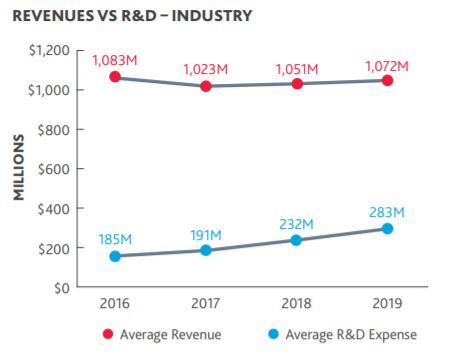

CHICAGO--(BUSINESS WIRE)--The global pandemic is accelerating once lofty ideals of collaboration and innovation in the biotech industry. According to a new analysis from professional services firm BDO USA, LLP, demands for innovation have caused research and development (R&D) spend to outpace revenue growth. R&D spending in the life sciences industry surged 22% from 2018 to 2019, while revenues increased just 2%. Looking ahead, that trend is likely to continue amid pricing pressures, shifting reimbursement models, looming patent expirations and creative partnerships formed amid the pandemic. Life sciences organizations have moved with haste to collaborate with government agencies, large pharma companies, academic researchers and tech companies across the globe to share resources, data and insight in the fight against COVID-19.

The 2020 BDO Biotech Briefing, which examines the most recent 10-K SEC filings of publicly traded companies on the NASDAQ Biotechnology Index (NBI), also finds that life sciences companies are likely to secure the cash they need. The outlook for debt and equity financing in the industry continues to look promising: Companies at every size on the NBI saw a market cap increase in 2019, with average growth reaching 95%. With the Federal Reserve’s move to cut interest rates, debt financing is likely to increase as companies work to invest heavily in COVID-19 R&D. Investors are also flocking to biotech and pharma stocks as vaccines and therapeutics progress.

“Sharing information across and beyond traditional boundaries is no longer a nice-to-have. It’s a must-have.” said Todd Berry, partner and co-leader of BDO’s Life Sciences practice. “In the race to develop a vaccine against the virus and therapeutics to better manage its symptoms, life sciences organizations that break down organizational silos and reprioritize or repurpose products in their R&D pipelines to focus on the most pressing public health needs—while managing new risks the pandemic has created—will come out of this crisis stronger.”

Key takeaways from the 2020 Biotech Briefing include:

Refocusing Pipeline to Align with Federal Funding Opportunities – Biotech success in 2020 and beyond will require tough decisions. Companies are assessing their portfolios to determine where to press pause, where to repurpose and where to increase spending. Prioritizing projects that address urgent public health needs and align with opportunities created by the CARES Act is critical. The CARES Act allocated resources to NIH, BARDA and other organizations, as well as granted the FDA permission to expedite reviews for animal drugs that can treat zoonotics and overhaul the regulatory process for drugs critical to combat the spread. The life sciences industry is likely to see greater investment and increased deals among companies who are working toward new treatments in these emerging areas.

Capitalizing on R&D Credits – Across the biotech industry, securing R&D credits can be a critical lifeline to offset the skyrocketing costs of research. While biotech claims on R&D tax credits ranged from $500K to 500M, average R&D credits increased 5% from 2018 to 2019, reaching nearly $50.6 million. And there’s more to claim: As biotechs increase and reroute R&D spending to COVID-19 therapeutics and vaccines, securing R&D credits is becoming even more essential to cash flow; and each year billions in federal and state credits go unclaimed because companies overlook opportunities or incorrectly believe that legal or documentation requirements no longer in effect still apply. Any activities to attempt to develop new or improved products, processes, or software can qualify.

Small-Caps Seek New Opportunities – Though small-cap NBI-listed companies saw the fastest growth in 2019 compared to their larger counterparts, they may face a tough road ahead. Small cap revenues are often highly dependent on non-recurring licensing fees, success of now-paused clinical trials, and equity financing—which continue to be unpredictable in today’s environment. The good news is that the equity markets are holding up, IPOs continue to close and venture funding continues to be fairly robust. In addition, as smaller companies look for opportunities to survive and larger companies seek new products or technologies in up-and-coming product categories, this trend could spur a new flurry of M&A activity and investment opportunities.

About the 2020 BDO Biotech Briefing

The 2020 BDO Biotech Briefing examines the most recent 10-K filings of companies listed on the NASDAQ Biotechnology Index, which includes organizations classified as biotechnology or pharmaceutical companies according to the Industry Classification Benchmark that also have a market capitalization of at least $200 million. BDO’s analysis separates companies into three categories: small-cap companies with revenue less than $50 million, mid-cap companies with revenue greater than $50 million but less than $1 billion, and large-cap companies with revenue greater than $1 billion.

About BDO USA

BDO is the brand name for BDO USA, LLP, a U.S. professional services firm providing assurance, tax and advisory services to a wide range of publicly traded and privately held companies. For more than 100 years, BDO has provided quality service through the active involvement of experienced and committed professionals. The firm serves clients through more than 60 offices and over 700 independent alliance firm locations nationwide. As an independent Member Firm of BDO International Limited, BDO serves multi-national clients through a global network of more than 88,000 people working out of more than 1,800 offices across 167 countries and territories.

BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms. For more information please visit: www.bdo.com.

Investment banking products and services within the United States are offered exclusively through BDO Capital Advisors, LLC, a separate legal entity and affiliated company of BDO USA, LLP, a Delaware limited liability partnership and national professional services firm. For more information, visit www.bdocap.com. Certain services may not be available to attest clients under the rules and regulations of public accounting. BDO Capital Advisors, LLC is a FINRA/SIPC Member Firm.

Material discussed is meant to provide general information and should not be acted on without professional advice tailored to your needs.