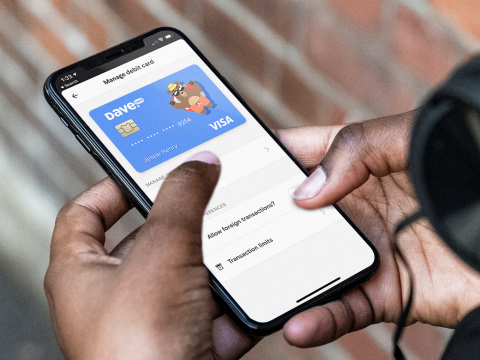

LOS ANGELES--(BUSINESS WIRE)--Today Dave, the finance version of David and Goliath, is again taking on the big banks by launching its own unique banking product. Dave Banking is the first account to automatically build credit by reporting everyday payments like rent and utility bills to the credit agencies. The account also provides a $100 no interest overdraft advance to cover budget gaps, which is available regardless of a user’s current credit score.

“Banks have failed their customers by building products that put their own interests ahead of the humans who use them. People don’t need predatory fees, they need tools that actually solve their challenges around credit building, finding work and getting access to their own money to cover immediate expenses. Dave is the banking product that works with its customers, not against them,” said Jason Wilk, Co-Founder and CEO of Dave.

The account, which has the tagline, “Banking For Humans™,” is launching this week to 500 thousand waitlist signups from current Dave users. It provides helpful, first-of-its-kind features including:

- $100 no interest overdraft alternative - With Dave Banking, users can advance $100 with no interest to cover immediate expenses and gaps in their budgets.

- Free credit-building - Dave Banking is the first checking account to report regular rent payments to the credit agencies to help automatically build users’ credit. Payments reporting for utilities like water, gas, electric, and mobile phone plans will also soon be available. This process is supported via an exclusive partnership with CreditPop, a service that costs more than $100 per year. Users who deposit their paycheck into their Dave Banking account receive this as a free benefit.

- Automatic direct deposit switching - Dave partners with 60,000 employers to automatically route direct deposits into their Dave Banking account.

- Side Hustle - Banking users will have access to 20 different types of part time jobs in their area through partnerships with gig economy and sharing economy companies.

- Expense forecasting - With Dave Banking, users can access Dave’s AI expense forecasting tool, predicting their account balance before their next payday and sending helpful texts and alerts when they’re in danger of dropping below $0.

Dave Banking accounts will be opened with Dave’s partner bank, Evolve Bank & Trust, which is FDIC insured. The account charges no monthly fees, no overdraft fees and lets people start an account for free using a debit card.

In addition to the launch of Dave Banking, Dave is announcing today a $110 million debt raise led by Victory Park Capital to scale the company as it grows from a leading personal finance app into a challenger bank in the US.

About Dave: Banking For Humans

Dave is the finance version of David and Goliath taking on the big banks. A financial friend to the millions of Americans who use the app, Dave helps with budgeting, building credit, finding work and accessing money to cover immediate expenses before payday. Instead of mandatory fees, Dave lets users pay what they think is fair through a ‘tip’ based model. Dave users plant a tree for each % tip they leave when taking an advance, resulting in tens of millions of trees planted. To learn more, visit https://www.dave.com/. Download the app in the App Store or Google Play.