ARLINGTON, Va.--(BUSINESS WIRE)--E*TRADE Financial Corporation (NASDAQ: ETFC) today announced results from the most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. Results show Gen Z and Millennials are focused on their investments amid the current crisis:

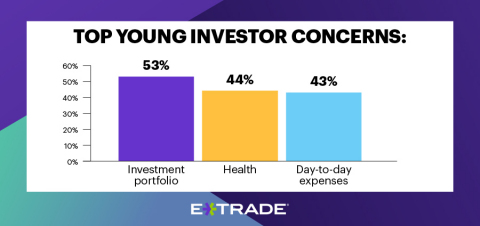

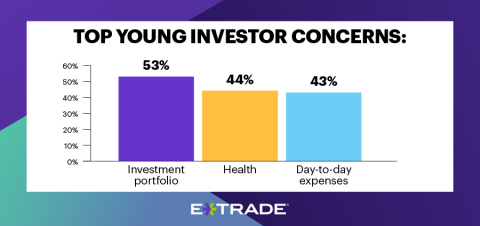

- Portfolio concerns surpass health worries. Investors under 30 say their #1 concern during the COVID-19 crisis is their investment portfolio (53%), followed by their health (44%), and then their ability to afford day-to-day living expenses (43%).

- They are checking their portfolio much more often than other generations. More than half of investors under 30(54%) check their portfolio at least daily, compared to 29% of the total population. In fact, almost three of out five investors under 30 (58%) say they check their portfolios more frequently since the coronavirus pandemic.

- Confidence remains, albeit slightly reduced. Nearly three out of five young investors (59%) remain confident they’re making the right decisions for their portfolios, compared to 38% of the total population. Confidence has dipped seven and 10 percentage points since last quarter among young investors and the total population, respectively.

“Millennial and Gen Z investors have primarily experienced the 10-year bull run in their investing lifetime so it’s understandable to see portfolio concerns bubble up, but it’s important to remember that time is on their side,” said Mike Loewengart, Managing Director of Investment Strategy at E*TRADE Financial. “To watch a nest egg’s value reduce drastically in almost the blink of an eye is enough to shake up anyone. Those who are concerned about market volatility should remain grounded in their financial goals, keep their eyes on the long term, and stay diversified. While these are no doubt unsettling times, they will run their course. I think we’re seeing some of this sentiment echoed in their unflagging market conviction.”

Mr. Loewengart offered additional guidance to young investors concerned about their portfolio in the current environment:

- The market doesn’t move in one direction. It makes sense seeing skittish behavior in the current environment. Although this was the quickest sell-off since the Great Depression, the S&P 500 is still up significantly from where it was even just five years ago—suggesting the importance of keeping a long-term view.

- Don’t attempt to time the market. Chasing performance is a risky business—you’re always looking in the rear-view mirror. While historical data can be helpful, it bears repeating that past performance does not guarantee future results. What goes down hard can come up strong and vice versa. A solid example is April’s impressive rally from the March low. If investors had fled the exits at the bottom, they would have missed out on those gains. Stay committed to the portfolio you’ve worked so hard to build.

- Diversification proves its mettle in this environment. In times of extreme market volatility, a balanced portfolio can help you ride out market swings. As earnings season continues, it’s becoming clearer that the pandemic is not hurting all sectors equally—consumer staples and health care are thriving. A simple way to participate in the market’s various sectors is to be broadly exposed, which one can achieve through such instruments as index ETFs or mutual funds.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from April 1 to April 8 of 2020 among an online US sample of 940 self-directed active investors who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands. The <30 data set is comprised of 112 investors between the ages of 18 and 30.

About E*TRADE Financial and Important Notices

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services, including mutual funds and ETFs, are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are national federal savings banks (Members FDIC). More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2020 E*TRADE Financial Corporation. All rights reserved.

E*TRADE Financial Corporation engages Dynata to program, field, and tabulate the study. Dynata provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.dynata.com.

Referenced Data

When it comes to the Coronavirus, which are you most concerned about? (Top 2) |

||

|

Total |

Age <30 |

My investment portfolio (e.g., self-directed brokerage account, retirement account, managed account) |

47% |

53% |

My own personal health, and the health of my family and friends |

68% |

44% |

My ability to afford day-to-day living expenses (e.g., groceries, rent, utilities, childcare) |

17% |

43% |

My job and potential job prospects |

18% |

29% |

My personal vacation and leisure plans |

14% |

18% |

The effect on the US and global economies |

34% |

13% |

How often do you evaluate the positions in your portfolio? |

||

|

Total |

Age <30 |

Hourly |

5% |

10% |

Daily |

24% |

44% |

Weekly |

33% |

35% |

Monthly |

18% |

7% |

Once a month or less often |

20% |

4% |

The frequency at which I check my portfolio has _____ since the Coronavirus outbreak. |

||

|

Total |

Age <30 |

Top two box |

47% |

58% |

Greatly increased |

18% |

20% |

Somewhat increased |

29% |

38% |

Stayed the same |

39% |

26% |

Somewhat decreased |

8% |

12% |

Greatly decreased |

6% |

4% |

Bottom two box |

14% |

16% |

How confident are you that you are making the right decisions for your portfolio? |

||||

|

Q2 2020 Total |

Q2 2020 Age <30 |

Q1 2020 Total |

Q1 2020 Age <30 |

Confident |

38% |

59% |

48% |

66% |

Extremely confident |

12% |

21% |

11% |

23% |

Very confident |

26% |

38% |

37% |

43% |

Somewhat confident |

46% |

30% |

45% |

28% |

Only a little confident |

13% |

9% |

7% |

6% |

Not confident at all |

3% |

2% |

0% |

0% |

Not confident |

16% |

11% |

7% |

6% |

Gen Z and Millennials (young investors) are defined as age 18–30 years old