SANTA MONICA, Calif.--(BUSINESS WIRE)--Institutional assets tracked by Wilshire Trust Universe Comparison Service® (Wilshire TUCS®) posted all-plan median returns of 1.00 and 4.58 percent for third quarter and the year ending September 30, 2019, respectively. Wilshire TUCS, a cooperative effort between Wilshire Analytics, the investment technology foundation of Wilshire Associates Incorporated (Wilshire®), and custodial organizations, is widely considered the definitive benchmark for U.S. institutional plan assets performance and allocation.

Weak third quarter gains pulled the one-year return down further from the June 2018 one-year return of 7.50 percent.

“The significant decline in interest rates boosted performance of bonds and other interest rate sensitive assets, including defensive equities during third quarter. Despite strong year-to-date performance, the sell-off in global equities during fourth quarter 2018 is weighing on the trailing one-year performance for most institutional plans,” said Jason Schwarz, president, Wilshire Analytics and Wilshire Funds Management.

U.S. equities, represented by the Wilshire 5000 Total Market Index℠, rose 1.23 and 2.95 percent third quarter and for the year, respectively; and, international equities, represented by the MSCI AC World ex U.S., fell -1.80 and -1.23 percent third quarter and for the year, respectively. U.S. bonds, represented by the Wilshire Bond Index℠, increased third quarter and for the year with gains of 2.86 and 11.77 percent, respectively. Multi-asset, represented by the Wilshire Risk Parity – 10% Target Volatility Index℠, rose 4.46 and 18.75 percent third quarter and for the year, respectively.

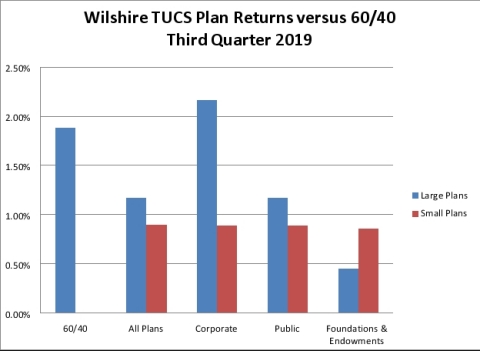

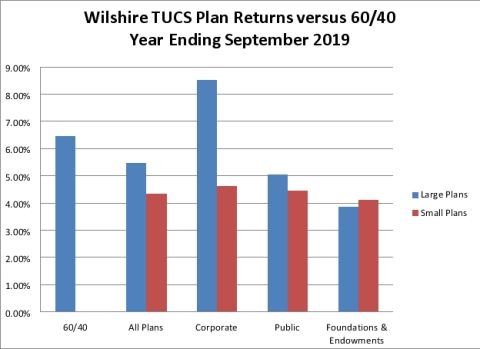

Median ranges for the quarter across plan types spanned from 0.45 to 2.17 percent for large foundations and endowments (assets above $500 million) and large corporate plans (assets above $1 billion), respectively. Mega public plans (assets above $5 billion) clocked second best for the quarter with a 1.19 percent gain. One-year medians ranged from 3.86 to 8.54 percent gains for large foundations and endowments (assets above $500 million) and large corporate plans (assets above $1 billion), respectively. Mega public plans (assets above $5 billion) also nabbed second best one-year returns with a 5.49 percent gain.

Once again all plan types, except large public plans, underperformed the 60/40 portfolio, up 1.88 percent third quarter.

For the year-ending September 2019, all plan types, except large corporate plans, underperformed the 60/40 portfolio, which rose 6.48 percent. For the year, large plans outperformed small across all types except foundations and endowments. Large foundations and endowments (assets above $500 million) continued significant alternatives exposure for the quarter, increasing to a median 51.03 percent.

Large plans (assets above $1 billion) posted median gains of 1.17 and 5.49 percent for the quarter and year ending September 30, respectively; meanwhile, small plans (assets less than $1 billion), slightly underperformed large for the quarter and outperformed for the year at 0.90 and 4.36 percent, respectively.

* Median allocations will not add up to 100 percent. No part of the chart may be re-produced.

About Wilshire Associates

Wilshire Associates, a leading global financial services firm, provides consulting services, analytics solutions and customized investment solutions to plan sponsors, investment managers and financial intermediaries. Its business units include, Wilshire Analytics, Wilshire Consulting, Wilshire Funds Management and Wilshire Private Markets. The firm was founded in 1972, providing revolutionary technology and acting as an early innovator in the application of investment analytics and research to investment managers in the institutional marketplace. Wilshire also is credited with helping to develop the field of quantitative investment analysis that uses mathematical tools to analyze market risks. All other business units evolved from Wilshire’s strong analytics foundation. Wilshire developed the Wilshire 5000 Total Market Index and became an early innovator in creating integrated asset/liability analysis/simulation models as well as practical models in risk budgeting through beta and active risk analysis. Wilshire has grown to a firm of approximately 270 employees serving the needs of investors around the world. Based in Santa Monica, California, Wilshire provides services to clients in more than 20 countries representing more than 500 organizations with assets totaling approximately US $9 trillion.* With ten offices worldwide, Wilshire Associates and its affiliates are dedicated to providing clients with the highest quality products and services. Wilshire® and Wilshire 5000® are registered service marks of Wilshire Associates Incorporated. Wilshire 5000 Total Market Index℠ is a service mark of Wilshire Associates Incorporated.

Please visit www.wilshire.com

Twitter: @WilshireAssoc

*Client assets are as represented by Pensions & Investments (P&I), detailed in P&I’s “Largest Retirement Funds” and P&I’s “Largest Money Managers (U.S. institutional tax-exempt assets)” as of 9/30/17 and 12/31/17, and published 2/5/18 and 5/28/18, respectively.

Data and charts in this article are copyrighted and owned by Wilshire Associates Incorporated.