COSTA MESA, Calif.--(BUSINESS WIRE)--Convenience, seamless digital banking services and strong checking account offerings are the formula to customer satisfaction with the country’s largest retail banks, according to the J.D. Power 2019 U.S. National Banking Satisfaction Study,SM released today. TD Bank ranks highest by consistently performing well in this formula, while excelling at branch service and online banking satisfaction.

The study, now in its third year, provides a comprehensive view of customer experience with all retail bank product lines for eight national banks in the United States that account for 50%1 of total domestic deposits. It evaluates bank customer experience across six factors; channel interactions; deposit accounts; credit accounts; investment accounts; convenience; and problem resolution.

“The core value propositions of national banks are rooted in convenience and providing consistent customer experiences, across all accounts and interaction channels,” said Paul McAdam, Senior Director of Banking Services at J.D. Power. “Within the national banks, 64% of customers have extended their product holdings beyond deposit accounts into lending or investment accounts and 13% of customers use bank services across all three account types. As national banks strive to serve a wider range of customers’ financial needs, service consistency across all lines of business is foundational to the development of customer trust and strong relationships.”

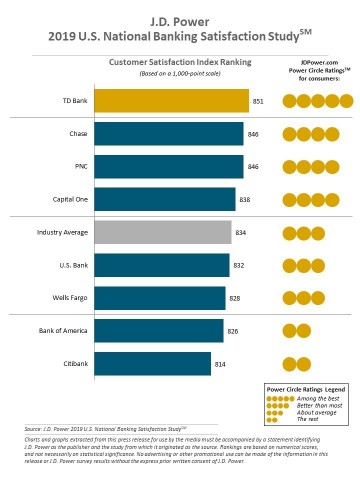

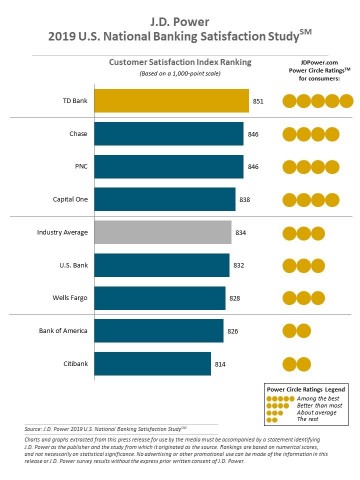

TD Bank ranks highest with an overall satisfaction score of 851 (on a 1,000-point scale). Chase (846) and PNC (846) rank second in a tie, followed by Capital One (838). These four banks outpaced the national average customer satisfaction score of 834.

Each of these four banks demonstrate service consistency, minimize customer problems and score well in ratings associated with ease of doing business. Customers also notice some service-level distinctions among the four banks:

- TD Bank’s convenience-based value proposition resonates with branch-oriented customers, and TD Bank ranks highest in the factors of convenience; branch service; and online banking satisfaction.

- Customers of Chase recognize the bank for providing innovative technology, having the lowest incidence of problems, and high satisfaction associated with credit cards and ATMs.

- PNC customers recognize the bank for providing trusted advice; prompt and courteous branch service; and strong satisfaction with checking and savings accounts.

- Capital One attracts digitally centric customers and receives strong satisfaction scores for mobile banking; checking and savings accounts; credit cards; and mortgages.

The study defines a national bank as a U.S. bank holding company with domestic deposits exceeding $200 billion. The study is based on responses from 8,337 retail banking customers and was fielded in August-September 2019. Customers of SunTrust and BB&T were surveyed in the study, but their satisfaction scores are excluded from the rank chart, as the merger was not yet final and both institutions held deposits less than $200 billion at the time of study fielding. SunTrust has an overall satisfaction score of 844 and BB&T has a score of 839. J.D. Power anticipates that Truist Bank will be included in the 2020 National Banking Satisfaction Study.

See the online press release at https://www.jdpower.com/pr-id/2019237.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Source: FDIC reporting for the quarter ending June 30, 2019.