LOS ANGELES--(BUSINESS WIRE)--Michael Goldberg, in his role as Trustee of the Woodbridge Liquidation Trust (the “Trust”), filed a lawsuit today in Los Angeles Superior Court against numerous law firms and lawyers including Sidley Austin LLP, Neal Sullivan, Davis Graham & Stubbs LLP, S. Lee Terry, Jr., Halloran & Sage LLP, Richard Roberts, Balcomb & Green, P.C., Lawrence Green, Rome McGuigan, P.C., Brian Courtney, Bailey Cavalieri LLC, Thomas Geyer, Robinson & Cole LLP, Shant Chalian, Jon H. Freis, Finn Dixon & Herling LLP, Reed Balmer, Haight Brown & Bonesteel LLP, and Ted Handel (the “Law Firm Defendants”). The lawsuit seeks damages in excess of $500 million.

This lawsuit arises out of a five-year $1.3 billion Ponzi scheme orchestrated by Robert Shapiro (“Shapiro”) and his now-defunct investment firm, Woodbridge Group of Companies (“Woodbridge”). Shapiro recently pleaded guilty to defrauding investors and was sentenced to 25 years in federal prison.

As outlined in the Complaint, Woodbridge marketed and sold promissory notes and other offerings as “low-risk,” high yield investments supposedly backed by real-estate loans to independent third-party borrowers. But, in fact, there were very few loans to independent borrowers. Woodbridge typically made its loans to entities that were secretly controlled by Shapiro and that had no income and made no payments on the mortgages.

Shapiro caused Woodbridge to take money from new investors and used it to pay old investors: a classic Ponzi scheme. Shapiro also lined his own pockets, taking millions of dollars of investor money and spending it on himself personally.

The scheme targeted retirees and retirement account funds. Many investors lost a substantial portion of their life savings. The Trust was created pursuant to a bankruptcy court approved plan to assist investors in recovering their losses. Thousands of investors have assigned their claims to the Trust, and the Trust is bringing the claims on behalf of the investors.

The conduct challenged in the Complaint includes knowingly and/or negligently preparing loan documents and investment agreements chock-full of false statements and concealing and manipulating material facts; designing securities products meant to deceive and evade regulators; preparing legal “opinion” memoranda meant to comfort investors and lead them to falsely believe their investments were not securities subject to securities laws and regulations; and assisting in the creation of Shapiro-controlled third-party “borrowers,” all while being paid millions in legal fees by Shapiro and Woodbridge.

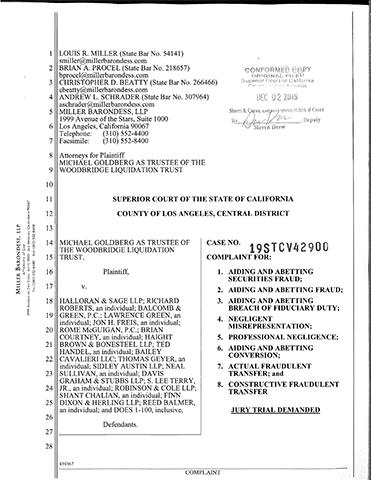

The claims filed against the Law Firm Defendants include (1) aiding and abetting securities fraud; (2) aiding and abetting fraud; (3) aiding and abetting breach of fiduciary duty; (4) negligent misrepresentation; (5) professional negligence; (6) aiding and abetting conversion; (7) actual fraudulent transfer; and (8) constructive fraudulent transfer. These claims go to the heart of the fraud that occurred here; and will be determined by a judge and jury.

The Trust is represented by Skip Miller and a team at Miller Barondess, LLP in Los Angeles. Per Miller, who is lead counsel, “We’re trying to pick up the pieces for these people and help them recover their massive—and tragic—losses. We look forward to facing the Defendants in a court of law and holding them responsible for the devastating losses they helped cause.”

About Miller Barondess, LLP:

Miller Barondess, LLP is a 40-lawyer firm in Los Angeles handling high-stakes litigation and trial work. Skip Miller is among the top trial lawyers in the nation, representing clients from celebrities to Fortune 500 companies to government in litigation matters. The firm’s attorneys hail from top law schools and aggressively and effectively litigate for their clients. For more information, please visit www.millerbarondess.com.

CASE NO. 19STCV42900