Nielsen Report Finds Overseas Merchants Are Actively Exploring Digitalization via Chinese Mobile Payments to Boost Sales and Customer Traffic

Nielsen Report Finds Overseas Merchants Are Actively Exploring Digitalization via Chinese Mobile Payments to Boost Sales and Customer Traffic

HANGZHOU, China--(BUSINESS WIRE)--Alipay and Nielsen have jointly released a new survey on the latest trends in Chinese outbound tourism and the consumption habits of Chinese travelers for the third consecutive year. This year’s survey also finds that overseas merchants are actively exploring digital operations via Chinese mobile payments to increase sales and customer traffic. This is demonstrated by nearly 8 out of 10 (78%) U.K. merchants surveyed saying they are likely to recommend Alipay to their peers, especially for utilizing digital operations to improve efficiency and turnover.

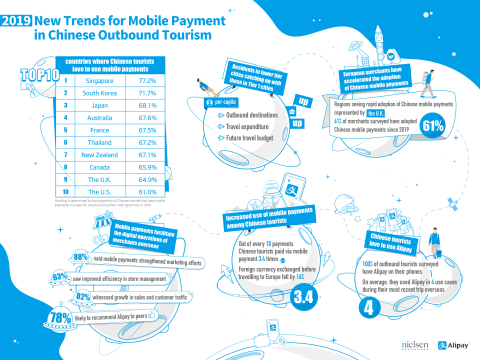

Surveying 4,837 Chinese travelers and 547 overseas merchants, the report finds that Chinese tourists’ usage of mobile payments while traveling overseas continues to increase, with Singapore, South Korea, Japan, Australia, France, Thailand, New Zealand, Canada, the U.K., and the U.S. ranked as the “top 10 countries where Chinese tourists love to use mobile payments in 2019.”

This trend is taking hold, with regions like the U.K. accelerating the acceptance of Chinese mobile payments. Overseas merchants are also going beyond payment to explore more digitalized solutions including digital marketing, with nearly 70% of U.K. merchants surveyed saying they have already utilized additional services other than payment in Alipay. Nearly 9 out of 10 (88%) U.K. merchants surveyed who have used additional services on Chinese mobile payment platforms recognized that these solutions helped market their stores, and 63% believed they improved the efficiency of store management.

The report provides a new look at the digitalization trends of the overseas retail sector at a time when online and offline businesses are increasingly merging, and Chinese tourists are poised to have more influence in this industry.

Key findings include:

- There is increased outbound tourism by Chinese residents in lower-tier cities. The gap between residents of second-and-third-tier cities and those from first-tier cities is quickly narrowing in terms of per capita outbound destinations, travel expenditure, and future travel budget. On per capita annual overseas travel expenditure, the difference between residents in third-tier and first-tier cities significantly dropped from USD 1,724 in 2018 to USD 606 in 2019.

- The transaction volume of Chinese mobile payments continues to increase. On average, Chinese tourists paid via mobile 3.4 times out of every 10 payments in 2019, up from 3.2 times in 2018.

- European merchants have accelerated the adoption of Chinese mobile payment solutions. In the U.K., 61% of local merchants surveyed adopted Chinese mobile payment solutions since 2019, and since then, usage among Chinese tourists has risen.

- The wider adoption of Chinese mobile payment solutions increases the willingness of Chinese tourist to spend. According to the survey, 92% of Chinese tourists traveling to Europe said they are more likely to pay with mobile phones if more local merchants supported Chinese mobile payment solutions, and 89% said that they are more likely to shop and spend locally.

- Mobile payment is more than payment; it also facilitates the digital operations of overseas merchants. In the U.K., where Chinese mobile payments are increasingly embraced, 88% of merchants surveyed recognized that additional services on Chinese payment platforms facilitated the marketing of their stores, and 63% saw improved efficiency in store management.

- More overseas merchants may continue to deepen their use of Chinese mobile payment platforms as they go digital. 66% of merchants surveyed hope to carry out more digital store operations and further their stores’ promotional and marketing activities by leveraging Chinese mobile payment platforms.

- Nearly 8 out of 10 (78%) U.K. merchants surveyed said that they are likely to recommend Alipay to their industry peers, especially utilizing digital operations to improve efficiency and turnover.

- The improved acceptance of mobile payment solutions has also made it possible for Chinese tourists to bring less cash, with data showing that the amount of foreign currency exchanged by Chinese tourists before leaving for Europe in 2019 fell by 16%.

- In 2019, 100% of Chinese tourists surveyed have Alipay on their mobile phones while travelling overseas. On average, Chinese tourists surveyed used Alipay in nearly 4 use cases during their most recent trip overseas.

Please find more findings in the attached infographic. To download the full report, please click here.

About Nielsen

Nielsen Holdings plc (NYSE: NLSN) is a global measurement and data analytics company that provides the most complete and trusted view available of consumers and markets worldwide. Nielsen is divided into two business units. Nielsen Global Media, the arbiter of truth for media markets, provides media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry required for markets to function. Nielsen Global Connect provides consumer packaged goods manufacturers and retailers with accurate, actionable information and insights and a complete picture of the complex and changing marketplace that companies need to innovate and grow.

Our approach marries proprietary Nielsen data with other data sources to help clients around the world understand what’s happening now, what’s happening next, and how to best act on this knowledge.

An S&P 500 company, Nielsen has operations in over 100 countries, covering more than 90% of the world’s population. For more information, visit www.nielsen.com.

About Alipay

Operated by Ant Financial Services Group, Alipay is the world’s leading payment and lifestyle platform. Launched in 2004, Alipay serves over 1.2 billion users with its local e-wallets partners as of June 2019. Over the years, Alipay has evolved from a digital wallet to a lifestyle enabler. Users can hail a taxi, book a hotel, buy movie tickets, pay utility bills, make appointments with doctors, or purchase wealth management products directly from within the app. In addition to online payments, Alipay is expanding to in-store offline payments both inside and outside of China. Alipay’s in-store payment service covers over 50 markets across the world, and tax reimbursement via Alipay is supported in 35 markets. Alipay currently supports 27 currencies, and works with over 250 overseas financial institutions and payment solution providers to enable cross-border payments for Chinese travelling overseas, and overseas customers who purchase products from Chinese e-commerce sites.

Contacts

Media Enquiry

Alipay

Bell Wang

yixing.wl@antfin.com

Nielsen

Lucille Liu

Lucille.liu@nielsen.com