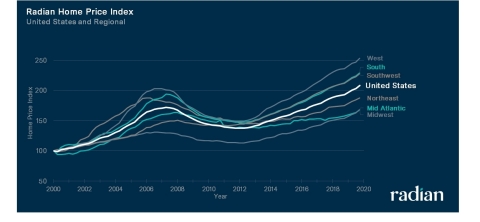

PHILADELPHIA--(BUSINESS WIRE)--Home price appreciation has accelerated across the United States, according to a new historical home price index (HPI) announced today by Radian Group Inc. (NYSE: RDN). The newly released September 2019 Radian HPI data shows a 7.9 percent year-over-year increase in median values, after a 5.8 percent annualized growth rate in the second quarter of 2019.

“Stronger year-over-year home price appreciation was driven by lower interest rates, lack of supply and a solid economy,” said Senior Vice President of Data and Analytics Steve Gaenzler. “Year-over-year gains in appreciation had slowed throughout much of 2018 and the first months of 2019, but the Radian Home Price Index tells a different story now. All indications are that low interest rates in particular have re-heated an already hot real estate market.”

On a regional basis, prices in all six of the tracking regions increased in September from the prior reading, but the Radian HPI detected a shift in regional strength. For each period from July 2016 through July 2019, the West region recorded the strongest annual price gains. Beginning this summer, however, the West has dropped from first to fourth place, behind the Midwest, South, and Southwest. The Northeast and Mid-Atlantic while growing, show comparatively slower rates of appreciation.

Existing First Time Homeowners Hold Win-Win Options

After years of positive home price appreciation, many existing first-time homeowners in need of more space are currently faced with the decision of whether to sell and buy their next home, or to tap into their home equity to expand their current residence.

The September 2019 Radian HPI evaluated three-digit zip code areas in the U.S. in order to identify those markets where renovating to expand a two-bedroom starter home may be a better housing option than selling and purchasing a larger home. Targeting U.S. markets where the five-year growth in home prices has eclipsed 35 percent, 10-year growth exceeded 50 percent, and where the minimum average gain was more than $50,000 over the last five years, Radian HPI evaluated the gaps in current prices between two-bedroom starter homes and the next “forever” home.

Of the eligible markets in the Radian HPI, home prices between the starter home and forever homes in four states showed the greatest opportunity in favor of renovations: Texas, Florida, Colorado, and California. Areas where equity build-up was enough to support cashing out without expanding loan-to-value ratios, and where the market price of the next larger house was more than the cost of the renovation are considered the best for a face lift.

- Homes in the 334 zip code, an area along the southeastern coast of Florida and including cities from Deerfield Beach to Jupiter, are a prime example. That zip code recorded a 10-year gain in two-bedroom property value of more than $80,000, well more than enough to cover the cost of an average addition, which is a little more than $45,000 depending upon location, type of addition, and finishes. In this area, the inferred increase in value created through an addition is more than $119,000, based on the current value of three-bedroom homes in the area.

- Not surprisingly, some metro areas registered more than one three-digit zip code at the top end of the list. These included areas around Dallas, TX (3); Denver, CO (2); Fresno, CA (2); Melbourne, FL (2); Miami, FL (3); Orlando, FL (2) and Phoenix, AZ (2).

- In addition to the larger metros, Radian HPI found a number of opportunities in midsized cities around Manchester, NH; Detroit, MI; Sioux City, IA; Burlington, VT and Kansas City, KS. These areas have also experienced strong home price increases, but still retain the value proposition of renovation relative to selling and buying a three-bedroom home.

For homes with large equity increases but where the price jump between two- and three-bedroom homes remains narrower, combined with near record low interest rates, it may make more economic sense to take the cash from a sale and invest in a larger home.

Regardless of the individual situation, the strong growth in home equity has created some win-win decisions for existing first-time homeowners looking to expand their living area.

About Radian HPI

The Radian HPI uses a wealth of housing market data and property valuation expertise to value nearly all of the housing inventory across the country, offering an unrivalled view on conditions and trends in the U.S. housing market. For more information about Radian HPI, visit info.radian.biz/hpi.

“The Radian Home Price Index is an excellent example of leveraging proprietary analytics to power new products and services for our clients and the broader housing markets,” said Chief Executive Officer Rick Thornberry. “We will continue to develop innovative, market-disruptive technologies for participants throughout the real estate value chain.”

The Radian HPI is based upon a proprietary automated valuation model, or AVM, for single-family houses and condominiums/townhomes in the U.S., which draws on multiple modeling methodologies and leverages one of the largest housing data repositories along with other proprietary sources. That collective information provides broader, deeper and more timely coverage of U.S. housing markets and submarkets compared to other indices.

The most widely publicized indices currently in the market, are “repeat sales” indices, which estimate the property value by calculating changes in the sales price of the same properties over time. But that means the only valid observations of pricing each month come from properties that are sold, so those indices will typically include only 400,000 unique observations each month.

In contrast, the Radian HPI evaluates nearly 70 million individual properties each month and takes numerous factors into consideration, including information about the property and the surrounding market, to determine a value. As a result, the Radian HPI is based on data that comprehensively captures the housing market, making the development of granular indices possible without sacrificing stability or accuracy.

The Radian HPI will provide coverage in all markets, including non-disclosure and rural markets, at multiple levels of geography – national, regional, state, county, city and even neighborhood – with the ability to compare and contrast over time. Users will also have the ability to dynamically build indices through a deep set of characteristics to produce property and portfolio valuations, pricing forecasts, micro market analysis and scenario creation.

About Radian

Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, real estate, and title services. We are powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk. Learn more about Radian’s financial strength and flexibility at www.radian.biz and visit www.radian.com to see how Radian is shaping the future of mortgage and real estate services.