NEW YORK--(BUSINESS WIRE)--Spotify Technology S.A. (NYSE:SPOT) today reported financial results for the second fiscal quarter of 2019 ending June 30, 2019.

Dear Shareholders,

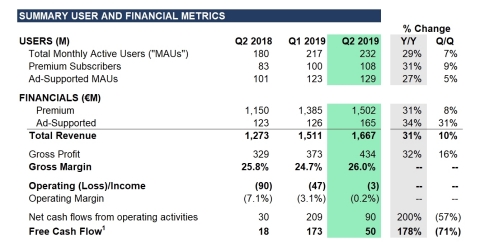

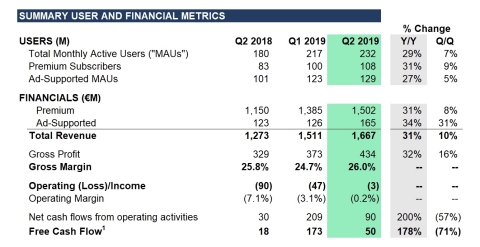

On balance, the business outperformed our expectations in 2Q19, with Gross Margin up slightly Y/Y, despite our investments in podcasting, and with revenue growing more than 2.5x faster than the growth in operating expenses (ex. Direct Listing fees in Q2’18), Operating Margin was near breakeven for Q2.

MONTHLY ACTIVE USERS (“MAUs”)

Total MAUs grew 29% Y/Y to 232 million, outperforming the high end of our 222-228 million MAU guidance range.

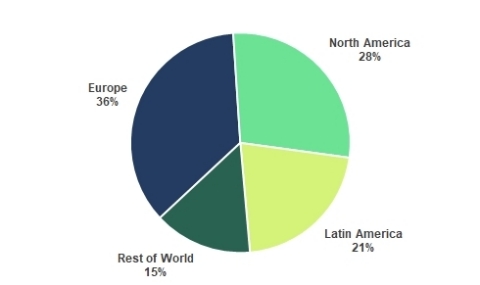

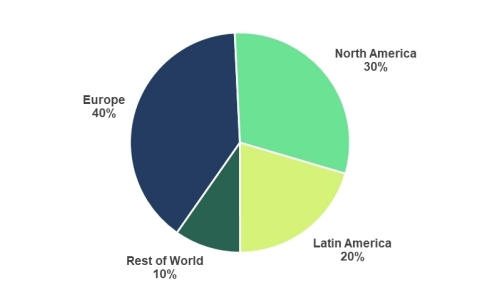

Outperformance was broad based, with most of our geographic regions growing faster than our expectations. Timing of certain global music releases yielded some incremental benefit, as did our launch on PlayStation consoles across the Middle East and Latin America. Of note, two markets that have been long tied to physical music distribution, Germany and Japan, both hit milestones during Q2, performing materially better than forecast. Additionally, our newest market India performed well and in line with expectations. However, the most significant source of upside has been improvement in long-term retention due to our continued product innovation, particularly evident in our emerging geographies.

As a company, our goal is to continually innovate by testing and learning from new product launches. During Q2, we launched a number of new product initiatives across our major regions. Of note, we rolled out Spotify Lite more widely, and this offering is now available in 36 markets. We also expanded our beta test of Spotify Stations (our genre based, radio-like, lean-back experience) to the US in late May/early June. While these are two of the more recent high profile tests, we are constantly adding and expanding upon our offerings in select markets. Some of these may become global products and some may never leave beta. We believe that launching and innovating rapidly has led to a better overall user experience, and will continue to improve retention and consumer satisfaction. Some initiatives may work, some may not, but we believe the learnings from quick innovation will inform our future product road map. Speed of iteration will trump quality of iteration.

PREMIUM SUBSCRIBERS

We finished Q2 with 108 million Premium Subscribers globally, up 31% Y/Y but below the midpoint of our guidance range of 107-110 million. Intake from our bi-annual campaign was in line with our expectations, monthly churn declined both sequentially and Y/Y to a record low 4.6%, and our winback percentage on gross ads reaccelerated Q/Q. However, intake into our Student product was below plan. As we have discussed previously, our goal is to perform at roughly the 70th percentile of our guidance range and we missed on subs. That’s on us. The good news is that the shortfall was execution related, rather than softness in the business, and we expect to make up the lost ground before year-end.

As mentioned above, our mid-year campaign kicked off in mid-May and ran through the end of June offering three months of Spotify Premium for $0.99 or equivalent. Intake was largely in line with our expectations, with notable strength seen across our emerging markets.

FINANCIAL METRICS

Revenue

Total revenue was €1,667 million in Q2, representing growth of 31% Y/Y. Premium revenue was €1,502 million of the total and grew 31% Y/Y, ahead of our expectations. Ad-Supported revenue was €165 million and grew 34% Y/Y, a meaningful acceleration of growth from Q1.

For the Premium business, average revenue per user (“ARPU”) was €4.86 in Q2, down less than 1% Y/Y (down 2% excluding the impact from foreign exchange rates). Downward pressure on ARPU continues to moderate, and we continue to expect that ARPU declines through the remainder of the year will be in the low single digits. As we mentioned last quarter, the declines in ARPU are a result of shifts in both product and geographic mix. Approximately 75% of the impact to ARPU is attributable to product mix changes, and the remainder a function of changes in geographic mix and other factors.

For the Ad-Supported business, Direct revenues outperformed our forecast primarily due to strength in the US. Audio was our fastest growing product for the third consecutive quarter, up 38% Y/Y, and Asia remained our fastest growing region.

Programmatic and Ad Studio revenue growth accelerated to 71% in Q2, and now account for approximately 30% of total Ad-Supported revenue. Programmatic growth in the US exceeded 50%, and our next 5 largest markets in aggregate increased triple digits Y/Y.

We are seeing increased demand for podcast advertising following our recent acquisitions and continued development of owned and exclusive non-music audio content. While still relatively small, we continue to expect fast revenue growth from podcasts through the remainder of 2019 and into 2020. Over time, our ambition is to reinvent the podcasting ad experience by building a new tech stack to enable targeting, measurement, and reporting capabilities like we have for our core Ad-Supported offering.

Gross Margin

Gross Margin was 26.0% in Q2, 50 bps above the high end of our guidance range of 23.5-25.5%. The performance was largely driven by better than expected streaming delivery costs as a result of efficiencies driven by usage optimization work, slower than anticipated release of original podcast content, and better than expected royalty margin resulting from slight differences in product and geographic mix.

Premium Gross Margin was 27.2% in Q2, up from 25.9% in Q1 and up 30 bps Y/Y. Ad-Supported Gross Margin was 15.8% in Q2, up seasonally from 11.3% in Q1 but down 50 bps Y/Y.

Operating Expenses / Income (Loss)

Operating expenses of €437 million in Q2 increased 4% Y/Y (12% Y/Y excluding the costs associated with our Direct Listing in Q2 2018). Operating Losses totaled €3 million yielding an Operating Margin of (0.2%), an improvement of 690 bps Y/Y (450 bps excluding the costs associated with our Direct Listing in Q2 2018). Our better than expected loss in the quarter was a result of higher Gross Profit and lower than expected spend across artist marketing, R&D, and G&A.

The growth in our share price in Q2 increased operating expenses more than plan because of higher social charges. The increased social expense was approximately 40 basis points higher than forecast due to the increase in our stock price during Q2. As a reminder, social costs are payroll taxes associated with employee salaries and benefits, including stock based compensation. We are subject to social taxes in several countries in which we operate, although Sweden accounts for the bulk of the social costs. We don’t forecast stock price changes in our guidance so upward or downward movements will impact our reported operating expenses.

IFRS 16

Starting January 1, 2019, we adopted the new lease accounting standards dictated by IFRS 16. This required certain leases which were accounted for as operating leases be treated as finance leases going forward. Certain leases were reclassified as assets and liabilities on the balance sheet which yielded increased depreciation and interest expense, offset by a reduction in rental expense. We recognized €10 million of lease liability interest expense in finance costs during the second quarter of 2019.

Free Cash Flow

We generated €90 million in net cash flows from operating activities and €50 million in Free Cash Flow in Q2. Each nearly tripled Y/Y. We maintain positive working capital dynamics, and our goal is to sustain and grow Free Cash Flow, excluding the impact of capital expenditures associated with the build-out of new and existing offices in New York, London, Los Angeles, Stockholm, and Boston, among others. We paid out approximately €40 million associated with our office builds in Q2. Delays of certain projects have pushed certain costs originally anticipated in Q2 into future quarters. We expect to complete these projects over the next four quarters at a cost of roughly €190 million. We expect the level of spend to be relatively consistent with our Q2 cash outflow over the period.

We ended Q2 with €1.6 billion in cash and cash equivalents, restricted cash, and short term investments.

Share Repurchase Program Update

On November 5, 2018, Spotify announced a program to repurchase up to $1.0 billion of its publicly traded shares. During Q2, the Company repurchased 1,372,896 shares at a total cost of $186.9 million and an average cost of $136.14 per share. In total, the Company has repurchased 3,079,576 shares at a total cost of $412.4 million and an average cost of $133.82 per share.

Podcasts

Tens of millions of users are now streaming podcast content on a monthly basis, and more are discovering new forms of audio content each day. Our podcast audience grew more than 50% Q/Q and has nearly doubled since the start of the year. Our Content team continues to find and support engaging material across a wide range of genres and geographies. Q2 saw the launch of a number of original and/or exclusive titles like Jemele Hill is Unbothered and Riggle’s Picks in the US, The Dark Side of… and The Two Princes from the recently acquired Parcast and Gimlet studios, respectively, Adam och Kompani in Sweden, and 3 Shots of Tequila in the UK. In addition to these titles, more than 30,000 new podcasts were delivered through our Spotify for Podcasters platform. We also launched a new product feature called Your Daily Drive to better serve the in-car listening experience that intertwines up to the minute news from partners including NPR, The Wall Street Journal, and The New York Times with music specific to your listening history.

Additionally, we announced a multi-year partnership with President Barack Obama and Michelle Obama’s production Company, Higher Ground, to produce exclusive content for the Spotify platform. The Obamas formed Higher Ground to produce powerful stories to entertain, inform, and inspire, and to lift up new, diverse voices in the entertainment industry. Under the Higher Ground partnership, President and Mrs. Obama will develop, produce, and lend their voices to select podcasts, connecting them to listeners around the world on wide-ranging topics.

Major Label License Renewals

We have reached agreement with two of our four major label partners on the renewal of our global sound recording licenses, and are in active discussions with the other two. This is the sixth round of label negotiations we’ve worked through in our thirteen year history and, while it is typically a long drawn-out process, it has become part of the normal cadence of the business.

Two-Sided Marketplace

We are making good progress on the development of a set of marketplace services and are actively building and testing prototype products with some label partners. We’ll have more to say about these products if and when they commercially launch. We expect the launch to begin in early 2020.

During our Investor Day last year, we mentioned that the number of top tier artists (those representing the vast majority of streams) grew almost 30% in two years, from 16,000 artists to 22,000 at the time of the presentation. Today, that cohort has grown another 36% to more than 30,000. This figure signifies accelerating growth in discovery and is a leading indicator of success in our mission to enable more than 1 million artists to live off their work. We now have more than 400,000 creators and their teams using Spotify for Artists, one of our marketplace tools. This is up 33% YTD.

Q3 AND Q4 2019 OUTLOOK

These forward-looking statements reflect Spotify’s expectations as of July 31, 2019 and are subject to substantial uncertainty.

Q3 2019 Guidance:

- Total MAUs: 240-245 million

- Total Premium Subscribers: 110-114 million

- Total Revenue: €1.57-€1.77 billion

- Gross Margin: 23.2-25.2%

- Operating Profit/Loss: €2-€(78) million

Q4 2019 Guidance:

- Total MAUs: 250-265 million

- Total Premium Subscribers: 120-125 million

- Total Revenue: €1.74-€1.94 billion

- Gross Margin: 23.7-25.7%

- Operating Profit/Loss: €(31)-€(131) million

Our quarterly guidance continues to include an estimate of the impact of social charges on our financial statements. This expense can vary materially from quarter to quarter based on fluctuations in the price of Spotify stock, which impacts our accruals for future expenses. Our forecast guidance ranges incorporate our best estimate of the impact of social charges on our income statement; however, material changes in the value of Spotify’s stock price could have an outsized impact on our reported profit or loss for the quarter and/or the year.

EARNINGS QUESTION & ANSWER SESSION

The Company will host a live question and answer session starting at 8 a.m. ET today on investors.spotify.com. Daniel Ek, our Founder and CEO, and Barry McCarthy, our Chief Financial Officer, will be on hand to answer questions submitted to ir@spotify.com and via the live chat window available through the webcast. Participants also may join using the listen-only conference line:

Participant Toll Free Dial-In Number: (866) 393-4306

Participant International Dial-In Number: (734) 385-2616

Conference ID: 9375306

Use of Non-IFRS Measures

This shareholder letter includes references to the non-IFRS financial measures of EBITDA and Free Cash Flow. Management believes that EBITDA and Free Cash Flow are important metrics because they present measures that approximate the amount of cash generated that is available to repay debt obligations, make investments, and for certain other activities that excludes certain infrequently occurring and/or non-cash items. However, these measures should be considered in addition to, not as a substitute for or superior to, net income, operating income, or other financial measures prepared in accordance with IFRS. This shareholder letter also includes references to the non-IFRS financial measures of Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect. Management believes that Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect are important metrics because they present measures that facilitate comparison to our historical performance. Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect should be considered in addition to, not as a substitute for or superior to, Revenue, Premium revenue, Ad-Supported revenue or other financial measures prepared in accordance with IFRS.

Forward Looking Statements

This shareholder letter contains estimates and forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” and similar words are intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties and are made in light of information currently available to us. Many important factors may adversely affect our results as indicated in forward-looking statements. These factors include, but are not limited to: our ability to attract prospective users and to retain existing users; our dependence upon third-party licenses for sound recordings and musical compositions; our lack of control over the providers of our content and their effect on our access to music and other content; our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; our ability to comply with the many complex license agreements to which we are a party; our ability to accurately estimate the amounts payable under our license agreements; the limitations on our operating flexibility due to the minimum guarantees required under certain of our license agreements; our ability to obtain accurate and comprehensive information about music compositions in order to obtain necessary licenses or perform obligations under our existing license agreements; potential breaches of our security systems; assertions by third parties of infringement or other violations by us of their intellectual property rights; competition for users and user listening time; our ability to accurately estimate our user metrics and other estimates; risks associated with manipulation of stream counts and user accounts and unauthorized access to our services; changes in legislation or governmental regulations affecting us; ability to hire and retain key personnel; our ability to maintain, protect, and enhance our brand; risks associated with our international expansion, including difficulties obtaining rights to stream music on favorable terms; risks relating to the acquisition, investment, and disposition of companies or technologies; dilution resulting from additional share issuances; tax-related risks; the concentration of voting power among our founders who have and will continue to have substantial control over our business; risks related to our status as a foreign private issuer; international, national or local economic, social or political conditions; and risks associated with accounting estimates, currency fluctuations and foreign exchange controls.

Other sections of this report describe additional risk factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time, and it is not possible for our management to predict all risk factors and uncertainties, nor are we able to assess the impact of all of these risk factors on our business or the extent to which any risk factor, or combination of risk factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements. You should read this report and the documents that we have filed as exhibits to this report completely and with the understanding that our actual future results may be materially different and worse from what we expect.

Interim condensed consolidated statement of operations

(Unaudited)

(in € millions, except share and per share data)

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||||||

|

|

June 30,

|

|

|

March 31,

|

|

|

June 30,

|

|

|

June 30,

|

|

|

June 30,

|

|

|||||

Revenue |

|

|

1,667 |

|

|

|

1,511 |

|

|

|

1,273 |

|

|

|

3,178 |

|

|

|

2,412 |

|

Cost of revenue |

|

|

1,233 |

|

|

|

1,138 |

|

|

|

944 |

|

|

|

2,371 |

|

|

|

1,800 |

|

Gross profit |

|

|

434 |

|

|

|

373 |

|

|

|

329 |

|

|

|

807 |

|

|

|

612 |

|

Research and development |

|

|

151 |

|

|

|

155 |

|

|

|

143 |

|

|

|

306 |

|

|

|

258 |

|

Sales and marketing |

|

|

200 |

|

|

|

172 |

|

|

|

173 |

|

|

|

372 |

|

|

|

311 |

|

General and administrative |

|

|

86 |

|

|

|

93 |

|

|

|

103 |

|

|

|

179 |

|

|

|

174 |

|

|

|

|

437 |

|

|

|

420 |

|

|

|

419 |

|

|

|

857 |

|

|

|

743 |

|

Operating loss |

|

|

(3 |

) |

|

|

(47 |

) |

|

|

(90 |

) |

|

|

(50 |

) |

|

|

(131 |

) |

Finance income |

|

|

8 |

|

|

|

34 |

|

|

|

41 |

|

|

|

42 |

|

|

|

56 |

|

Finance costs |

|

|

(64 |

) |

|

|

(156 |

) |

|

|

(343 |

) |

|

|

(220 |

) |

|

|

(497 |

) |

Finance income/(costs) - net |

|

|

(56 |

) |

|

|

(122 |

) |

|

|

(302 |

) |

|

|

(178 |

) |

|

|

(441 |

) |

Loss before tax |

|

|

(59 |

) |

|

|

(169 |

) |

|

|

(392 |

) |

|

|

(228 |

) |

|

|

(572 |

) |

Income tax expense/(benefit) |

|

|

17 |

|

|

|

(27 |

) |

|

|

2 |

|

|

|

(10 |

) |

|

|

(9 |

) |

Net loss attributable to owners of the parent |

|

|

(76 |

) |

|

|

(142 |

) |

|

|

(394 |

) |

|

|

(218 |

) |

|

|

(563 |

) |

Loss per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

(0.42 |

) |

|

|

(0.79 |

) |

|

|

(2.20 |

) |

|

|

(1.21 |

) |

|

|

(3.25 |

) |

Weighted-average ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

180,409,115 |

|

|

|

180,613,539 |

|

|

|

179,077,124 |

|

|

|

180,510,763 |

|

|

|

173,459,249 |

|

Condensed consolidated statement of financial position

(Unaudited)

(in € millions)

|

|

June 30,

|

|

|

December 31,

|

|

||

Assets |

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

Lease right-of-use assets |

|

|

398 |

|

|

|

— |

|

Property and equipment |

|

|

243 |

|

|

|

197 |

|

Goodwill |

|

|

464 |

|

|

|

146 |

|

Intangible assets |

|

|

55 |

|

|

|

28 |

|

Long term investments |

|

|

1,883 |

|

|

|

1,646 |

|

Restricted cash and other non-current assets |

|

|

68 |

|

|

|

65 |

|

Deferred tax assets |

|

|

10 |

|

|

|

8 |

|

|

|

|

3,121 |

|

|

|

2,090 |

|

Current assets |

|

|

|

|

|

|

|

|

Trade and other receivables |

|

|

429 |

|

|

|

400 |

|

Income tax receivable |

|

|

2 |

|

|

|

2 |

|

Short term investments |

|

|

586 |

|

|

|

915 |

|

Cash and cash equivalents |

|

|

909 |

|

|

|

891 |

|

Other current assets |

|

|

66 |

|

|

|

38 |

|

|

|

|

1,992 |

|

|

|

2,246 |

|

Total assets |

|

|

5,113 |

|

|

|

4,336 |

|

Equity and liabilities |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Share capital |

|

|

— |

|

|

|

— |

|

Other paid in capital |

|

|

3,854 |

|

|

|

3,801 |

|

Treasury shares |

|

|

(365 |

) |

|

|

(77 |

) |

Other reserves |

|

|

1,197 |

|

|

|

875 |

|

Accumulated deficit |

|

|

(2,741 |

) |

|

|

(2,505 |

) |

Equity attributable to owners of the parent |

|

|

1,945 |

|

|

|

2,094 |

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Lease liabilities |

|

|

517 |

|

|

|

— |

|

Accrued expenses and other liabilities |

|

|

11 |

|

|

|

85 |

|

Provisions |

|

|

5 |

|

|

|

8 |

|

Deferred tax liabilities |

|

|

2 |

|

|

|

2 |

|

|

|

|

535 |

|

|

|

95 |

|

Current liabilities |

|

|

|

|

|

|

|

|

Trade and other payables |

|

|

440 |

|

|

|

427 |

|

Income tax payable |

|

|

4 |

|

|

|

5 |

|

Deferred revenue |

|

|

290 |

|

|

|

258 |

|

Accrued expenses and other liabilities |

|

|

1,327 |

|

|

|

1,076 |

|

Provisions |

|

|

53 |

|

|

|

42 |

|

Derivative liabilities |

|

|

519 |

|

|

|

339 |

|

|

|

|

2,633 |

|

|

|

2,147 |

|

Total liabilities |

|

|

3,168 |

|

|

|

2,242 |

|

Total equity and liabilities |

|

|

5,113 |

|

|

|

4,336 |

|

Interim condensed consolidated statement of cash flows

(Unaudited)

(in € millions)

|

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||||||

|

|

|

June 30,

|

|

|

March 31,

|

|

|

June 30,

|

|

|

June 30,

|

|

|

June 30,

|

|

|||||

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

|

(76 |

) |

|

|

(142 |

) |

|

|

(394 |

) |

|

|

(218 |

) |

|

|

(563 |

) |

Adjustments to reconcile net loss to net cash flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

|

17 |

|

|

|

17 |

|

|

|

4 |

|

|

|

34 |

|

|

|

13 |

|

Amortization of intangible assets |

|

|

|

3 |

|

|

|

4 |

|

|

|

2 |

|

|

|

7 |

|

|

|

4 |

|

Share-based payments expense |

|

|

|

37 |

|

|

|

26 |

|

|

|

23 |

|

|

|

63 |

|

|

|

41 |

|

Finance income |

|

|

|

(8 |

) |

|

|

(34 |

) |

|

|

(41 |

) |

|

|

(42 |

) |

|

|

(56 |

) |

Finance costs |

|

|

|

64 |

|

|

|

156 |

|

|

|

343 |

|

|

|

220 |

|

|

|

497 |

|

Income tax expense/(benefit) |

|

|

|

17 |

|

|

|

(27 |

) |

|

|

2 |

|

|

|

(10 |

) |

|

|

(9 |

) |

Other |

|

|

|

(10 |

) |

|

|

8 |

|

|

|

(3 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Increase)/decrease in trade receivables and other assets |

|

|

|

(50 |

) |

|

|

35 |

|

|

|

12 |

|

|

|

(15 |

) |

|

|

27 |

|

Increase in trade and other liabilities |

|

|

|

75 |

|

|

|

155 |

|

|

|

78 |

|

|

|

230 |

|

|

|

148 |

|

Increase in deferred revenue |

|

|

|

19 |

|

|

|

13 |

|

|

|

7 |

|

|

|

32 |

|

|

|

16 |

|

Increase/(decrease) in provisions |

|

|

|

8 |

|

|

|

— |

|

|

|

(4 |

) |

|

|

8 |

|

|

|

(7 |

) |

Interest paid on lease liabilities |

|

|

|

(9 |

) |

|

|

(4 |

) |

|

|

— |

|

|

|

(13 |

) |

|

|

— |

|

Interest received |

|

|

|

4 |

|

|

|

4 |

|

|

|

2 |

|

|

|

8 |

|

|

|

12 |

|

Income tax paid |

|

|

|

(1 |

) |

|

|

(2 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

Net cash flows from operating activities |

|

|

|

90 |

|

|

|

209 |

|

|

|

30 |

|

|

|

299 |

|

|

|

114 |

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business combinations, net of cash acquired |

|

|

|

(36 |

) |

|

|

(288 |

) |

|

|

(9 |

) |

|

|

(324 |

) |

|

|

(9 |

) |

Purchases of property and equipment |

|

|

|

(40 |

) |

|

|

(37 |

) |

|

|

(5 |

) |

|

|

(77 |

) |

|

|

(11 |

) |

Purchases of short term investments |

|

|

|

(298 |

) |

|

|

(104 |

) |

|

|

(444 |

) |

|

|

(402 |

) |

|

|

(715 |

) |

Sales and maturities of short term investments |

|

|

|

370 |

|

|

|

383 |

|

|

|

451 |

|

|

|

753 |

|

|

|

881 |

|

Change in restricted cash |

|

|

|

— |

|

|

|

1 |

|

|

|

(7 |

) |

|

|

1 |

|

|

|

(11 |

) |

Other |

|

|

|

(3 |

) |

|

|

(4 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

|

|

(13 |

) |

Net cash flows (used in)/from investing activities |

|

|

|

(7 |

) |

|

|

(49 |

) |

|

|

(17 |

) |

|

|

(56 |

) |

|

|

122 |

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments of lease liabilities |

|

|

|

(4 |

) |

|

|

(5 |

) |

|

|

— |

|

|

|

(9 |

) |

|

|

— |

|

Repurchases of ordinary shares |

|

|

|

(157 |

) |

|

|

(126 |

) |

|

|

— |

|

|

|

(283 |

) |

|

|

— |

|

Proceeds from exercise of share options |

|

|

|

20 |

|

|

|

33 |

|

|

|

57 |

|

|

|

53 |

|

|

|

96 |

|

Other |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

2 |

|

Net cash flow (used in)/from financing activities |

|

|

|

(141 |

) |

|

|

(98 |

) |

|

|

55 |

|

|

|

(239 |

) |

|

|

98 |

|

Net (decrease)/increase in cash and cash equivalents |

|

|

|

(58 |

) |

|

|

62 |

|

|

|

68 |

|

|

|

4 |

|

|

|

334 |

|

Cash and cash equivalents at beginning of the period |

|

|

|

966 |

|

|

|

891 |

|

|

|

733 |

|

|

|

891 |

|

|

|

477 |

|

Net exchange gains/(losses) on cash and cash equivalents |

|

|

|

1 |

|

|

|

13 |

|

|

|

9 |

|

|

|

14 |

|

|

|

(1 |

) |

Cash and cash equivalents at period end |

|

|

|

909 |

|

|

|

966 |

|

|

|

810 |

|

|

|

909 |

|

|

|

810 |

|

Reconciliation of IFRS to Non-IFRS Results

(Unaudited)

(in € millions, except percentages)

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||

|

|

June 30, 2019 |

|

|

June 30, 2018 |

|

|

June 30, 2019 |

|

|

June 30, 2018 |

|

||||

IFRS revenue |

|

|

1,667 |

|

|

|

1,273 |

|

|

|

3,178 |

|

|

|

2,412 |

|

Foreign exchange effect on 2019 revenue using 2018 rates |

|

|

(33 |

) |

|

|

|

|

|

|

(66 |

) |

|

|

|

|

Revenue excluding foreign exchange effect |

|

|

1,634 |

|

|

|

|

|

|

|

3,112 |

|

|

|

|

|

IFRS revenue year-over-year change % |

|

|

31 |

% |

|

|

|

|

|

|

32 |

% |

|

|

|

|

Revenue excluding foreign exchange effect year-over-year change % |

|

|

28 |

% |

|

|

|

|

|

|

29 |

% |

|

|

|

|

IFRS Premium revenue |

|

|

1,502 |

|

|

|

1,150 |

|

|

|

2,887 |

|

|

|

2,187 |

|

Foreign exchange effect on 2019 Premium revenue using 2018 rates |

|

|

(25 |

) |

|

|

|

|

|

|

(51 |

) |

|

|

|

|

Premium revenue excluding foreign exchange effect |

|

|

1,477 |

|

|

|

|

|

|

|

2,836 |

|

|

|

|

|

IFRS Premium revenue year-over-year change % |

|

|

31 |

% |

|

|

|

|

|

|

32 |

% |

|

|

|

|

Premium revenue excluding foreign exchange effect year-over-year change % |

|

|

28 |

% |

|

|

|

|

|

|

30 |

% |

|

|

|

|

IFRS Ad-Supported revenue |

|

|

165 |

|

|

|

123 |

|

|

|

291 |

|

|

|

225 |

|

Foreign exchange effect on 2019 Ad-Supported revenue using 2018 rates |

|

|

(8 |

) |

|

|

|

|

|

|

(15 |

) |

|

|

|

|

Ad-Supported revenue excluding foreign exchange effect |

|

|

157 |

|

|

|

|

|

|

|

276 |

|

|

|

|

|

IFRS Ad-Supported revenue year-over-year change % |

|

|

34 |

% |

|

|

|

|

|

|

29 |

% |

|

|

|

|

Ad-Supported revenue excluding foreign exchange effect year-over-year change % |

|

|

28 |

% |

|

|

|

|

|

|

23 |

% |

|

|

|

|

EBITDA

(Unaudited)

(in € millions)

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||||||

|

|

June 30, 2019 |

|

|

March 31, 2019 |

|

|

June 30, 2018 |

|

|

June 30, 2019 |

|

|

June 30, 2018 |

|

|||||

Net loss attributable to owners of the parent |

|

|

(76 |

) |

|

|

(142 |

) |

|

|

(394 |

) |

|

|

(218 |

) |

|

|

(563 |

) |

Finance income/(costs) - net |

|

|

56 |

|

|

|

122 |

|

|

|

302 |

|

|

|

178 |

|

|

|

441 |

|

Income tax expense/(benefit) |

|

|

17 |

|

|

|

(27 |

) |

|

|

2 |

|

|

|

(10 |

) |

|

|

(9 |

) |

Depreciation and amortization |

|

|

20 |

|

|

|

21 |

|

|

|

6 |

|

|

|

41 |

|

|

|

17 |

|

EBITDA |

|

|

17 |

|

|

|

(26 |

) |

|

|

(84 |

) |

|

|

(9 |

) |

|

|

(114 |

) |

Free Cash Flow

(Unaudited)

(in € millions)

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||||||

|

|

June 30, 2019 |

|

|

March 31, 2019 |

|

|

June 30, 2018 |

|

|

June 30, 2019 |

|

|

June 30, 2018 |

|

|||||

Net cash flows from operating activities |

|

|

90 |

|

|

|

209 |

|

|

|

30 |

|

|

|

299 |

|

|

|

114 |

|

Capital expenditures |

|

|

(40 |

) |

|

|

(37 |

) |

|

|

(5 |

) |

|

|

(77 |

) |

|

|

(11 |

) |

Change in restricted cash |

|

|

— |

|

|

|

1 |

|

|

|

(7 |

) |

|

|

1 |

|

|

|

(11 |

) |

Free Cash Flow |

|

|

50 |

|

|

|

173 |

|

|

|

18 |

|

|

|

223 |

|

|

|

92 |

|

1Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS Measures” and “Reconciliation of IFRS to Non-IFRS Results” for additional information.