LONDON--(BUSINESS WIRE)--Capri Holdings Limited (NYSE:CPRI), a global fashion luxury group, today provided an update on the coordinated actions the company is taking to protect our employees and maintain the company’s financial position in response to the continued global health and economic impact of the COVID-19 pandemic.

“The impact of COVID-19 on the world and the global economy is changing rapidly in ways we could not have anticipated,” said John D. Idol, Chairman and Chief Executive Officer. “This is a very challenging time for our business. We are diligently working to address this unprecedented situation by taking measures to protect our employees and maintain the company’s financial flexibility. We do not take any of these measures lightly, particularly with respect to our employees who are the heart and soul of our company. We believe that these actions are necessary in order to enable us to overcome the burdens of this financial crisis. We continue to believe in the power of our three fashion luxury brands and the resiliency of our company to navigate these extraordinary times.”

Mr. Idol continued, “Given our size and scale, we believe that Capri is well-positioned to continue to operate its business despite this unprecedented situation. We have a strong balance sheet and will continue to take disciplined actions to preserve our cash and liquidity. Leveraging our strong relationships with our vendors, suppliers and landlords, we intend to work together in an effort to maintain our financial strength. Given our current projections of the future impact of COVID-19 on the global economy and our business, we are optimistic that Capri will rebound and believe we have the financial resources to emerge a strong company.”

Maintaining Financial Strength

As of April 1, 2020, the company had total cash and cash equivalents on its balance sheet of approximately $900 million. The Company has fully drawn the remaining $300 million of availability under its revolving credit facility.

Reducing Costs and Expenses

The company has also taken further additional actions to preserve its cash flows and maintain its financial strength, including:

- Reducing board of director pay – For Fiscal 2021, the company’s board of directors annual total cash compensation will be reduced by 50%.

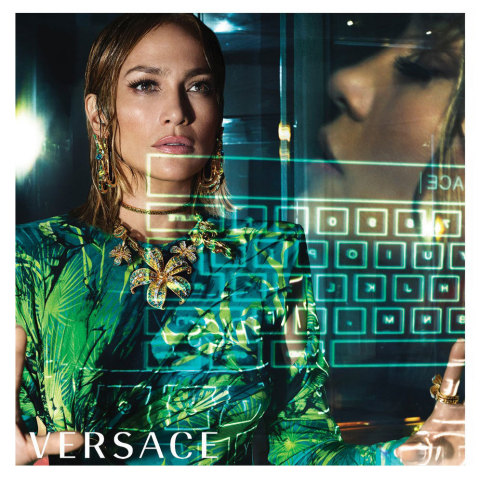

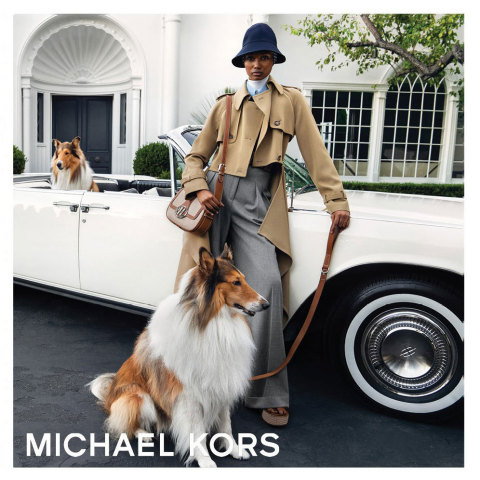

- Foregoing and reducing executive compensation – John D. Idol, Chairman and Chief Executive Officer, Michael Kors, Chief Creative Officer of Michael Kors, Donatella Versace, Chief Creative Officer of Versace, and Sandra Choi, Chief Creative Officer of Jimmy Choo, have each voluntarily elected to forgo their salary for Fiscal 2021 (except for the minimum necessary to cover benefits or to otherwise comply with international statutory requirements). In addition, the company will be exploring opportunities to reduce overall salaries at various levels throughout the organization by approximately 20%.

- Restructuring corporate organization – In the future the company anticipates reducing its corporate workforce in order to generate additional payroll savings.

- North America: Furloughing retail staff – Since March 18, 2020, the company has provided salary continuation and benefits to all retail store employees impacted by its temporary store closures that started on that same date and were expected to end on April 10, 2020. The company now anticipates that retail stores in North America and Europe will be closed until approximately June 1, 2020 and will only reopen once it is deemed safe to do so. The company has therefore made the difficult decision that effective April 11, 2020, it will furlough all of its approximately 7,000 North America retail store employees. During this time, the company will continue to pay the employer portion of benefits to support impacted retail personnel. In the United States and Canada, furloughed employees are also eligible for unemployment insurance as well as other government relief programs where available. The company expects to require a smaller workforce as it resets its business post-COVID-19. The goal of the company is to return as many retail employees as possible to work in the second half of the fiscal year as its business rebuilds.

- Europe: Obtaining subsidies – the company is applying for national payroll subsidy programs in various countries throughout Europe to further reduce payroll expense.

- Significantly reducing inventory purchases – The company is diligently managing inventory purchases in light of the store closures in North America and EMEA and the anticipated decreased demand in the second half of the fiscal year by reducing or canceling commitments, redeploying inventory and consolidating upcoming seasons.

- Extending payment terms – The company is working closely with its partners to extend the terms of its future payables. Additionally, the company is working to secure relief of certain payables in order to maintain its financial flexibility for the long term.

- Reducing capital expenditures – The company expects to significantly reduce capital expenditures in Fiscal 2021.

- Minimizing operating expenses – The company is eliminating all non-essential operating expenses, including decreasing marketing spend, delaying or canceling select new store openings, reducing external third-party services and halting unnecessary systems implementations in order to reduce costs.

- Suspending share buybacks – The company is suspending the remaining $400 million under its current share repurchase program.

An update on the operational and financial impacts of the COVID-19 pandemic will be provided on the company’s fourth quarter Fiscal 2020 earnings call.

About Capri Holdings Limited

Capri Holdings Limited is a global fashion luxury group, consisting of iconic brands that are industry leaders in design, style and craftsmanship. Its brands cover the full spectrum of fashion luxury categories including women’s and men’s accessories, footwear and ready-to-wear as well as wearable technology, watches, jewelry, eyewear and a full line of fragrance products. The Company’s goal is to continue to extend the global reach of its brands while ensuring that they maintain their independence and exclusive DNA. Capri Holdings Limited is publicly listed on the New York Stock Exchange under the ticker CPRI.

Forward Looking Statements

This press release contains statements which are, or may be deemed to be, “forward-looking statements.” Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Capri Holdings Limited (the “Company”) about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. All statements other than statements of historical facts included in this press release may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “plans”, “believes”, “expects”, “intends”, “will”, “should”, “could”, “would”, “may”, “anticipates”, “might” or similar words or phrases, are forward-looking statements. These forward-looking statements are not guarantees of future financial performance. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions, which could cause actual results to differ materially from those projected or implied in any forward-looking statements. These risks, uncertainties and other factors include the effect of the COVID-19 pandemic and its potential material and significant impact on the Company’s future financial and operational results if retail stores remain closed and the pandemic is prolonged, including that our estimates could materially differ if the severity of the COVID-19 situation worsens, the length and severity of such outbreak across the globe and the pace of recovery following the COVID-19 pandemic, levels of cash flow and future availability of credit, compliance with restrictive covenants under the Company’s credit agreement, the Company’s ability to integrate successfully and to achieve anticipated benefits of any acquisition; the risk of disruptions to the Company’s businesses; the negative effects of events on the market price of the Company’s ordinary shares and its operating results; significant transaction costs; unknown liabilities; the risk of litigation and/or regulatory actions related to the Company’s businesses; fluctuations in demand for the Company’s products; levels of indebtedness (including the indebtedness incurred in connection with acquisitions); the timing and scope of future share buybacks, which may be made in open market or privately negotiated transactions, and are subject to market conditions, applicable legal requirements, trading restrictions under the Company’s insider trading policy and other relevant factors, and which share repurchases may be suspended or discontinued at any time, the level of other investing activities and uses of cash; changes in consumer traffic and retail trends; loss of market share and industry competition; fluctuations in the capital markets; fluctuations in interest and exchange rates; the occurrence of unforeseen epidemics and pandemics, disasters or catastrophes; political or economic instability in principal markets; adverse outcomes in litigation; and general, local and global economic, political, business and market conditions, as well as those risks set forth in the reports that the Company files from time to time with the U.S. Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the fiscal year ended March 30, 2019 (File No. 001-35368) and Quarterly Report on Form 10-Q for the fiscal quarter ended December 28, 2019 (File No. 001-35368). Any forward-looking statement in this press release speaks only as of the date made and the Company disclaims any obligation to update or revise any forward-looking or other statements contained herein other than in accordance with legal and regulatory obligations.