FORT MILL, S.C.--(BUSINESS WIRE)--A study released today by Harvard Business Review Analytic Services (HBRAS), commissioned by Basware, identifies a clear link between commercial success and the visibility of supplier practices. As well as placing importance on ethical considerations, the most common factors for evaluating suppliers remain economic. Sixty percent of respondents cite “value for money” and 54% call out “cost savings” as their top criteria. Firms identified as much more successful are nearly twice as likely to be effective at evaluating suppliers.

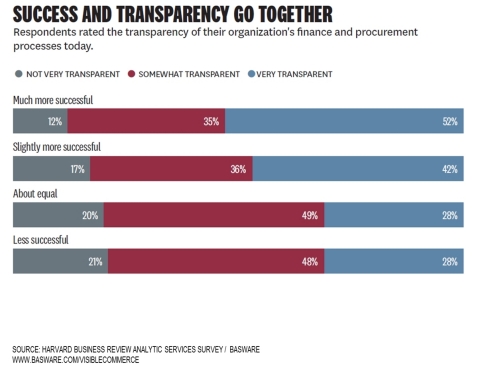

Nine in ten of the 779 business executives interviewed for the Using Transparency to Enhance Reputation and Manage Business Risk report believe a culture of transparency is essential to increase employee engagement and simplify processes. The majority (59%) expect their finance and accounting arms to drive that culture of transparency, with a third (36%) attributing operational savings in excess of 10 percent to visible commerce. 40 percent of firms are keen to do more to ensure ethical best practice amongst suppliers.

Klaus Andersen, Chief Executive, of Basware commented:

“That so many organisations lack the ability to effectively monitor who they do business with is a significant cause for concern. Chief Executives are right to be worried about the reputational and commercial implications of blind-spots across their supply chain. This report finds that visibility of the flow of money, goods and services is a defining characteristic of successful businesses. This means taking responsibility for not only the quality of goods and services, but also the manner in which they are produced. We define this as Visible Commerce - having full transparency which allows you to make better, more responsible decisions.”

Many organisations lack transparency in their supply chains with the majority of those surveyed (60%) warning that poor visibility of who they do business with is a significant source of risk. Nearly a quarter (24%) admit they fail to effectively evaluate supplier business practices, with 45 percent citing manual processes that lead to incomplete data entry as a key cause.

Guillaume Roels, Timken Chaired Professor of Global Technology and Innovation at INSEAD who was interviewed for the report remarks:

“We have to move beyond the mentality of siloes. Many organisations try to optimize just for their business, but they don’t see the whole value chain. Businesses really compete at the supply chain level. You need to find ways to capture the savings and to share the benefits with your supply chain partners. But transparency doesn’t come for free; you have to work hard to get it.”

While executives identify the finance and accounting arms of their enterprises as key to transparency, they cite technical, organisational, and cultural barriers to fully realising the benefits of that openness. 44 percent say they lack the tools and technology to evaluate and monitor their suppliers. Alarmingly, nearly a quarter (23%) of respondents said that none of their suppliers are electronically connected to their purchase-to pay-system.

A link to the full report is published here.

About Basware

Basware is the only procure-to-pay and e-invoicing solution provider that empowers businesses with 100% spend visibility through 100% data capture. Our cloud-based technology enables organizations to fully manage their spend, mitigate financial risk and reduce the cost of operations via automation. With the world’s largest open business network and an open technology ecosystem, we are uniquely positioned to deliver the solution required for Visible Commerce, which provides customers with complete transparency into all the flows of money, goods, and services around the world. A global company, Basware has offices in 14 countries and is traded on the Helsinki exchange (BAS1V: HE).

About the HBR Analytics

Harvard Business Review Analytic Services is an independent commercial research unit within Harvard Business Review Group, conducting research and comparative analysis on important management challenges and emerging business opportunities. Seeking to provide business intelligence and peer-group insight, each report is published based on the findings of original quantitative and/or qualitative research and analysis. Quantitative surveys are conducted with the HBR Advisory Council, HBR’s global research panel, and qualitative research is conducted with senior business executives and subject matter experts from within and beyond the Harvard Business Review author community.

Forty-seven percent of the 779 survey respondents interviewed in October 2019 for this report were from North America, 25% from Europe, 15% from Asia, and 13% from the rest of the world. They represented senior-level executives from companies primarily in the middle market. Thirty percent report less than $100 million in revenue and 16% report revenue of more than $10 billion.