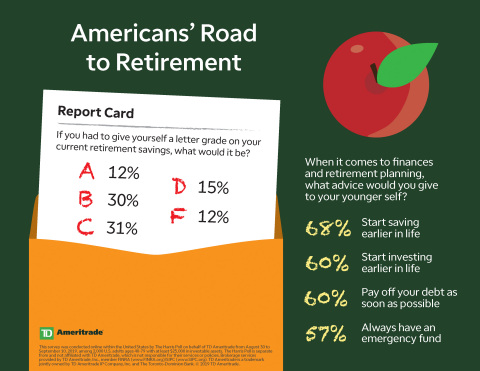

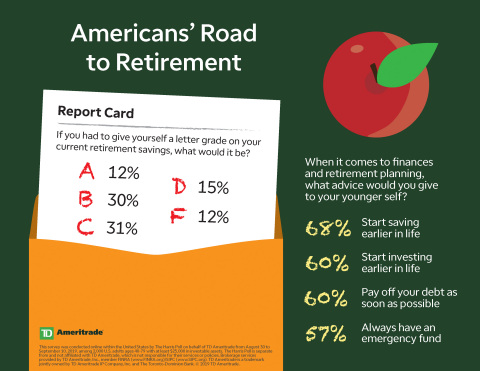

OMAHA, Neb.--(BUSINESS WIRE)--While the majority of Americans age 40 and over (60%) claim to have a well-defined retirement strategy, almost the same number (58%) would give themselves a ‘C’ grade or lower on their retirement savings, according to a new survey conducted by The Harris Poll on behalf of TD Ameritrade.

Despite planning, the number of Americans who have at least $100,000 saved for retirement doesn’t change significantly until reaching their 60s:

- Ages 40-49: 41%

- Ages 50-59: 46%

- Ages 60-69: 62%

- Ages 70-79: 67%

“Americans don’t ramp up their retirement savings until they reach their 60s – this is where we see the biggest shift in saving attitudes,” said Dara Luber, senior manager of retirement at TD Ameritrade. “At the same time, the top retirement advice they’d give to their younger selves would be to start saving (68%) and investing (60%) earlier in life.”

Things may not always go as planned

- The average target age to retire is 67, but only 60% of those in their 40s and 65% of those in their 50s think it’s likely they’ll be able to retire at their desired age.

- Sixty-six percent of pre-retirees would retire today if they had the financial means to do so.

The road to retirement can be winding

Americans in their 40s and 50s, as well as those with $250K+ in investable assets, are especially likely to change course with their retirement plan.

-

Have changed their retirement savings plan at least once:

- Ages 40-49: 59%

- Ages 50-59: 58%

- Ages 60-69: 37%

- Ages 70-79: 19%

- Twenty-five percent of those with $250K+ in investable assets have changed their retirement plan more than six times.

- Career (26%) and family (22%) events are the most common impetus for Americans to reassess or make changes to their retirement plans. One in 10 (9%) Americans say new political leaders have triggered them to reassess or make changes to their retirement plans.

- Nearly half (46%) of those in their 40s have already withdrawn from their retirement accounts. Meanwhile, only one in three (31%) Americans 50 and over are taking advantage of catch-up contributions.

The effects of a longer lifespan

- With a weakened reliance on Social Security, Americans are also adjusting to living longer.

- Eight in 10 (81%) are shifting their financial strategies to prepare for a potentially longer lifespan.

-

Most Americans also plan to cut back during retirement in anticipation of longevity.

- To prepare for a potentially longer lifespan, three in five (59%) plan to reduce their overall expenses during retirement.

-

Those with higher assets are planning to lean on financial advisors and lower retirement withdrawal rates:

- Thirty-eight percent with $250K+ in investable assets plan to get help or are getting help from a financial advisor on a how to plan during retirement.

- Thirty-five percent with $250K+ in investable assets plan to take less or are taking less out of their retirement accounts during retirement.

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to approximately 12 million client accounts totaling approximately $1.3 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing an average of approximately 800,000 trades per day for our clients, more than a quarter of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

About The Harris Poll

The Harris Poll is one of the longest-running surveys in the U.S., tracking public opinion, motivations and social sentiment since 1963. It is now part of Harris Insights & Analytics, a global consulting and market research firm that strives to reveal the authentic values of modern society to inspire leaders to create a better tomorrow. We work with clients in three primary areas; building twenty-first-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. TD Ameritrade is separate from and not affiliated with the Harris Poll, and is not responsible for their services or policies.

Survey Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of TD Ameritrade from August 30 to September 10, 2019, among 2,000 U.S. adults ages 40-79 with at least $25,000 in investable assets. The audience was divided into four decades: 40-49 (n=500), 50-59 (n=500), 60-69 (n=500) and 70-79 (n=500).