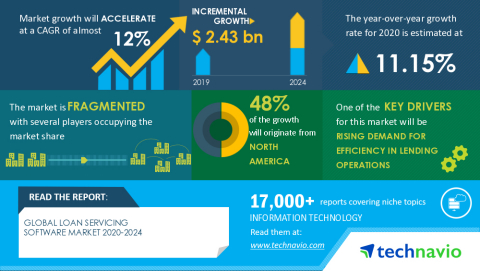

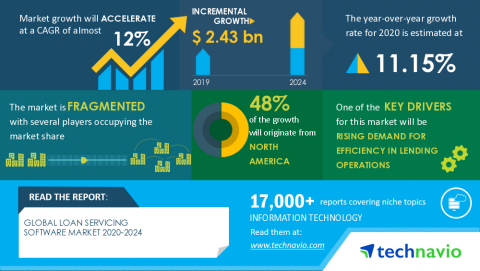

LONDON--(BUSINESS WIRE)--The global loan servicing software market size is expected to grow by USD 2.43 billion during 2020-2024. The report also provides the market impact and new opportunities created due to the COVID-19 pandemic. We expect the impact to be significant in the first quarter but gradually lessen in subsequent quarters – with a limited impact on the full-year economic growth.

Request challenges and opportunities influenced by COVID-19 pandemic - Request a Free Sample Report on COVID-19 Impacts

The lending process, in general, consists of loan creation, origination, management, collection, and services. These processes were earlier done manually with minimal technological support, which made them complex and time-consuming. With advancements in technology, financial organizations are adopting new solutions, such as loan origination software, loan management software, loan analytics software, and loan servicing software solutions, to improve their operational efficiency and reduce costs. With the assistance of loan servicing software, lenders can monitor all activities right from the time of loan processing until the loan is paid off. Thus, the increasing demand for efficiency in lending operations will drive the growth of the loan servicing software market during the forecast period.

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR44321

As per Technavio, the rise in the adoption of cloud-based loan servicing software will have a positive impact on the market and contribute to its growth significantly over the forecast period. This research report also analyzes other significant trends and market drivers that will influence market growth over 2020-2024.

Loan Servicing Software Market: Rise in Adoption of Cloud-based Loan Servicing Software

The adoption of cloud computing is rapidly increasing across the world, owing to the flexibility and cost benefits associated with cloud services. Organizations worldwide are focusing on reducing their overall capital expenditure (CAPEX) and are looking to adopt new technologies with lower CAPEX. Cloud-based loan servicing software can be easily configured and implemented within a short span of time. It also lowers the overall processing time, paperwork, error rate, and other issues. Furthermore, the documents are stored in a centralized server and are managed using a cloud-based system. This makes it easy to share, update, and find the required information. Thus, the adoption of cloud-based loan servicing software is expected to increase, thereby driving the growth of the market.

“Factors such as the rising cost of loan servicing, and increasing demand for consumer loans will have a significant impact on the growth of the loan servicing software market value during the forecast period,” says a senior analyst at Technavio.

Register for a free trial today and gain instant access to 17,000+ market research reports

Technavio's SUBSCRIPTION platform

Loan Servicing Software Market: Segmentation Analysis

This market research report segments the loan servicing software market by deployment (cloud-based and on-premise) and geography (North America, Europe, APAC, South America, and MEA).

The North American region led the loan servicing software market share in 2019, followed by Europe, APAC, South America, and MEA respectively. During the forecast period, the North American region is expected to register the highest incremental growth due to the increasing focus of major banking and financial institutions towards the streamlining of their loan process in a bid to reduce processing time.

Technavio’s sample reports are free of charge and contain multiple sections of the report, such as the market size and forecast, drivers, challenges, trends, and more. Request a free sample report

Some of the key topics covered in the report include:

Market Drivers

Market Challenges

Market Trends

Vendor Landscape

- Vendors covered

- Vendor classification

- Market positioning of vendors

- Competitive scenario

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.