NEW YORK--(BUSINESS WIRE)--iShares today announces the launch of a megatrend investing framework, including a new suite of exchange traded funds (ETFs) designed to capture the structural shifts influencing the future of the global economy and society.

BlackRock’s research, portfolio management, and Investment Institute teams – informed by work with corporations, thought leaders and global organizations – have identified five megatrends. These forces provide a new investment framework that goes beyond traditional sector, market cap and geographic classifications.

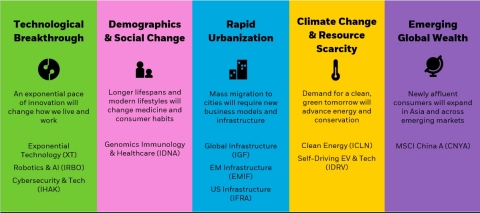

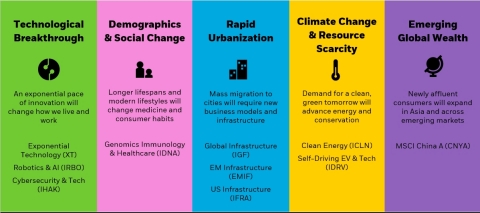

- Technological Breakthrough: Technology is driving exponential progress in the tech sector and far beyond

- Emerging Global Wealth: A newly affluent class of consumers will expand in Asia and across emerging markets

- Climate Change and Resource Scarcity: Demand for a clean, green tomorrow will advance energy and conservation

- Demographics and Social Change: Longer lifespans and modern lifestyles will change medicine and consumer habits

- Rapid Urbanization: Mass migration to cities will require new business models and infrastructure

iShares megatrend ETFs are unconstrained index equity ETFs that seek to track indexes developed by leading industry index providers. The global indexes target stocks with high return potential across relevant industry value chains. For example, investment opportunities for autonomous vehicles would include not just car-makers but also hardware companies making road sensors and navigation cameras, and battery manufacturers.

Armando Senra, Head of U.S., Canada and Latin America iShares, says: “The iShares megatrend ETF suite seeks to capture the most powerful investment trends driving the global economy today, and that we expect to play out for decades to come. The ability for anyone to access these targeted growth opportunities through an ETF represents the next frontier of efficiency, transparency and the democratization of investing.”

A powerful ETF technology for powerful forces

Today, iShares is also launching two new products – the iShares Cybersecurity and Tech ETF (IHAK) and iShares Genomics Immunology and Healthcare ETF (IDNA). IHAK provides investors access to companies around the world that are helping fight the rise in cyber crime by using cybersecurity solutions across hardware and software. The other, IDNA, seeks exposure to companies worldwide at the forefront of medical revolutions in the rapidly expanding fields of molecular biology and mapping of genomes, and immunology.

Chad Slawner, Head of U.S. iShares Product and Strategy, says: “This framework is the culmination of years spent analyzing and observing broad structural changes shaping the world around us. We took the best thinking from across our firm, including active investment teams, to create our megatrends. Our mission is to provide efficient ways to access these forces to improve long-term outcomes for clients.”

A long-term proposition

Megatrends ETFs can serve a number of roles in a portfolio, including as alternatives for, or alongside, investment approaches that seek above-benchmark performance over time. As the identified megatrends are pervasive across industries and tend to be forward-looking, they naturally resonate with investors and advisors seeking to capture future alpha.

“For most people, trends like urbanization and technological breakthroughs are intuitive growth stories with real impact on their own lives,” says Armando Senra. “That’s the essence of megatrends ETFs, providing investors with the shortest path possible to innovation that is shaping the future.”

About BlackRock

BlackRock helps investors build better financial futures. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. As of March 31, 2019, the firm managed approximately $6.52 trillion in assets on behalf of investors worldwide. For additional information on BlackRock, please visit www.blackrock.com | Twitter: @blackrock | Blog: www.blackrockblog.com | LinkedIn: www.linkedin.com/company/blackrock.

About iShares

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of 800+ exchange traded funds (ETFs) and $1.9 trillion in assets under management as of March 31, 2019, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock, trusted to manage more money than any other investment firm1.

1 Based on $6.52 trillion in AUM as of 3/31/19

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes than the general securities market.

Technology companies may be subject to severe competition and product obsolescence.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

©2019 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owners.