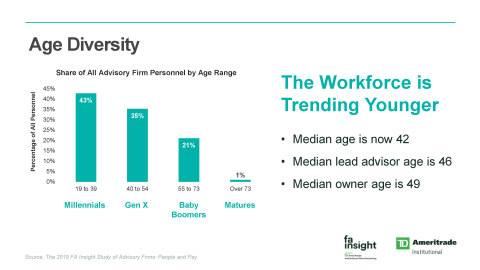

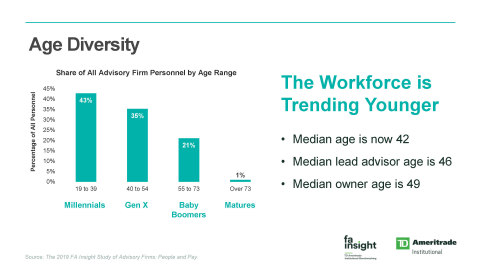

JERSEY CITY, N.J.--(BUSINESS WIRE)--New FA Insight benchmarking research from TD Ameritrade Institutional1 finds the leadership of registered investment advisor firms (RIAs) is getting younger – passing the torch from the Baby Boomer to Gen X – and investing to sustain their firms’ strong performance well into the future.

The report found that the advisory community as a whole is getting younger, reversing a graying trend that had many advisors worried about the sustainability of the industry. With a median age of 49 years – three years younger than in 2015 -- six out of 10 firms have at least one owner who expects to stay at the helm for at least another 12 years, according to The 2019 FA Insight Study of Advisory Firms: People and Pay.

The median age of firm associates, overall, dropped to 42 from 44 in 2015, while the median age of lead advisors is now 46 years, down from 50. The study also found that the number of owners who are 40 years of age or younger equals the number of firm owners who are over 60.

“As the next generation of RIA leaders comes to the forefront, they’re investing in their firms with a long time horizon,” said Vanessa Oligino, Director of Business Performance Solutions at TD Ameritrade Institutional. “We expect to see different approaches to industry challenges – whether they be staffing and compensation, growth and organizational design, or technology and innovation.”

Firm owners remain characteristically confident about continuing growth in 2019. They’re investing in senior-level experience, with lead advisor compensation up by 12 percent over the last two years, in an effort to secure seasoned talent that can help supercharge growth and navigate tomorrow’s challenges.

The report found that, although 2018 ended with the major stock indexes posting their worst yearly performances since the 2008 global financial crisis,2 choppy markets did not quell firm owners’ optimism, even as growth in assets under management (AUM) slowed.

The median revenue growth rate for firms was 14 percent in 2018, up slightly from 2017, while the median client growth rate of 7.4 percent was little changed. The rate of growth for AUM dropped to 5.9 percent.

Today’s Advisory Firms: Growing and Profitable

Firms continued on their growth trajectory in 2018, thanks to efficient operations management and the increase in productivity from associates in revenue-generating roles.

At 21 percent, a typical firm’s operating profit margin last year rose by more than a percentage point from 2017, and overhead expenses as a share of revenue fell slightly in 2018. This translated to rising income for firm owners, whose median total income rose 3.6 percent in 2018 to $633,000, the highest since 2014, or 55 cents for every dollar or firm revenue.

Despite market declines at the end of 2018, firm financial performance was also strong compared to the average of the previous five years. The rate of revenue growth increased to 14 percent, versus 12 percent, while operating profit margin increased from 20 percent to 21 percent. Revenues generated by revenue-generating roles were up 14 percent to $547,000 in 2018, while annual revenues per full-time equivalent (FTE) were up 13 percent over a two-year period.

Wanted: Seasoned Help

Advisory firms anticipate doubling their hiring rate in 2019 compared to 2018, with 61 percent making at least one hire last year. The largest firms plan to increase headcount by 10 to 12 percent, bringing on board seven FTEs.

Senior revenue generators and advisory firm staff, who have a proven ability to navigate market volatility and ease client concerns, have seen compensation rise over the last two years, whereas compensation for less experienced revenue generators has fallen. The compensation of associate advisors, who are now generally younger and have less experience than in prior years, has gone down by 8.5 percent and operations manager compensation rose during this period by 8 percent during this period.

The quest for experience may also help explain why firms continue to recruit lateral hires from inside the industry. RIAs tend to hire predominately from other independent RIAs for revenue roles, though they may also consider recruiting from other financial services firms and wirehouses.

Only 4 percent of firms are hiring recent college graduates for revenue-generating roles. A slightly higher amount, 6 percent, are hiring professionals from outside of the financial services industry.

People costs represent 77 percent of a typical firms expenses and 59 percent of total revenues. For every dollar spent on cash compensation, firms spend an additional 14 cents, on average, on retirement programs, medical benefits, training and payroll taxes.

“Independent advisory firms are laser-focused on growth and profitability, keeping expenses in line, while generating healthy returns across market cycles,” said Oligino. “Entrepreneurial and optimistic, successful owners are making investments they believe will benefit their firm in the long-run.”

Click here to read the executive summary of The 2019 FA Insight Study of Advisory Firms: People and Pay.

Methodology

The 2019 FA Insight Study of Advisory Firms: People and Pay is based on responses to an online survey that was fielded between February 5 and March 29, 2019. This year, 405 qualifying firms completed submissions. To qualify for participation, firm must have a minimum of $100,000 in annual revenues and be in business for at least 12 months. All survey responses were screened for data accuracy using automated and manual review methods. When discrepancies were found, follow ups were conducted with firms to clarify their information.

Survey questions focused on advisory firm human capital practices, as well as basic financial performance and operating characteristics. Information specific to individual firms participating in this study is strictly confidential. All data presented in the report are the aggregate of participating firms.

FA Insight is a product of TD Ameritrade Institutional, Division of TD Ameritrade Inc. FA Insight is a trademark owned by TD Ameritrade IP Company, Inc.

About TD Ameritrade Institutional

TD Ameritrade Institutional empowers more than 7,000 independent registered investment advisors to transform the lives of their clients. It provides powerful technology and resources that help simplify running a business and let advisors spend more time doing what matters most — serving their clients. Through meaningful innovation, steadfast advocacy and unwavering service, TD Ameritrade Institutional supports RIAs as they build businesses that positively impact their clients and communities. TD Ameritrade Institutional is a division of TD Ameritrade, Inc., member FINRA/SIPC, a brokerage subsidiary of TD Ameritrade Holding Corp.

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to more than 11 million client accounts totaling approximately $1.3 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing an average of approximately 800,000 trades per day for our clients, more than a quarter of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org).

1 TD Ameritrade Institutional is a division of TD Ameritrade, Inc., a brokerage subsidiary of TD Ameritrade Holding Corporation

2 US stocks post worst year in a decade as the S&P 500 falls more than 6% in 2018, CNBC.com, December 31, 2018.

Source: TD Ameritrade Holding Corporation