SAN JOSE, Calif.--(BUSINESS WIRE)--Adobe (Nasdaq:ADBE) today unveiled the Adobe Digital Economy Index, the first real-time barometer of the digital economy, which analyzes trillions of online transactions across 100 million product SKUs in 18 product categories. Growing at a faster pace than the economy as a whole, the digital economy has never been more important than during the COVID-19 pandemic as consumers and businesses across the globe grapple with a digital-only reality. More broadly, as the digital economy continues to evolve, the need to accurately track online prices and actual spending to better understand trends and predict changes across industries and countries becomes even more critical.

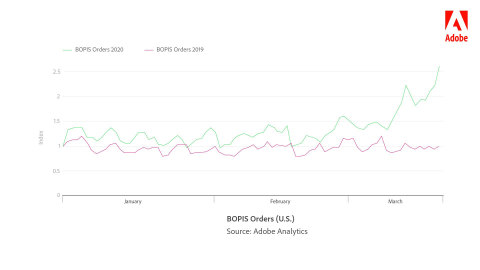

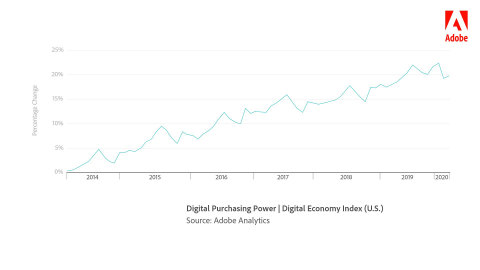

Powered by Adobe Analytics and based on a new “digital consumer shopping basket” measuring sales of online goods and services, Adobe's Digital Economy Index findings include a 20% increase in digital purchasing power—the amount consumers can buy with a set amount of money over a period of time—since 2014. Sales in certain categories, including groceries, cold medications, fitness equipment and computers have surged as a result of COVID-19. Buy Online, Pickup In-Store (BOPIS) shopping has increased 62%.

Additional insights include:

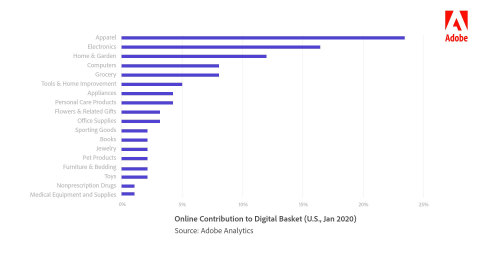

- Digital is driving new shopping behavior: Some product categories have taken a bigger share of the digital basket while others have fallen off. The grocery category has increased its share of the basket from 6% to 8% in three years. Apparel retailers made the pivot to digital early and have seen their share of total online transactions increase from 21% to 23% over the last five years. Conversely, computers have decreased from 21% to 8% in the wake of the mobile computing boom.

- Digital purchasing power continues to rise: Consumers continue to get more for the dollars they spend online. The digital purchasing power of consumers is up 3% year-over-year and has increased 20% since 2014, with $1 buying today what it would have taken $1.20 to buy in 2014. Over that same time, $1 spent buying a similar set of goods offline lost value, with $1 in 2020 buying what would have only cost 88 cents in 2014. However, the expectation is that as more of people’s lives move online, the offline and online economies will continue to converge and so will their prices.

- COVID-19 drives surge in eCommerce: Between January 1, 2020 and March 11, 2020, purchases of several products have seen a significant jump in sales: 807% for hand sanitizers, gloves, masks and anti-bacterial sprays; 217% for over-the-counter drug purchases (cold, flu and pain relievers); 231% for toilet paper; and 87% for canned goods and shelf-stable items. Additionally, with many U.S. consumers confined to their homes starting in March, orders for fitness equipment (kettlebells, dumbbells, stationary bikes and treadmills) and computers (desktops and laptops) have seen 55% and 40% boosts in online sales respectively. The online grocery shopping category overall has seen a 100% increase in daily online sales between March 13 and March 15, while BOPIS has seen a surge with a 62% year-over-year increase between February 24 and March 21.

- Innovation pushes online prices down: Categories with the most product updates (new SKUs) released in a year (Electronics, Computers, TVs) have seen online prices decrease, digital purchasing power increase, and have kept U.S. inflation down overall. Online electronics prices, for example, have decreased over 40% over a five-year period. From January 2014 to July 2017, online deflation drove digital purchasing power up by an average of 3.9% per year, but as people started buying more goods and services where innovation was less common—like groceries and furniture—online deflation and digital purchasing power slowed to 2% growth year over year. As online shopping begins to represent all that people buy, not just the most innovative goods, the price advantage to shopping online will diminish.

New Digital Consumer Basket

The total online purchase share in the U.S. includes Apparel (23% share), Electronics (16%), Home and Garden (12%), Computers (8%), Groceries (8%), Home Improvement Tools (5%), Home Appliances (4%), Personal Care Products (4%), Flowers and Related Gifts (3%), Office Supplies (3%), Sporting Goods (2%), Books (2%), Jewelry (2%), Furniture and Bedding (2%), Pet Supplies and Products (2%), and Toys and Games (2%). Goods in the Non-Prescription Drugs and Medical Equipment and Supplies categories make up 1% each.

Methodology

The Adobe Digital Economy Index offers the most comprehensive set of insights of its kind, based on the analysis of over one trillion visits to sites and over 100 million SKUs. Adobe Analytics measures transactions from 80 of the top 100 U.S. online retailers—more than any other technology company. Analysis is significantly more in-depth and accurate compared to survey-based assessments, because only Adobe has access to this volume of real-time, transactional consumer data. Several government bodies and industry trade organizations including the U.S. Bureau of Labor Statistics, the Federal Reserve and the U.S. Census Bureau agreed to work with Adobe to get an instant read on the digital economy and access to data.

Supporting Resources

- Blog post on Adobe Digital Economy Index.

- Stay tuned for updates to the Adobe Digital Economy Index here.

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2020 Adobe Inc. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in the United States and/or other countries. All other trademarks are the property of their respective owners.