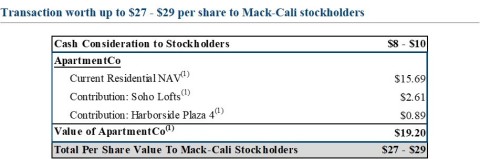

NEW YORK--(BUSINESS WIRE)--Bow Street LLC ("Bow Street"), a New York-based investment firm that beneficially owns approximately 4.5% of the outstanding shares of common stock of Mack-Cali Corporation (“Mack-Cali” or the “Company”) (NYSE: CLI), today sent a letter to Mack-Cali’s Board of Directors (the “Board”) reiterating its proposal to acquire Mack-Cali’s office portfolio and highlighting the need for a reconstituted Mack-Cali Board that is willing to seriously explore all solutions to maximize stockholder value. Under the terms of the proposal, Mack-Cali stockholders will receive expected net cash consideration of $8-$10 per Mack-Cali share as well as an equity distribution of a new, high-growth apartment REIT, comprised of Mack-Cali’s current multifamily portfolio with a calculated net asset value of $19.20 per share.

As detailed in its letter, Bow Street’s proposal, made in partnership with DWREI LLC and first shared with the Board on February 25, 2019, was hastily and publicly rejected prior to any meaningful inquiry from the Company regarding valuation, structure, tax or other implications for stockholders. Bow Street strongly believes that the Board’s perfunctory response suggests an alarming lack of commitment to good governance and long-term stockholder value, as well as an unwillingness to explore value-maximizing opportunities following years of Company underperformance.

Accordingly, Bow Street has nominated four highly-qualified, independent director candidates for election to the Board at the 2019 Annual Meeting of Stockholders to ensure the Board seriously evaluates all solutions that may achieve a superior result for stockholders.

The full text of the letter is below, followed by biographies of Bow Street’s four director nominees.

April 16, 2019

Board of Directors

Mack-Cali Realty Corporation

Harborside 3

210

Hudson Street, Suite 400

Jersey City, NJ 07311

Dear Mack-Cali Board of Directors,

Bow Street LLC (“Bow Street”) manages funds that beneficially own approximately 4.5% of Mack-Cali Realty Corporation (“Mack-Cali” or “the Company”). Over the last several months, we have attempted to engage constructively with Mack-Cali to propose a transaction that achieves long-needed structural change at the Company, which has underperformed for many years. In a letter dated March 14th and subsequent press release dated March 18th, the Mack-Cali Board of Directors (the “Board”) formally rejected our proposal.

This hasty and public rejection was delivered prior to any meaningful inquiry from Mack-Cali regarding valuation, structure, tax or other implications for stockholders. Regrettably, this response suggests an alarming lack of commitment to good governance and long-term stockholder value, and is consistent with the Board’s well-earned reputation for discouraging prospective strategic acquirers. As significant Mack-Cali stockholders, we remain deeply concerned about the value of our investment. We are therefore writing once again to urge the Board to engage with us regarding our proposal as well as to explore all strategic alternatives to maximize stockholder value.

Bow Street’s Proposal

As

you know, on February 25th, 2019 we submitted a proposal to

acquire Mack-Cali’s office portfolio. We made this offer in partnership

with DWREI LLC, a privately-held real estate investment company that

owns a substantial commercial office portfolio across the Northeastern

United States and Chicago. Under the terms of this proposal, Mack-Cali

stockholders will receive a) expected net cash consideration of $8-$10

per share, and b) an equity distribution of a new, high-growth apartment

REIT (“ApartmentCo”) comprised of Mack-Cali’s current multifamily

portfolio with a calculated net asset value (“NAV”) of $19.20 per share1.

See Chart Detailing Value Provided to Mack-Cali Stockholders

Our proposal is as follows:

a) Estimated net consideration of $8-$10 per Mack-Cali share for certain commercial assets. This net consideration reflects a ~7%-8% cap rate2 despite above peer leverage and meaningfully higher than peer vacancy. Our proposed range represents estimated net consideration to CLI stockholders after deal friction.

b) A distribution of equity in new ApartmentCo with an estimated NAV of $19.20 per share3. ApartmentCo’s NAV estimate represents the midpoint of the Company’s fourth quarter NAV disclosure. Our ApartmentCo financial model contemplates double-digit net operating income growth over the next five years, funded by internally generated cash flow and a loan-to-value ratio maintained at ~50%.

It is our view that standalone ApartmentCo will be exceptionally well-received as a public company. Given its unique pure-play portfolio of New Jersey waterfront residential exposure set to benefit directly from New York’s continuing shift to Hudson Yards, we believe ApartmentCo will generate significant interest from myriad potential acquirers. In a call with Bow Street on April 9th, Mack-Cali CEO Michael DeMarco agreed, expressing his belief that a standalone ApartmentCo was likely to become a target of industry consolidation. Confirming this intuition, we have received numerous expressions of interest from potential acquirers of Mack-Cali’s residential portfolio following the Company’s disclosure of our proposal.

Proposal Structured to Unlock Significant Value

for Mack-Cali Investors

Bow Street’s proposal

provides investors immediate value of up to $27-$29 per Mack-Cali Share,

a 28%-37% premium to its unaffected trading value4, and a

32%-41% premium to its 3-month average trading price. Most importantly,

it addresses Mack-Cali’s intractable structural deficiency – its

deleterious combination of development rich multifamily assets with a

disparate portfolio of highly indebted, underperforming, and

capital-constrained office assets. We therefore believe this

transformative transaction would be welcomed by all stockholders.

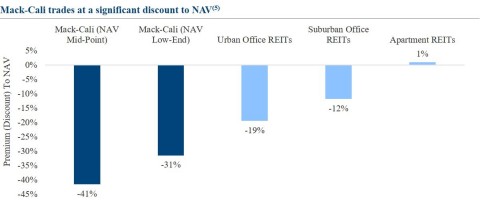

Despite the generally well-executed portfolio transition undertaken by management over the last five years, Mack-Cali’s commercial business remains over-levered and under-occupied. Further, the Company lacks the financial resources to pursue its highest return development opportunities, consistently ceding value to external joint-venture partners such as Rockpoint Group. As evidenced by the Company’s persistently wide discount to NAV (currently and historically amongst the widest in the REIT universe5), the market has limited confidence in management’s current strategy.

See Chart Detailing Mack-Cali’s NAV Trading Discount to Peers

Our proposed transaction permanently resolves these concerns, allowing stockholders to monetize almost half the current value of their stock while providing concentrated exposure to Mack-Cali’s highest quality asset – its apartment portfolio. While we firmly believe our transaction will unlock significant value for all stockholders, we encourage Mack-Cali to explore all alternative solutions that may achieve a superior result for investors.

Proposed Transaction Was Not Seriously

Considered by Mack-Cali’s Board

We are deeply

disappointed by the Board’s perfunctory rejection of our proposal.

Following the submission of our offer, we expected the Company would

actively engage with us and our advisors to address important questions

regarding valuation, tax, process and structure to fully comprehend and

evaluate our proposal. As demonstrated by the Company’s misleading press

release and as confirmed in subsequent meetings with Chairman William

Mack and CEO Michael DeMarco, the Board’s familiarity with and

understanding of our transaction prior to its decision was limited at

best. Instead of credibly engaging with us, the Board has hidden behind

its retention of investment bankers, clearly hired to justify the

Board’s predetermined rejection of this value creative proposal.

Unfortunately, Mack-Cali’s decided indifference to our approach is unsurprising. It is reflective of a deeply entrenched Board that is fundamentally resistant to change. Our concern therefore extends far beyond Mack-Cali’s unwillingness to seriously consider our transaction. Indeed, the Board is apparently unwilling to consider any transaction that does not originate inside its own boardroom. This posture is particularly troubling in the context of Mack-Cali’s share price, which has underperformed all relevant indices and asset classes over any appreciable multi-year period.

To this end, we have nominated four highly-qualified independent director candidates for election to the Board of Directors at the 2019 Annual Meeting of Stockholders to ensure the Board seriously evaluates our proposal and any other proposals the Company receives to maximize stockholder value. We urge Mack-Cali to immediately form a special committee of independent directors (excluding any members of the Mack family or their designees to the Board, and any members of Company Management) to explore all strategic alternatives.

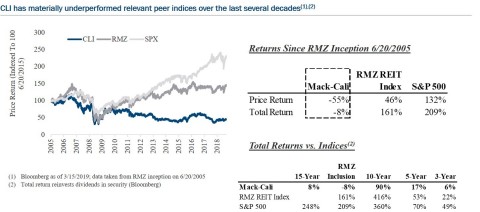

Persistent Underperformance Highlights Need for

Board Level Change

The current Board has failed

stockholders, who have suffered decades of underperformance. Mack-Cali’s

share price has consistently trailed its peers, resulting in bottom

quartile performance across 3, 5, 10, and 15 year periods6.

In fact, since its IPO in August of 1994, Mack-Cali shares have

appreciated a mere ~1% per year during a

period of unprecedented real estate value appreciation across the New

York City Metro area and nationwide. Absent a transformational

transaction, we believe Mack-Cali shares will continue to languish,

extending this underperformance.

See Chart Detailing Mack-Cali’s Material Underperformance Against Relevant Peer Indices Over the Last Several Decades

Mack-Cali is clearly in need of a new strategic direction, and change must begin with its long-tenured Board. A majority of Mack-Cali’s current directors have served on the Board for over fifteen years, overseeing the serial value erosion detailed above. During our meeting at the Mack Group’s offices, Mr. Mack repeatedly detailed the meaningful wealth he has created – both personally and for the private equity firm he has led – transacting in New York Metro Area real estate. For the last twenty years, Mack-Cali stockholders have neither participated in these opportunities, nor have they benefitted from their commensurate windfall.

It remains our strong preference to work constructively with the Board in pursuit of a path forward that is best for Mack-Cali and all of its stockholders. We would once again encourage you to explore all strategic alternatives to maximize stockholder value, including a serious and comprehensive review of our proposal. We look forward to discussing this proposal further with the Board and with all Mack-Cali stockholders, who will ultimately determine the future of the Company.

Respectfully,

| Akiva Katz | Howard Shainker | ||||||

| Managing Partner | Managing Partner | ||||||

Biographies of Director Nominees

Alan R. Batkin

Alan R. Batkin has served as the Chief

Executive Officer and Chairman of the Board of Directors of Converse

Associates, Inc., a strategic advisory firm, since 2013. From 2007 until

2012, Mr. Batkin served as Vice Chairman of Eton Park Capital

Management, L.P., a global multi-disciplinary investment firm.

Previously, from 1990 until 2006, Mr. Batkin served as Vice Chairman of

Kissinger Associates, Inc., a geopolitical consulting firm that advises

multi-national companies.

Mr. Batkin has extensive public board experience, as he has served on the Board of Directors of Pattern Energy Group Inc. since 2013, Omnicom Group Inc. since 2008, and Cantel Medical Corp since 2014. Mr. Batkin previously served on the Board of Directors of Hasbro, Inc., from 1992 until 2017.

Mr. Batkin received a B.S. from the University of Rochester and a M.B.A. from New York University Graduate School of Business.

Frederic Cumenal

Frederic Cumenal served as the Chief

Executive Officer of Tiffany & Co. from 2015 to 2017 and as President

from 2013 to 2015. Previously, he served and as Executive President with

responsibility for sales and global distribution from 2011 to 2013.

Prior to his service at Tiffany, Mr. Cumenal served for fifteen years in

senior leadership positions in LVMH Group’s wine and spirits businesses,

including as President and Chief Executive Officer of Moët & Chandon,

S.A.

Previously, Mr. Cumenal served as Chief Executive Officer of Domaine Chandon and was Managing Director of Moët Hennessy Europe. Mr. Cumenal also served as Executive Vice President of Marketing, Strategy and Development at Ferruzi Group and was a Brand Manager at Procter & Gamble, France S.A.S.

Mr. Cumenal has served on the Board of Directors of Blue Nile, Inc., an online jewelry retailer, since 2017.

Mr. Cumenal has significant public board experience, having served on the Board of Directors of Constellation Brands, Inc. from 2016 until 2017. Mr. Cumenal also served on the Board of Directors of Tiffany & Co. from 2013 until 2017.

Mr. Cumenal is a graduate of Institut d'Etudes Politiques and holds a M.B.A. from Ecole Superieure des Sciences Economiques et Commerciales.

MaryAnne Gilmartin

MaryAnne Gilmartin is the Co-Founder and

Chief Executive Officer of L&L MAG, a New York-based real estate

development firm. Ms. Gilmartin has also served as a director of

Jefferies Financial Group Inc. since 2014. Previously. Ms. Gilmartin

served as the Chief Executive Officer and President of Forest City

Ratner Companies, LLC, a subsidiary of Forest City Realty Trust, Inc.

from 2013 to 2018. During her tenure at Forest City, Ms. Gilmartin

oversaw, among other projects, the development of The New York Times

Building, New York by Gehry and the Tata Innovation Center at Cornell

Tech. Prior to joining Forest City, Ms. Gilmartin served as Managing

Director for Consulting Services at Grubb & Ellis Companies, advising

corporations and developers on real estate and relocation needs.

Previously, she served as Assistant Vice President for Commercial

Development at the New York City Economic Development Corporation (EDC)

during the Koch and Dinkins administrations.

Ms. Gilmartin also serves as Vice Chair of New York Public Radio, Inc. and as a member of the Executive Committee of the Brooklyn Academy of Music Inc. In addition, Ms. Gilmartin serves as a Member of the Executive Committee and Board of Governors of the Real Estate Board of New York, Chair Emeritus of the Downtown Brooklyn Partnership and as a Member of the Industry Advisory Board of the MS Real Estate Development Program at Columbia University.

Ms. Gilmartin received a B.A. in Political Science, summa cum laude, and a M.P.A., both from Fordham University.

Nori Gerardo Lietz

Nori Gerardo Lietz is a Senior Lecturer

of Business Administration in the Finance and Entrepreneurial Management

Units at Harvard Business School where she currently teaches Real Estate

Private Equity and Venture Capital Private Equity.

Ms. Gerardo Lietz is the President of Areté Capital, a real estate advisory firm she founded in 2010. Previously, Ms. Gerardo Lietz served the Chairman of the Advisory Board of Allele Fund in 2011. Ms. Gerardo Lietz was a Partner and Chief Strategist for Private Real Estate and a member of the firm’s Global Investment Committee at Partners Group Holding AG from 2007 to 2011. Ms. Gerardo Lietz co-founded Pension Consulting Alliance, Inc. in 1998 and served as a Managing Director while developing its real estate investment management and advisory activities until 2007. In 1985, Ms. Gerardo Lietz co-founded Public Storage Institutional, Inc., an institutional money management firm deploying pension capital to acquire real estate assets, where she served as Senior Vice President until 1988. Ms. Gerardo Lietz practiced law in the corporate department of Paul Hastings LLP from 1982 to 1985.

Ms. Gerardo Lietz is a former member of the Pension Real Estate Association Board of Directors and the Real Estate Research Institute Board of Directors.

Ms. Gerardo Lietz received an A.B. with honors from Stanford University in 1979 and a J.D. from the UCLA School of Law in 1982, where she was Chief Comment Editor of the UCLA Law Review.

About Bow Street LLC

Founded in 2011, Bow Street is a New York-based investment manager that partners with institutional investors and family offices globally to invest opportunistically across public and private securities.

| 1 | ApartmentCo comprised of: (i) $1,582 million current residential NAV (mid-point of management NAV disclosed page 7, Mack-Cali Q4 2018 Supplement), (ii) $264 million Soho Lofts NAV (purchased in April 2019 at this valuation, disclosed page 5, Q4 2018 Mack-Cali Supplement), and (iii) $90 million Harborside Plaza 4 NAV (mid-point Company valuation disclosed page 7, Q4 2018 Supplement, currently included in office portfolio but (per management) is available for residential or condo development); total value of $1,936 million or $19.20/share assuming 100.8 million shares (per page 7, Mack-Cali Q4 2018 Supplement) | |

| 2 | Implies ~$2.4 billion - ~$2.6 billion of purchase price for commercial assets that i) does not include flex portfolio, 99 Wood Avenue acquisition (would increase GAV for acquisition), or Harborside Plaza 4 land, and ii) treats “Hotel and Other JV Interests” as an equity interest ($31 million at Company mid-point NAV) | |

| 3 | See footnote 1 on prior page | |

| 4 | CLI trading price of $21.12 / share on 3/15/2019 (closing price prior to Mack-Cali press release on 3/18/2019 regarding proposal) | |

| 5 | Mack-Cali NAV calculated using management guidance as of Q4 2018 Supplement (stock price as of 3/15/2019); peer / industry REIT NAV levels using Citi Research “the Hunter Express and Lodging Valuation Tool” as of 3/18/2019. | |

| 6 | Using public REITs that were public throughout performance period with market caps greater than $250m; Bloomberg; data as of last unaffected trading close (3/15/2019) | |

Important Information

Bow Street LLC ("Bow Street"), A. Akiva Katz, Howard Shainker, Alan R. Batkin, Frederic Cumenal, MaryAnne Gilmartin, and Nori Gerardo Lietz (collectively, the "Participants") intend to file with the Securities and Exchange Commission (the "SEC") a definitive proxy statement and accompanying form of proxy to be used in connection with the solicitation of proxies by the Participants when they become available, as they will contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying proxy card will be furnished to some or all of the stockholders of Mack-Cali Corporation (the "Company") and will be, along with other relevant documents, available at no charge on the SEC website at http://www.sec.gov/ and by contacting the Participants' proxy solicitor, Innisfree M&A Incorporated.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained in the preliminary proxy statement on Schedule 14A filed by Bow Street with the SEC on April 16, 2019. This document is available free of charge from the sources indicated above.

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this press release are for general information only, and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained in this press release that are not historical facts are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. In light of the significant uncertainties inherent in the forward-looking statements, the inclusion of such information should not be regarded as a representation as to future results. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this presentation in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates and subject to revision without notice. Bow Street disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results.