and amortization of acquisition-related intangible assets because we believe this facilitates more consistent comparisons of operating results over time between our newly acquired and existing businesses, and with our peer companies. We believe, however, that it is important for investors to understand that such intangible assets contribute to revenue generation and that intangible asset amortization will recur in future periods until such intangible assets have been fully amortized.

For additional media and information, please follow us at:

Facebook: http://www.facebook.com/aerovironmentinc

Twitter: http://www.twitter.com/aerovironment

LinkedIn: https://www.linkedin.com/company/aerovironment

YouTube: http://www.youtube.com/user/AeroVironmentInc

Instagram: https://www.instagram.com/aerovironmentinc/