TROY, Mich.--(BUSINESS WIRE)--Those pharmacist consultation kiosks, exam rooms and walk-in vaccination sites popping up in neighborhood pharmacies across the country are not a coincidence. They are part of a concerted effort by the nation’s major pharmacy chains to become the center of gravity for consumer healthcare. According to the J.D. Power 2020 U.S. Pharmacy Study,SM released today, the strategy is working, with pharmacy expansion into primary care driving significant increases in both satisfaction and consumer spending.

“When you look at the major pharmacy business trends of the past couple of years—CVS acquiring Aetna, Walgreens partnering with Humana and Walmart moving into health insurance—it’s clear that pharmacy operators are positioning themselves to become hubs of consumer healthcare, edging into the space once reserved for primary care physicians’ offices,” said James Beem, Managing Director of Healthcare Intelligence at J.D. Power. “What has not been clear until now is exactly how consumers would react to the shift. Simply put, they’re embracing it, and it’s driving higher overall satisfaction and increased spending as they use more health and wellness-oriented services.”

Following are some of the key findings of the 2020 study:

- Use of health and wellness services grows, driving higher satisfaction: Nearly half (48%) of retail pharmacy customers have used at least one health and wellness-oriented service provided by their pharmacy this year, up a significant 5 percentage points from 2019. More importantly, overall customer satisfaction with the retail pharmacy is 26 points higher (on a 1,000-point scale) among customers who use health and wellness services vs. those who have not.

- Deeper penetration into primary care drives increased satisfaction and spending: Customers who use at least one health and wellness-oriented service provided by their pharmacy spend an average of $11 more per customer than those who do not use these services ($35 vs. $24, respectively). When customers use two or more health and wellness-oriented services, that average spend climbs to $58. Among customers who use two or more health and wellness-oriented services, overall satisfaction jumps to 907 vs. 861 for those who don’t use any service.

- Digital ordering drives high levels of satisfaction, but utilization remains low: Just 9% of brick-and-mortar pharmacy customers order their prescriptions via digital channels. Despite the stubbornly low utilization rate, overall satisfaction among those customers who do order digitally through a brick-and-mortar pharmacy is 859, which is 5 points higher than among those who only visit the store in person. By contrast, mail-order pharmacy customers are far more frequent users of digital ordering, with 32% ordering prescriptions via digital channels. These mail-order digital customers have even higher levels of satisfaction, with an overall satisfaction score of 867.

- Key influencers important to health and wellness services utilization: Physician recommendations for pharmacy-delivered health and wellness services are associated with an 80% utilization rate and recommendations from friends and family are associated with a 75% utilization rate. However, just 8% of customers say they’ve received a recommendation from their doctor and 9% have received a recommendation from friends and family. The most common means of hearing about these services is in-store advertising, which drives a 45% utilization rate.

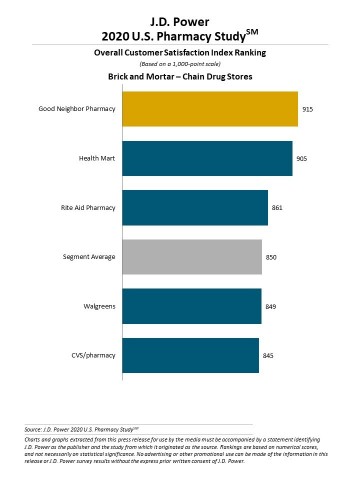

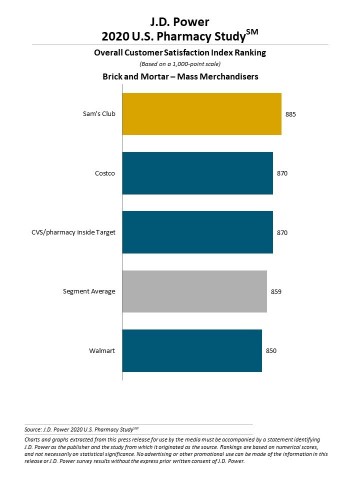

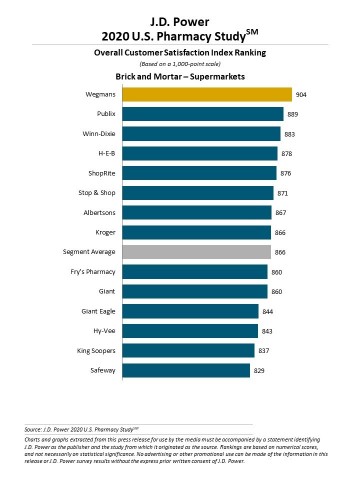

Study Rankings

Good Neighbor Pharmacy ranks highest among brick-and-mortar chain drug store pharmacies for a fourth consecutive year, with a score of 915. Health Mart (905) ranks second and Rite Aid Pharmacy ranks third (861).

Sam’s Club ranks highest among brick-and-mortar mass merchandiser pharmacies for a fifth consecutive year, with a score of 885. Costco and CVS/pharmacy inside Target (870 each) rank second in a tie.

Wegmans ranks highest among brick-and-mortar supermarket pharmacies for a third consecutive year, with a score of 904. Publix (889) ranks second and Winn-Dixie ranks third (883).

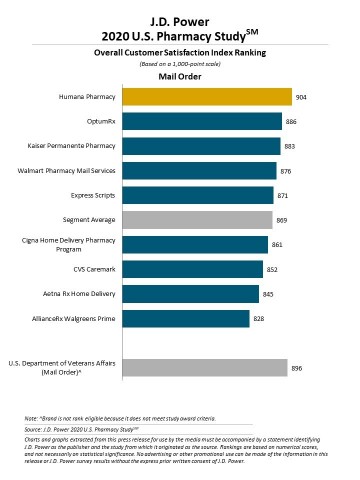

Humana Pharmacy ranks highest in the mail order segment for a third consecutive year, with a score of 904. OptumRx (886) ranks second and Kaiser Permanente Pharmacy (883) ranks third.

The U.S. Pharmacy Study, now in its 12th year, measures customer satisfaction with brick-and-mortar and mail order pharmacies. The 2020 study is based on responses from 13,378 pharmacy customers who filled a prescription during the three months prior to the survey period of September 2019-May 2020.

For more information about the U.S. Pharmacy Study, visit

https://www.jdpower.com/business/resource/us-pharmacy-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020097.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info