NEW YORK--(BUSINESS WIRE)--The D. E. Shaw Group (“D. E. Shaw”), which has been an investor in Emerson Electric Co. (the “Company”, “Emerson Electric” or “Emerson”) (NYSE: EMR) for over four years and currently hold a more than 1.0% interest in the common stock and equivalents of the Company, today sent a letter to the Board of Directors of Emerson.

The letter and presentation can be downloaded at www.deshawmaterials.com.

The full text of the letter follows:

October 15, 2019

Board of Directors

Emerson Electric Corporation

8000 West Florissant Avenue PO Box 4100

St. Louis, MO 63136

Attn: Chairman David Farr

Attn: Lead Director Clemens Boersig

Dear Members of the Board:

We are writing to you on behalf of certain investment funds advised by D. E. Shaw & Co., L.P., (collectively the “D. E. Shaw group”). The D. E. Shaw group is a global investment and technology development firm with over $50 billion in assets under management and a track record of working with companies to create long-term, fundamental value. We have been shareholders of Emerson Electric Co. (the “Company”, “Emerson Electric” or “Emerson”) (NYSE: EMR) for over four years and today hold a more than 1.0% interest in the common stock and equivalents of the Company.

Emerson is an iconic company with world-class assets. However, persistent undermanagement of those assets and a long track record of poor capital allocation, excessive costs, suboptimal business configuration, deficient corporate governance, and misalignment of interests have led to significant underperformance of Emerson stock relative to its peers and to the broader market over every relevant measurement period. Simply put, we believe that Emerson has the assets and businesses to be a great company with a premium valuation, but the management team and Board have let shareholders down.

To create maximum and enduring value for its shareholders, Emerson needs to change. We believe the right set of actions could result in over 50% upside to Emerson’s share price, or over $20 billion of equity value creation for Emerson shareholders, while at the same time preserving Emerson’s market leading position in its various businesses. We have outlined our perspectives in this letter and in the attached slide deck, which we are making available to our fellow shareholders, today.

Emerson Has Been a Perennial Underperformer

Despite Emerson’s brand recognition and reputation, the hard truth is that Emerson has not performed for its shareholders.

Measured over every relevant period against any relevant set of peers or indices, Emerson has disappointed. For example, over the past five years Emerson’s total shareholder return has underperformed the peers it selected in its proxy statement by 45%. Over that same timeframe, Emerson has underperformed the S&P 500® Index by 47%. Emerson has similarly underperformed its peer group and the S&P 500® Index over one-, three- and 10-year periods.

This pattern holds true, as noted in the table below, when Emerson is compared to its peers within its two segments (automation and climate), to an index of multi-industrial companies, to peers selected by Institutional Shareholder Services, and even to an index of peers with heavier oil and gas exposure.

Capital invested elsewhere has consistently generated better returns than capital invested in Emerson.

Emerson’s TSR Relative to: |

1 Year |

|

3 Year |

|

5 Year |

|

10 Year |

|

Proxy Peers (1) |

-10% |

|

-1% |

|

-45% |

|

-198% |

|

Automation Peers (2) |

-13% |

|

-7% |

|

-24% |

|

-155% |

|

HVAC OEM Peers (3) |

-29% |

|

-19% |

|

-88% |

|

-272% |

|

Multi-Industry Average (4) |

-13% |

|

-4% |

|

-42% |

|

-209% |

|

ISS Selected Peer Average (5) |

-16% |

|

-23% |

|

-71% |

|

-235% |

|

O&G Exposed Peers (6) |

-11% |

|

-7% |

|

-19% |

|

-159% |

|

XLI |

-15% |

|

-7% |

|

-42% |

|

-138% |

|

S&P 500 |

-18% |

|

-11% |

|

-47% |

|

-125% |

| Note(s): | |||||

• |

Source: Bloomberg Market Data as of 9/26/19, one day prior to press reports of the D. E. Shaw group’s involvement with the Company | ||||

• |

Peer index returns calculated on an equal weighted basis | ||||

1. |

Includes CAT, CMI, DHR, DE, ETN, FLR, GD, GT, HON, ITW, IR, IP, LMT, NOC, PH, PPG, RTN, SLB, TEL, TXT, UTX and MMM | ||||

2. |

Includes ABB, AME, FLS, HON, ROK, ROR and SU FP | ||||

3. |

Includes IR, JCI, LII, UTX | ||||

4. |

Includes ROK, HON, FLS, ABB, JCI, UTX, LII, IR, FBHS, SWK, MMM, ALLE, AME, DOV, ETN, FTV, GE, PH, PHR, CGNX, GDI, ROP, NVT, KMT, GGG, ITW, SIE, SU FP, ROR and FLOW | ||||

5. |

Includes MMM, DE, HON, IR, CMI, RTN, ETN, ITW, TXT, PH, ROK, LHX, PCAR | ||||

6. |

Includes ABB, AME, DOV, FLS, HON, PNR, ROK, ROR | ||||

The Underperformance Stems from Decisions Made by the Board and Management

During our meetings, and in the materials we have presented to you multiple times, we described how decisions made by the Board and management team have directly led to Emerson’s substantial stock market underperformance.

First, the Company has a poor track record of allocating capital. Emerson’s network power investment, for example, cost shareholders billions. Substantial spending on research and development and capital equipment and goods has produced exceedingly small improvements in annual cash flow – certainly not enough to justify the expenditures. The Company’s failed bid for Rockwell Automation at nearly 20x EBITDA suggests the Company has been more focused on growth at any cost rather than on creating long-term shareholder value. As a result of this behavior, investors have grown skeptical of how each incremental dollar earned at Emerson will be invested.

Second, Emerson is inefficient and insufficiently focused on cost containment. Relative to peers, Emerson’s SG&A expenses are excessive and unjustified, leading to costs substantially above peers. As we detail in the accompanying materials, the Company’s organizational structure is replete with overlapping and redundant positions and layers upon layers of middle management. The Company also has an inefficient physical footprint, with as many as 18 locations in the city of Houston alone. In the Automation Solutions business, salesforce productivity severely lags the Company’s peers. Unlike nearly any other company in the S&P 500, Emerson maintains an internal “aviation department” that manages a fleet of eight corporate jets and a helicopter, at great expense to shareholders. While the Company, apparently in response to the D.E. Shaw group raising concerns about excessive spending, has recently engaged a consulting firm to help streamline Emerson’s structure and reduce costs, this bloated structure and expense base has persisted for years, with insufficient attention or concern from the Board or management.

Third, the Company maintains a conglomerate business configuration even though the structure has no tangible business benefits and creates substantial complications for investors, capital allocation, management focus, and valuation. By operating two dissimilar businesses under one corporate umbrella, Emerson serves neither the businesses nor its shareholders well, as is evident from the remarkable fact that Emerson is valued below the pure-play peers of both segments. Emerson’s Board has allowed this “one-plus-one equals one-and-a-half” structure to persist for far too long.

Fourth, Emerson’s Board is one of the few remaining holdouts in the S&P 500 that insists its directors be elected to three-year terms, providing each of the directors a wide moat of insulation from the shareholders they represent. We believe this antiquated governance structure (which the Board could eliminate unilaterally) reduces accountability and the incentives to serve shareholder interests well. Nearly 90% of S&P 500 companies have now adopted annual elections for all directors; Emerson’s “director protection program” is especially unjustified given the persistent underperformance of Emerson’s stock.

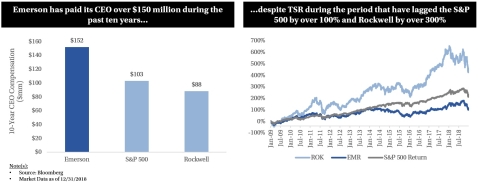

Fifth, the Board has adopted executive compensation metrics that encourage management to pursue the wrong goals. All but one of Emerson’s peers incentivize their management teams to achieve target operating or financial returns. Emerson instead has provided incentives for management to grow the Company, even if returns – in the business or to shareholders – suffer as a result of value destructive growth. Not surprisingly, then, the business has grown and management has been paid – CEO David Farr has earned more than $150 million in just the last ten years – despite shareholder returns that have substantially lagged both peers and market. Indeed, Emerson’s CEO has earned 50% more than his S&P 500 peers and nearly double the compensation of the CEO of Rockwell Automation, the Company’s closest peer despite substantially worse performance. Furthermore, the Company’s long-term incentive compensation plans seemingly always pays out nearly 100% of its potential value – regardless of how well or poorly the Company’s stock performs.

The D. E. Shaw Group’s Efforts to Assist in Creating Value

We have spent considerable time over the past two months outlining our concerns and proposed solutions in detail for the Board and management team. Rather than continue to engage with us in constructive, private dialogue, the Board appears instead to be laying the public groundwork for a full-throated defense of its indefensible track record.

Just days after we last met in person, the Board apparently thought it could neutralize our concerns and quell shareholder discontent by publicly announcing it would “study” Emerson’s issues. However, the announced effort – “evaluating” Emerson’s well known “operational, capital allocation and portfolio” issues – is obviously reactive to our analysis and years overdue. Furthermore, the announcement commits the Board to nothing, lacking any targets, deadlines or areas of focus.

In addition, the Company’s recent failure to correct the public record when it was suggested that the D. E. Shaw group had proposed a levered recapitalization of the Company – an action we have never suggested and something we have told you multiple times we do not think would be prudent – appears to be a clear effort to discredit our views and is a disservice to all your investors. The D. E. Shaw group is a large, long-term shareholder seeking for Emerson what we believe every shareholder wants: optimal allocation of capital, efficient operations, a sensible business configuration, governance that enshrines accountability, and executive compensation programs that properly align management with shareholders.

Rather than muddying the waters, we suggest instead Emerson acknowledge its shortcomings and commit to addressing them.

Emerson Needs Change

We are pleased that in our private meetings, the Board and management team have acknowledged the need for change at Emerson. However, we believe half-measures will only produce mediocre results, and so we encourage a fully independent, objective, and extensive strategy and operations review.

We believe there are highly actionable portfolio and cost actions that can result in significant value creation for shareholders. In particular, the set of steps we have proposed could result in more than 50% appreciation in Emerson’s stock price, which equates to more than $20 billion of value in the aggregate.

In arriving at our recommendations, we performed extensive research, including retaining a leading consulting firm to perform a detailed assessment of cost rationalization opportunities (including a line-item analysis for every cost element in the Automation business and corporate center), assessing the dis-synergies from splitting Emerson’s business units, working with experienced industrial automation and HVAC operating executives to assess the business (in addition to conducting more than 50 in-depth interviews with other leading experts), and consulting with tax and corporate counsel to understand various business configuration and corporate governance alternatives.

As described more fully in the presentation we are sending you today, we believe the optimal path forward for Emerson is to:

- Reduce costs. We estimate that Emerson can save over $1 billion annually, mostly within Emerson’s Automation Solutions segment and Emerson’s corporate center through cost rationalization and efficiencies. We estimate that such a plan alone could generate over 30% upside to Emerson’s current share price. We have provided line-by-line benchmarking and suggestions for cost savings, including in organizational structure, consolidation of the engineering function, improved salesforce productivity, real estate footprint consolidation, aviation expenses and many other areas. We believe all shareholders would benefit from a greater sense of urgency in capturing this opportunity, including a detailed timeline for achieving these savings. For example, it shouldn’t take a team of high-priced consultants to understand that operating a fleet of eight private jets isn’t efficient or optimal. We believe the Emerson aviation department should be pared back immediately and personal use of remaining corporate aircraft should be substantially limited, as a visible first step that would send an important signal to Emerson’s employees and shareholders that the Company’s spending culture needs to change.

- Separate the Company. We believe Emerson should be split into a pure play industrial automation company (“Automation Co.”) and a climate technology-focused company (“Climate Co.”). Emerson can execute the separation through a tax-free spinoff of Climate Co. to shareholders with limited dis-synergies. Since Emerson currently trades at a discount to its lowest multiple segment, we believe a separation alone would generate at least 20% upside to the current share price based on achieving peer valuation multiples for each segment.1 It is important to note that we do not view the separation as an isolated recommendation: it is an essential step toward maximizing shareholder value by creating two leading companies that can independently structure the proper compensation and incentive schemes for their respective management teams, enabling each to efficiently optimize its own cost and capital structure, and, ultimately its strategic position, outside of the conglomerate umbrella that has prevented each business from achieving its full potential. Put simply, creating two separate, leaner, more focused organizations would ensure that Emerson’s businesses remain forces to be reckoned with, far into the future.

- Improve corporate governance and align executive compensation. The Board should immediately move to annually elected directors to ensure accountability and alignment with the interests of shareholders. Emerson should also take immediate steps to better align executive compensation with shareholder returns by adding a return-focused metric to its long-term incentive compensation plan.

Next Steps

Emerson has best-in-class assets with leading market positions but has not been effective at creating value for shareholders. The Board’s decisions regarding capital allocation, cost structure, business configuration, corporate governance, and executive compensation have cost shareholders significant value over time.

Emerson must undertake substantial reforms if it desires to modify its trajectory. We believe there are fairly easy and straightforward ways to address Emerson’s history of underperformance, including by containing costs in the automation business and corporate overhead, separating the two divisions into independent public companies, allowing shareholders to have annual input into the performance of the directors, and aligning the pay of the executive team with the outcomes most correlated to the creation of shareholder value.

While we appreciate that the Board has recently launched a “review” of the Company, we believe urgent action is required and that any such review would benefit from objective, independent, and fresh perspectives.

We therefore encourage you to augment the Board’s composition to bring such fresh perspectives into the boardroom to assist in evaluating our proposals. The Board should also commit to annual elections and aligning executive compensation. These three easy decisions – renewed board composition, adopting modern governance and ensuring incentives are aligned – are neither controversial nor time consuming. A delay in executing upon them should provoke skepticism from your shareholders about your bona fide intentions. On the other hand, swift action will instill confidence in your judgment and willingness to adopt change that shareholders desire.

Emerson is at an important crossroads in its history with the upcoming retirement of CEO David Farr. The Company has a unique opportunity to reinvigorate itself, ensuring that it remains a competitive force for many years to come for the benefit of all its stakeholders. We look forward to continuing to work with the Board and Management to enhance Emerson and appreciate this opportunity to share our views with you and our fellow shareholders.

Best Regards,

Edwin Jager |

Michael O’Mary |

|

Managing Director |

Managing Director |

|

D. E. Shaw & Co., L.P. |

D. E. Shaw & Co., L.P. |

|

|

About the D. E. Shaw Group

The D. E. Shaw group is a global investment and technology development firm with more than $50 billion in investment and committed capital as of July 1, 2019, and offices in North America, Europe, and Asia. Since our founding in 1988, our firm has earned an international reputation for successful investing based on innovation, careful risk management, and the quality and depth of our staff. We have a significant presence in the world's capital markets, investing in a wide range of companies and financial instruments in both developed and developing economies.

This letter reflects the opinions of D. E. Shaw & Co., L.P. (“DESCO LP”) on behalf of certain investment funds managed or advised by it that currently beneficially own, or otherwise have an economic interest in, shares of Emerson Electric Co. (the “Company”). This letter is for informational purposes only and does not constitute investment advice or convey an offer or solicitation of any type with respect to any securities or other financial products. The views expressed in this letter are expressed as of the date hereof and are based on publicly available information and DESCO LP’s analyses. This letter contains statements reflecting DESCO LP’s opinions and beliefs with respect to the Company and its business based on DESCO LP’s research, analysis, and experience; all such statements are based on DESCO LP’s opinion and belief, whether or not those statements are expressly so qualified. DESCO LP acknowledges that the Company may possess information that could lead the Company to disagree with DESCO LP’s views and/or analyses. Nothing contained in this letter may be relied upon as a guarantee, promise, assurance, or representation as to future events. The investment funds managed or advised by DESCO LP are in the business of trading (i.e., buying and selling) securities, and it is expected that they will from time to time engage in transactions that result in changes to their beneficial and/or economic interest in the Company.

1 Market data as 9/26/2019 prior to press reports of the D. E. Shaw Group’s involvement with the Company. Automation Solutions peers include FLS, HON, ROK, ROR; Climate peers include LII, IR, UTX and JCI; Primary Tools peer is SWK