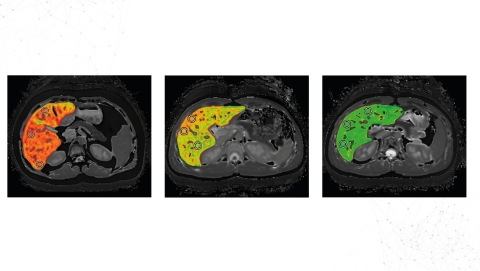

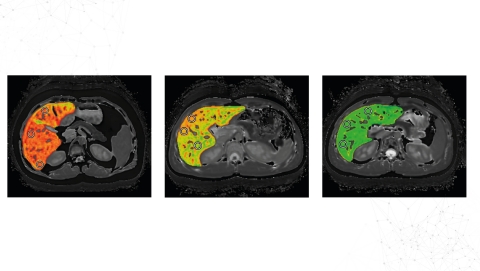

OXFORD, England--(BUSINESS WIRE)--Perspectum® (“Perspectum” or “the Company”) a medical software company that provides non-invasive technology for identifying and monitoring multiple diseases announced today the completion of a $36M financing from new and existing investors. The company’s first diagnostic product (LiverMultiScan®) uses software to extract quantitative data from current MRI scans to aid with the detection of chronic liver disease. Additionally, Perspectum has an imaging-focused Contract Research Organization (CRO) solutions business that supports biopharmaceutical companies developing assets in liver and metabolic diseases. The funding will drive the commercialization of LiverMultiScan® for clinical use, expand the CRO business as well as develop additional products for biliary disease, diabetes and cancer for both clinical and CRO applications. The investment was co-led by the Blue Venture Fund (“BVF”) and HealthQuest Capital, with participation from Oxford Science Innovation, Puhua Capital and the University of Oxford and other existing investors.

LiverMultiScan® is the only FDA-cleared technology that has proven accuracy and precision in assessment of liver tissue. This enables improved diagnostic pathways for liver disorders, such as Non-Alcoholic Fatty Liver Disease (NAFLD) and Non-Alcoholic Steatohepatitis (NASH), conditions that impact more than 100 million people in the US, with an annual cost to the US healthcare system of $32bn. NASH is a global condition, with increasing prevalence in China, where the technology is already being evaluated. The FDA will likely approve Ocaliva by Intercept Pharmaceuticals as the first medication indicated for NASH later this year, and there are more than 70 active clinical trials to address this unmet need, the majority of which are in Phase II or later. Effective use of non-invasive technology will be instrumental for drug development efforts and then to ensure appropriate utilization of specialty drug therapy as these drugs come online.

“We are excited to have Blue Venture Fund and HealthQuest Capital as lead investors in this financing. Blue Venture Fund’s invaluable insight in navigating reimbursement and coverage decisions, and HealthQuest’s experience ramping growth stage healthcare companies and specific experience in clinical diagnostics and clinical trial services will be enormously beneficial to our business.”, said Dr Rajarshi Banerjee, Founder and Chief Executive Officer of Perspectum.

"Perspectum offers an innovative imaging technology which will help curb the staggering morbidity and mortality associated with Nonalcoholic Fatty Liver Disease,” said Thomas Hawes, Managing Director of the Blue Venture Fund. “Perspectum is uniquely positioned to advance pharmaceutical development, inform clinical care, and improve the patient experience. We believe Perspectum has the opportunity to become a market leader in imaging biomarkers and hepatic disease. We are thrilled to partner with Perspectum's outstanding management team and HealthQuest Capital."

Garheng Kong, MD, PhD, Managing Partner at HealthQuest will join the Perspectum Board, and commented “Perspectum is addressing a large medical need with very few current solutions and has the opportunity to become the standard of care for liver disease diagnosis as a first application. We believe there is an opportunity to build a best-in-class medical imaging company for multiple clinical indications and are excited to work alongside BVF to help Perspectum realize this vision.”

About Perspectum

Perspectum delivers cutting-edge digital technologies that help clinicians provide better care for patients with liver disease, diabetes and cancer. With a strong focus on precision medicine using advanced imaging and genetics, our vision is to empower patients and clinicians through quantitative assessments of health enabling early detection, diagnosis, and targeted treatment. With a diverse team of physicians, biomedical scientists, engineers and technologists, Perspectum offers a way to manage complex health problems at scale. For more information, visit perspectum.com

About The Blue Venture Fund

The Blue Venture Fund (BlueCross BlueShield Venture Partners) is a corporate venture fund program to which thirty-six Blue Cross and Blue Shield (BCBS) companies have committed over $800 million across four Funds. The Funds invest in promising emerging companies of strategic relevance to Blue Cross and Blue Shield companies and provide access to its portfolio to deploy innovation at scale. The Blue Venture Fund is sponsored by the Blue Cross Blue Shield Association (BCBSA), an association of independent Blue Cross and Blue Shield companies. For more information, visit www.bcbsvp.com.

About HealthQuest Capital

Based in the San Francisco Bay Area, HealthQuest Capital is a growth capital firm investing in commercial-stage companies that are optimizing value in healthcare by improving outcomes and reducing costs. With more than $850 million in capital under management, the firm focuses on fostering innovation across the healthcare spectrum, including medical technologies, diagnostics/tools, digital health and innovative services. The HealthQuest team combines decades of successful investing experience with deep domain expertise in all aspects of the healthcare industry. For more information, visit www.healthquestcapital.com.