SPRING, Texas--(BUSINESS WIRE)--Southwestern Energy Company (NYSE: SWN) today announced several recent financial developments that reinforce its resiliency and strategic flexibility in a low commodity price environment.

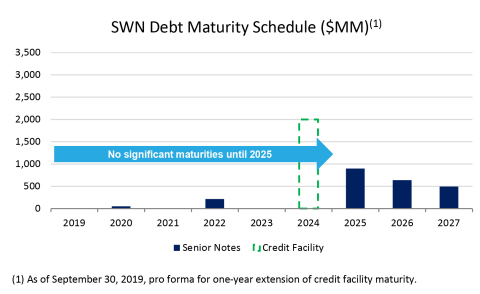

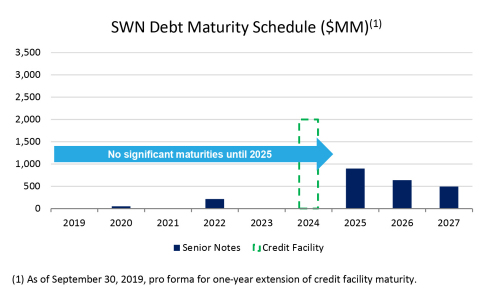

- Borrowing base unchanged in semi-annual redetermination under the $2 billion credit facility with maturity extended one year to 2024; no borrowings outstanding as of September 30, 2019

- Repurchased $50 million of senior notes due 2025 to 2027 during the third quarter at an average 13% discount, funded principally by sales of non-core, non-producing assets

- Leading 5-year maturity window with no significant maturities until 2025

- S&P reaffirmed BB credit rating with a stable outlook

- Additional hedges added during the third quarter, including 186 Bcf and 99 Bcf of natural gas for 2020 and 2021

“Financial strength is a core priority for Southwestern Energy. The Company is strategically advantaged in this low price environment, given our strong balance sheet, liquidity position and debt maturity profile. The recent actions by our bank group and S&P validate this view. Financial resilience, coupled with a premier asset base, outstanding operational execution and lowered cost structure, sets SWN apart as a leading Appalachia producer,” said Bill Way, President and Chief Executive Officer of Southwestern Energy.

Hedging Update

The table presented below summarizes the Company’s commodity hedging positions as of September 30, 2019 for the remainder of 2019 and the full years 2020 and 2021.

|

Q4 2019 |

|

2020 |

|

2021 |

||||||

|

Volume(1) |

|

Price(2) |

|

Volume(1) |

|

Price(2) |

|

Volume(1) |

|

Price(2) |

Natural Gas |

111 |

|

$2.85 |

|

360 |

|

$2.63 |

|

134 |

|

$2.55 |

Propane |

1,116 |

|

$29.62 |

|

3,294 |

|

$25.54 |

|

456 |

|

$22.24 |

Ethane |

2,194 |

|

$10.53 |

|

3,843 |

|

$9.80 |

|

─ |

|

─ |

Oil |

1,152 |

|

$60.24 |

|

2,837 |

|

$58.48 |

|

730 |

|

$53.00 |

(1) The volumes presented are Bcf for natural gas and MBbls for propane, ethane and oil.

|

|||||||||||

The Company’s derivative positions include fixed price swaps, two-way costless collars and three-way collars, which provide protection to downside risk while affording partial price upside. Additional detail on the Company’s derivative position will be available in the third quarter Form 10-Q.

About Southwestern Energy

Southwestern Energy Company is an independent energy company engaged in natural gas, natural gas liquids and oil exploration, development, production and marketing. For additional information, visit our website www.swn.com.

Forward Looking Statement

This news release contains forward-looking statements. Forward-looking statements relate to future events and anticipated results of operations, business strategies, and other aspects of our operations or operating results. In many cases you can identify forward-looking statements by terminology such as “anticipate,” “intend,” “plan,” “project,” “estimate,” “continue,” “potential,” “should,” “could,” “may,” “will,” “objective,” “guidance,” “outlook,” “effort,” “expect,” “believe,” “predict,” “budget,” “projection,” “goal,” “forecast,” “target” or similar words. Statements may be forward looking even in the absence of these particular words. Where, in any forward-looking statement, the Company expresses an expectation or belief as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, there can be no assurance that such expectation or belief will result or be achieved. The actual results of operations can and will be affected by a variety of risks and other matters including, but not limited to, changes in commodity prices (including geographic basis differentials); changes in expected levels of natural gas and oil reserves or production; operating hazards, drilling risks, unsuccessful exploratory activities; natural disasters; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets; international monetary conditions; the risks related to the discontinuation of LIBOR and/or other reference rates that may be introduced following the transition, including increased expenses and litigation and the effectiveness of interest rate hedge strategies; unexpected cost increases; potential liability for remedial actions under existing or future environmental regulations; failure or delay in obtaining necessary regulatory approvals; potential liability resulting from pending or future litigation; general domestic and international economic and political conditions; the impact of a prolonged federal, state or local government shutdown and threats not to increase the federal government’s debt limit; as well as changes in tax, environmental and other laws, including court rulings, applicable to our business. Other factors that could cause actual results to differ materially from those described in the forward-looking statements include other economic, business, competitive and/or regulatory factors affecting our business generally as set forth in our filings with the Securities and Exchange Commission. Unless legally required, Southwestern Energy Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Click here to subscribe to Mobile Alerts for Southwestern Energy.