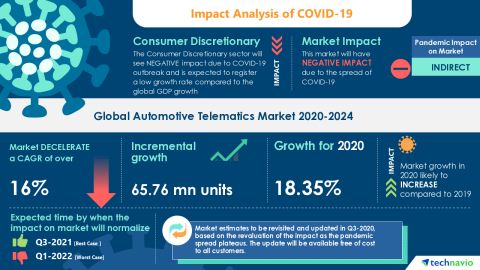

LONDON--(BUSINESS WIRE)--Technavio has been monitoring the automotive telematics market and it is poised to grow by 65.76 million units during 2020-2024, progressing at a CAGR of over 16% during the forecast period. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment.

Although the COVID-19 pandemic continues to transform the growth of various industries, the immediate impact of the outbreak is varied. While a few industries will register a drop in demand, numerous others will continue to remain unscathed and show promising growth opportunities. Technavio’s in-depth research has all your needs covered as our research reports include all foreseeable market scenarios, including pre- & post-COVID-19 analysis. Download a Free Sample Report on COVID-19 Impacts

Frequently Asked Questions-

- What was the size of the automotive telematics market in 2019?

- Technavio says that the value of the market was at 58.43 million units in 2019 and it is projected to reach 124.19 million units by 2024.

- Based on segmentation by application, which is the leading segment in the market?

- The commercial vehicles segment is expected to be the leading segment in the global market during the forecast period.

- At what rate is the market projected to grow?

- Growing at a CAGR of over 16%, the incremental growth of the market is anticipated to be 65.76 million units during the forecast period.

- Who are the top players in the market?

- Agero Inc., Airbiquity Inc., Continental AG, LG Electronics Inc., Panasonic Corp., Robert Bosch GmbH, TomTom International BV, Trimble Inc., Verizon Communications Inc., and Visteon Corp. are some of the major market participants.

- What are the key market drivers and challenges?

- Popularity of EVs and the presence of a conducive technology environment are the major factors driving the market. However, the high cost associated with telematics services restraints the market growth.

- How big is the APAC market?

- The market in the APAC region was valued at 19.37 million units in 2019 and it is anticipated to grow to 45.49 million units by 2024.

The market is fragmented, and the degree of fragmentation will decelerate during the forecast period. Agero Inc., Airbiquity Inc., Continental AG, LG Electronics Inc., Panasonic Corp., Robert Bosch GmbH, TomTom International BV, Trimble Inc., Verizon Communications Inc., and Visteon Corp. are some of the major market participants. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

The popularity of EVs has been instrumental in driving the growth of the market.

Technavio's custom research reports offer detailed insights on the impact of COVID-19 at an industry level, a regional level, and subsequent supply chain operations. This customized report will also help clients keep up with new product launches in direct & indirect COVID-19 related markets, upcoming vaccines and pipeline analysis, and significant developments in vendor operations and government regulations.

Automotive Telematics Market 2020-2024: Segmentation

Automotive Telematics Market is segmented as below:

-

Application

- Commercial Vehicles

- Passenger Cars

-

Fitment

- Embedded

- Smartphone Integration

- Tethered

-

Geographic Landscape

- APAC

- Europe

- MEA

- North America

- South America

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR41037

Automotive Telematics Market 2020-2024: Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. The automotive telematics market report covers the following areas:

- Automotive Telematics Market Size

- Automotive Telematics Market Trends

- Automotive Telematics Market Analysis

This study identifies the presence of a conducive technology environment as one of the prime reasons driving the automotive telematics market growth during the next few years.

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Technavio’s in-depth research has direct and indirect COVID-19 impacted market research reports.

Register for a free trial today and gain instant access to 17,000+ market research reports. Technavio's SUBSCRIPTION platform

Automotive Telematics Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist automotive telematics market growth during the next five years

- Estimation of the automotive telematics market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive telematics market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive telematics market vendors

Table of Contents:

Executive Summary

- Market Overview

Market Landscape

- Market ecosystem

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019 - 2024

Five Forces Analysis

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Application

- Market segments

- Comparison by Application placement

- Commercial vehicles - Market size and forecast 2019-2024

- Passenger cars - Market size and forecast 2019-2024

- Market opportunity by Application

Market Segmentation by Type

- Market segments

- Comparison by Type placement

- Embedded - Market size and forecast 2019-2024

- Smartphone integration - Market size and forecast 2019-2024

- Tethered - Market size and forecast 2019-2024

- Market opportunity by Type

Customer Landscape

- Overview

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- North America - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- Europe - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity by geography

Drivers, Challenges, and Trends

- Market drivers

- Volume driver - Demand led growth

- Volume driver - Supply led growth

- Volume driver - External factors

- Volume driver - Demand shift in adjacent markets

- Price driver - Inflation

- Price driver - Shift from lower to higher-priced units

- Market challenges

- Market trends

Vendor Landscape

- Overview

- Landscape disruption

- Vendor Analysis

Vendors covered

- Market positioning of vendors

- Agero Inc.

- Airbiquity Inc.

- Continental AG

- LG Electronics, Inc.

- Panasonic Corp.

- Robert Bosch GmbH

- TomTom International BV

- Trimble Inc.

- Verizon Communications Inc.

- Visteon Corp.

Appendix

- Scope of the report

- Currency conversion rates for US$

- Research methodology

-

List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.