BOSTON--(BUSINESS WIRE)--According to Fidelity Investments’® College Savings: Lessons Learned Study, nearly half of current college students (46%) and recent graduates (47%) who have accumulated any debt, or anticipate having any, admit to feeling stressed about the level of student debt -- about $40,000 on average -- and are afraid they’ll never pay it off. (Fact Sheet here). Despite this, the overwhelming majority of students (85%) feel they made the right choice about the school they attended (and parents agree, 92%).

When digging deeper, however, the study reveals recent graduates seem slightly more cynical about their college choices, perhaps because they are now starting to pay off their student loans. Current students, in contrast, appear to be a bit more optimistic and have a slightly more realistic view of what to expect entering freshman year:

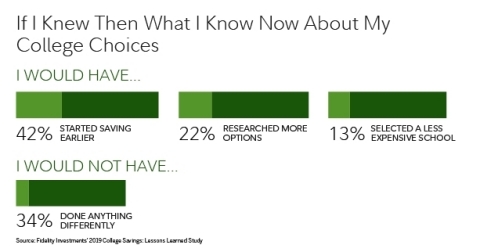

- Recent graduates are more likely to say they would have selected a less expensive school (21%) versus current students (14%), if they knew then what they know now. In addition, only 14% feel the value of their education was worth more than the money they spent, with 40% of all recent grads saying while they don’t regret going to college, they would have made different choices.

- A greater percentage of current students (83%) seem to have given consideration to the total cost of college before matriculating than recent graduates (69%). They’re also more likely to indicate that cost was a huge factor in deciding where to attend and limited their choice to what was most affordable (39% current versus 32% recent graduates).

“The good news is, it seems today’s college students are perhaps more aware of the financial situation they entered into than those who graduated before them. They’re taking positive actions to lessen their stress, and that’s a step in the right direction,” said Melissa Ridolfi, vice president of retirement and college leadership at Fidelity.

Lessons Learned: Save Earlier to Avoid College Debt-Related Stress

What can be done to ease the stress level and student debt burden for future college-bound students? Survey respondents offer interesting insights, but a predominant theme seems to be the positive impact saving early can have on the college burden. In fact, when asked, “If you knew then what you know now when it comes to school selection, what would you do differently?” the No. 1 answer for all respondents: “I would have started saving earlier.”

That said, Fidelity’s College Savings: Lessons Learned findings also suggest there are alternative methods (aside from a traditional savings account) both current students and recent graduates could have considered exploring to maximize their college funding potential, including opening a 529 savings plan, and yet only 17% opened one prior to college.

The silver lining is, among families who are using a 529 plan to save for college at Fidelity, they’re opening accounts and starting to save earlier. “On average, Fidelity sees families starting to contribute to their child’s 529 plan when the child is about the age of six and a half, and contribute over $3,700 annually,” says Ridolfi. In fact, 36% of Fidelity 529s are opened for beneficiaries under the age of two and 52% for those under age five.*

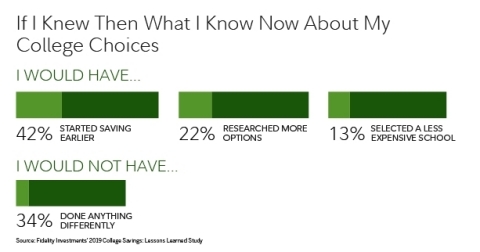

Furthermore, when asked about how they went about closing the college savings gap if they weren’t on target, the top three strategies used by those who anticipated having or had college debt are:

- 41% cut back on other expenses to save more

- 38% got a job or second job

- 29% lived at home and commuted

Less-frequently chosen avenues include taking online courses for credit (17%) and graduating in fewer semesters by taking extra courses (13%).

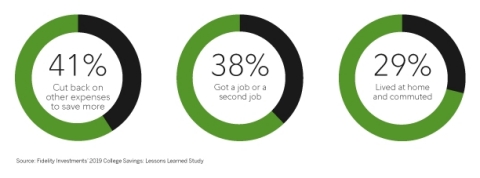

Top Advice: Do the Research

What advice do those who have been through the college experience have for today’s college-bound students? Those who have been there say: Do your research. In fact, the importance of research appears as a top piece of advice in two different ways:

- 47% research more grants and scholarships to help offset costs

- 37% save as early as possible for college

- 34% research and understand financial aid and the implications of taking on student loans

- 34% take on as little debt as possible

Another critical component to college planning is communicating as a family. Surprisingly, although current students appear to be more realistic about the cost of college than recent graduates, the survey suggests that for too many, family conversations about college finances remain a taboo topic:

- Only 1 in 4 respondents stress the importance of getting involved in college financing discussions with parents and family early, well before the time to decide on a school. This number is surprisingly low, given the impact these conversations can have.

“These findings underscore something we’ve seen for years when it comes to college planning—the earlier you start, the less stressed you’ll be. We’ve also seen that bringing kids into the conversation as soon as they’re able to grasp these concepts can help create a better plan with fewer surprises about what the student’s expected contribution will be,” says Ridolfi.

Whether families work with an advisor or create a plan on their own, just having one can help them feel more prepared to manage college costs.

College Savings Resources

Fidelity offers a variety of resources for families looking for more ways to boost college savings:

- Viewpoints articles providing more insights on college topics, including: Are your college savings on track? and Paying for College: How much is too much?

- Fidelity’s Learning Center offers a Student Loan Guide to help families compare the costs of different loan options.

- Fidelity.com/529 provides an overview of the benefits of 529 College Savings Plans and help for those choosing a plan.

- Fidelity’s College Savings Quick Check is an online calculator that can show parents the impact of saving a few extra dollars each month, based on their own timeline or set a college planning goal in Fidelity’s Planning & Guidance Center.

- Fidelity’s College Savings Learning Center provides a library of online resources for parents, including video courses on saving account options and strategies and resources on more ways to pay for college—such as how to apply for financial aid and scholarships.

- Through Fidelity’s new College Cost Prep tool, one can view financial snapshots of thousands of schools, including estimated costs, grants, and scholarships. It also helps to compare school choices and discover additional school options that may meet a child’s needs, without taking on more debt than a family can afford.

- Fidelity’s student loan tool can help manage student debt, including lifetime costs, interest paid and age of payoff.

- Fidelity’s new online college planning experience provides resources for parents with children of any age to help get their kids to and through college – from saving for and choosing the right school, to managing school debt and starting life after graduation.

About Fidelity Investments’ 2019 College Savings: Lessons Learned Study

This study presents the findings of an online survey, consisting of 4,002 respondents ages 17 or older who are a recent graduate, current undergraduate, parent of a recent graduate, or parent of an undergrad. Fielding for this survey was completed between July 3, 2019 and July 17, 2019 by Engine Insights, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $7.8 trillion, including managed assets of $2.8 trillion as of July 31, 2019, we focus on meeting the unique needs of a diverse set of customers: helping more than 30 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 02110

The UNIQUE College Investing Plan, U.Fund College Investing Plan, Delaware College Investment Plan, and Fidelity Arizona College Savings Plan are offered by the state of New Hampshire, MEFA, the state of Delaware, and the Arizona Commission for Postsecondary Education, respectively, and managed by Fidelity Investments. If you or the designated beneficiary is not a New Hampshire, Massachusetts, Delaware, or Arizona resident, you may want to consider, before investing, whether your state or the beneficiary's home state offers its residents a plan with alternate state tax advantages or other state benefits such as financial aid, scholarship funds and protection from creditors.

Units of the portfolios are municipal securities and may be subject to market volatility and fluctuation. Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online. Read it carefully before you invest or send money.

895441.1.0

© 2019 FMR LLC. All rights reserved.

___________________________

* Fidelity Investments 529 data from all managed plans between 1/1/2018 to 6/30/2019