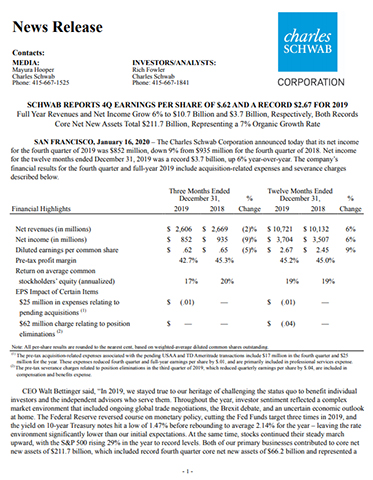

SAN FRANCISCO--(BUSINESS WIRE)--The Charles Schwab Corporation announced today that its net income for the fourth quarter of 2019 was $852 million, down 9% from $935 million for the fourth quarter of 2018. Net income for the twelve months ended December 31, 2019 was a record $3.7 billion, up 6% year-over-year. The company’s financial results for the fourth quarter and full-year 2019 include acquisition-related expenses and severance charges described below.

|

|

Three Months Ended

|

|

% |

|

Twelve Months Ended

|

|

% |

||||||||||||

Financial Highlights |

|

2019 |

|

2018 |

|

Change |

|

2019 |

|

2018 |

|

Change |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Net revenues (in millions) |

|

$ |

2,606 |

|

|

$ |

2,669 |

|

|

(2)% |

|

$ |

10,721 |

|

|

$ |

10,132 |

|

|

6% |

Net income (in millions) |

|

$ |

852 |

|

|

$ |

935 |

|

|

(9)% |

|

$ |

3,704 |

|

|

$ |

3,507 |

|

|

6% |

Diluted earnings per common share |

|

$ |

.62 |

|

|

$ |

.65 |

|

|

(5)% |

|

$ |

2.67 |

|

|

$ |

2.45 |

|

|

9% |

Pre-tax profit margin |

|

42.7 |

% |

|

45.3 |

% |

|

|

|

45.2 |

% |

|

45.0 |

% |

|

|

||||

Return on average common stockholders’ equity (annualized) |

|

17 |

% |

|

20 |

% |

|

|

|

19 |

% |

|

19 |

% |

|

|

||||

EPS Impact of Certain Items |

||||||||||||||||||||

$25 million in expenses relating to pending acquisitions (1) |

|

$ |

(.01 |

) |

|

— |

|

|

|

|

$ |

(.01 |

) |

|

— |

|

|

|

||

$62 million charge relating to position eliminations (2) |

|

$ |

— |

|

|

— |

|

|

|

|

$ |

(.04 |

) |

|

— |

|

|

|

||

| Note: All per-share results are rounded to the nearest cent, based on weighted-average diluted common shares outstanding. | |

(1) |

The pre-tax acquisition-related expenses associated with the pending USAA and TD Ameritrade transactions include $17 million in the fourth quarter and $25 million for the year. These expenses reduced fourth quarter and full-year earnings per share by $.01, and are primarily included in professional services expense. |

(2) |

The pre-tax severance charges related to position eliminations in the third quarter of 2019, which reduced quarterly earnings per share by $.04, are included in compensation and benefits expense. |

CEO Walt Bettinger said, “In 2019, we stayed true to our heritage of challenging the status quo to benefit individual investors and the independent advisors who serve them. Throughout the year, investor sentiment reflected a complex market environment that included ongoing global trade negotiations, the Brexit debate, and an uncertain economic outlook at home. The Federal Reserve reversed course on monetary policy, cutting the Fed Funds target three times in 2019, and the yield on 10-year Treasury notes hit a low of 1.47% before rebounding to average 2.14% for the year – leaving the rate environment significantly lower than our initial expectations. At the same time, stocks continued their steady march upward, with the S&P 500 rising 29% in the year to record levels. Both of our primary businesses contributed to core net new assets of $211.7 billion, which included record fourth quarter core net new assets of $66.2 billion and represented a 7% full-year organic growth rate, as well as our second consecutive year over $200 billion. Altogether, our robust asset gathering plus strong market returns drove total client assets to surpass the $4 trillion mark to a record $4.04 trillion at December 31st, closing the year up 24%.”

“During 2019 our commitment to seeing “through clients’ eyes” prompted us to take a number of bold steps that further enhance our offer to clients and help position Schwab to build value for our stakeholders – clients, employees, and stockholders – over the long-term,” Mr. Bettinger continued. “We shared the benefits of the scale we have worked so hard to achieve and removed the final barrier to investing by eliminating commissions for stocks, ETFs, and options listed on U.S. or Canadian exchanges, across all mobile and web trading channels. We also announced two significant acquisitions. In July, we agreed to acquire certain assets of USAA’s Investment Management Company while also entering into a long-term referral arrangement. We are honored to have the opportunity to serve the financial needs of USAA members and remain on track for closing in mid-2020. In late November, we entered into a definitive agreement to acquire TD Ameritrade. As we work towards a second half 2020 close and subsequent integration, our challenger mindset will guide us to ensure we leverage each organization’s strengths, including a common client-centric focus and a unique passion for breaking down barriers for investors and advisors alike.”

Mr. Bettinger concluded, “Last year we also focused on deepening our capabilities around innovative solutions and offering clients greater choice and value in meeting their investment needs. In the first quarter, we replaced Schwab Intelligent Advisory® with Schwab Intelligent Portfolios PremiumTM, the industry’s first subscription-based, automated investing solution with unlimited access to a planning professional. In December, we took action to meet the unfilled needs of millions of Americans by introducing Schwab Intelligent IncomeTM, a low-cost solution designed to offer a simple, modern way to generate income from existing investment portfolios. Additionally, in December, we lowered operating expense ratios on five fixed income ETFs, making each among the lowest OERs in their respective Morningstar categories. Last year also marked the 10th anniversary of our first proprietary ETF. Since that launch, we’ve added 24 more ETFs and $164 billion in assets. For our independent advisor clients, we are investing in a variety of technologies to best serve firms of all sizes and complexity. Since its April release, Schwab Advisor Portfolio Connect® – our modern portfolio management solution, available free of charge – has been delivering core capabilities and features to over 700 firms with an average AUM of $40 million. As part of our ongoing digital transformation work, we recently made enhancements to our status request experience including dynamic search functionality, more robust review capabilities, and increased flexibility to update pending requests. With these enhancements, status-related call volume has declined approximately 15% in our advisor business. Chuck Schwab, the Board, and I are all proud of the Schwab team’s many accomplishments in 2019 and we remain dedicated to helping investors reach their financial goals as we create an even stronger, more capable firm in the years ahead.”

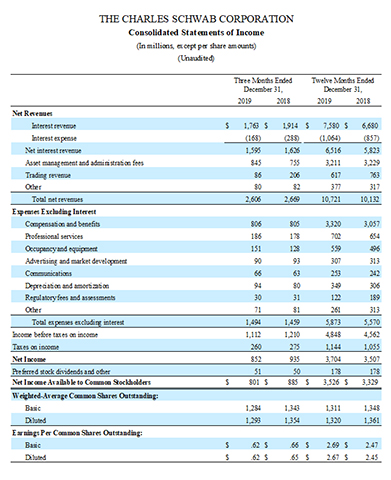

CFO Peter Crawford commented, “We achieved impressive financial results in 2019 given the somewhat more challenging than expected macroeconomic backdrop and our own pricing decisions. We delivered a record $10.7 billion in total revenue, up 6% year-over-year, which was just shy of the range we outlined at the beginning of the year. Net interest revenue increased 12% from the prior year to $6.5 billion, driven by higher average investment yields – even after the Fed’s rate cuts – and an increase in client cash balances held at our bank and brokerage subsidiaries. While trading revenue declined 19% to $617 million due to our pricing actions, asset management and administration fees of $3.2 billion remained essentially flat year-over-year. Rising balances in third-party mutual funds, along with growing enrollment in our advisory solutions, helped to largely offset declines in Mutual Fund OneSource® and lower money market fund revenue due to sweep transfers to our balance sheet. In response to the environment, we carefully managed our overall 2019 spending to $5.9 billion for the year, including $62 million in severance charges associated with a 3% reduction in our workforce and $25 million in costs relating to our two aforementioned acquisitions. Together, these items contributed roughly a third of our 5% overall expense growth, and we finished the year significantly below our initial 6%-7% outlook. Reflecting our commitment to balancing long-term profitability with reinvesting for growth, we achieved a record 45.2% pre-tax profit margin and a 19% return on equity for the year – our second consecutive year of at least 45% and 19%, respectively.”

Mr. Crawford added, “Disciplined balance sheet management remains core to our strategy as we continue to support business growth and meaningful capital returns across a range of conditions. We entered 2019 with a $4 billion share repurchase authorization, and through year end we had repurchased more than 55 million shares for $2.2 billion –including 6.4 million shares for approximately $230 million during the fourth quarter. By month-end December, our balance sheet assets reached $294 billion, up 5% from month-end September, and down 1% from a year ago; our preliminary consolidated Tier 1 Leverage Ratio was 7.3%. As we look forward to continuing to build Schwab both organically and through our pending transactions, our intent to return excess capital above our long-term operating objective of 6.75%-7.00% remains in place. Overall, our 2019 results emphasize the enduring nature of Schwab’s financial model, which allows us to consistently invest in our capabilities and our clients while building value for stockholders through the business cycle.”

Commentary from the CFO

Periodically, our Chief Financial Officer provides insight and commentary regarding Schwab’s financial picture at: https://www.aboutschwab.com/cfo-commentary. The most recent commentary, which provides perspective on our decision to reduce online trade commissions for U.S. and Canadian-listed equities, ETFs, and options to $0, was posted on October 1, 2019.

Forward-Looking Statements

This press release contains forward-looking statements relating to building value for stakeholders; the company’s (i) acquisition of certain assets of USAA’s Investment Management Company (IMCO) and entering into a referral agreement with USAA and (ii) acquisition and subsequent integration of TD Ameritrade, including the timing of closing those acquisitions; balancing long-term profitability with reinvesting for growth; balance sheet management; business growth; capital returns to stockholders; and Tier 1 Leverage Ratio operating objective. Achievement of these expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but are not limited to, general market conditions, including the level of interest rates, equity valuations, and trading activity; the company’s ability to attract and retain clients and registered investment advisors and grow those relationships and client assets; competitive pressures on pricing, including deposit rates; the company’s ability to develop and launch new and enhanced products, services, and capabilities, as well as enhance its infrastructure, in a timely and successful manner; client use of the company’s advisory solutions and other products and services; client sensitivity to rates; level of client assets, including cash balances; capital and liquidity needs and management; the company’s ability to manage expenses; failure of the parties to satisfy the closing conditions in the USAA IMCO purchase agreement and the TD Ameritrade merger agreement in a timely manner or at all, including regulatory approvals, stockholder approvals (for TD Ameritrade) and the implementation of conversion plans (for USAA IMCO); and other factors set forth in the company’s most recent report on Form 10-K.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with more than 360 offices and 12.3 million active brokerage accounts, 1.7 million corporate retirement plan participants, 1.4 million banking accounts, and $4.04 trillion in client assets as of December 31, 2019. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, asset management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC, https://www.sipc.org), and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent, fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at https://www.schwab.com and https://www.aboutschwab.com.

THE CHARLES SCHWAB CORPORATION |

||||||||||||||||

Consolidated Statements of Income |

||||||||||||||||

(In millions, except per share amounts) |

||||||||||||||||

(Unaudited) |

||||||||||||||||

|

Three Months Ended

|

|

Twelve Months Ended

|

|||||||||||||

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|||||||||

Net Revenues |

|

|

|

|

|

|

|

|||||||||

Interest revenue |

$ |

1,763 |

|

|

$ |

1,914 |

|

|

$ |

7,580 |

|

|

$ |

6,680 |

|

|

Interest expense |

(168 |

) |

|

(288 |

) |

|

(1,064 |

) |

|

(857 |

) |

|||||

Net interest revenue |

1,595 |

|

|

1,626 |

|

|

6,516 |

|

|

5,823 |

|

|||||

Asset management and administration fees |

845 |

|

|

755 |

|

|

3,211 |

|

|

3,229 |

|

|||||

Trading revenue |

86 |

|

|

206 |

|

|

617 |

|

|

763 |

|

|||||

Other |

80 |

|

|

82 |

|

|

377 |

|

|

317 |

|

|||||

Total net revenues |

2,606 |

|

|

2,669 |

|

|

10,721 |

|

|

10,132 |

|

|||||

Expenses Excluding Interest |

|

|

|

|

|

|

|

|||||||||

Compensation and benefits |

806 |

|

|

805 |

|

|

3,320 |

|

|

3,057 |

|

|||||

Professional services |

186 |

|

|

178 |

|

|

702 |

|

|

654 |

|

|||||

Occupancy and equipment |

151 |

|

|

128 |

|

|

559 |

|

|

496 |

|

|||||

Advertising and market development |

90 |

|

|

93 |

|

|

307 |

|

|

313 |

|

|||||

Communications |

66 |

|

|

63 |

|

|

253 |

|

|

242 |

|

|||||

Depreciation and amortization |

94 |

|

|

80 |

|

|

349 |

|

|

306 |

|

|||||

Regulatory fees and assessments |

30 |

|

|

31 |

|

|

122 |

|

|

189 |

|

|||||

Other |

71 |

|

|

81 |

|

|

261 |

|

|

313 |

|

|||||

Total expenses excluding interest |

1,494 |

|

|

1,459 |

|

|

5,873 |

|

|

5,570 |

|

|||||

Income before taxes on income |

1,112 |

|

|

1,210 |

|

|

4,848 |

|

|

4,562 |

|

|||||

Taxes on income |

260 |

|

|

275 |

|

|

1,144 |

|

|

1,055 |

|

|||||

Net Income |

852 |

|

|

935 |

|

|

3,704 |

|

|

3,507 |

|

|||||

Preferred stock dividends and other |

51 |

|

|

50 |

|

|

178 |

|

|

178 |

|

|||||

Net Income Available to Common Stockholders |

$ |

801 |

|

|

$ |

885 |

|

|

$ |

3,526 |

|

|

$ |

3,329 |

|

|

Weighted-Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|||||||||

Basic |

1,284 |

|

|

1,343 |

|

|

1,311 |

|

|

1,348 |

|

|||||

Diluted |

1,293 |

|

|

1,354 |

|

|

1,320 |

|

|

1,361 |

|

|||||

Earnings Per Common Shares Outstanding: |

|

|

|

|

|

|

|

|||||||||

Basic |

$ |

.62 |

|

|

$ |

.66 |

|

|

$ |

2.69 |

|

|

$ |

2.47 |

|

|

Diluted |

$ |

.62 |

|

|

$ |

.65 |

|

|

$ |

2.67 |

|

|

$ |

2.45 |

|

|

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||

Financial and Operating Highlights |

|||||||||||||||||||||||||||

(Unaudited) |

|||||||||||||||||||||||||||

|

Q4-19 % change |

|

|

2019 |

|

2018 |

|||||||||||||||||||||

|

vs. |

|

vs. |

|

|

Fourth |

|

Third |

|

Second |

|

First |

|

Fourth |

|||||||||||||

(In millions, except per share amounts and as noted) |

Q4-18 |

|

Q3-19 |

|

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|||||||||||||

Net Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Net interest revenue |

(2 |

)% |

|

(2 |

)% |

|

|

$ |

1,595 |

|

|

$ |

1,631 |

|

|

$ |

1,609 |

|

|

$ |

1,681 |

|

|

$ |

1,626 |

|

|

Asset management and administration fees |

12 |

% |

|

2 |

% |

|

|

845 |

|

|

825 |

|

|

786 |

|

|

755 |

|

|

755 |

|

||||||

Trading revenue |

(58 |

)% |

|

(50 |

)% |

|

|

86 |

|

|

172 |

|

|

174 |

|

|

185 |

|

|

206 |

|

||||||

Other |

(2 |

)% |

|

(4 |

)% |

|

|

80 |

|

|

83 |

|

|

112 |

|

|

102 |

|

|

82 |

|

||||||

Total net revenues |

(2 |

)% |

|

(4 |

)% |

|

|

2,606 |

|

|

2,711 |

|

|

2,681 |

|

|

2,723 |

|

|

2,669 |

|

||||||

Expenses Excluding Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Compensation and benefits |

— |

|

|

(6 |

)% |

|

|

806 |

|

|

857 |

|

|

807 |

|

|

850 |

|

|

805 |

|

||||||

Professional services |

4 |

% |

|

11 |

% |

|

|

186 |

|

|

168 |

|

|

178 |

|

|

170 |

|

|

178 |

|

||||||

Occupancy and equipment |

18 |

% |

|

5 |

% |

|

|

151 |

|

|

144 |

|

|

133 |

|

|

131 |

|

|

128 |

|

||||||

Advertising and market development |

(3 |

)% |

|

27 |

% |

|

|

90 |

|

|

71 |

|

|

77 |

|

|

69 |

|

|

93 |

|

||||||

Communications |

5 |

% |

|

5 |

% |

|

|

66 |

|

|

63 |

|

|

62 |

|

|

62 |

|

|

63 |

|

||||||

Depreciation and amortization |

18 |

% |

|

7 |

% |

|

|

94 |

|

|

88 |

|

|

84 |

|

|

83 |

|

|

80 |

|

||||||

Regulatory fees and assessments |

(3 |

)% |

|

— |

|

|

|

30 |

|

|

30 |

|

|

30 |

|

|

32 |

|

|

31 |

|

||||||

Other |

(12 |

)% |

|

31 |

% |

|

|

71 |

|

|

54 |

|

|

74 |

|

|

62 |

|

|

81 |

|

||||||

Total expenses excluding interest |

2 |

% |

|

1 |

% |

|

|

1,494 |

|

|

1,475 |

|

|

1,445 |

|

|

1,459 |

|

|

1,459 |

|

||||||

Income before taxes on income |

(8 |

)% |

|

(10 |

)% |

|

|

1,112 |

|

|

1,236 |

|

|

1,236 |

|

|

1,264 |

|

|

1,210 |

|

||||||

Taxes on income |

(5 |

)% |

|

(9 |

)% |

|

|

260 |

|

|

285 |

|

|

299 |

|

|

300 |

|

|

275 |

|

||||||

Net Income |

(9 |

)% |

|

(10 |

)% |

|

|

$ |

852 |

|

|

$ |

951 |

|

|

$ |

937 |

|

|

$ |

964 |

|

|

$ |

935 |

|

|

Preferred stock dividends and other |

2 |

% |

|

34 |

% |

|

|

51 |

|

|

38 |

|

|

50 |

|

|

39 |

|

|

50 |

|

||||||

Net Income Available to Common Stockholders |

(9 |

)% |

|

(12 |

)% |

|

|

$ |

801 |

|

|

$ |

913 |

|

|

$ |

887 |

|

|

$ |

925 |

|

|

$ |

885 |

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Basic |

(6 |

)% |

|

(11 |

)% |

|

|

$ |

.62 |

|

|

$ |

.70 |

|

|

$ |

.67 |

|

|

$ |

.69 |

|

|

$ |

.66 |

|

|

Diluted |

(5 |

)% |

|

(11 |

)% |

|

|

$ |

.62 |

|

|

$ |

.70 |

|

|

$ |

.66 |

|

|

$ |

.69 |

|

|

$ |

.65 |

|

|

Dividends declared per common share |

31 |

% |

|

— |

|

|

|

$ |

.17 |

|

|

$ |

.17 |

|

|

$ |

.17 |

|

|

$ |

.17 |

|

|

$ |

.13 |

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Basic |

(4 |

)% |

|

(1 |

)% |

|

|

1,284 |

|

|

1,300 |

|

|

1,328 |

|

|

1,333 |

|

|

1,343 |

|

||||||

Diluted |

(5 |

)% |

|

(1 |

)% |

|

|

1,293 |

|

|

1,308 |

|

|

1,337 |

|

|

1,344 |

|

|

1,354 |

|

||||||

Performance Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Pre-tax profit margin |

|

|

|

|

|

42.7 |

% |

|

45.6 |

% |

|

46.1 |

% |

|

46.4 |

% |

|

45.3 |

% |

||||||||

Return on average common stockholders’ equity (annualized) (1) |

|

|

|

|

|

17 |

% |

|

20 |

% |

|

19 |

% |

|

20 |

% |

|

20 |

% |

||||||||

Financial Condition (at quarter end, in billions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Cash and cash equivalents |

5 |

% |

|

44 |

% |

|

|

$ |

29.3 |

|

|

$ |

20.3 |

|

|

$ |

24.2 |

|

|

$ |

32.6 |

|

|

$ |

27.9 |

|

|

Cash and investments segregated |

51 |

% |

|

27 |

% |

|

|

20.5 |

|

|

16.2 |

|

|

14.1 |

|

|

13.9 |

|

|

13.6 |

|

||||||

Receivables from brokerage clients — net |

— |

|

|

3 |

% |

|

|

21.8 |

|

|

21.1 |

|

|

21.4 |

|

|

20.5 |

|

|

21.7 |

|

||||||

Available for sale securities |

(8 |

)% |

|

9 |

% |

|

|

61.4 |

|

|

56.5 |

|

|

54.6 |

|

|

60.0 |

|

|

66.6 |

|

||||||

Held to maturity securities |

(6 |

)% |

|

(4 |

)% |

|

|

134.7 |

|

|

140.2 |

|

|

138.3 |

|

|

132.4 |

|

|

144.0 |

|

||||||

Bank loans — net |

10 |

% |

|

8 |

% |

|

|

18.2 |

|

|

16.9 |

|

|

16.6 |

|

|

16.5 |

|

|

16.6 |

|

||||||

Total assets |

(1 |

)% |

|

5 |

% |

|

|

294.0 |

|

|

279.0 |

|

|

276.3 |

|

|

282.8 |

|

|

296.5 |

|

||||||

Bank deposits |

(5 |

)% |

|

5 |

% |

|

|

220.1 |

|

|

209.3 |

|

|

208.4 |

|

|

219.5 |

|

|

231.4 |

|

||||||

Payables to brokerage clients |

20 |

% |

|

10 |

% |

|

|

39.2 |

|

|

35.6 |

|

|

31.0 |

|

|

29.7 |

|

|

32.7 |

|

||||||

Long-term debt |

7 |

% |

|

— |

|

|

|

7.4 |

|

|

7.4 |

|

|

7.4 |

|

|

6.8 |

|

|

6.9 |

|

||||||

Stockholders’ equity |

5 |

% |

|

1 |

% |

|

|

21.7 |

|

|

21.4 |

|

|

21.3 |

|

|

21.6 |

|

|

20.7 |

|

||||||

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Full-time equivalent employees (at quarter end, in thousands) |

1 |

% |

|

(1 |

)% |

|

|

19.7 |

|

|

19.8 |

|

|

20.5 |

|

|

20.0 |

|

|

19.5 |

|

||||||

Capital expenditures — purchases of equipment, office facilities, and

|

31 |

% |

|

10 |

% |

|

|

$ |

209 |

|

|

$ |

190 |

|

|

$ |

173 |

|

|

$ |

181 |

|

|

$ |

159 |

|

|

Expenses excluding interest as a percentage of average client assets

|

|

|

|

|

|

0.15 |

% |

|

0.16 |

% |

|

0.16 |

% |

|

0.17 |

% |

|

0.17 |

% |

||||||||

Clients’ Daily Average Trades (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Revenue trades (2) |

(68 |

)% |

|

(62 |

)% |

|

|

151 |

|

|

395 |

|

|

392 |

|

|

418 |

|

|

466 |

|

||||||

Asset-based trades (3) |

(27 |

)% |

|

12 |

% |

|

|

138 |

|

|

123 |

|

|

138 |

|

|

149 |

|

|

188 |

|

||||||

Other trades (4) |

133 |

% |

|

148 |

% |

|

|

496 |

|

|

200 |

|

|

186 |

|

|

210 |

|

|

213 |

|

||||||

Total |

(9 |

)% |

|

9 |

% |

|

|

785 |

|

|

718 |

|

|

716 |

|

|

777 |

|

|

867 |

|

||||||

Average Revenue Per Revenue Trade (2) |

28 |

% |

|

32 |

% |

|

|

$ |

9.13 |

|

|

$ |

6.94 |

|

|

$ |

6.94 |

|

|

$ |

7.19 |

|

|

$ |

7.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

(1) |

Return on average common stockholders’ equity is calculated using net income available to common stockholders divided by average common stockholders’ equity. |

|

(2) |

Includes all client trades that generate trading revenue (i.e., commission revenue or principal transaction revenue); also known as DART. Effective October 7, 2019, CS&Co eliminated online trading commissions for U.S. and Canadian-listed stocks and ETFs, as well as the base charge on options. |

|

(3) |

Includes eligible trades executed by clients who participate in one or more of the company’s asset-based pricing relationships. |

|

(4) |

Includes all commission-free trades, including Schwab Mutual Fund OneSource® funds and ETFs, and other proprietary products. |

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||||||||||||||

Net Interest Revenue Information |

|||||||||||||||||||||||||||||||||||||||||||||||

(In millions) |

|||||||||||||||||||||||||||||||||||||||||||||||

(Unaudited) |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended

|

|

|

Twelve Months Ended

|

|||||||||||||||||||||||||||||||||||||||||||

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|||||||||||||||||||||||||||||||||||||

|

Average

|

|

Interest

|

|

Average

|

|

|

Average

|

|

Interest

|

|

Average

|

|

|

Average

|

|

Interest

|

|

Average

|

|

|

Average

|

|

Interest

|

|

Average

|

|||||||||||||||||||||

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Cash and cash equivalents |

$ |

20,563 |

|

|

$ |

86 |

|

|

1.64 |

% |

|

|

$ |

22,590 |

|

|

$ |

131 |

|

|

2.27 |

% |

|

|

$ |

23,512 |

|

|

$ |

518 |

|

|

2.17 |

% |

|

|

$ |

17,783 |

|

|

$ |

348 |

|

|

1.93 |

% |

|

Cash and investments segregated |

18,434 |

|

|

81 |

|

|

1.71 |

% |

|

|

9,854 |

|

|

57 |

|

|

2.28 |

% |

|

|

15,694 |

|

|

345 |

|

|

2.17 |

% |

|

|

11,461 |

|

|

206 |

|

|

1.78 |

% |

|||||||||

Broker-related receivables |

828 |

|

|

3 |

|

|

1.60 |

% |

|

|

241 |

|

|

2 |

|

|

3.99 |

% |

|

|

376 |

|

|

7 |

|

|

1.87 |

% |

|

|

303 |

|

|

6 |

|

|

2.09 |

% |

|||||||||

Receivables from brokerage clients |

19,241 |

|

|

185 |

|

|

3.77 |

% |

|

|

20,584 |

|

|

230 |

|

|

4.38 |

% |

|

|

19,270 |

|

|

821 |

|

|

4.20 |

% |

|

|

19,870 |

|

|

830 |

|

|

4.12 |

% |

|||||||||

Available for sale securities (1) |

56,528 |

|

|

357 |

|

|

2.51 |

% |

|

|

59,720 |

|

|

382 |

|

|

2.52 |

% |

|

|

58,181 |

|

|

1,560 |

|

|

2.67 |

% |

|

|

54,542 |

|

|

1,241 |

|

|

2.26 |

% |

|||||||||

Held to maturity securities |

136,717 |

|

|

870 |

|

|

2.53 |

% |

|

|

138,629 |

|

|

928 |

|

|

2.66 |

% |

|

|

134,708 |

|

|

3,591 |

|

|

2.65 |

% |

|

|

131,794 |

|

|

3,348 |

|

|

2.53 |

% |

|||||||||

Bank loans |

17,457 |

|

|

141 |

|

|

3.22 |

% |

|

|

16,649 |

|

|

149 |

|

|

3.55 |

% |

|

|

16,832 |

|

|

584 |

|

|

3.47 |

% |

|

|

16,554 |

|

|

559 |

|

|

3.37 |

% |

|||||||||

Total interest-earning assets |

269,768 |

|

|

1,723 |

|

|

2.53 |

% |

|

|

268,267 |

|

|

1,879 |

|

|

2.77 |

% |

|

|

268,573 |

|

|

7,426 |

|

|

2.75 |

% |

|

|

252,307 |

|

|

6,538 |

|

|

2.57 |

% |

|||||||||

Other interest revenue |

|

|

40 |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

154 |

|

|

|

|

|

|

|

142 |

|

|

|

|||||||||||||||||

Total interest-earning assets |

$ |

269,768 |

|

|

$ |

1,763 |

|

|

2.59 |

% |

|

|

$ |

268,267 |

|

|

$ |

1,914 |

|

|

2.82 |

% |

|

|

$ |

268,573 |

|

|

$ |

7,580 |

|

|

2.80 |

% |

|

|

$ |

252,307 |

|

|

$ |

6,680 |

|

|

2.63 |

% |

|

Funding sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Bank deposits |

$ |

211,172 |

|

|

$ |

84 |

|

|

0.16 |

% |

|

|

$ |

217,325 |

|

|

$ |

206 |

|

|

0.38 |

% |

|

|

$ |

212,605 |

|

|

$ |

700 |

|

|

0.33 |

% |

|

|

$ |

199,139 |

|

|

$ |

545 |

|

|

0.27 |

% |

|

Payables to brokerage clients |

27,051 |

|

|

11 |

|

|

0.16 |

% |

|

|

19,953 |

|

|

19 |

|

|

0.38 |

% |

|

|

24,353 |

|

|

79 |

|

|

0.33 |

% |

|

|

21,178 |

|

|

56 |

|

|

0.27 |

% |

|||||||||

Short-term borrowings (2) |

11 |

|

|

— |

|

|

1.72 |

% |

|

|

5 |

|

|

— |

|

|

1.69 |

% |

|

|

17 |

|

|

— |

|

|

2.36 |

% |

|

|

3,359 |

|

|

54 |

|

|

1.59 |

% |

|||||||||

Long-term debt |

7,428 |

|

|

66 |

|

|

3.54 |

% |

|

|

6,524 |

|

|

59 |

|

|

3.59 |

% |

|

|

7,199 |

|

|

258 |

|

|

3.58 |

% |

|

|

5,423 |

|

|

190 |

|

|

3.50 |

% |

|||||||||

Total interest-bearing liabilities |

245,662 |

|

|

161 |

|

|

0.26 |

% |

|

|

243,807 |

|

|

284 |

|

|

0.46 |

% |

|

|

244,174 |

|

|

1,037 |

|

|

0.42 |

% |

|

|

229,099 |

|

|

845 |

|

|

0.37 |

% |

|||||||||

Non-interest-bearing funding sources |

24,106 |

|

|

|

|

|

|

|

24,460 |

|

|

|

|

|

|

|

24,399 |

|

|

|

|

|

|

|

23,208 |

|

|

|

|

|

|||||||||||||||||

Other interest expense |

|

|

7 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

12 |

|

|

|

|||||||||||||||||

Total funding sources |

$ |

269,768 |

|

|

$ |

168 |

|

|

0.25 |

% |

|

|

$ |

268,267 |

|

|

$ |

288 |

|

|

0.43 |

% |

|

|

$ |

268,573 |

|

|

$ |

1,064 |

|

|

0.39 |

% |

|

|

$ |

252,307 |

|

|

$ |

857 |

|

|

0.34 |

% |

|

Net interest revenue |

|

|

$ |

1,595 |

|

|

2.34 |

% |

|

|

|

|

$ |

1,626 |

|

|

2.39 |

% |

|

|

|

|

$ |

6,516 |

|

|

2.41 |

% |

|

|

|

|

$ |

5,823 |

|

|

2.29 |

% |

|||||||||

(1) |

Amounts have been calculated based on amortized cost. |

|

(2) |

Interest revenue or expense was less than $500,000 in the period or periods presented. |

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||||||||||||||||||||||

Asset Management and Administration Fees Information |

|||||||||||||||||||||||||||||||||||||||||||||||

(In millions) |

|||||||||||||||||||||||||||||||||||||||||||||||

(Unaudited) |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Three Months Ended

|

|

|

Twelve Months Ended

|

|||||||||||||||||||||||||||||||||||||||||||

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|||||||||||||||||||||||||||||||||||||

|

Average

|

|

Revenue |

|

Average

|

|

|

Average

|

|

Revenue |

|

Average

|

|

|

Average

|

|

Revenue |

|

Average

|

|

|

Average

|

|

Revenue |

|

Average

|

|||||||||||||||||||||

Schwab money market funds |

$ |

196,074 |

|

|

$ |

147 |

|

|

0.30 |

% |

|

|

$ |

137,541 |

|

|

$ |

117 |

|

|

0.34 |

% |

|

|

$ |

173,558 |

|

|

$ |

525 |

|

|

0.30 |

% |

|

|

$ |

141,018 |

|

|

$ |

568 |

|

|

0.40 |

% |

|

Schwab equity and bond funds, ETFs, and collective trust funds (CTFs) (1) |

288,750 |

|

|

79 |

|

|

0.11 |

% |

|

|

225,869 |

|

|

73 |

|

|

0.13 |

% |

|

|

267,213 |

|

|

298 |

|

|

0.11 |

% |

|

|

222,830 |

|

|

302 |

|

|

0.14 |

% |

|||||||||

Mutual Fund OneSource® and other non-transaction fee funds |

193,665 |

|

|

154 |

|

|

0.32 |

% |

|

|

191,620 |

|

|

156 |

|

|

0.32 |

% |

|

|

191,552 |

|

|

606 |

|

|

0.32 |

% |

|

|

210,429 |

|

|

680 |

|

|

0.32 |

% |

|||||||||

Other third-party mutual funds and ETFs (2) |

462,466 |

|

|

80 |

|

|

0.07 |

% |

|

|

325,497 |

|

|

71 |

|

|

0.09 |

% |

|

|

478,037 |

|

|

318 |

|

|

0.07 |

% |

|

|

328,150 |

|

|

287 |

|

|

0.09 |

% |

|||||||||

Total mutual funds, ETFs, and CTFs (3) |

$ |

1,140,955 |

|

|

460 |

|

|

0.16 |

% |

|

|

$ |

880,527 |

|

|

417 |

|

|

0.19 |

% |

|

|

$ |

1,110,360 |

|

|

1,747 |

|

|

0.16 |

% |

|

|

$ |

902,427 |

|

|

1,837 |

|

|

0.20 |

% |

|||||

Advice solutions (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Fee-based |

$ |

262,516 |

|

|

320 |

|

|

0.48 |

% |

|

|

$ |

226,184 |

|

|

280 |

|

|

0.49 |

% |

|

|

$ |

246,888 |

|

|

1,198 |

|

|

0.49 |

% |

|

|

$ |

227,790 |

|

|

1,139 |

|

|

0.50 |

% |

|||||

Non-fee-based |

73,356 |

|

|

— |

|

|

— |

|

|

|

64,085 |

|

|

— |

|

|

— |

|

|

|

70,191 |

|

|

— |

|

|

— |

|

|

|

62,813 |

|

|

— |

|

|

— |

|

|||||||||

Total advice solutions |

$ |

335,872 |

|

|

320 |

|

|

0.38 |

% |

|

|

$ |

290,269 |

|

|

280 |

|

|

0.38 |

% |

|

|

$ |

317,079 |

|

|

1,198 |

|

|

0.38 |

% |

|

|

$ |

290,603 |

|

|

1,139 |

|

|

0.39 |

% |

|||||

Other balance-based fees (1,4) |

443,814 |

|

|

54 |

|

|

0.05 |

% |

|

|

365,691 |

|

|

49 |

|

|

0.05 |

% |

|

|

432,613 |

|

|

216 |

|

|

0.05 |

% |

|

|

383,050 |

|

|

206 |

|

|

0.05 |

% |

|||||||||

Other (5) |

|

|

11 |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

47 |

|

|

|

|||||||||||||||||

Total asset management and administration fees |

|

|

$ |

845 |

|

|

|

|

|

|

|

$ |

755 |

|

|

|

|

|

|

|

$ |

3,211 |

|

|

|

|

|

|

|

$ |

3,229 |

|

|

|

|||||||||||||

(1) |

Beginning in the first quarter of 2019, a change was made to move CTFs from other balance-based fees. Prior periods have been recast to reflect this change. |

|

(2) |

Beginning in the fourth quarter of 2019, Schwab ETF OneSourceTM was discontinued as a result of the elimination of online trading commissions for U.S. and Canadian-listed ETFs. |

|

(3) |

Advice solutions include managed portfolios, specialized strategies, and customized investment advice such as Schwab Private ClientTM, Schwab Managed PortfoliosTM, Managed Account Select®, Schwab Advisor Network®, Windhaven® Strategies, ThomasPartners® Strategies, Schwab Index Advantage® advised retirement plan balances, Schwab Intelligent Portfolios®, Institutional Intelligent Portfolios®, and Schwab Intelligent Portfolios PremiumTM; as well as legacy non-fee advice solutions including Schwab Advisor Source and certain retirement plan balances. Average client assets for advice solutions may also include the asset balances contained in the mutual fund and/or ETF categories listed above. For the total end of period view, please see the Monthly Activity Report. |

|

(4) |

Includes various asset-related fees, such as trust fees, 401(k) recordkeeping fees, and mutual fund clearing fees and other service fees. |

|

(5) |

Includes miscellaneous service and transaction fees relating to mutual funds and ETFs that are not balance-based. |

THE CHARLES SCHWAB CORPORATION |

|||||||||||||||||||||||||||

Growth in Client Assets and Accounts |

|||||||||||||||||||||||||||

(Unaudited) |

|||||||||||||||||||||||||||

|

Q4-19 % Change |

|

|

2019 |

|

2018 |

|||||||||||||||||||||

|

vs. |

|

vs. |

|

|

Fourth |

|

Third |

|

Second |

|

First |

|

Fourth |

|||||||||||||

(In billions, at quarter end, except as noted) |

Q4-18 |

|

Q3-19 |

|

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|||||||||||||

Assets in client accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Schwab One®, certain cash equivalents and bank deposits |

(2 |

)% |

|

6 |

% |

|

|

$ |

256.7 |

|

|

$ |

242.9 |

|

|

$ |

237.3 |

|

|

$ |

247.0 |

|

|

$ |

261.2 |

|

|

Proprietary mutual funds (Schwab Funds® and Laudus Funds®) and CTFs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Money market funds (1) |

31 |

% |

|

7 |

% |

|

|

200.8 |

|

|

187.0 |

|

|

168.1 |

|

|

159.7 |

|

|

153.5 |

|

||||||

Equity and bond funds and CTFs (2,3) |

30 |

% |

|

9 |

% |

|

|

122.5 |

|

|

112.4 |

|

|

110.9 |

|

|

106.2 |

|

|

94.3 |

|

||||||

Total proprietary mutual funds and CTFs |

30 |

% |

|

8 |

% |

|

|

323.3 |

|

|

299.4 |

|

|

279.0 |

|

|

265.9 |

|

|

247.8 |

|

||||||

Mutual Fund Marketplace® (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Mutual Fund OneSource® and other non-transaction fee funds |

12 |

% |

|

4 |

% |

|

|

202.1 |

|

|

194.7 |

|

|

197.8 |

|

|

195.1 |

|

|

180.5 |

|

||||||

Mutual fund clearing services |

32 |

% |

|

10 |

% |

|

|

217.4 |

|

|

197.2 |

|

|

192.9 |

|

|

182.7 |

|

|

164.4 |

|

||||||

Other third-party mutual funds |

27 |

% |

|

6 |

% |

|

|

824.5 |

|

|

776.8 |

|

|

767.3 |

|

|

737.2 |

|

|

650.4 |

|

||||||

Total Mutual Fund Marketplace |

25 |

% |

|

6 |

% |

|

|

1,244.0 |

|

|

1,168.7 |

|

|

1,158.0 |

|

|

1,115.0 |

|

|

995.3 |

|

||||||

Total mutual fund assets |

26 |

% |

|

7 |

% |

|

|

1,567.3 |

|

|

1,468.1 |

|

|

1,437.0 |

|

|

1,380.9 |

|

|

1,243.1 |

|

||||||

Exchange-traded funds (ETFs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Proprietary ETFs (3) |

42 |

% |

|

9 |

% |

|

|

163.8 |

|

|

150.8 |

|

|

143.6 |

|

|

134.7 |

|

|

115.2 |

|

||||||

Schwab ETF OneSource™ (4,5) |

N/M |

|

N/M |

|

|

— |

|

|

94.1 |

|

|

88.1 |

|

|

82.5 |

|

|

30.6 |

|

||||||||

Other third-party ETFs (5) |

47 |

% |

|

42 |

% |

|

|

457.0 |

|

|

321.6 |

|

|

315.7 |

|

|

303.7 |

|

|

309.9 |

|

||||||

Total ETF assets |

36 |

% |

|

10 |

% |

|

|

620.8 |

|

|

566.5 |

|

|

547.4 |

|

|

520.9 |

|

|

455.7 |

|

||||||

Equity and other securities (2) |

28 |

% |

|

9 |

% |

|

|

1,286.4 |

|

|

1,178.0 |

|

|

1,168.3 |

|

|

1,131.3 |

|

|

1,005.4 |

|

||||||

Fixed income securities |

7 |

% |

|

(2 |

)% |

|

|

327.1 |

|

|

332.3 |

|

|

332.1 |

|

|

324.1 |

|

|

306.1 |

|

||||||

Margin loans outstanding |

1 |

% |

|

1 |

% |

|

|

(19.5 |

) |

|

(19.4 |

) |

|

(19.7 |

) |

|

(18.8 |

) |

|

(19.3 |

) |

||||||

Total client assets |

24 |

% |

|

7 |

% |

|

|

$ |

4,038.8 |

|

|

$ |

3,768.4 |

|

|

$ |

3,702.4 |

|

|

$ |

3,585.4 |

|

|

$ |

3,252.2 |

|

|

Client assets by business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Investor Services |

25 |

% |

|

8 |

% |

|

|

$ |

2,131.0 |

|

|

$ |

1,978.7 |

|

|

$ |

1,946.5 |

|

|

$ |

1,886.7 |

|

|

$ |

1,701.7 |

|

|

Advisor Services |

23 |

% |

|

7 |

% |

|

|

1,907.8 |

|

|

1,789.7 |

|

|

1,755.9 |

|

|

1,698.7 |

|

|

1,550.5 |

|

||||||

Total client assets |

24 |

% |

|

7 |

% |

|

|

$ |

4,038.8 |

|

|

$ |

3,768.4 |

|

|

$ |

3,702.4 |

|

|

$ |

3,585.4 |

|

|

$ |

3,252.2 |

|

|

Net growth in assets in client accounts (for the quarter ended) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Net new assets by business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Investor Services |

50 |

% |

|

70 |

% |

|

|

$ |

43.1 |

|

|

$ |

25.4 |

|

|

$ |

17.9 |

|

|

$ |

29.2 |

|

|

$ |

28.7 |

|

|

Advisor Services |

29 |

% |

|

10 |

% |

|

|

34.2 |

|

|

31.2 |

|

|

19.3 |

|

|

22.5 |

|

|

26.6 |

|

||||||

Total net new assets |

40 |

% |

|

37 |

% |

|

|

$ |

77.3 |

|

|

$ |

56.6 |

|

|

$ |

37.2 |

|

|

$ |

51.7 |

|

|

$ |

55.3 |

|

|

Net market gains (losses) |

N/M |

|

N/M |

|

|

193.1 |

|

|

9.4 |

|

|

79.8 |

|

|

281.5 |

|

|

(366.8 |

) |

||||||||

Net growth (decline) |

N/M |

|

N/M |

|

|

$ |

270.4 |

|

|

$ |

66.0 |

|

|

$ |

117.0 |

|

|

$ |

333.2 |

|

|

$ |

(311.5 |

) |

|||

New brokerage accounts (in thousands, for the quarter ended) |

14 |

% |

|

19 |

% |

|

|

433 |

|

|

363 |

|

|

386 |

|

|

386 |

|

|

380 |

|

||||||

Client accounts (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Active brokerage accounts |

6 |

% |

|

2 |

% |

|

|

12,333 |

|

|

12,118 |

|

|

11,967 |

|

|

11,787 |

|

|

11,593 |

|

||||||

Banking accounts |

7 |

% |

|

2 |

% |

|

|

1,390 |

|

|

1,361 |

|

|

1,336 |

|

|

1,300 |

|

|

1,302 |

|

||||||

Corporate retirement plan participants |

6 |

% |

|

2 |

% |

|

|

1,748 |

|

|

1,718 |

|

|

1,698 |

|

|

1,684 |

|

|

1,655 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

(1) |

Total client assets in purchased money market funds are located at: https://www.aboutschwab.com/investor-relations. |

|

(2) |

Beginning in the first quarter of 2019, a change was made to move CTFs from equity and other securities. Prior periods have been recast to reflect this change. |

|

(3) |

Includes balances held on and off the Schwab platform. As of December 31, 2019, off-platform equity and bond funds, CTFs, and ETFs were $14.0 billion, $5.0 billion, and $45.1 billion, respectively. |

|

(4) |

Excludes all proprietary mutual funds and ETFs. |

|

(5) |

Beginning in the fourth quarter of 2019, Schwab ETF OneSource™ was discontinued. These assets are now included with other third-party ETFs. |

|

N/M Not meaningful. |

||

The Charles Schwab Corporation Monthly Activity Report For December 2019 |

|||||||||||||||||||||||||||||||||||||||||||||

|

2018 |

2019 |

|

|

|

|

|

|

|

|

|

|

|

Change |

|||||||||||||||||||||||||||||||

|

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Mo. |

Yr. |

||||||||||||||||||||||||||||||

Market Indices (at month end) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Dow Jones Industrial Average |

23,327 |

|

25,000 |

|

25,916 |

|

25,929 |

|

26,593 |

|

24,815 |

|

26,600 |

|

26,864 |

|

26,403 |

|

26,917 |

|

27,046 |

|

28,051 |

|

28,538 |

|

2 |

% |

22 |

% |

|||||||||||||||

Nasdaq Composite |

6,635 |

|

7,282 |

|

7,533 |

|

7,729 |

|

8,095 |

|

7,453 |

|

8,006 |

|

8,175 |

|

7,963 |

|

7,999 |

|

8,292 |

|

8,665 |

|

8,973 |

|

4 |

% |

35 |

% |

|||||||||||||||

Standard & Poor’s 500 |

2,507 |

|

2,704 |

|

2,784 |

|

2,834 |

|

2,946 |

|

2,752 |

|

2,942 |

|

2,980 |

|

2,926 |

|

2,977 |

|

3,038 |

|

3,141 |

|

3,231 |

|

3 |

% |

29 |

% |

|||||||||||||||

Client Assets (in billions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Beginning Client Assets |

3,431.9 |

|

3,252.2 |

|

3,447.7 |

|

3,533.0 |

|

3,585.4 |

|

3,668.5 |

|

3,530.6 |

|

3,702.4 |

|

3,746.7 |

|

3,716.5 |

|

3,768.4 |

|

3,854.6 |

|

3,942.2 |

|

|

|

|||||||||||||||||

Net New Assets (1) |

24.8 |

|

15.1 |

|

18.3 |

|

18.3 |

|

(0.3 |

) |

17.3 |

|

20.2 |

|

19.3 |

|

19.9 |

|

17.4 |

|

35.2 |

|

12.0 |

|

30.1 |

|

151 |

% |

21 |

% |

|||||||||||||||

Net Market (Losses) Gains |

(204.5 |

) |

180.4 |

|

67.0 |

|

34.1 |

|

83.4 |

|

(155.2 |

) |

151.6 |

|

25.0 |

|

(50.1 |

) |

34.5 |

|

51.0 |

|

75.6 |

|

66.5 |

|

|

|

|||||||||||||||||

Total Client Assets (at month end) |

3,252.2 |

|

3,447.7 |

|

3,533.0 |

|

3,585.4 |

|

3,668.5 |

|

3,530.6 |

|

3,702.4 |

|

3,746.7 |

|

3,716.5 |

|

3,768.4 |

|

3,854.6 |

|

3,942.2 |

|

4,038.8 |

|

2 |

% |

24 |

% |

|||||||||||||||

Core Net New Assets (2) |

24.8 |

|

15.1 |

|

18.3 |

|

18.3 |

|

(0.3 |

) |

17.3 |

|

20.2 |

|

19.3 |

|

19.9 |

|

17.4 |

|

24.1 |

|

12.0 |

|

30.1 |

|

151 |

% |

21 |

% |

|||||||||||||||

Receiving Ongoing Advisory Services (at month end) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Investor Services |

272.4 |

|

286.9 |

|

294.2 |

|

298.4 |

|

305.7 |

|

298.5 |

|

311.6 |

|

314.8 |

|

314.2 |

|

318.5 |

|

324.6 |

|

330.8 |

|

337.1 |

|

2 |

% |

24 |

% |

|||||||||||||||

Advisor Services (3) |

1,436.1 |

|

1,514.2 |

|

1,551.6 |

|

1,572.8 |

|

1,608.0 |

|

1,554.6 |

|

1,626.6 |

|

1,646.1 |

|

1,635.7 |

|

1,659.4 |

|

1,691.6 |

|

1,728.2 |

|

1,769.7 |

|

2 |

% |

23 |

% |

|||||||||||||||

Client Accounts (at month end, in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Active Brokerage Accounts |

11,593 |

|

11,653 |

|

11,712 |

|

11,787 |

|

11,870 |

|

11,929 |

|

11,967 |

|

12,026 |

|

12,085 |

|

12,118 |

|

12,189 |

|

12,247 |

|

12,333 |

|

1 |

% |

6 |

% |

|||||||||||||||

Banking Accounts (4) |

1,302 |

|

1,312 |

|

1,313 |

|

1,300 |

|

1,310 |

|

1,323 |

|

1,336 |

|

1,352 |

|

1,361 |

|

1,361 |

|

1,374 |

|

1,384 |

|

1,390 |

|

— |

|

7 |

% |

|||||||||||||||

Corporate Retirement Plan Participants |

1,655 |

|

1,679 |

|

1,685 |

|

1,684 |

|

1,690 |

|

1,699 |

|

1,698 |

|

1,701 |

|

1,711 |

|

1,718 |

|

1,735 |

|

1,743 |

|

1,748 |

|

— |

|

6 |

% |

|||||||||||||||

Client Activity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

New Brokerage Accounts (in thousands) |

132 |

|

131 |

|

115 |

|

140 |

|

147 |

|

123 |

|

116 |

|

129 |

|

126 |

|

108 |

|

142 |

|

127 |

|

164 |

|

29 |

% |

24 |

% |

|||||||||||||||

Inbound Calls (in thousands) |

1,839 |

|

1,924 |

|

1,742 |

|

1,882 |

|

1,966 |

|

1,671 |

|

1,595 |

|

1,773 |

|

1,759 |

|

1,570 |

|

1,771 |

|

1,605 |

|

1,884 |

|

17 |

% |

2 |

% |

|||||||||||||||

Web Logins (in thousands) |

53,920 |

|

64,563 |

|

60,121 |

|

63,692 |

|

65,669 |

|

61,522 |

|

60,824 |

|

65,809 |

|

63,928 |

|

63,530 |

|

72,547 |

|

66,394 |

|

69,733 |

|

5 |

% |

29 |

% |

|||||||||||||||

Client Cash as a Percentage of Client Assets (5) |

12.8 |

% |

11.7 |

% |

11.5 |

% |

11.3 |

% |

10.9 |

% |

11.3 |

% |

10.9 |

% |

11.0 |

% |

11.3 |

% |

11.4 |

% |

11.3 |

% |

11.3 |

% |

11.3 |

% |

— |

|

(150) bp |

||||||||||||||||

Mutual Fund and Exchange-Traded Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Net Buys (Sells) (6, 7) (in millions of dollars) |

|||||||||||||||||||||||||||||||||||||||||||||

Large Capitalization Stock |

717 |

|

1,343 |

|

1,109 |

|

1,045 |

|

980 |

|

1,114 |

|

206 |

|

717 |

|

328 |

|

23 |

|

900 |

|

1,406 |

|

991 |

|

|

|

|||||||||||||||||

Small / Mid Capitalization Stock |

(1,414 |

) |

1,329 |

|

638 |

|

302 |

|

136 |

|

(190 |

) |

18 |

|

10 |

|

(374 |

) |

(212 |

) |

(458 |

) |

73 |

|

201 |

|

|

|

|||||||||||||||||

International |

(2,163 |

) |

2,212 |

|

1,086 |

|

1,274 |

|

863 |

|

(100 |

) |

225 |

|

744 |

|

(1,390 |

) |

(355 |

) |

340 |

|

735 |

|

993 |

|

|

|

|||||||||||||||||

Specialized |

(2,105 |

) |

124 |

|

609 |

|

750 |

|

(109 |

) |

(440 |

) |

341 |

|

418 |

|

353 |

|

583 |

|

618 |

|

484 |

|

455 |

|

|

|

|||||||||||||||||

Hybrid |

(2,985 |

) |

(321 |

) |

(309 |

) |

(357 |

) |

(228 |

) |

(316 |

) |

(181 |

) |

(366 |

) |

(569 |

) |

(372 |

) |

(202 |

) |

(290 |

) |

(96 |

) |

|

|

|||||||||||||||||

Taxable Bond |

(4,342 |

) |

3,956 |

|

2,871 |

|

1,923 |

|

3,029 |

|

1,821 |

|

2,378 |

|

3,806 |

|

2,725 |

|

2,935 |

|

2,813 |

|

2,274 |

|

4,710 |

|

|

|

|||||||||||||||||

Tax-Free Bond |

(409 |

) |

1,184 |

|

1,111 |

|

1,133 |

|

760 |

|

1,057 |

|

682 |

|

960 |

|

760 |

|

593 |

|

809 |

|

860 |

|

1,255 |

|

|

|

|||||||||||||||||

Net Buy (Sell) Activity (in millions of dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Mutual Funds (6) |

(21,372 |

) |

6,740 |

|

2,312 |

|

1,850 |

|

1,860 |

|

86 |

|

7 |

|

2,151 |

|

(1,281 |

) |

(573 |

) |

(473 |

) |

(761 |

) |

1,097 |

|

|

|

|||||||||||||||||

Exchange-Traded Funds (7) |

8,671 |

|

3,087 |

|

4,803 |

|

4,220 |

|

3,571 |

|

2,860 |

|

3,662 |

|

4,138 |

|

3,114 |

|

3,768 |

|

5,293 |

|

6,303 |

|

7,412 |

|

|

|

|||||||||||||||||

Money Market Funds |

13,548 |

|

4,944 |

|

(1,577 |

) |

1,785 |

|

(2,097 |

) |

5,067 |

|

4,570 |

|

6,143 |

|

6,068 |

|

5,833 |

|

7,059 |

|

4,768 |

|

1,515 |

|

|

|

|||||||||||||||||

Average Interest-Earning Assets (8) |

|||||||||||||||||||||||||||||||||||||||||||||

(in millions of dollars) |

274,913 |

|

277,068 |

|

270,718 |

|

272,727 |

|

270,308 |

|

263,718 |

|

262,759 |

|

263,993 |

|

265,005 |

|

266,430 |

|

266,089 |

|

268,254 |

|

274,911 |

|

2 |

% |

— |

|

|||||||||||||||

(1) |

October 2019 includes an inflow of $11.1 billion from a mutual fund clearing services client. |

|

(2) |

Net new assets before significant one-time inflows or outflows, such as acquisitions/divestitures or extraordinary flows (generally greater than $10 billion) relating to a specific client. These flows may span multiple reporting periods. |

|

(3) |

Excludes Retirement Business Services. |

|

(4) |

In March 2019, banking accounts were reduced by approximately 23,000 as a result of inactive account closures. |

|

(5) |

Schwab One®, certain cash equivalents, bank deposits, and money market fund balances as a percentage of total client assets. |

|

(6) |

Represents the principal value of client mutual fund transactions handled by Schwab, including transactions in proprietary funds. Includes institutional funds available only to Investment Managers. Excludes money market fund transactions. |

|

(7) |

Represents the principal value of client ETF transactions handled by Schwab, including transactions in proprietary ETFs. |

|

(8) |

Represents average total interest-earning assets on the company’s balance sheet. |