SAN FRANCISCO--(BUSINESS WIRE)--Smarking, the commercial real estate industry's leading provider of business intelligence and yield management software solutions for parking assets, today announced the official release of the industry’s first algorithmic and fully-automatic dynamic pricing engine. The product, known as AYM (read as “aim”; Automated Yield Management), utilizes Smarking’s business intelligence solution to capture historic, current, and forecasted demand in order to dynamically set parking prices that will maximize revenue for the applied parking assets.

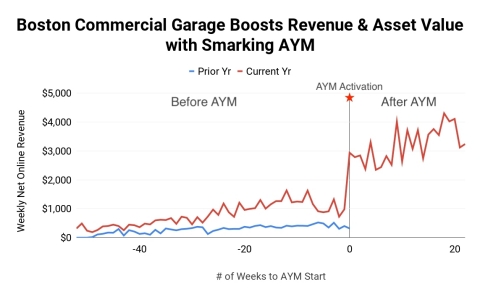

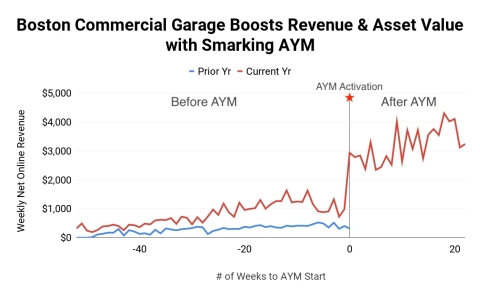

The results have been consistent across parking locations in over 10 cities and deliver an 163% average increase for online parking sales without involvement required from property managers or friction created for consumers. See figure above for example AYM results at a commercial garage in Boston before/after, estimated $150,000 annual net revenue increase, or $2.25MM-$3MM asset value uplift.

AYM, in pilot for over a year, is officially available now from Smarking.

Typically, most parking rates are set in the same way they were decades ago. Prices are determined primarily based on competitors’ rates and are rarely updated, if at all. But parking, just as the airline and hotel industries, exhibits an ever-changing consumer demand and perishable inventory. So, under the current practice where prices are predominately static, revenues are lost during both high and low demand periods. Smarking’s AYM solution automatically calculates the demand curves for parking at a location and algorithmically sets the price in order to maximize revenue at varying levels of demand.

Smarking initially tested the solution at eight parking locations in three metropolitan regions, including New York, Chicago and Boston. The results were positive in all locations, leading Smarking and their customers, including some of the largest commercial real estate landlords in the country, to expand to over ten cities in just two quarters.

“One of our Chicago assets deployed Smarking AYM in March 2019, and we have observed continuously growing revenue increases since then for up to 136% (YOY), annualizing a very meaningful NOI and asset valuation uplift,” said Peter Owusu-Opoku, Asset Manager at LaSalle Investment Management. “Our partnership with Smarking helps us deliver competitive investment performance through economic and property market cycles, which is a driving principle here at LaSalle.”

“Millennium is one of the largest garages in the world, serving downtown Chicago,” said Rick West, CEO of Millennium Parking. “Even if we hired a full-time person just to set fees, we couldn’t post hundreds of rates multiple times a day, let alone develop the number of products and analyze the results Smarking’s algorithm does.”

Parking is an often-overlooked revenue stream for asset owners. But the math is compelling: an increase of the parking revenue by hundreds of thousands of dollars could give the building asset value an uplift for millions of dollars. The typical parking asset revenue is in the range of $10-$30/sqft in urban areas in North America, while there’s a potential to lift that up for another $1-$15/sqft or even more with dynamic pricing engine for commercial parking assets.

“Many of our forward thinking commercial real estate customers saw the lower hanging fruit from parking assets, and are demanding revenue maximization there, just like their leasing businesses,” said Wen Sang, CEO of Smarking. “We started with our business intelligence solution, enabling the customers to manage parking revenue in a data-driven fashion. Now with AYM, we are empowering our customers with a fully-automated solution for revenue and asset value maximization, leveraging the most cutting-edge technologies in data science, cloud computing, and asset management.”

About Smarking

Smarking is a San Francisco based tech company serving commercial real estate owners, parking operators, municipalities, and others to maximize parking asset returns. Consisting of a team of MIT data scientists, urban real estate and mobility experts, Silicon Valley software engineers, and business professionals, Smarking’s market leading business intelligence and yield management software currently empowers over 2,000 parking locations across North America, maximizing asset income, tenant satisfaction, and cost saving.

About LaSalle Investment Management

LaSalle Investment Management is one of the world's leading real estate investment managers. On a global basis, LaSalle manages approximately $68.4 billion of assets in private and public real estate property and debt investments as of Q1 2019. LaSalle's diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit http://www.lasalle.com, and LinkedIn.

About Millennium Garages

Millennium Garages is a 3.8 million-square-foot parking facility with approximately 9,176 parking spaces located in four underground parking garages underneath Millennium, Grant and Maggie Daley Parks boarding on Michigan Avenue. As the largest underground parking system in the Unites States, Millennium Garages offer customers in downtown Chicago parking near restaurants, hotels, theaters, universities, offices, retail shops, cultural venues, tourist attractions--plus events, including concerts, sports and seasonal festivals such as the Taste of Chicago. For more information, visit www.MillenniumGarages.com.