TORONTO--(BUSINESS WIRE)--Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) today reported its second quarter and first half financial results for the period ended June 30, 2020.

For complete details of the unaudited Condensed Interim Consolidated Financial Statements and associated Interim Management’s Discussion and Analysis please refer to the Company’s filings on SEDAR (www.sedar.com) or the Company’s website (www.roxgold.com). All amounts are in U.S. dollars unless otherwise indicated.

Q2 2020 Highlights:

During the three and six-month period ended June 30, 2020, the Company:

Safety

- Continued a strong safety record with no lost time injuries over the last twelve months of 2.7 million hours worked

- Management of the current global COVID-19 crisis is ongoing with operations at Yaramoko not materially impacted as heightened preventative measures and response plans are in place to mitigate and minimize any potential impacts

Operations

- Produced 32,812 ounces of gold at an average grade of 8.2 grams per tonne in Q2 2020, totalling 65,192 ounces produced for YTD 2020

- Reported quarterly plant throughput of 1,399 tonnes per day (“tpd”) for a total of 127,309 tonnes which exceeded increased nameplate capacity of 1,100 tpd by approximately 27%

- Reduced cash operating costs1 by 3% to $151 per tonne processed compared to $156 per tonne processed in Q2 2019

- Maintained upper end of annual gold production guidance between 120,000 and 130,000 ounces subject to existing operating conditions being maintained

Financial

- Sold 36,279 ounces of gold3 for a total of $62.1 million in gold sales3 (33,102 ounces3 and $42.9 million respectively in Q2 2019) and 66,405 ounces for $110.2 million YTD 2020 (65,900 ounces and $85.8 million respectively YTD 2020)

- Achieved an adjusted EBITDA1 and adjusted EBITDA margin1 of $29.0 million and 48% respectively in 2020 compared to $15.7 million and 37% in Q2 2019

- Generated record cash flow from mining operations1 totalling $33.3 million for cash flow from mining operations per share1 of $0.09 and free cashflow (before growth spend)2 of $9.3 million in Q2 2020

- Adjusted net income1 of $11.0 million ($0.03 per share) compared to $0.7 million ($0.00 per share) in Q2 2019

- Produced a mine operating margin1 of $1,016 per ounce in Q2 2020 and a return on equity1 of 16%

- Executed the refinancing of its existing Yaramoko Facility and secured an additional $20 million as a revolving credit facility to provide increased liquidity and financial flexibility

Growth

- Delivered a PEA for Séguéla Gold Project in April 2020 with after-tax NPV of $268 million and 66% IRR at a gold price of $1,450 per ounce and NPV of $548 million and 121% IRR at a gold price of $2,000 per ounce

- Multiple high grade results in Ancien deposit at Séguéla including: 10 metres ("m") at 59.4 grams per tonne gold ("g/t Au") in drill hole SGRD705 from 207m and 20 metres at 28.0 g/t Au in drill hole SGRC730 from 28m

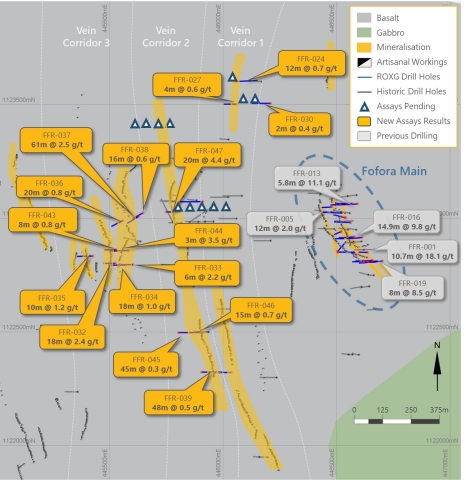

- Encouraging drill results at Fofora deposit at Boussoura including: 61m at 2.5 g/t Au in drill hole BSR-20-RC-FFR-037 from 28m including 30m at 3.1 g/t Au from 28m including 6m at 9.6 g/t Au from 32m and 1m at 17.7 g/t from 54m

“In the face of an unparalleled global crisis, Roxgold has delivered remarkably strong operating and financial results,” commented John Dorward, President and CEO of Roxgold. “In the quarter, we achieved adjusted net income of US$11 million, generated over US$33 million in cash flow from mining operations and reported a return on equity of 16%. Our financial performance has been driven by the strong operational performance with 65,192 ounces of gold produced in the first half of this year, putting the company well on its way towards hitting the upper end of our annual production guidance of 120,000 to 130,000 ounces. This is further supported by operating performance in July with production over 12,600 ounces for the month. Our operations, while challenged by the pandemic, were able to continue uninterrupted, ensuring a continued 1,400 tpd throughput rate and low cash operating costs of $151/tonne which translated to record operating margins of $1,016/oz. With a solid balance sheet, strong momentum on production, and gold prices reaching record highs we are well positioned to deliver very strong results in H2 2020.

“Looking ahead, the Séguéla Gold Project in Cote d’Ivoire is advancing on schedule towards completion of the Feasibility early next year and a construction decision to follow soon thereafter. The Séguéla has been a substantially value accretive acquisition for Roxgold with an NPV of $548 million and 121% IRR at a gold price of $2,000 per ounce, as well as the potential to double our production within a short timeframe without dilution to our shareholders. With four drills turning on the project returning regular results, we believe there is a significant potential opportunity for the upcoming Feasibility Study to outline a bigger and more significantly accretive Séguéla project with additional production ounces and improved valuation.

“Finally, as we reported last month, recent exploration success at Boussoura is building confidence that the project has the potential to become Roxgold’s third advanced asset. The Boussoura project is in the right jurisdiction on the southern end of the Houndé greenstone belt – a prolific gold belt that is host to numerous high-grade, large scale gold discoveries. We have tested a fraction of the vein sets on our land package, and while early days, with continued success we are hopeful that these will come together to form the basis of a project. Two drills are currently turning at Boussoura conducting target definition drilling within the Fofora corridor, and we look forward to seeing the project take shape through the year towards a maiden resource next year.”

Q2 2020 Highlights

|

Three months

|

Three months

|

Six months

|

Six months

|

|

|

|

|

|

Gold ounces produced |

32,812 |

34,354 |

65,192 |

68,006 |

Gold ounces sold3 |

36,279 |

33,102 |

66,405 |

65,900 |

|

|

|

|

|

Financial Data (in thousands of U.S. dollars) |

|

|

|

|

Gold sales3 |

62,107 |

42,949 |

110,153 |

85,789 |

Mine operating profit1 |

23,399 |

11,465 |

38,299 |

24,101 |

EBITDA1 |

25,480 |

11,975 |

43,015 |

28,131 |

Adjusted EBITDA1 |

29,035 |

15,677 |

48,809 |

33,952 |

Adjusted EBITDA margin1 |

47% |

37% |

44% |

41% |

Net income (loss) |

7,467 |

(2,955) |

9,378 |

(1,026) |

Basic earnings per share attributable to shareholders |

0.02 |

(0.01) |

0.02 |

(0.01) |

Adjusted net income1 |

11,021 |

747 |

15,172 |

4,795 |

Per share1 |

0.03 |

0.00 |

0.04 |

0.01 |

Cash flow from mining operations1 |

33,281 |

21,814 |

58,104 |

45,227 |

Per share1 |

0.09 |

0.06 |

0.16 |

0.12 |

Return on equity1 |

16% |

11% |

11% |

11% |

Cash on hand end of period |

44,783 |

19,413 |

44,783 |

19,413 |

Total assets |

303,829 |

278,813 |

303,829 |

278,813 |

|

|

|

|

|

Statistics (in dollars) |

|

|

|

|

Average realized selling price (per ounce) |

1,712 |

1,304 |

1,659 |

1,305 |

Cash operating cost (per tonne processed)1 |

151 |

156 |

148 |

152 |

Cash operating cost (per ounce produced)1 |

586 |

518 |

576 |

493 |

Total cash cost (per ounce sold)1 |

696 |

580 |

678 |

554 |

Sustaining capital cost (per ounce sold)1 |

245 |

206 |

290 |

193 |

Site all-in sustaining cost (per ounce sold)1 |

940 |

785 |

969 |

749 |

All-in sustaining cost (per ounce sold) 1 |

983 |

836 |

1,017 |

806 |

2020 Operating Outlook

- Gold production between 120,000 and 130,000 ounces

- Cash operating cost1 between $520 and $580/ounce

- All-in sustaining cost1 between $930 and $990/ounce

- Non-sustaining capital spend of $5-$10 million

- Growth spend (includes Exploration and Séguéla study spend) of $15-$20 million

Based upon Q2 production results, Roxgold is on track to deliver at the upper end of annual gold production guidance from Yaramoko. As noted earlier this year, AISC is expected to be relatively higher compared to prior years due to increased projected capital spend as the Bagassi South decline development is completed in 2020 along with enhanced security infrastructure investment. Growth spend has been maintained at $15-$20 million as the accelerated drilling program at Séguéla and Boussoura follow recent exploration successes at these projects. Although the COVID-19 pandemic has not materially impact Roxgold’s operations during the first half of 2020, a prolonged COVID-19 related interruption may have an impact on production and cost guidance.

Response to the COVID-19 Pandemic

As previously announced on April 8, 2020, management of the current global COVID-19 crisis is ongoing. Operations at Yaramoko were not materially impacted by COVID-19 with heightened preventative measures and response plans in place to mitigate and minimize any potential impacts from the virus. The Company is continually assessing the health and safety risks to the Company’s personnel and contractors at its operations and offices. Whilst production has been maintained, a prolonged COVID-19 related interruption may have an impact on the Company’s operations, financial position and liquidity.

The Company strengthened its liquidity position in the quarter following the refinancing of its existing Yaramoko Facility and secured an additional $20 million as a revolving credit facility to provide increased liquidity and financial flexibility given the volatile and uncertain financial market conditions. In addition, the Company continues to make regularly scheduled gold shipments from the Yaramoko Gold Mine.

Mine Operating Activities

|

Three months

|

Three months

|

Six months

|

Six months

|

|

|

|

|

|

Operating Data |

|

|

|

|

Ore mined (tonnes) |

112,523 |

109,840 |

247,844 |

207,980 |

Ore processed (tonnes) |

127,308 |

113,866 |

253,188 |

220,682 |

Head grade (g/t) |

8.2 |

9.0 |

8.4 |

9.5 |

Recovery (%) |

98.0 |

98.2 |

98.0 |

98.3 |

Gold ounces produced |

32,812 |

34,354 |

65,192 |

68,006 |

Gold ounces sold1 |

36,279 |

33,102 |

66,405 |

65,900 |

|

|

|

|

|

Financial Data (in thousands of dollars) |

|

|

|

|

Gold sales3 |

62,107 |

42,949 |

110,153 |

85,789 |

Mine operating expenses1 |

(21,507) |

(17,285) |

(38,419) |

(32,722) |

Government royalties1 |

(3,730) |

(1,904) |

(6,613) |

(3,880) |

Depreciation and depletion1 |

(13,471) |

(11,835) |

(26,822) |

(23,778) |

|

|

|

|

|

Statistics (in dollars) |

|

|

|

|

Average realized selling price (per ounce) |

1,712 |

1,304 |

1,659 |

1,305 |

Cash operating cost (per tonne processed) 1 |

151 |

156 |

148 |

152 |

Cash operating cost (per ounce produced) 1 |

586 |

518 |

576 |

493 |

Total cash cost (per ounce sold) 1 |

696 |

580 |

678 |

554 |

Sustaining capital cost (per ounce sold) 1 |

245 |

206 |

290 |

193 |

Site all-in sustaining cost (per ounce sold) 1 |

940 |

785 |

969 |

749 |

All-in sustaining cost (per ounce sold)1 |

983 |

836 |

1,017 |

806 |

Health and safety performance

There were no Lost Time Injury (“LTI”) incidents in the second quarter of 2020 representing nil LTI reports in 530,955 hours worked.

Operational performance

The Company’s gold production in Q2 2020 was 32,812 ounces at a head grade of 8.2 g/t compared to 34,354 ounces at 9.0 g/t in Q2 2019.

Mining operations at the 55 Zone and Bagassi South saw notable improvement through the quarter, as mined grades at Bagassi South averaged a record 10.6 g/t in the quarter, while 55 Zone reported higher grades at depth with an average mined grade of 11.6 g/t in June 2020.

There was a total of 112,523 tonnes of ore mined at a grade of 8.83 g/t (includes marginal ore mined totalling 11,582 tonnes at a grade of 2.2 g/t) and 1,121 metres of waste development. This compares with 109,840 tonnes of ore at 9.3 g/t and 1,562 metres of waste development in Q2 2019. The 55 Zone mine produced 72,826 tonnes at 7.9 g/t and the Bagassi South mine contributed 39,698 tonnes at a grade of 10.6 g/t.

The mining tonnage increase was attributable to the ramping up of stoping activities at the Bagassi South mine in Q2, with stoping operations expanding as more development levels were completed. During Q2 2020, approximately 72% of ore produced came from stoping activities and 28% from development.

Decline development at the 55 Zone mine reached the 4734 level, approximately 580 metres below surface. Ore development continued down to 4754 level and on the eastern extensions of the 4845, 4862 and 4879 levels. The development of the Bagassi South decline reached the 5061 level and ore development commenced on the 5078 level, which is approximately 240 metres below surface. Good progress on ore development has seen the Bagassi South mine largely developed, providing additional stoping access for the remainder of the year.

Mine reconciliation performance between the Mineral Reserve and Grade Control model was 98% for tonnes and 106% for grade in the second quarter of 2020.

The plant processed 127,308 tonnes at an average head grade of 8.2 g/t in Q2 2020 compared to 113,866 tonnes of ore at 9.0 g/t in Q2 2019. There was an increase in the processing of stockpiled material to supplement the mined ore as Yaramoko operated with reduced personnel due to COVID-19 travel restrictions and isolation protocols in Q2 2020.

The processing plant availability was 96.7% in the quarter compared to 97.6% in Q2 2019 and reported an average throughput rate of 1,399 tonnes per day exceeding nameplate capacity by approximately 27%. Plant recovery was 98.0% in Q2 2020 compared to 98.2% for the comparative quarter.

The Yaramoko Gold Mine continued to maintain a low cash operating cost1 of $151 per tonne processed driven by increased throughput and strong cost control.

Financial Performance

i) Second quarter of 2020 vs second quarter of 2019

Gold sales in Q2 2020 totalled $62.1 million from 36,279 ounces of gold. The Company’s average realized gold price was $1,712 per ounce sold, 31% higher than the average realized gold price in Q2 2019.

The Company continued to maintain a low cash operating cost1 per tonne processed of $151 per tonne. The cash operating cost1 per ounce produced totalled $586 per ounce for the period compared to $156 per tonne and $518 per ounce in the prior.

The total cash cost1 per ounce sold of $696 in Q2 2020 was higher compared to $580 per ounce sold in Q2 2019. This was primarily impacted by the processing of lower grade stockpiled material which had an impact of $40 per ounce sold, the higher gold price in Q2 2020 which increased royalty payments by $20 per ounce sold and the commencement of the 1% contribution to the Mining fund for local development increasing royalties by $17 per ounce sold.

As a result, the Company achieved a site all-in sustaining cost1 of $940 per ounce sold and an all-in sustaining cost1 of $983 per ounce sold in the three-month period in 2020 compared to $785 per ounce and $836 per ounce sold, respectively in the comparable 2019 period. The higher all-in sustaining cost in the quarter is attributed to the higher cash cost per ounce sold and ongoing decline development at Bagassi South which is weighted towards the first half of the year.

The Company generated a mine operating margin1 of $1,016 per ounce in 2020 which was 40% higher than in 2019 mainly due to the higher average gold sales price.

The Company invested $5.4 million in underground mine development at the 55 Zone and $3.5 million at Bagassi South in the second quarter of 2020.

The Company generated strong cash flow from mining operations1 of $33.3 million in Q2 2020, for cash flow from mining operations per share1 of $0.09 (C$0.12/share). Comparatively, the Company generated cash flow from mining operations1 of $21.8 million and $0.06 cash flow from mining operations per share1 in Q2 2019.

ii) First six months of 2020 vs first six months of 2019

The Company sold 66,405 ounces of gold3 resulting in revenue from gold sales3 totalling $110.2 million compared to 65,900 ounces3 and $85.8 million, respectively in the comparable period in 2019. During this period, the Company’s average realized gold price was $1,659 per ounce sold compared to an average realized gold price of $1,305 per ounce in Q2 2019.

During the six-month period ended June 30, 2020, the maintained a low cash operating cost1 per tonne processed of $148 per tonne, which compared to $152 per tonne achieved during the comparable period in 2019. The cash operating cost1 per ounce produced totalled $576 per ounce for the period compared to $493 per ounce in the prior year mainly driven by the processing of lower grade stockpiled material which had an impact of $22 per ounce sold, the higher gold price in 2020 which increased royalty payments by $18 per ounce sold and the commencement of the 1% contribution to the Mining fund for local development increasing royalties by $17 per ounce sold.

The total cash cost1 per ounce sold of $678 in six-month ended period ended June 30, 2020 was higher compared to $554 per ounce sold in the same period in 2019. As a result, the Company achieved a site all-in sustaining cost1 of $969 per ounce sold and an all-in sustaining cost1 of $1,017 per ounce sold for YTD 2020 compared to $749 per ounce and $806 per ounce sold, respectively in the same period in 2019.

The Company has invested $11.5 million in underground development at 55 Zone for the six-month period compared to $12.7 million for the comparable period in 2019. The comparable period also included $12.0 million invested in pre-commercial production underground mine development at the Bagassi South mine.

Review of Q1 2020 financial results

Mine operating profit

During the quarter ended June 30, 2020, revenues totalled $62.1 million (2019 - $39.7 million) while mine operating expenses and royalties totalled $21.5 million (2019 - $14.8 million) and $3.7 million (2019 - $1.8 million), respectively. The increase in sales is primarily due to the 31% increase in the average realized gold price and the 10% increase in ounces sold. During the quarter, the Company achieved total cash cost1 per ounce sold of $696 and a mine operating margin1 of $1,016 per ounce sold.

During the six-month period ended June 30, 2020, revenues totalled $110.2 million (2019 - $79.5 million) while mine operating expenses and royalties totalled $38.4 million (2019 - $28.4 million) and $6.6 million (2019 - $3.6 million), respectively. The increase in revenue is primarily due to the 27% increase in the average realized gold price. During the six-month ended June 30, 2020, the Company achieved total cash cost1 per ounce sold of $678 and a mine operating margin1 of $981 per ounce sold.

For more information on the cash operating costs1 see the financial performance of the Mine Operating Activities section of this MD&A.

During the three and six-month period ended June 30, 2020, depreciation totalled $13.5 million and $26.8 million compared to $11.6 million and $23.4 million in 2019. The increase in depreciation is a result of the Company’s continued investment in the underground development of 55 Zone and Bagassi South combined with higher throughput.

General and administrative expenses

General and administrative expenses for the three and six-month period were $1.1 million and $2.4 million compared to $1.2 million and $2.6 million for respective periods.

Sustainability and other in-country costs

Sustainability and in-country costs totalled $0.4 million and $0.8 million for the three and six-month ended June 30, 2020, respectively compared to $0.5 million and $1.1 million in the comparative period. The decrease in expenditures primarily relates to timing of community investments in 2020. These expenditures are incurred as part of Roxgold’s commitment to responsible operations in Burkina Faso including several sustainability and community projects.

Exploration and evaluation expenses (“E&E”)

Exploration and evaluation expenses totalled $4.3 million and $12.0 million for the three and six-month ended June 30, 2020, respectively compared to $4.1 million and $7.3 million in the comparative period. The significant increase in exploration and evaluation activities was primarily due to advancing the PEA at the Séguéla Gold Project which was released in a press release on April 14, 2020. There was also drilling at the Boussoura project in Burkina Faso.

E&E expenses totalled $8.9 million at the Séguéla Gold Project and $3.1 million for Boussoura and Yaramoko for the six-month end June 30, 2020. Expenditures at the Séguéla Gold Project included $5.5 million in drilling costs with $3.5 million of exploration drilling primarily at Ancien and $2.0 million relating to infill drilling at Boulder and Agouti. The Company has spent an additional $1.3 million on PEA and feasibility study costs.

Drilling expenses totalled $1.7 million for YTD 2020 at the Boussoura permit and $0.3 million spent related to regional drilling at Yaramoko.

Share-based payments

Share-based payments totalled $1.7 million and $2.0 million for the three and six-month ended June 30, 2020, respectively compared to 0.7 million and $1.1 million in the comparative period. The increase is primarily due to the timing of the deferred share units (DSU”) grant and the Company’s higher share price.

Financial expenses

Financial expenses totalled $4.3 million and $5.9 million for the three and six-month ended June 30, 2020, respectively compared to $5.5 million and $9.0 million in the comparative period. The decrease is mainly attributed to the favourable movement in foreign exchange gain (loss) of $2.1 million along with a decrease in financing costs and other expenses of $1.1 million.

Current and deferred income tax expense

The current income tax expense for the three and six-month ended June 30, 2020 periods has increased with the comparable period in 2019 due to higher mine operating profits. The higher effective tax rate is also driven by the significant increase in exploration expenditures in 2020 incurred in Burkina Faso and Côte d’Ivoire not being tax effected due to the Company’s status under the mining regulations.

Net income & EBITDA

The Company’s net income was $7.5 million for the three-month ended June 30, 2020 and $9.4 million for the six-month ended June 30, 2020 compared to net loss of $3.0 million and $1.0 million respectively in the comparative 2019 period.

The Company’s EBITDA1 was $25.5 million for the three-month ended June 30, 2020 and $43.0 million for the six-month ended June 30, 2020, respectively compared to $12.0 million and $28.1 million, respectively in the comparative 2019 period.

Net income increased significantly compared to prior period primarily as a result of higher average realized gold sales price, offset by its focus on growth with significant investments in exploration and evaluation at Séguéla and Boussoura and higher depreciation.

Income Attributable to Non-Controlling Interest

For the three and six-month period ended June 30, 2020, the income attributable to the non-controlling (“NCI”) interest was $1.5 million and $2.5 million, respectively. The Government of Burkina Faso holds a 10% carried interest in Roxgold SANU SA and as such is considered Roxgold’s NCI. The NCI attributable income is based on IFRS accounting principles and does not reflect dividend payable to the minority shareholder of the operating legal entity in Burkina Faso.

Exploration activities

Séguéla Gold Project

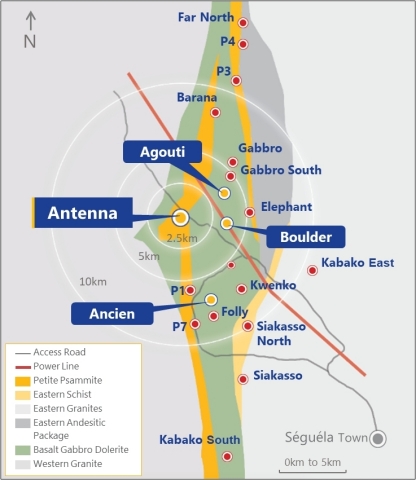

Exploration activities have continued to progress with the objective of delineating additional mineral resources within close proximity to Antenna. The current targets, including Agouti, Boulder and Ancien, are within 6 kilometres of the Antenna deposit (Figure 1).

Figure 1: Séguéla Location Plan

Significant progress was made on defining and extending mineralization at Boulder, Agouti and Ancien with 4 RC/diamond core rigs active throughout the second quarter of 2020, along with concluding geotechnical drilling in support of the feasibility study.

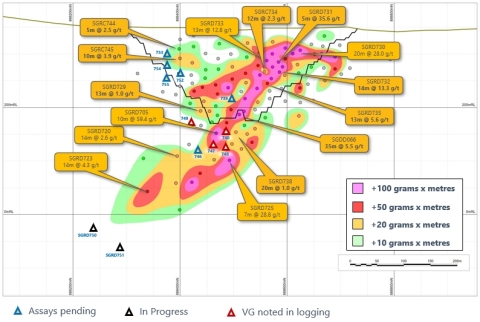

Ancien

Infill and extension drilling continued during the quarter with two RC/ diamond core drill rigs completing 18 holes, bringing to a total of 81 holes which have been completed at Ancien since the drillhole data cut-off date (February 12 2020) used to support the Inferred Mineral Resource estimate in the PEA of 261,000 ounces (refer to Company press release dated April 14, 2020). These most recent results reflect the two objectives of the current programs, namely a dedicated infill program for geostatistical support of the very high grade and continuous nature of the core Ancien mineralization and targeting depth and strike extensions to the high-grade core beyond the PEA US$1550 conceptual shell.

The results from the six holes of the high grade infill program reinforce the broad nature of the high grade intervals previously intersected (Figure 2), both along strike as well as across the mineralized zone, and correlate well with the high levels of visible gold logged in the samples. These close-spaced infill results support the high grade tenor of the deposit and provide a strong degree of confidence in the geostatistical and geological continuity of the high grade core.

In addition to the infill drilling of the high grade zone, drilling in an area previously modelled as waste in the conceptual pit, returned 10m at 3.9 g/t Au from SGRC745 and 5m at 2.5 g/t Au from SGRC744, extending mineralization a further 25m to the south and where it remains open.

Extension drilling below the conceptual pit base included high grade results such as 35m at 5.5 g/t from SGDD066 and 14m at 4.3 g/t Au from SGRD723, one of the deepest holes drilled to date. Also, a high grade hanging wall lens has been identified and includes grades such as 7m at 28.8 g/t Au.

Highlights from the most recent drilling at Ancien include:

Infill Drilling

-

14 metres ("m") at 13.3 grams per tonne gold ("g/t Au") in drill hole SGRD732 from 71m including

- 4m at 24.5 g/t Au from 71m and

- 2m at 18.8 g/t Au from 82m

-

5m at 35.6 g/t Au in drill hole SGRD731 from 61m including

- 3m at 54.8 g/t Au from 63m

-

9m at 2.2 g/t Au in drill hole SGRD735 from 78m and

- 13m at 5.6 g/t Au from 95m

- 12m at 2.3 g/t Au in drill hole SGRD734 from 73m

-

35m at 5.5 g/t Au in drill hole SGDD066 from 136m including

- 3m at 23.1 g/t Au from 137m and

- 3m at 23.4 g/t Au from154m

- 20m at 1.0 g/t Au in drill hole SGRC738 from 172m

Extension Drilling

- 10m at 3.9 g/t Au in drill hole SGRC745 from 61m

- 5m at 2.5 g/t Au in SGRC744 from 32m

Figure 2: Ancien Longsection highlights

Antenna North

An infill program designed to upgrade the drill spacing of the Antenna North deposits to Indicated spacing has been completed, with encouraging shallow results including:

- 15m at 2.8 g/t Au in drill hole SGRC807 from 15m

- 7m at 3.0 g/t Au in drill hole SGRC812 from 26m

- 3m at 5.4 g/t Au in drill hole SGRC813 from 19m

- 5m at 7.5 g/t Au in drill hole SGRC815 from 20m

- 4m at 6.8 g/t Au in drill hole SGRC816 from 24m

Agouti

Two RC/diamond core rigs have started infill and extension drilling at Agouti with the objective of increasing the current resource at depth and along strike, with these results to be incorporated into an upgraded resource model in Q3.

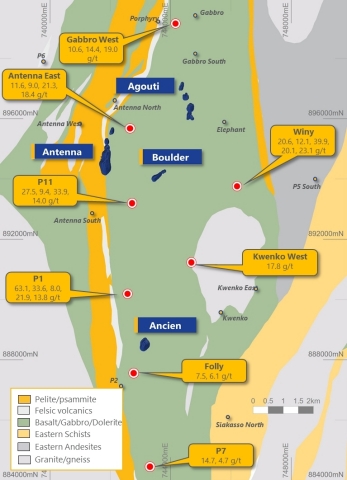

Séguéla Regional Reconnaissance

Mapping and reconnaissance sampling at Séguéla support the regional prospectivity with several prospects identified (Figure 3) and where rock chip samples also recorded several instances of visible gold. In addition to ongoing detailed field mapping, auger drilling is underway targeting the southern extensions of key favourable structural corridors that host the Antenna, Ancien-Boulder-Agouti, and Elephant-Winy mineralization. Follow up scout RC drilling is planned in the second half of the year across these prospects.

*note: values are g/t Au

Figure 3: Séguéla regional reconnaissance sampling program

Boussoura Project

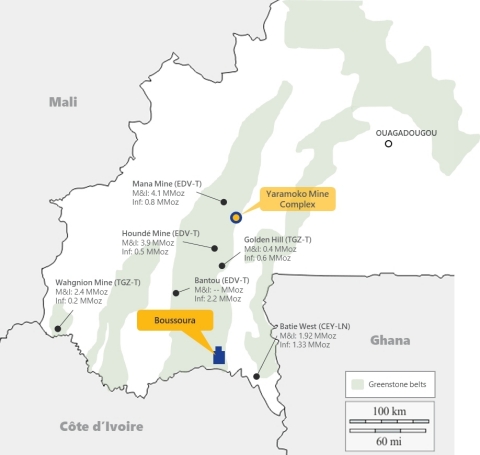

Located approximately 190km south of Yaramoko, RC and core drilling at the Boussoura project has led to a new high grade discovery at Galgouli, and excellent results following up historic drilling at Fofora (refer to Company press releases dated February 3 and 20, 2020 and July 29, 2020). The Boussoura project is located in the southern portion of the Houndé Greenstone Belt in southern Burkina Faso.

Figure 4: Boussoura Project Location on Houndé Belt

Fofora

Drilling resumed at Boussoura in early May after a pause to assess the potential impact of the coronavirus. The program restarted with an RC/DD rig moving to scout drilling testing three vein sets with coincident artisanal workings, geophysical and geochemical targets within 1km west of the Fofora vein. These targets form part of the large and active 3km by 3km artisanal field and are very similar in appearance to the high grade Fofora vein, consisting of a series of parallel north to north-west striking quartz veins and associated shear zones with surface strike expressions of up to 1,000m.

Highlights from the most recent drilling at Fofora include:

-

61m at 2.5 g/t in drill hole BSR-20-FFR-037 from 28m including

- 30m at 3.1 g/t Au 7 from 28m including

- 6m at 9.6 g/t Au from 32m and

- 1m at 17.7 g/t from 54m

-

28m at 1.9g/t Au from 61m including

- 7m at 6.9 g/t Au from 69m

-

18m at 2.4 g/t Au in drill hole BSR-20-RC-FFR-032 from 12m including

- 8m at 4.5 g/t Au from 22m

-

20m at 4.4 g/t Au in drill hole BSR-20-RC-FFR-047 from 88m including

- 1m at 66 g/t Au from 95m

-

6m at 2.2 g/t Au in drill hole BSR-20-RC-FFR-033 from 32m and

- 1m at 11.2 g/t Au from 36m

- 2m at 5.6 g/t Au in drill hole BSR-20-RC-FFR-034 from 62m

Scout drilling is continuing on several additional nearby targets with final results and follow-up drilling scheduled for late Q3.

Figure 5: Assay results from scout drill program at Fofora

Galgouli

Exploration activities at Galgouli during the quarter focussed on extending Auger drilling and soil geochemistry sampling across a 5km by 7km grid, extending along strike to the south east of the high grade Galgouli vein. Auger drilling is continuing, however, results to date have highlighted several elongate 1-2km long anomalies with similar strike orientations to the north-west striking Galgouli vein, with peak results >500ppb. These auger geochemistry results highlight the potential strike extensions of the Galgouli mineralization. This program will continue, weather depending, with follow-up scout RC drilling planned for late Q3.

2020 Exploration Program

At Yaramoko, a 14,000 metre infill resource drilling program from the 4700m RL in the 55 Zone is scheduled to commence in H2 2020, with the results to form the basis of an updated Yaramoko mineral resource estimate planned for Q1 2021.

Exploration activities at Séguéla will focus on potential resource growth at Ancien, Agouti and Boulder to support the upcoming feasibility study, while also advancing other satellite opportunities. Additional target generation activities will also continue at Séguéla.

The Boussoura program will focus on Galgouli and Fofora, as well as testing other high priority targets associated with artisanal mining activities and targets generated from soil geochemistry programs.

Regional work on the remaining properties in Côte d’Ivoire will involve interpretation of the airborne magnetic surveys, BLEG, auger, soil geochemistry and termite mound sampling the results of which will be ranked for further work.

Conference Call and Webcast Information

The Company will host a conference call and live webcast on Wednesday, August 12, 2020 at 8:00 am ET to discuss its financial results and business outlook.

Conference Call Details

For the conference call, our provider has implemented a new registration protocol called Direct Event, which will ensure participants a smooth entry to the call and avoid delays. To participate in the live conference call, please register in advance using the following link: http://www.directeventreg.com/registration/event/1499704

After registering, a confirmation will be sent through email, including dial-in details and unique conference call codes for entry. Registration is open through the live call, but to ensure you are connected for the full call, we suggest registering a minimum of 10 minutes before the start of the call.

Alternatively, participants can pre-register by phone by dialing 1 (888) 869-1189 within North America or (706) 643-5902 from international locations and provide the Conference ID: 1499704 to the live agent. Please pre-register in advance of the call.

The conference call replay will be available for two weeks after the call, from 11:00 am ET on August 12, 2020 until 11:59 pm ET on August 26, 2020, by dialing toll free 1 (800) 585-8367 within North American or 1 (416) 621-4642 from international locations and entering passcode: 1499704.

Webcast Details

Listeners may access a live webcast of the conference call from the events section of the Company's website at www.roxgold.com. An archive of the webcast will be available on the Company website approximately two hours after the live call ends.

Notes:

- The Company provides some non-IFRS measures as supplementary information that management believes may be useful to investors to explain the Company’s financial results. Please refer to note 15 “Non-IFRS financial performance measures” of the Company’s MD&A dated August 11, 2020, available on the Company’s website at www.roxgold.com or on SEDAR at www.sedar.com for reconciliation of these measures.

- Free cashflow (before growth spend) is a non-IFRS financial performance measure with no standard definition under IFRS. Calculated as cash flow from operations activities minus capital expenditures, adding back growth expenditures.

- For the three and six-month period ended June 30, 2019, gold ounces sold, and gold sales include pre-commercial production ounces sold of 2,485 ounces and 4,790 ounces respectively, revenues of $3.3 million and $6.3 million respectively, and mine operating profit includes $0.5 million and $1.3 million respectively relating to Bagassi South pre-production revenue net of expenses. The pre-commercial production gold sales and mine operating expenses were accounted against Property, Plant and Equipment.

Qualified Persons

Paul Criddle, FAusIMM, Chief Operating Officer for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has reviewed, verified and approved the technical disclosure contained in this news release.

Paul Weedon, MAIG, Vice-President, Exploration for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has verified and approved the technical disclosure contained in this news release. This includes the QA/QC, sampling, analytical and test data underlying this information. For more information on the Company’s QA/QC and sampling procedures, please refer to the Company’s Annual Information Form dated December 31, 2019, available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

For further information regarding the Yaramoko Gold Mine, please refer to the technical report dated December 20, 2017, and entitled “Technical Report for the Yaramoko Gold Mine, Burkina Faso” (the “Yaramoko Technical Report”) and the technical report prepared for the Séguéla Gold Project entitled “NI 43-101 Technical Report, Séguéla Project, Preliminary Economic Assessment, Worodougou Region, Côte d’Ivoire” dated April 14, 2020 (the “Séguéla Technical Report”) and together with the Yaramoko Technical Report, the “Technical Reports” available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

About Roxgold

Roxgold is a Canadian-based gold mining company with assets located in West Africa. The Company owns and operates the high-grade Yaramoko Gold Mine located on the Houndé greenstone belt in Burkina Faso and is advancing the development and exploration of the Séguéla Gold Project located in Côte d’Ivoire. Roxgold trades on the TSX under the symbol ROXG and as ROGFF on OTCQX.

This press release contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”). Such forward-looking statements include, without limitation: economic statements with respect to Mineral Reserves and Mineral Resource estimates (including proposals for the potential growth, extension and/or upgrade thereof and any future economic benefits which may be derived therefrom), future production and life of mine estimates, production and cost guidance, anticipated recovery grades, and potential increases in throughput, the anticipated increased proportion of mill feed coming from stoping ore, future capital and operating costs and expansion and development plans including with respect to the 55 zone and Bagassi South, and the expected timing thereof (including with respect to the delivery of ore and future stoping operations), proposed exploration plans and the timing and costs thereof, the anticipated operations, costs, proposed funding, timing and other factors set forth in the Technical Report, and sufficiency of future funding. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. In certain cases, forward-looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the estimation of Mineral Resources and Mineral Reserves, the realization of resource estimates and reserve estimates, gold metal prices, the timing and amount of future exploration and development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Yaramoko Gold Project and other properties including the Séguéla Gold Project in the short and long-term, the progress of exploration and development activities as currently proposed and anticipated, the receipt of necessary regulatory approvals and permits, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters, as well as assumptions set forth in the Company’s technical report dated December 20, 2017, and entitled “Technical Report for the Yaramoko Gold Mine, Burkina Faso” (the “Yaramoko Technical Report”) and the technical report prepared for the Séguéla Gold Project entitled “NI 43-101 Technical Report, Séguéla Project, Worodougou Region, Cote d’Ivoire” dated July 23, 2019 (the “Séguéla Technical Report” and together with the Yaramoko Technical Report, the “Technical Reports” available on the Company’s website at www.roxgold.com and SEDAR at www.sedar.com. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: delays resulting from the COVID-19 pandemic, changes in market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses, changes in the costs and timing of the development of new deposits, inaccurate reserve and resource estimates, changes in the price of gold, unanticipated changes in key management personnel, failure to obtain permits as anticipated or at all, failure of exploration and/or development activities to progress as currently anticipated or at all, and general economic conditions. Mining exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.