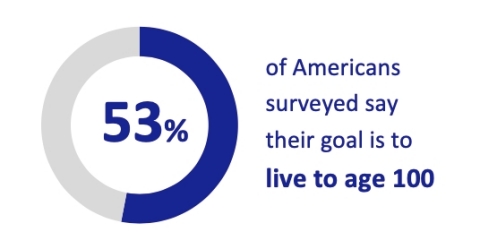

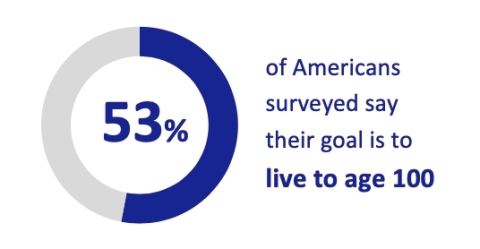

NEW YORK--(BUSINESS WIRE)--As more people are living into their 80s and 90s, more than one out of every two Americans has their sights set on even greater longevity. According to a survey1 released today by AIG Life & Retirement, a surprising 53 percent say their goal is to live to 100 years. Thirty-nine percent identify deeper family relationships as the main benefit of such a long life, 32 percent name seeing the world change and 17 percent want to remain productive.

Longer Lives Come with an Array of Concerns

This optimism for aging—fueled in part by medical advances and healthier lifestyles—is tempered by the financial challenges individuals may face in a retirement that could stretch 40 years or more:

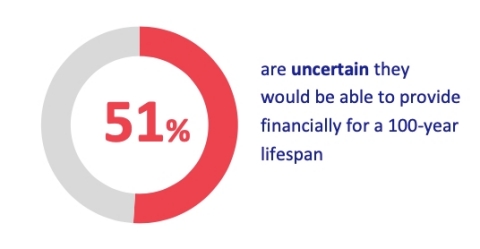

- More than half (51 percent) of respondents are uncertain their current retirement savings plan would financially provide for a 100-year lifespan

- Less than one in 10 (9 percent) are extremely confident they will have enough income throughout their retirement

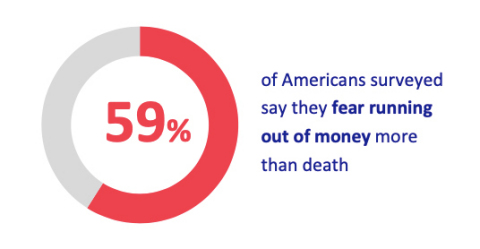

- Nearly six in 10 (59 percent) fear running out of money more than they fear death

“Living longer should be a cause for celebration, but for many, longevity can bring anxiety and financial uncertainty,” said Kevin Hogan, Chief Executive Officer, AIG Life & Retirement. “While no one can know if they will live to 100, they can plan for it. Our goal is to help educate Americans about the need to prepare for longer lives so they can achieve financial and retirement security.”

When asked to pinpoint their greatest concern about living to 100, the potential for serious health conditions (35 percent) topped the list, followed by burdening their family (27 percent) and running out of the money needed to live comfortably in retirement (25 percent). When considering financial concerns, generating lasting retirement income (23 percent) and the rising cost of healthcare (23 percent) tied as the most significant financial challenge Americans said they would face when planning for retirement. These challenges were followed by concerns about Social Security and Medicare (19 percent) and stock market volatility (19 percent).

Furthermore, with recent market volatility and December’s nearly ten percent stock market drop still fresh in consumers’ minds, 86 percent of Americans confess to anxiety about funding their retirement lifestyle through their retirement account investments, which typically include stock market exposure, as opposed to a guaranteed source of income.

While financing a long life is a concern for all, the burden weighs more heavily on the shoulders of female respondents—especially since they have longer projected life expectancies than men. Women are significantly more anxious than men about funding their retirement lifestyle through their retirement account investments versus a guaranteed source of income (60 percent of women are somewhat or very anxious, compared to 47 percent of men).

Income Certainty and Professional Help Enhance Happiness and Retirement Security

Results show that even a little more certainty can go a long way; six in 10 (60 percent) said $10,000 more per year of guaranteed retirement income would help ease their minds. Additionally, 75 percent of survey respondents said guaranteed income every year for life would give them greater levels of happiness and satisfaction in retirement. Certainty seems to have an even greater impact on female respondents; women were more likely than men to say they believe they would derive happiness from guaranteed income (women averaged 4.21 on a 5-point scale vs. men at 3.98).

“Retirement planning in the U.S. has yet to adequately adjust for an aging population, a decline in pension benefits, and longer lifespans,” said Todd Solash, President, Individual Retirement, AIG. “As a country, we have to face the fact that relying on savings alone will leave many at risk of running out of money during their golden years. We must fundamentally change how we talk about retirement and replace what has been more of a singular focus on savings with a broader perspective that also includes protected lifetime income sources like annuities as part of an overall retirement plan.”

Working with a financial professional also boosts confidence for a potentially long retirement. When asked whether they believe their current retirement savings plan will sustain them financially until the age of 100, respondents with advisors are significantly more confident than those going it alone. Nearly half (45 percent) of those with advisors are very or extremely confident, compared to only 8 percent of do-it-yourselfers. In fact, working with an advisor allays financial fears about growing older; nearly two-thirds (64 percent) of respondents with an advisor say they want to live to 100, compared to only 37 percent of those without an advisor.

“Preparing financially for a long life is achievable if you have a financial plan,” said Robert Scheinerman, President, AIG Retirement Services (formerly known as VALIC). “Personal finance can be intimidating, but it doesn’t have to be. Working with an advisor can help you clarify goals, map out the future you envision and build a strategy for creating a secure retirement. For employers, there is a real opportunity to better educate and engage employees to help them create a financial plan and develop strong savings habits early in their career. Individuals, employers, financial advisors and legislators all have a part to play in ensuring Americans can achieve retirement security.”

Respondents are also thinking about how they can ensure the financial security of their loved ones in the case where their life expectancy differs from their spouse; only 16 percent of respondents say they are extremely confident that their partner would be able to manage his or her spending from retirement savings if they were to die first.

“Planning for 100 means planning for the unexpected,” added Rod Rishel, Chief Executive Officer, Life Insurance, AIG. “For their peace of mind, Americans should be financially prepared to live to 100 while also taking steps to ensure the financial security of their loved ones in the event of an untimely illness, disability or death, especially if you’re the breadwinner.”

Plan for 100

The survey was conducted as part of the launch of AIG’s Plan for 100, a new initiative focused on educating and empowering individuals, employers and financial advisors to help Americans prepare for longer lives and, in turn, retirements that could last four decades or more. The initiative, with its 100-year theme complementing the centennial celebration at AIG, includes the launch of a new website (Planfor100.com) and podcast series to raise awareness about the impact of increased longevity and educate Americans about potential solutions. The Plan for 100 Podcast is available on the Planfor100.com website, as well as iTunes, Google Play, Spotify, Stitcher and SoundCloud. The podcasts feature a variety of experts and thought leaders, including: financial researcher Michael Finke, Ph.D.; retirement finance author and speaker Ed Slott; economist and retirement expert Tom Hegna; and aging and cognition researcher Alan Castel, Ph.D. The Planfor100.com website will be updated regularly with additional podcasts, videos and research.

The AIG 2019 Plan for 100 Survey was conducted online within the United States by Michael Finke, Ph.D., The American College of Financial Services, in December 2018 and January 2019 among 1,012 U.S. adults ages 40-74 who have at least $50,000 in retirement accounts.

About AIG Life & Retirement

AIG Life & Retirement, a division of AIG (NYSE: AIG), brings together a broad portfolio of protection, retirement savings, investment and lifetime income solutions to help people achieve financial and retirement security. The business consists of four operating segments – Individual Retirement, AIG Retirement Services, Life Insurance and Institutional Markets – and holds longstanding, leading market positions in many of the markets it serves.

AIG Life & Retirement includes AIG member insurance companies American General Life Insurance Company (Houston, TX), The United States Life Insurance Company in the City of New York, and The Variable Annuity Life Insurance Company (VALIC), Houston, TX as well as their affiliates. Securities products are distributed by AIG Capital Services, Inc., member FINRA. Additional information about AIG Life & Retirement can be found at www.linkedin.com/showcase/aig-life-&-retirement.

About AIG

American International Group, Inc. (AIG) is a leading global insurance organization. Building on 100 years of experience, today AIG member companies provide a wide range of property casualty insurance, life insurance, retirement solutions, and other financial services to customers in more than 80 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock Exchange.

Additional information about AIG can be found at www.aig.com | YouTube: www.youtube.com/aig | Twitter: @AIGinsurance www.twitter.com/AIGinsurance | LinkedIn: www.linkedin.com/company/aig. These references with additional information about AIG have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release.

AIG is the marketing name for the worldwide property-casualty, life and retirement, and general insurance operations of American International Group, Inc. For additional information, please visit our website at www.aig.com. All products and services are written or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty coverages may be provided by a surplus lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds.

1 Survey of 1,012 U.S. adults ages 40-74 who have at least $50,000 in retirement accounts