HONG KONG--(BUSINESS WIRE)--Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported selected unaudited financial data for the three-month period ended 31 March 2020. (All amounts are expressed in HKD unless otherwise stated)

LETTER FROM THE CHAIRMAN OF GALAXY ENTERTAINMENT GROUP

Q1 2020 has been a very difficult period for the community and businesses globally due to the COVID-19 pandemic. I would like to express my heartfelt thanks to everyone globally for their efforts and restraints during this period of time. In particular, I would like to acknowledge and thank all of the medical and emergency personnel for their efforts and sacrifice.

The introduction of immigration and quarantine restrictions has adversely affected visitations to Macau and impacted virtually all businesses in Macau. However, I am pleased to say that the Macau Government has been doing an excellent job to implement a wide range of health and safety and financial measures, to minimize the impact of the pandemic and to unite society. Also, all the concessionaires are working closely with the Macau Government and the relevant departments to contain the spread of the virus.

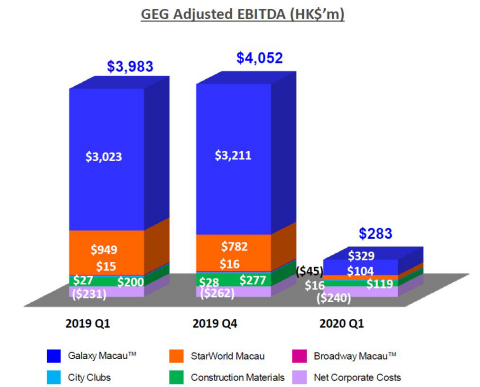

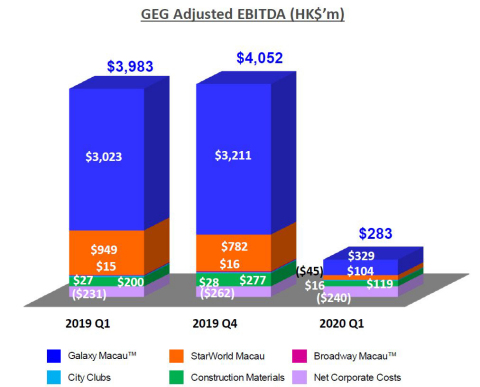

Moving onto our Q1 2020 performance, our net revenue during this difficult quarter was $5.1 billion and Adjusted EBITDA was $283 million. At this point in time it is difficult to quantify the full year financial impact of the virus, but it will have a material impact on our financial results and we cannot determine the duration of the pandemic.

We remain well capitalized. Having said that, we are doing our best to adjust our operations to the current business environment and effectively control costs. I would like to thank everyone on the GEG team who supported the Company in these difficult times by contributing to our cost control program. I am proud to report that virtually all team members made voluntary contributions including the Board of Directors (the “Board”) which also waived their Director’s fee, management who participated in our non-paid leave program and the many group members who joined our Flexi Family Care Program. At GEG we have tried to spread the impact of COVID-19 fairly across all team members as we prefer not to engage in redundancies. We continue with our Cotai development of Phases 3 & 4. We paid the previously announced special dividend of $0.45 per share on 24 April 2020.

Further to our previously announced financial donations, face masks, education support, social services and food & hygiene hampers, in April 2020, we announced an additional donation of MOP75 million through the Galaxy Entertainment Group Foundation. The goal of these initiatives is to assist healthcare workers, help with public health promotion and support the medical and scientific research related to the epidemic. In addition, Galaxy Entertainment Group Foundation subscribed $100 million to a special purpose Macau COVID-19 Recovery Bond that was specifically launched to provide financial assistance to SMEs in Macau. Total philanthropic contributions by GEG now total MOP200 million.

During this challenging period of time, we need to stay focused on the battle against the pandemic and I would like to thank all of the medical and emergency personnel for their efforts and sacrifice. I would also like to thank our loyal staff for maintaining the highest level of cleanliness and hygiene within our resorts. I would like to acknowledge the outstanding efforts of the Central and the Macau SAR Governments and thank them for their leadership during this period. I am confident in the longer term that we will recover from this challenge and we are committed to supporting the Macau Government in their vision to develop Macau into a World Centre of Tourism and Leisure.

Thank you.

Dr. Lui Che Woo

GBM, MBE, JP, LLD, DSSc, DBA

Chairman

Q1 2020 RESULTS HIGHLIGHTS

GEG: Well Capitalized to Weather the Storm

- Q1 Group Net Revenue of $5.1 billion, down 61% year-on-year and down 61% quarter-on-quarter

- Q1 Group Adjusted EBITDA of $283 million, down 93% year-on-year, down 93% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $84 million, normalized Q1 Adjusted EBITDA of $199 million, down 95% year-on-year and down 95% quarter-on-quarter

- Continue to effectively control costs

Galaxy Macau™: Adjusting Operations to the Current Business Environment

- Q1 Net Revenue of $3.5 billion, down 62% year-on-year and down 62% quarter-on-quarter

- Q1 Adjusted EBITDA of $329 million, down 89% year-on-year, down 90% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $73 million, normalized Q1 Adjusted EBITDA of $256 million, down 91% year-on-year and down 91% quarter-on-quarter

- Hotel occupancy for Q1 across the five hotels was 38%

StarWorld Macau: Adjusting Operations to the Current Business Environment

- Q1 Net Revenue of $1.0 billion, down 66% year-on-year and down 62% quarter-on-quarter

- Q1 Adjusted EBITDA of $104 million, down 89% year-on-year, down 87% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $12 million, normalized Q1 Adjusted EBITDA of $92 million, down 90% year-on-year and down 89% quarter-on-quarter

- Hotel occupancy for Q1 was 42%

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported by Macau SMEs

- Q1 Net Revenue of $53 million, down 65% year-on-year and down 66% quarter-on-quarter

- Q1 Adjusted EBITDA of $(45) million versus $15 million in Q1 2019 and $16 million in Q4 2019

- Played unlucky in Q1 which decreased Adjusted EBITDA by approximately $1 million, normalized Q1 Adjusted EBITDA of $(44) million versus $11 million in Q1 2019 and $17 million in Q4 2019

- Hotel occupancy for Q1 was 34%

Balance Sheet: Healthy and Liquid Balance Sheet

- Cash and liquid investments were $51.9 billion and net cash was $47.5 billion as at 31 March 2020

- Debt of $4.4 billion as at 31 March 2020, primarily reflects ongoing treasury yield management initiative

- Paid the previously announced special dividend of $0.45 per share on 24 April 2020

Development Update: Continue to Pursue Development Opportunities

- Property Enhancement Program – Almost completed the previously announced $1.5 billion property enhancement program in both Galaxy Macau™ and StarWorld Macau, are reviewing additional enhancement opportunities

- Cotai Phases 3 & 4 – Continue with development works for Phases 3 & 4, with a strong focus on non-gaming, primarily targeting MICE, entertainment, family facilities and also including gaming, given COVID-19 timelines may be impacted

- Hengqin – Refining plans for a lifestyle resort to complement our high-energy entertainment resorts in Macau

- International – Continuously exploring opportunities in overseas markets, including Japan

Macau Market Overview

Macau Gross Gaming Revenue for Q1 2020 was $29.6 billion, down 60% year-on-year and down 58% quarter-on-quarter. Immigration and quarantine restrictions were introduced due to COVID-19. These restrictions have impacted visitor arrivals to Macau. In Q1 2020, visitor arrivals were down 69% year-on-year to 3.2 million. Same-day visitors were 1.7 million and overnight visitors were 1.5 million, a decrease of 70% and 68% respectively. The average length of stay of overnight visitors extended by 0.5 day to 2.7 days. Visitors from Mainland China, Hong Kong and Taiwan fell by 69%, 64% and 69% year-on-year respectively.

Group Financial Results

We would like to thank everyone on the GEG team who supported the Company in these difficult times by contributing to our cost control program. We are proud to report that virtually all team members made voluntary contributions including the Board which also waived their Director’s fee, management who participated in our non-paid leave program and the many group members who joined our Flexi Family Care Program. At GEG we have tried to spread the impact of COVID-19 fairly across all team members as we prefer not to engage in redundancies.

In Q1 2020, the Group posted net revenue of $5.1 billion, down 61% year-on-year and down 61% quarter-on-quarter. Adjusted EBITDA was $283 million, down 93% year-on-year and down 93% quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $329 million, down 89% year-on-year and down 90% quarter-on-quarter. StarWorld Macau’s Adjusted EBITDA was $104 million, down 89% year-on-year and down 87% quarter-on-quarter. Broadway Macau™’s Adjusted EBITDA was $(45) million versus $15 million in Q1 2019 and $16 million in Q4 2019.

GEG played lucky in Q1 2020 which increased Adjusted EBITDA by approximately $84 million. Normalized Q1 Adjusted EBITDA was $199 million, down 95% year-on-year and down 95% quarter-on-quarter.

The Group’s total GGR on a management basis1 in Q1 2020 was $5.5 billion, down 64% year-on-year and down 62% quarter-on-quarter. Total mass table GGR was $2.8 billion, down 62% year-on-year and down 62% quarter-on-quarter. Total VIP GGR was $2.5 billion, down 67% year-on-year and down 62% quarter-on-quarter. Total electronic GGR was $231 million, down 62% year-on-year and down 65% quarter-on-quarter.

Group Key Financial Data |

|

|

|

(HK$'m) |

Q1 2019 |

Q4 2019 |

Q1 2020 |

Revenues: |

|

|

|

Net Gaming |

11,091 |

10,745 |

4,046 |

Non-gaming |

1,338 |

1,426 |

549 |

Construction Materials |

616 |

802 |

475 |

Total Net Revenue |

13,045 |

12,973 |

5,070 |

Adjusted EBITDA |

3,983 |

4,052 |

283 |

|

|

|

|

Gaming Statistics2 |

|

|

|

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Rolling Chip Volume3 |

203,568 |

168,975 |

68,169 |

Win Rate % |

3.6% |

3.8% |

3.6% |

Win |

7,429 |

6,460 |

2,475 |

|

|

|

|

Mass Table Drop4 |

30,463 |

30,601 |

11,189 |

Win Rate % |

24.1% |

24.0% |

25.2% |

Win |

7,345 |

7,330 |

2,815 |

|

|

|

|

Electronic Gaming Volume |

16,178 |

17,984 |

7,119 |

Win Rate % |

3.7% |

3.7% |

3.2% |

Win |

606 |

659 |

231 |

|

|

|

|

Total GGR Win5 |

15,380 |

14,449 |

5,521 |

Balance Sheet and Special Dividend

As of 31 March 2020, cash and liquid investments were $51.9 billion and net cash was $47.5 billion. Total debt was $4.4 billion which primarily reflects our treasury yield enhancement initiative. GEG paid the previously announced special dividend of $0.45 per share on 24 April 2020. Our balance sheet combined with cash flow from operations allows us to return capital to shareholders via special dividends and to fund both our Macau development pipeline and international expansion ambitions.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In Q1 2020, Galaxy Macau™’s net revenue was $3.5 billion, down 62% year-on-year and down 62% quarter-on-quarter. Adjusted EBITDA was $329 million, down 89% year-on-year and down 90% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 9% (Q1 2019: 33%).

Galaxy Macau™ played lucky in Q1 2020 which increased Adjusted EBITDA by approximately $73 million. Normalized Q1 Adjusted EBITDA was $256 million, down 91% year-on-year and down 91% quarter-on-quarter.

Hotel occupancy for Q1 across the five hotels was 38%.

Galaxy Macau™ Key Financial Data |

|||

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Revenues: |

|

|

|

Net Gaming |

8,130 |

8,137 |

3,060 |

Hotel / F&B / Others |

829 |

872 |

313 |

Mall |

305 |

327 |

151 |

Total Net Revenue |

9,264 |

9,336 |

3,524 |

|

|

|

|

Adjusted EBITDA |

3,023 |

3,211 |

329 |

Adjusted EBITDA Margin |

33% |

34% |

9% |

|

|

|

|

Gaming Statistics6 |

|

|

|

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Rolling Chip Volume7 |

135,344 |

114,669 |

47,842 |

Win Rate % |

3.9% |

4.0% |

4.1% |

Win |

5,253 |

4,612 |

1,962 |

|

|

|

|

Mass Table Drop8 |

17,906 |

18,359 |

6,519 |

Win Rate % |

28.3% |

28.4% |

29.1% |

Win |

5,068 |

5,221 |

1,897 |

|

|

|

|

Electronic Gaming Volume |

11,106 |

11,872 |

4,482 |

Win Rate % |

4.5% |

4.5% |

4.0% |

Win |

502 |

539 |

178 |

|

|

|

|

Total GGR Win |

10,823 |

10,372 |

4,037 |

StarWorld Macau

In Q1 2020, StarWorld Macau’s net revenue was $1.0 billion, down 66% year-on-year and down 62% quarter-on-quarter. Adjusted EBITDA was $104 million, down 89% year-on-year and down 87% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 10% (Q1 2019: 32%).

StarWorld Macau played lucky in Q1 2020 which increased Adjusted EBITDA by approximately $12 million. Normalized Q1 Adjusted EBITDA was $92 million, down 90% year-on-year and down 89% quarter-on-quarter.

Hotel occupancy for Q1 was 42%.

StarWorld Macau Key Financial Data |

|

|

|

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Revenues: |

|

|

|

Net Gaming |

2,858 |

2,515 |

948 |

Hotel / F&B / Others |

115 |

125 |

49 |

Mall |

14 |

13 |

5 |

Total Net Revenue |

2,987 |

2,653 |

1,002 |

|

|

|

|

Adjusted EBITDA |

949 |

782 |

104 |

Adjusted EBITDA Margin |

32% |

29% |

10% |

|

|

|

|

Gaming Statistics9 |

|

|

|

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Rolling Chip Volume10 |

67,580 |

50,539 |

18,509 |

Win Rate % |

3.2% |

3.5% |

2.4% |

Win |

2,165 |

1,770 |

451 |

|

|

|

|

Mass Table Drop11 |

9,265 |

9,217 |

3,584 |

Win Rate % |

18.9% |

17.5% |

20.2% |

Win |

1,749 |

1,614 |

725 |

|

|

|

|

Electronic Gaming Volume |

2,018 |

2,421 |

1,149 |

Win Rate % |

2.3% |

2.2% |

2.1% |

Win |

46 |

55 |

24 |

|

|

|

|

Total GGR Win |

3,960 |

3,439 |

1,200 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs, it does not have a VIP gaming component. In Q1 2020, Broadway Macau™’s net revenue was $53 million, down 65% year-on-year and down 66% quarter-on-quarter. Adjusted EBITDA was $(45) million versus $15 million in Q1 2019 and $16 million in Q4 2019. Adjusted EBITDA margin under HKFRS is not applicable (Q1 2019: 10%).

Broadway Macau™ played unlucky in Q1 2020 which decreased Adjusted EBITDA by approximately $1 million. Normalized Q1 Adjusted EBITDA was $(44) million versus $11 million in Q1 2019 and $17 million in Q4 2019.

Hotel occupancy for Q1 was 34%.

Broadway Macau™ Key Financial Data |

|||

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Revenues: |

|

|

|

Net Gaming |

76 |

65 |

22 |

Hotel / F&B / Others |

64 |

78 |

25 |

Mall |

11 |

11 |

6 |

Total Net Revenue |

151 |

154 |

53 |

|

|

|

|

Adjusted EBITDA |

15 |

16 |

(45) |

Adjusted EBITDA Margin |

10% |

10% |

N/A |

|

|

|

|

Gaming Statistics12 |

|

|

|

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Mass Table Drop13 |

342 |

320 |

114 |

Win Rate % |

20.3% |

19.1% |

17.9% |

Win |

70 |

61 |

20 |

|

|

|

|

Electronic Gaming Volume |

554 |

471 |

220 |

Win Rate % |

2.7% |

2.3% |

2.0% |

Win |

15 |

11 |

5 |

|

|

|

|

Total GGR Win |

85 |

72 |

25 |

City Clubs

In Q1 2020, City Clubs contributed $16 million of Adjusted EBITDA to the Group’s earnings, down 41% year-on-year and down 43% quarter-on-quarter.

City Clubs Key Financial Data |

|||

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Adjusted EBITDA |

27 |

28 |

16 |

|

|

|

|

Gaming Statistics14 |

|

|

|

(HK$'m) |

|

|

|

Q1 2019 |

Q4 2019 |

Q1 2020 |

|

Rolling Chip Volume15 |

644 |

3,767 |

1,818 |

Win Rate % |

1.6% |

2.1% |

3.4% |

Win |

11 |

78 |

62 |

|

|

|

|

Mass Table Drop16 |

2,950 |

2,705 |

972 |

Win Rate % |

15.5% |

16.1% |

17.8% |

Win |

458 |

434 |

173 |

|

|

|

|

Electronic Gaming Volume |

2,500 |

3,220 |

1,268 |

Win Rate % |

1.7% |

1.7% |

1.9% |

Win |

43 |

54 |

24 |

|

|

|

|

Total GGR Win |

512 |

566 |

259 |

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $119 million, down 41% year-on-year and down 57% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We have almost completed the previously announced $1.5 billion property enhancement program in both Galaxy Macau™ and StarWorld Macau, and we are reviewing additional enhancement opportunities.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. Our development works for Phases 3 & 4 include approximately 3,500 hotel rooms and villas, including family and premium high end rooms, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We will try to maintain our development target, however due to COVID-19, development timelines may be impacted. At this point we cannot quantify the impact but we will endeavor to maintain our schedule.

Hengqin

We continue to make progress with our concept plan for a lifestyle resort on Hengqin that will complement our high energy resorts in Macau. We are encouraged by the Macau Chief Executive’s recent positive comments in his inaugural Policy Address about the future role of Hengqin in the further development of Macau. We look forward to working with respective governments to develop our plan in Hengqin and support the government’s strategy to diversify Macau’s economy.

International

Our Japan based team continues with our Japan development efforts. We view Japan as a great long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, look forward to bringing our brand of World Class IRs to Japan.

Selected Major Awards in Q1 2020

Award |

Presenter |

GEG |

|

Casino Operator of the Year Australia & Asia Socially Responsible Operator (Asia / Australia) |

13th International Gaming Awards |

Social Responsibility Award |

The 2nd Greater China Most Influential Brand & Entrepreneur Awards Ceremony |

Galaxy Macau™ |

|

Five-Star Hotel:

Five-Star Restaurant:

Belon

Five-Star Spa: The Ritz-Carlton Spa, Macau Banyan Tree Spa Macau |

2020 Forbes Travel Guide |

100 Top Tables 2020: 8½ Otto e Mezzo BOMBANA Yamazato Lai Heen |

South China Morning Post |

Hotel Group B Excellence Award: Galaxy Macau™ |

Macau Energy Saving Activity 2019 |

StarWorld Macau |

|

100 Top Tables 2020 - Feng Wei Ju |

South China Morning Post |

Construction Materials Division |

|

Caring Company Scheme – 15 Years Plus Caring Company Logo |

The Hong Kong Council of Social Service |

Hong Kong Awards for Environmental Excellence – Manufacturing and Industrial Services – Certificate of Merit

Hong Kong Green Organisation Certification - Wastewi$e - Certificate - Excellence Level - Carbon Reduction - Certificate – Achieved 7% Carbon Reduction |

Environmental Campaign Committee |

Occupational Health Award 2019-20 Joyful@Healthy Workplace Best Practices Award (Enterprise / Organisation Category) – Grand Award |

Occupational Safety and Health Council |

BOCHK Corporate Environmental Leadership Awards 2019 – EcoPartner & 3 Years+ EcoPioneer |

Bank of China (Hong Kong) and Federation of Hong Kong Industries |

Outlook

The outlook for the foreseeable future is difficult to forecast. This is due to a lack of certainty around immigration, travel and quarantine restrictions associated with COVID-19. The Individual Visit Scheme (“IVS”) and group tours to Macau are still suspended, and on returning to the mainland, visitors are required to undergo 14 days of quarantine. Until we have visibility on these variables it is difficult to predict the shorter term outlook for Macau. Further, the China economy has been negatively impacted by the virus and it will take some time for the economy to ramp up and for consumer confidence to return to pre-virus levels. This is further impacted by weaker demand for China exports throughout the world.

At this point in time we still cannot determine the duration of the COVID-19 and therefore we are not yet able to quantify the full financial impact. We wish to highlight that the COVID-19 crisis is likely to have a material adverse effect on our 2020 financial results and impact our development projects in Macau.

In the interim we are focused on carefully controlling costs and ensuring our resorts are ready to fully reopen when the market demand returns. Again, we wish to thank all GEG team members for their support during this challenging time. We continue to ramp up our construction efforts of Cotai Phases 3 and 4, as we firmly believe the market for tourism and leisure in China is greatly under penetrated. It is positive that recent surveys of Chinese indicated that upon the lifting of travel restrictions, that Chinese tourists have a preference to travel domestically as distinct to international travel. Importantly in Mainland China, Macau is considered domestic travel and with the planned opening of Cotai Phase 3, GEG is well positioned for future growth.

Longer term we remain very confident in the outlook for Macau. In his inaugural Policy Address in April 2020, the Chief Executive stated that Macau SAR will request for the Central Government to resume travel visa issuance, increase the numbers of IVS cities and relax the travel visas policies from Guangdong. Furthermore, the Macau tourism authority is working on plans to relaunch tourism marketing programs in the main source markets which accounted for approximately 90% of all visitor arrivals in 2019. The Government is also planning a variety of tourism incentives and festive events in Macau to encourage tourists to visit Macau.

Again, we recognize the serious impact of the crisis across the globe, and we encourage people to take caution and increase their level of personal hygiene and safety and remain well during this period of time.

- END -

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also planning to develop a world class, lifestyle leisure resort on a 2.7 square kilometer land parcel on Hengqin adjacent to Macau. This resort will complement GEG’s offerings in Macau, and at the same time differentiate it from its peers while supporting Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Etrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 Gaming statistics are presented before deducting commission and incentives.

7 Reflects junket rolling chip volume only.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Gaming statistics are presented before deducting commission and incentives.

10 Reflects junket rolling chip volume only.

11 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

12 Gaming statistics are presented before deducting commission and incentives.

13 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

14 Gaming statistics are presented before deducting commission and incentives.

15 Reflects junket rolling chip volume only.

16 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.