NEW YORK--(BUSINESS WIRE)--A new study by Merrill conducted in partnership with Age Wave finds that financial independence defines adulthood today (75 percent) – more so than the traditional milestones of employment (61 percent), homeownership (30 percent) or starting a family (20 percent). However, due to mounting debt, higher costs of living and other hurdles, 80 percent of early adults (ages 18-34) say it is harder to become financially independent than it was for previous generations. Seventy percent of baby boomers, the parents of most of today’s early adults, agree. The study also found that despite unique financial challenges, today’s women are progressing through early adulthood faster and more successfully than men.

“Early Adulthood: The Pursuit of Financial Independence” takes an in-depth look at the experiences and challenges of contemporary early adulthood: pressures of new roles and responsibilities; pursuit of education and burden of student loans; the power of intergenerational interdependence; and the ripple effects of debt. The study revealed that one in four early adults with a retirement account have already made an early withdrawal, primarily to pay off credit card or student loan debt.

“Early adulthood is an exciting time of exploration and self-discovery, but there are new choices and challenges as well. Today’s young adults are encountering more complex financial paths than prior generations, forcing them to postpone life milestones and putting their ability to save for retirement at risk,” said Lorna Sabbia, head of Retirement and Personal Wealth Solutions at Bank of America. “To achieve financial independence, early adults can focus on developing smart financial habits, identifying areas to cut expenses to free up money for their goals, and seeking out financial education and guidance.”

The study surveyed a nationally representative sample of more than 2,700 respondents in the United States, with a focus on Americans ages 18 to 34. Key findings include:

- Financial resources are the top barrier to achieving goals. Early adults cite finances as their No. 1 source of stress and top barrier to achieving their life goals, such as buying a home and starting a family.

- Being debt-free defines financial success. As early adults confront nearly $1.6 trillion in cumulative student debt today1, 60 percent define financial success as being debt-free, compared to only 19 percent who say financial success is being rich.

- Early adults crave financial guidance and role models. Seventy-two percent of early adults say they would benefit from more financial guidance – more so than those in any other life stage.

- Parental financial support is the norm. Seventy percent of early adults have received financial support from their parents in the last year, and as many as 58 percent say they would not be able to afford their current lifestyles without ongoing parental support. The aggregate amount spent by parents today on their early adult children is enormous – over $500 billion annually2.

- Support goes both ways. As lifespans increase, children may also be providing more support – both financial and caregiving – to their parents down the road. Eighty-nine percent of early adults say they would be willing to “pay it back” by financially supporting their parents in the future.

- Social media is exacerbating financial pressures. With 68 percent of early adults fearing they are continually missing out (FOMO) on what their peers are experiencing and 49 percent feeling addicted to social media, early adults are comparing their financial accomplishments to their peers online. Eighty-two percent of early adults say they feel pressure to make a lot of money, and 60 percent feel pressure to buy things they cannot easily afford.

- Work isn’t “working” for many. Forty-six percent say they plan to look for a new job in the next 12 months, the top reason being higher pay (69 percent). Finding work that combines meaning with adequate pay is a growing challenge. Less than half of employed early adults feel that in their current job, they have career potential (44 percent), fair compensation (41 percent), or work that aligns with their passions/interests (35 percent).

According to Ken Dychtwald, Ph.D., psychologist/gerontologist and CEO of Age Wave, “More than ever, early adulthood is a complex matrix of new choices, freedoms and financial responsibilities – and it’s a life stage as exhilarating as it is challenging. As early adulthood becomes redefined by multiple forces, from the dominance of technology and rising levels of debt to an increasingly diverse workforce, it is a mistake to assume that you understand early adulthood today if you experienced it decades ago. When we reviewed the results of this study, I realized that I was never their age!”

Young women’s and men’s paths are not parallel

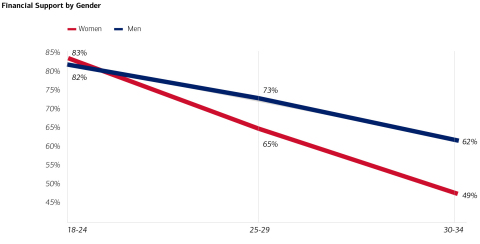

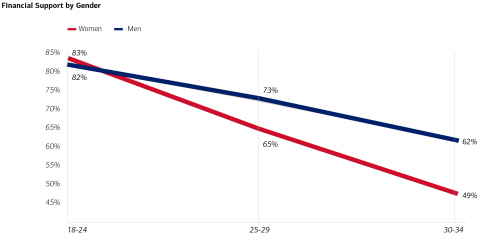

According to

the study, women are outpacing men in the quest for financial

independence – despite greater student debt, unequal pay and more family

caregiving involvement. Today, women carry almost two-thirds of the

cumulative student debt in the U.S.3

- Launching faster – and with less parental support. Among those in their early thirties, 49 percent of women receive support from parents, compared to 62 percent of men. Women are around half as likely to be receiving support across nearly all expense categories, including food and groceries (40 percent of men vs. 23 percent of women), rent/mortgage payments (33 percent of men vs. 15 percent of women), vacations (36 percent of men vs. 17 percent of women) and student loans (32 percent of men vs. 14 percent of women).

- More highly educated and ready for the jobs of the future. For every 100 young men who completed college last year, there were 141 women.4 Today’s young women are better prepared to succeed in a workforce where more jobs are requiring a college education.

- Long-term view on finances. Women are more likely than men to say that their highest financial priority is saving for the future and paying down debt (72 percent of women vs. 60 percent of men). Meanwhile, men are significantly more likely to say their highest financial priority is to “enjoy life now” (40 percent of men vs. 28 percent of women).

- Investing remains the exception. Only 27 percent of early adult women surveyed reported holding investments outside employer-sponsored retirement plans, compared to 46 percent of men. Women report less confidence than men in managing investments5, and their biggest fear about investing is not about market volatility or rate of return, but rather not feeling they know enough about what they’re doing (41 percent of women vs. 28 percent of men).

“Each generation experiences early adulthood differently. Young adults today have opportunities – technology at their fingertips, advanced education, and new career options – that their parents didn’t have,” says Lisa Margeson, head of Retirement Client Experience and Communications, Bank of America. “Those, in addition to more accessible guidance and advice, can help guide their path to financial independence.”

This study marks the fifth in a multi-year research series from Merrill Lynch and Age Wave that examines five distinct life stages: early adulthood, parenting, caregiving, widowhood, and end of life/legacy.

1 Federal Reserve Bank of New York, “Center for Microeconomic

Data,” 2018

2 Age Wave/Merrill Lynch, “The Financial

Journey of Parenting: Joy, Complexity and Sacrifice,” 2018

3 AAUW,

“Deeper in Debt: Women and Student Loans,” 2017

4 National

Center for Education Statistics, 2018

5 Age Wave/Merrill

Lynch, “Women & Financial Wellness: Beyond the Bottom Line,” 2018

Age Wave

Age Wave is the nation’s foremost thought leader on

population aging and its profound business, social, financial, health

care, workforce, and cultural implications. Under the leadership of

Co-founder Dr. Ken Dychtwald, CEO, Age Wave has developed a unique

understanding of new generations of maturing consumers and workers and

their expectations, attitudes, hopes, and fears regarding their longer

lives. Since its inception in 1986, the firm has provided breakthrough

research, compelling presentations, award-winning communications,

education and training systems, and results-driven marketing and

consulting initiatives to over half the Fortune 500. For more

information, please visit www.agewave.com.

(Age Wave is not affiliated with Bank of America Corporation or Merrill

Lynch.)

Merrill Lynch Wealth Management

Merrill Lynch Wealth Management is

a leading provider of comprehensive wealth management and investment

services for individuals and businesses globally. With 14,796 financial

advisors and $2.2 trillion in client balances as of December 31, 2018,

it is among the largest businesses of its kind in the world. Bank of

America Corporation, through its subsidiaries, specializes in

goals-based wealth management, including planning for retirement,

education, legacy, and other life goals through investment, cash and

credit management. Within this business, Merrill Private Wealth

Management focuses on the unique and personalized needs of wealthy

individuals, families and their businesses. These clients are served by

approximately 200 highly specialized private wealth advisor teams, along

with experts in areas such as investment management, concentrated stock

management and intergenerational wealth transfer strategies. Merrill

Lynch Wealth Management is part of Bank of America Corporation. For more

information, please visit https://www.ml.com/financial-goals-and-priorities.html.

Bank of America

Bank of America is one of the world’s leading

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range of

banking, investing, asset management and other financial and risk

management products and services. The company provides unmatched

convenience in the United States, serving approximately 66 million

consumer and small business clients with approximately 4,400 retail

financial centers, including approximately 1,800 lending centers, 2,200

financial centers with a Consumer Investment Financial Solutions

Advisor, and 1,500 business centers; approximately 16,400 ATMs; and

award-winning digital banking with more than 37 million active users,

including over 27 million mobile users. Bank of America is a global

leader in wealth management, corporate and investment banking and

trading across a broad range of asset classes, serving corporations,

governments, institutions and individuals around the world. Bank of

America offers industry-leading support to approximately 3 million small

business owners through a suite of innovative, easy-to-use online

products and services. The company serves clients through operations

across the United States, its territories and approximately 35

countries. Bank of America Corporation stock (NYSE: BAC) is listed on

the New York Stock Exchange.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom. Click here to register for news email alerts.