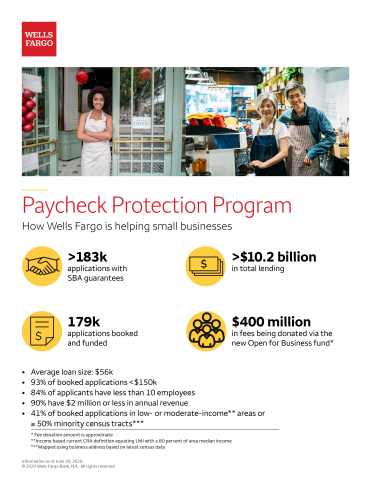

SAN FRANCISCO--(BUSINESS WIRE)--Following an April 2020 industry-leading commitment to donate all gross processing fees from the Paycheck Protection Program, Wells Fargo unveiled today the details of an approximately $400 million effort to help small businesses impacted by the ongoing COVID-19 pandemic keep their doors open, retain employees, and rebuild. Through Wells Fargo’s new Open for Business Fund, the company will engage nonprofit organizations to provide capital, technical support, and long-term resiliency programs to small businesses with an emphasis on those that are minority-owned businesses.

Through June 30, Wells Fargo funded loans under the PPP for more than 179,000 customers, with an average loan amount of $56,000, totaling $10.1 billion. Of the loans made, 84% of those are for companies that have less than 10 employees; 60% were for amounts of $25,000 or less; and, 90% of these applicants had $2 million or less in annual revenue. Given the federal government’s extension of the PPP, Wells Fargo will reopen its PPP loan application process to eligible customers as soon as possible through a link in Business Online Banking® or CEO®.

“By donating approximately $400 million in processing fees to assist small businesses in need, Wells Fargo’s Open for Business Fund creates opportunities for near-term access to capital and addresses the road ahead to meaningful economic recovery, especially for Black and African American entrepreneurs and other minority-owned businesses,” said Wells Fargo CEO Charlie Scharf. “Wells Fargo is committed to helping small businesses impacted by COVID-19 stay open and get back to growth.”

According to data from Wells Fargo’s June Gallup/Small Business Index, more than half of small business owners surveyed expect either stagnant or decreasing revenues in the coming 12 months.

Accelerating small business recovery for communities in need

The Open for Business Fund’s initial grants will allocate $28 million to Community Development Financial Institutions (CDFIs), also known as nonprofit community lenders, aimed at empowering Black and African American-owned small businesses, which are closing at nearly twice the rate of the industry, according to the National Bureau of Economic Research. Among the first grantees:

- Expanding Black Business Credit Initiative (EBBC) will support the launch of the Black Vision Fund to increase the flow of capital to Black-focused CDFIs for transformational work to close the racial wealth gap in African American communities. The CDFIs will also receive capital for urgent deployment to impacted businesses in the Mid-Atlantic, Southeast, and Midwest.

- Local Initiatives Support Corporation (LISC) will provide grants and low cost capital to more than 2,800 entrepreneurs with a focus on preventing loss in revenue, sustaining employment, and averting vacancies among vulnerable small business owners in urban and rural markets nationwide.

“Black businesses have faced the largest shutdown of any diverse group in the country,” said Ron Busby, Sr., CEO of U.S. Black Chambers, Inc. “We lost 41%, or 450,000 Black-owned small businesses, in this pandemic so far and all of those businesses provided jobs so we need to accelerate an economic agenda that helps them recover. The funding that Wells Fargo is putting back into Black businesses and other minority-owned small businesses across the country is truly going to be appreciated and will give the kick start entrepreneurs need to continue and grow.”

Beginning today, the Open for Business Fund is accepting applications from CDFIs and special purpose funds formed by CDFIs serving racially and ethnically diverse small businesses for its first grant cycle, open now through August 7. Additional grant cycles focused on technical assistance and recovery and resiliency will open later this year. Nonprofits can learn more at www.wellsfargo.com/about/corporate-responsibility/community-giving.

Small business sentiment

The Small Business Index, which provides a quarterly pulse check of sentiment from small business owners on their economic situations and the wider economic landscape, highlighted higher optimism on their financial outlook in June than in April. However, this was still 19% lower than in January, prior to the outbreak of COVID-19. In specifically oversampling African American, Hispanic, Asian, and women business owners, June’s survey also observed that 52% of these owners felt the U.S. economy was in a recession or depression, while 26% said they did not feel very prepared or at all prepared for the economic downturn from the pandemic.

“June’s survey saw business owner optimism increasing as reopenings have been getting underway, but the overall data shows that for many, there’s still a long road to recovery,” said Mark Vitner, chief economist at Wells Fargo. “The pandemic’s effects are also still being sorted out as communities across the country are in different stages of recovery, so optimism around indicators like revenues and number of jobs will continue to shift as those stages progress.”

Contributing to the small business ecosystem

Building a thriving small business sector has a lasting impact on communities and on job creation. Since 2015, the $175 million Wells Fargo Diverse Community Capital program has enabled more than 90 CDFIs to finance $1.6 billion in loans and offer 1.8 million hours of training to diverse small business owners, which have helped them sustain 195,000 jobs.

As part of the Diverse Community Capital program, the Wells Fargo Foundation and the National Association of Latino Community Asset Builders started the nation’s largest loan fund for Latino-owned small businesses with a $10 million grant.

Separately, in March, Wells Fargo announced it aims to invest up to $50 million in Minority Depository Institutions (MDIs) as part of its commitment to support economic growth in African American communities where MDIs, often community-based banks, provide mortgage loans, small business lending, and other banking services.

SmalI Business Index Methodology

Results for Wells Fargo/Gallup Small Business Index survey are based on web interviews with 1,478 small business owners, conducted during the period of May 29-June 5, 2020. This survey also included an oversample of diverse segments — ensuring a minimum of 300 interviews each among African American, Asian, and Hispanic small business owners. Beginning in second quarter 2019, the interview process formally transitioned from outbound phone data collection to a national small business web opt-in panel provider.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified, community-based financial services company with $1.98 trillion in assets. Wells Fargo’s vision is to satisfy our customers’ financial needs and help them succeed financially. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, investment, and mortgage products and services, as well as consumer and commercial finance, through 7,400 locations, more than 13,000 ATMs, the internet (wellsfargo.com), and mobile banking, and has offices in 31 countries and territories to support customers who conduct business in the global economy. With approximately 263,000 team members, Wells Fargo serves one in three households in the United States. Wells Fargo & Company was ranked No. 30 on Fortune’s 2020 rankings of America’s largest corporations. News, insights, and perspectives from Wells Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com | Twitter: @WellsFargo. Video and b-roll footage can be found in the Wells Fargo newsroom.

Cautionary Statement About Forward-Looking Statements

This news release contains forward-looking statements about our future financial performance and business. Because forward-looking statements are based on our current expectations and assumptions regarding the future, they are subject to inherent risks and uncertainties. Do not unduly rely on forward-looking statements as actual results could differ materially from expectations. Forward-looking statements speak only as of the date made, and we do not undertake to update them to reflect changes or events that occur after that date. For information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 as filed with the Securities and Exchange Commission and available on its website at www.sec.gov.