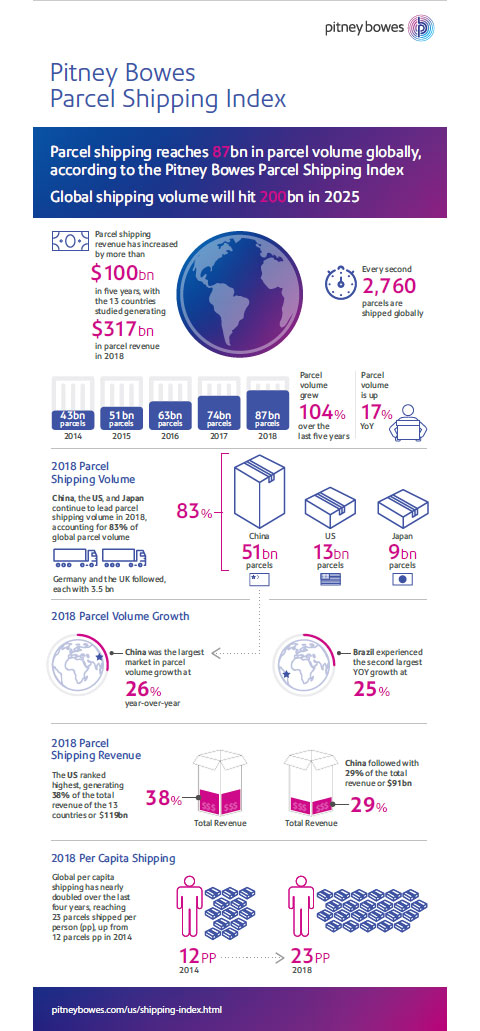

STAMFORD, Conn.--(BUSINESS WIRE)--Pitney Bowes Inc. (NYSE:PBI), a global technology company that provides commerce solutions in the areas of ecommerce, shipping, mailing, data and financial services, today unveiled the Pitney Bowes Parcel Shipping Index. The annual report discovered global parcel volume reached 87 billion in 2018, up from 74bn parcels in 2017 and the highest since the Index began. Despite unprecedented global trade uncertainty, the report forecasts this figure will more than double within the next six years and reach 200 billion parcels by 2025 with a 13.7 percent CAGR for 2019-2023.

The Pitney Bowes Parcel Shipping Index measures both volume and spend for business-to-business, business-to-consumer, consumer-to-business and consumer consigned shipments with weight up to 31.5 kg (70 lbs.) in 13 major markets, representing 3.7 billion people - U.S., Canada, Brazil, Germany, UK, France, Italy, Norway, Sweden, China, Japan, Australia and India. Based on proprietary and published data, the Index has been compiled annually since 2015, and has become a valued industry benchmark.

The latest report reveals growth of 17% in 2018, in line with the 17-28 percent growth projection range given in previous Parcel Shipping Index reports. On average in 2018, there were 23 parcels shipped per person in the 13 major markets in 2018, and 2760 parcels shipped every second. Global shipping volume remains on track to surpass 100 billion parcels in 2020 in aggregate across the 13 countries reviewed. China remains the strongest influence on the market with 51 billion parcels shipped in 2018. Excluding China, parcel volume increased by 6 percent, from 34 billion in 2017 to 36 billion in 2018. Global parcel revenue remains strong, reaching $317bn – up 13 percent since the previous year.

Key findings include:

- China’s parcel industry volumes achieved CAGR of 41 percent from 2013-2018. Volume grew 26 percent year-over-year although this growth has declined from the 48-61 percent growth seen from 2012-16

- United States ranks highest in the Index for parcel shipping revenue at $119bn.

- Brazil sees the second highest year-over-year growth rate in the Index with a 25 percent increase in year-over-year parcel volume from 2017-18

- India is experiencing CAGR of 25% in parcel volume 2013-18 and year-over-year growth of 21 percent

China continues to exert its influence on the global parcel shipping market. In 2018, it extended its global lead in parcel volume, with 26 percent year-over-year growth and a CAGR of 41 percent from 2013-18. At 51 billion, its parcel volume is more than four times that of the United States which stands at 13 billion. However, the United States’ parcel revenues - at $119.bn - remain higher than China’s parcel revenues of $91bn.

Jason Dies, EVP and Vice President Sending Technology Solutions, Pitney Bowes said, “Global parcel revenues continue to benefit from the explosive impact of ecommerce, but it isn’t just online shoppers boosting the industry. We know from our clients’ own behaviors that office sending is increasing, particularly in industries such as IT, Healthcare and Manufacturing. Carriers are trialing new and exciting strategies to deliver the best customer experience, to keep costs down, boost productivity and generate profitability, such as forming partnerships, designing next-generation sending technologies and developing last mile innovation.”

While all countries except Japan saw steady growth in parcel volume, the impact of emerging ecommerce markets such as Brazil and India is strongly evident in the figures. Brazil’s year-over-year percentage growth in parcel volume reached 25 percent in 2018 – second only to China - as 738m parcels were shipped. This growth comes despite the economic slowdown in Brazil, as ecommerce and logistics partnerships help shift the market.

India also experienced high growth in parcel volumes in 2018, up 21 percent year-over-year to 2.5bn, and revenues achieving CAGR of 20 percent, boosted by rapid growth in its ecommerce market, higher levels of disposable income and increased internet penetration.

Complementing the Shipping Index, Pitney Bowes carried out separate research on its clients’ sending patterns and behaviors to identify key trends across different industries. The research found sustained growth in Enterprise sending, primarily office shipping, across several different industries. Shipping volume generated by the IT industry is forecast to grow at 7.5 percent CAGR to 2023, with Wholesale B2C rising at the same CAGR of 7.5 percent to 2023. Manufacturing shipping volume is expected to grow at 6.5 percent CAGR, and the Healthcare industry at 3.7 percent, also to 2023.

Shipping Index Topline Trends Across Countries

- China’s Parcel Volume Quadruples that of United States: China (51 billion), the United States (13 billion), and Japan (9 billion) represented the top three countries for parcel shipping volume. Collectively, China, US, and Japan represented 83% of global parcel volume in 2018.

- United States Tops Shipping Revenue: The United States ranks highest in parcel shipping revenue at $119 billion. China ($91 billion) and Japan ($30 billion) follow.

- Japanese Parcel Volume is Declining but Revenue Increased: Revenues generated by parcel shipments in Japan currently stand in the top three of all 13 markets studied, despite a slight decline in parcel volume.

Key Findings by Region

Americas (Brazil, Canada, United States)

- Brazil, parcel volume grew 25 percent year-over-year, with volume reaching 738 million parcels – an average CAGR from 2014-18 of 12.3 percent

- Canada, parcel shipments reached 1.1bn, up 3 percent from the year prior

- United States generated $119bn revenue in parcel revenue, the highest of all 13 countries studied and an increase of 8 percent year-over-year. The market shipped 13bn parcels, up from 12bn in 2017.

Europe (France, Germany, Italy, Norway, Sweden and United Kingdom)

- France saw parcel volumes reaching 1.3bn and CAGR of 5 percent from 2013-18

- Germany generated 3.5bn parcel shipments in 2018. Germany has the largest B2B sector in Europe, comprising around 65 percent of its overall market

- Italy 865m parcels were shipped in 2018, 10 percent growth since the previous year

- Norway saw parcel volumes increase by 9 percent since 2017. Parcel shipments reached 61m

- Sweden saw 12.5 percent growth in parcel volumes since the previous year, reaching 127m in 2018

- United Kingdom parcel shipments generated $15.1bn in revenue

Asia Pacific (Australia, China, India, Japan)

- Australia shipped 864 million parcels, an increase of more than 10 percent year over year

- China’s parcel volume reached 51 billion in 2018, up from 40 billion in 2017

- India, parcel volumes have increased steadily since 2013 to 2.5bn, with CAGR since 2013 of 25 percent – the third highest rate of volume growth in the Index.

- Japan’s parcel shipments by volume, at 9bn, declined by 2 percent from the previous year. Revenue increased by 13 percent, to $30bn.

View the Pitney Bowes Shipping Index interactive map and infographic to learn more.

The Parcel Shipping Index is one example of proprietary research conducted by Pitney Bowes on behalf of its clients to help guide investment decisions and go-to-market strategies. Later this month, the company will release the results of its annual Global Online Shopping Study, a survey that tracks the online shopping behaviors and preferences of consumers around the globe. To review the findings of last year's survey, please visit: https://www.pitneybowes.com/us/ecommerce-study.html

About the Pitney Bowes Parcel Shipping Index

The Pitney Bowes Parcel Shipping Index measures parcel volume and spend for business-to-business, business-to-consumer, consumer-to-business and consumer consigned shipments with weight up to 31.5kg (70 pounds) across Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Norway, Sweden, the United Kingdom and the United States. Population data points were sourced from the International Monetary Fund, World Economic Outlook Database published in October 2018. The Pitney Bowes Parcel Shipping Index spans 13 countries and represents the parcel shipping activity of 3.7 billion people.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global technology company providing commerce solutions that power billions of transactions. Clients around the world, including 90 percent of the Fortune 500, rely on the accuracy and precision delivered by Pitney Bowes solutions, analytics, and APIs in the areas of ecommerce fulfillment, shipping and returns; cross-border ecommerce; office mailing and shipping; presort services; location data; customer information and engagement software; services; and financing. For nearly 100 years Pitney Bowes has been innovating and delivering technologies that remove the complexity of getting commerce transactions precisely right. For additional information visit Pitney Bowes, the Craftsmen of Commerce, at www.pitneybowes.com.