NEW YORK--(BUSINESS WIRE)--In the tenth paragraph, third sentence of release the month should read "October" instead of "September."

The corrected release reads:

OCTOBER CONSTRUCTION STARTS FALL 11 PERCENT

Broad based declines pull total construction activity lower

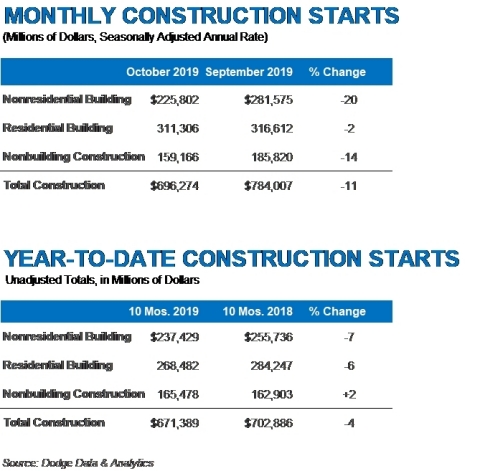

New construction starts declined 11% in October to a seasonally adjusted annual rate of $696.3 billion, according to Dodge Data & Analytics. This is the third consecutive monthly drop in construction starts activity. By major sector, nonresidential building starts fell 20% from September to October and nonbuilding starts dropped 14%, while residential starts moved 2% lower. The October statistics pushed the Dodge Index down to 147 (2000=100) compared to 166 in September.

Through the first ten months of the year, total construction starts were 4% lower than in the same period of 2018. Both residential and nonresidential construction starts were down through ten months, although nonbuilding starts remained on the plus side due to gains in electric utilities/gas plants and environmental public works.

“Concern over the health of the U.S. economy continues to play a key role in the pullback in starts over the past few months,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “However, solid real estate fundamentals (such as vacancy rates) in addition to stable public funding will continue to support a modest level of construction activity across both public and private projects.”

Nonbuilding construction fell 14% in October to a seasonally adjusted annual rate of $159.2 billion. Starts in the electric utility/gas plant category fell 69% in October as activity retreated from a strong September. Environmental public works starts (drinking water, sewers, hazardous waste, and other water resource projects) moved 12% lower over the month. On the plus side, highway and bridge starts increased 4% in October and miscellaneous nonbuilding starts increased 14%.

The largest nonbuilding construction project to get underway in October was the $2.1 billion first phase of the Red/Purple Line Modernization project in Chicago IL. Also starting in October was the $390 million Nobles 2 County Wind Farm in Wilmont MN and the $346 million improvement to I-485 intersections in Charlotte NC.

Through the first ten months of 2019, nonbuilding construction was 2% higher than in the comparable period of 2018. The electric utility/gas plant category was 108% higher than a year earlier and environmental public works was up 2%. Miscellaneous nonbuilding was 21% lower through ten months and highways and bridges declined 10%.

Nonresidential building starts lost 20% over the month in October, falling to $225.8 billion (at a seasonally adjusted annual rate). This steep decline comes after a very strong September that saw two projects valued at nearly $1 billion break ground — a consolidated rental car facility in Los Angeles CA and a large manufacturing complex in Detroit MI. In October, commercial starts fell 3% with gains in the office and hotel sectors muting the downturn. Manufacturing starts peeled back 69% and institutional starts moved 20% lower.

The largest nonresidential building project to break ground in October was the $600 million Vision Northland Medical Campus in Duluth MN. Also starting in October was the $200 million Volpe Transportation Center in Cambridge MA and a $200 million dry dock in Groton CT that will serve the new Columbia class nuclear powered ballistic missile submarines.

On a year-to-date basis through October, nonresidential building starts were 7% lower than a year earlier. Commercial starts were up 3% due to gains in office buildings, warehouses and parking structures, while institutional construction was down 6% through October with all major categories posting declines. Manufacturing starts were 43% lower.

Residential building dropped 2% in October to $311.3 billion at a seasonally adjusted annual rate. Single family housing starts were 7% lower, while multifamily starts increased 14% over the month. The largest multifamily construction project to get underway in October was the $278 million second tower of the Lakeshore East – Cascade Apartment Tower in Chicago IL. Also breaking ground during the month was the $253 million (apartment portion only) Azure Ala Mona Residential building in Honolulu HI and the $230 million (apartment portion only) 40 Trinity Place Residential Tower in Boston MA.

Through the first ten months of the year, residential construction starts were 6% lower than in the same period of 2018. Single family starts were down 3%, while multifamily declined 12% year-to-date.

About Dodge Data & Analytics: Dodge Data & Analytics is North America’s leading provider of analytics and software-based workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities and execute on those opportunities for enhanced business performance. Whether it’s on a local, regional or national level, Dodge makes the hidden obvious, empowering its clients to better understand their markets, uncover key relationships, size growth opportunities, and pursue those opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its 100-year-old legacy of continuous innovation to help the industry meet the building challenges of the future. To learn more, visit www.construction.com.