Goldman Sachs BDC, Inc. Provides Business Update Amid COVID-19 Exigency

Goldman Sachs BDC, Inc. Provides Business Update Amid COVID-19 Exigency

NEW YORK--(BUSINESS WIRE)--Goldman Sachs BDC, Inc. (the “Company,” “us” or “our”) (NYSE:GSBD) today provides a business update amid the COVID-19 Exigency.

Actions Taken in Response to Current Economic Conditions

One of the core tenets of our investment strategy is to maintain regular, ongoing contact with our portfolio companies in order to anticipate events and be prepared to take actions to preserve capital. Since the COVID-19 outbreak around the world, our investment teams have been in direct contact with the owners and management teams of our portfolio companies on a frequent basis to assess potential impacts and ensure preparedness for contingencies. We are generally encouraged by the actions that our portfolio companies have taken to date to manage through the current environment. We also continue to benefit from the insights of colleagues across Goldman Sachs, including Goldman Sachs’ risk management personnel, to gain further insight into the unfolding economic environment as well as to update and revise portfolio stress scenarios. We believe that the strength of the Goldman Sachs platform is a significant asset for the Company as we navigate the current environment.

Current Portfolio Positioning

Another core tenet of our investment strategy is to underwrite each loan based on the assumption that an economic recession will occur during the life of the loan. This philosophy permeates the construction of our portfolio, which is focused on first lien, senior secured loans to US domiciled middle market companies that we believe are less exposed to cyclical pressures. Moreover, our portfolio has limited direct exposure to sectors that we believe will be most impacted by the COVID-19 outbreak, including energy, leisure, travel and transportation. Rather, our top five sector exposures are in industries that we believe are less directly impacted by the COVID-19 outbreak, including Healthcare Providers and Services, Software, Interactive Media and Services, IT Services, and Healthcare Technology. The US domiciled middle market companies that comprise our portfolio are generally focused on domestic customers and have domestic operations, resulting in limited exposure to Asia and Europe where the COVID-19 impact has been most acute to date. However, we anticipate that efforts and behaviors to contain the spread of the coronavirus will have an adverse effect on overall economic activity, which could impact a broader swath of industries and regions.

Importantly, the supermajority of the senior secured loans in our portfolio benefit from significant amounts of subordinated capital, including equity, that ranks junior to our investments. This junior capital beneath our investments provides a substantial cushion to absorb losses of value in our portfolio companies. Much of this junior capital has been invested by private equity sponsors who we believe have robust capabilities to steward companies through the current economic environment. We are actively working with the private equity sponsors of our portfolio companies to vigilantly monitor this continually evolving situation.

Capital and Liquidity

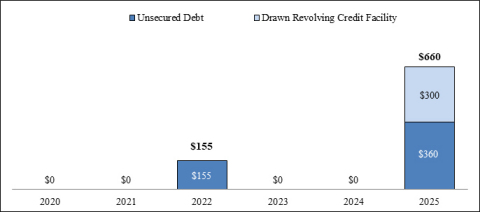

Since our IPO in 2015, we have sought to carefully manage our sources of funding. Most importantly, in our view, we have diverse sources of funding that are heavily weighted toward unsecured borrowings with long-dated maturities. Specifically, our total borrowings of approximately $815 million as of March 18, 2020 are comprised of approximately 63% unsecured debt and approximately 37% secured debt. Given the large percentage of our assets that are financed with unsecured debt, the current estimated borrowing base under our secured debt facility is approximately 3.5x the current drawn amount, providing a very significant collateral cushion to our secured creditors. We have $795 million of capital committed to our revolving credit facility from a syndicate of 11 banks, and have drawn only approximately $300 million of this amount as of March 18, 2020. By comparison, we currently have unfunded commitments of $68 million. We expect to be prudent in the near term in making any additional investment commitments as we believe that liquidity is a very important strategic asset, particularly in times of stress and opportunity. Importantly, we have no near term maturities as illustrated in the chart attached.

We believe that the recent market volatility has highlighted many important virtues of the publicly listed BDC vehicle structure. For example, while open-end investment vehicles are forced to sell assets due to net capital outflows, the long duration of permanent capital vehicles such as GSBD make them well positioned to withstand market volatility. In addition, the stability of our capital base highlights the attractiveness of private credit solutions to sponsors and business owners. We continue to evaluate investment opportunities on a daily basis, and anticipate that the market volatility will give rise to potential widening of spreads and tightening of loan structures, which should benefit long term investors.

ABOUT GOLDMAN SACHS BDC, INC.

Goldman Sachs BDC, Inc. is a specialty finance company that has elected to be regulated as a business development company under the Investment Company Act of 1940. GSBD was formed by The Goldman Sachs Group, Inc. (“Goldman Sachs”) to invest primarily in middle-market companies in the United States, and is externally managed by Goldman Sachs Asset Management, L.P., an SEC-registered investment adviser and a wholly-owned subsidiary of Goldman Sachs. GSBD seeks to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, first lien/last-out unitranche and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments. For more information, visit www.goldmansachsbdc.com. Information on the website is not incorporated by reference into this press release and is provided merely for convenience.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “target,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. These statements represent the Company’s belief regarding future events that, by their nature, are uncertain and outside of the Company’s control. Any forward-looking statement made by us in this press release speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission, and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

Goldman Sachs BDC, Inc.

Investors: Florina Mendez, 917-343-7823

Media: Patrick Scanlan, 212-902-6164