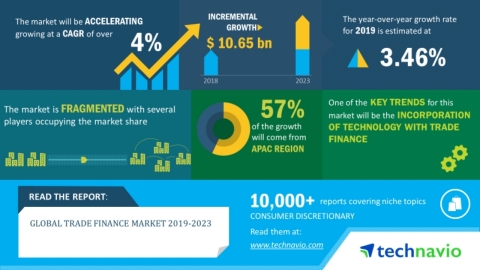

LONDON--(BUSINESS WIRE)--The trade finance market size is expected to post a CAGR over 4% during the period 2019-2023, according to the latest market research report by Technavio. Request a free sample report

The emergence of clearing houses is one of the major reasons for the growth of the market. Clearing houses act as an intermediary between sellers and buyers of financial instruments. Clearing houses ensure a smooth transaction between the seller and buyer by verifying the financial capabilities of both the parties. Clearing houses also help in delivering desired products to buyers in the promised quality and quantity. This eliminates the need for arbitration and complaints after the completion of the transaction.

To learn more about the global trends impacting the future of market research, download free sample: https://www.technavio.com/talk-to-us?report=IRTNTR31509

As per Technavio, the incorporation of technology with trade finance will have a positive impact on the market and contribute to its growth significantly over the forecast period. This research report also analyzes other important trends and market drivers that will affect market growth over 2019-2023.

Trade Finance Market: Incorporation of Technology with Trade Finance

Technology is increasingly being integrated in critical businesses across industries including banking, financial services, and insurance sector. Modern technical concepts including blockchain, artificial intelligence, machine learning, and IoT are often deployed to solve banking problems and find applications in trade financing. AI and machine learning use predictive analytics to provide enterprises with opportunities and solutions for specific problems in the trade financing market. Moreover, the deployment of blockchain technology with trade finance enables enterprises to increase efficiency and reduce the complexity of end-to-end invoice finance transactions. Thus, with the rising deployment of innovative technologies, conventional trade finance solutions are set to improve significantly in terms of efficiency. Therefore, the global trade finance market is anticipated to witness a surge in growth over the next few years.

“Rising benefits of trade finance services coupled with the growing incorporation of technology are fueling the trade finance market growth. This has encouraged vendors to launch technologically advanced trade finance solutions to help streamline the manual process of document identification and simplify trade transactions,” says a senior analyst at Technavio.

Register for a free trial today and gain instant access to 10,000+ market research reports.

Technavio's SUBSCRIPTION platform

Trade Finance Market: Segmentation Analysis

This market research report segments the trade finance market by trade finance instruments (traditional trade finance, supply chain finance, and structured trade finance) and geography (APAC, Europe, MEA, North America, and South America).

The APAC region led the market in 2018, followed by Europe, MEA, North America, and South America respectively. The growth of the trade finance market share in APAC can be attributed to factors such as the increasing focus of global trade toward APAC, and the growing support from the government to strengthen trade finance and increase exports.

Technavio’s sample reports are free of charge and contain multiple sections of the report, such as the market size and forecast, drivers, challenges, trends, and more.

Some of the key topics covered in the report include:

Market Landscape

- Market ecosystem

- Market characteristics

- Market segmentation analysis

Market Sizing

- Market definition

- Market size and forecast

Five Forces Analysis

Market Segmentation

Geographical Segmentation

- Regional comparison

- Key leading countries

Market Drivers

Market Challenges

Market Trends

Vendor Landscape

- Vendors covered

- Vendor classification

- Market positioning of vendors

- Competitive scenario

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 10,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

If you are interested in more information, please contact our media team at media@technavio.com.