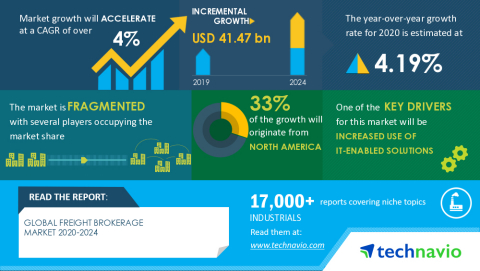

LONDON--(BUSINESS WIRE)--Technavio has been monitoring the freight brokerage market and it is poised to grow by USD 41.47 billion during 2020-2024, progressing at a CAGR of over 4% during the forecast period. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment.

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Please Request Free Sample Report on COVID-19 Impact

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. C.H. Robinson Worldwide Inc., Echo Global Logistics Inc., Expeditors International of Washington Inc., Hub Group Inc., J.B. Hunt Transport Services Inc., Kuehne + Nagel International AG, Nippon Yusen Kabushiki Kaisha, Panalpina World Transport (Holding) Ltd., United Parcel Service of America Inc., and XPO Logistics Inc. are some of the major market participants. The increased use of IT-enabled solutions will offer immense growth opportunities. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Increased use of IT-enabled solutions has been instrumental in driving the growth of the market.

Freight Brokerage Market 2020-2024: Segmentation

Freight Brokerage Market is segmented as below:

-

Service

- LTL

- FTL

- Temperature-controlled Freight

- Others

-

Geographic Landscape

- APAC

- Europe

- MEA

- North America

- South America

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR40504

Freight Brokerage Market 2020-2024: Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. Our freight brokerage market report covers the following areas:

- Freight Brokerage Market size

- Freight Brokerage Market trends

- Freight Brokerage Market industry analysis

This study identifies the presence of FTAs and trade blocs at global level as one of the prime reasons driving the freight brokerage market growth during the next few years.

Freight Brokerage Market 2020-2024: Vendor Analysis

We provide a detailed analysis of vendors operating in the freight brokerage market, including some of the vendors such as C.H. Robinson Worldwide Inc., Echo Global Logistics Inc., Expeditors International of Washington Inc., Hub Group Inc., J.B. Hunt Transport Services Inc., Kuehne + Nagel International AG, Nippon Yusen Kabushiki Kaisha, Panalpina World Transport (Holding) Ltd., United Parcel Service of America Inc., and XPO Logistics Inc. Backed with competitive intelligence and benchmarking, our research reports on the freight brokerage market are designed to provide entry support, customer profile and M&As as well as go-to-market strategy support.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Freight Brokerage Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist freight brokerage market growth during the next five years

- Estimation of the freight brokerage market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the freight brokerage market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of freight brokerage market vendors

Table Of Contents:

Executive Summary

- Market Overview

Market Landscape

- Market ecosystem

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019-2024

Five Forces Analysis

- Five Forces Summary

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Service

- Market segments

- Comparison by Service placement

- LTL - Market size and forecast 2019-2024

- FTL - Market size and forecast 2019-2024

- Temperature-controlled freight - Market size and forecast 2019-2024

- Others - Market size and forecast 2019-2024

- Market opportunity by Service

Customer Landscape

- Overview

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- North America - Market size and forecast 2019-2024

- Europe - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity by geography

Drivers, Challenges, and Trends

- Market drivers

- Volume driver - Demand led growth

- Volume driver - Supply led growth

- Volume driver - External factors

- Volume driver - Demand shift in adjacent markets

- Price driver - Inflation

- Price driver - Shift from lower to higher-priced units

- Market challenges

- Market trends

Vendor Landscape

- Overview

- Vendor landscape

- Landscape disruption

Vendor Analysis

- Vendors covered

- Market positioning of vendors

- C.H. Robinson Worldwide, Inc.

- Echo Global Logistics, Inc.

- Expeditors International of Washington Inc.

- Hub Group, Inc.

- J.B. Hunt Transport Services Inc.

- Kuehne + Nagel International AG

- Nippon Yusen Kabushiki Kaisha

- Panalpina World Transport (Holding) Ltd.

- United Parcel Service of America Inc.

- XPO Logistics Inc.

Appendix

- Scope of the report

- Currency conversion rates for US$

- Research methodology

- List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.