BOSTON--(BUSINESS WIRE)--Fidelity Investments®, one of the industry’s most diversified financial services firms, today announced its annual Retiree Health Care Cost Estimate. According to Fidelity, a 65-year old couple retiring in 2019 can expect to spend $285,0001 in health care and medical expenses throughout retirement, compared with $280,000 in 2018. For single retirees, the health care cost estimate is $150,000 for women and $135,000 for men.

While there’s no surprise that health care costs are a top financial concern in retirement, the past two years combined have seen a slower rise (3.6 percent) than in the previous two (2015-2017), which saw the estimate grow to $275,000 from $245,000 (up a total of 12.2 percent). Even without the same rate of growth, some retirees are still surprised by today’s cost of health care.

“Paying for health care – before and in retirement – continues to be top-of-mind for Americans, and understandably so as it’s a cost that can vary significantly by individual and is difficult for many to predict,” said Hope Manion, senior vice president, Fidelity Workplace Consulting. “Knowing this, Fidelity wants to help by offering a guideline for today’s retirees, and to broaden awareness among people of all ages so they can set more realistic expectations and become better prepared for potential health care costs when planning for retirement.”

Many of the metrics contributing to Fidelity’s annual retiree health care cost estimate are susceptible to shifts in the economic landscape and changes in government regulations.

Fidelity’s estimate assumes both members of the couple are eligible for Medicare, which between Medicare Part A and Part B covers expenses such as hospital stays, care at a skilled nursing facility, doctor visits and services, physical therapy, lab tests and more. The promising news for this year’s retirees is that out-of-pocket Medicare costs have leveled – meaning at least in the past year, medical costs have not increased at the rate experienced in previous years. However, many Americans are still unclear about what Medicare does and does not cover, likely a reason many still underestimate the costs of health care in retirement.

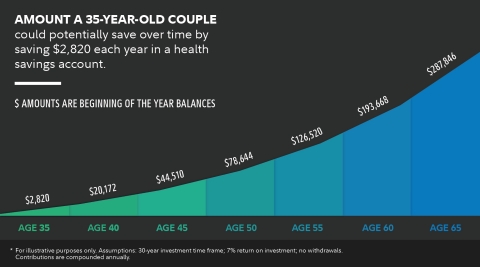

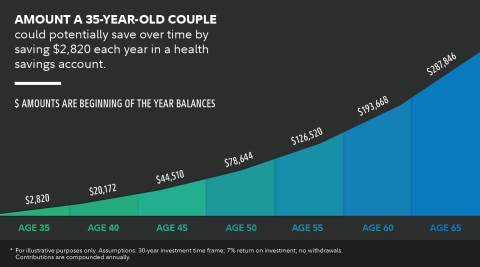

Is it possible to save $285,000 in 30 years? Yes, it is.

Even without a steep rise in the estimate, this year’s retiree health care cost estimate is still daunting for many. While Fidelity’s estimate is for a couple retiring in 2019, it’s also a call-to-action to younger generations, reminding them to take advantage of the time and investing opportunities they may have available to them. What would it take for a 35-year-old couple today to save $285,000 by the time they were 65?

[see graphic]

“We recognize that when today’s 35-year-olds retire in 2049 their medical costs could be more than this year’s estimate, and the U.S. health care system could potentially look dramatically different. It’s hard for any of us to predict that far out, but it’s prudent to anticipate that health care costs could represent a significant expense in retirement and prepare as much as we can,” added Manion. “We’re often asked how we can help people better understand the power of investing to grow their savings over time, especially for young adults who have time on their side. My suggestion: save early and save often. We know that consistency and compound interest help save for the future.”

Of course it takes some diligent savings habits, but it also varies based on the type of account being used. Or more importantly, it depends if that money is in an account where it can be invested for potential growth. In conjunction with a high deductible health plan, health savings accounts (HSAs) were created to help Americans save for their health care expenses. HSAs offer a triple-tax advantage2: 1) tax-free contributions; 2) tax-free growth on balances and 3) tax-free withdrawals for qualified health expenses. According to a recent report3, there are more than 25 million HSAs, an increase of 13 percent from last year. Fidelity has also seen growth in its workplace HSA business, with double-digit asset growth4. For those who are enrolled in a high deductible health plan and do not have access to an HSA through their employer, consider opening a retail Fidelity HSA® to help save for health care expenses.

However, many account holders are not using these accounts to their full potential. Account holders are more likely to use their HSA for everyday transactions -- paying for today’s medical expenses, while not knowing they can invest that money for potential growth – similar to how other retirement accounts can be invested - and use it for future health care costs. In fact, at the end of 2018, more than 91 percent of Fidelity HSA funded account holders held all of their savings in cash.

Five Health Care Savings Tips for Pre-Retirees

For pre-retirees who don’t have 30 more years to save, here are five tips to consider:

1. Get up to speed with Medicare: Many Americans assume Medicare is free and covers all their retirement health care expenses. That’s not true, and could be a harsh wake-up call. Medicare requires premiums, and doesn’t cover most dental care, hearing aids, prescription eye exams or vision hardware such as glasses and contacts, plus other expenses. As a pre-retiree approaches age 65, review all the Medicare options. There's a lot to learn and they will want to know about Medicare Parts A, B, and D, as well as Medicare Advantage and “Medigap” supplemental insurance plans. Learn more here.

2. Maximize tax-advantaged savings accounts: Most pre-retirees are already familiar with a 401(k) or 403(b), and this year’s contribution limit for both accounts is $19,000, plus for those who are age 50 or older, they can contribute another $6,000 in catch-up contributions. As well, even those closer to retirement can still benefit from saving in an HSA to take advantage of pre-tax contributions and potential growth through investing. This year’s HSA contribution limits are: $3,500 for individuals, $7,000 for families and an additional $1,000 for people age 55 and older for catch-up contributions.

3. Consider deferring Social Security benefits: Generally speaking, the closer to age 70 an individual can wait to take Social Security benefits, the more they can collect, assuming they live a long life.

4. Meet the employer’s HR department: While still employed, pre-retirees should find out what health care benefits, if any, their employer may offer in retirement. Even having access to group coverage or professional support in choosing a Medicare product can be valuable benefits.

5. Talk with a financial professional: Long-term care needs are difficult to predict and are not included in Fidelity’s retirement health care cost estimate, so it’s recommended that pre-retirees meet with a financial professional to discuss potential long-term care needs based on their current health, family history, and other personal factors. The earlier people start to explore options, the more affordable policies may be.

For individuals who retire prior to the age of 65 and are not yet eligible for Medicare, there are financial implications they need to consider. Fidelity’s “Bridging the gap to Medicare” provides several resources to help them build a plan, feel confident they are making educated decisions, and are getting the health insurance they need.

Need More Help? Resources Outlining Ways to Save for Health Care -- Now and In the Future

To help individuals better understand their potential health care costs, and to start preparing while they are still working, Fidelity offers a number of resources, including:

- Fidelity Viewpoints articles, “How to plan for rising health care costs” and “How to talk to your doctor – and save money”

- A video that outlines tips to save on today’s health care costs, such as considering generic drugs over brand and using online chats with medical professionals – if available through their insurance plan.

For those who have a health savings account, read Fidelity Viewpoints articles, “3 healthy habits for health savings accounts” and “5 ways HSAs can fortify your retirement”; and watch a video “Getting Started with Your New HSA” for more insights on how to get the most out of these powerful accounts.

Fidelity has also published an age-based set of retirement savings guidelines, inclusive of health care expenses, designed to help individuals understand approximately how much they should have save by specific age milestones.

About Fidelity Investments

Fidelity’s

mission is to inspire better futures and deliver better outcomes for the

customers and businesses we serve. With assets under administration of

$7.3 trillion, including managed assets of $2.6 trillion as of February

28, 2019, we focus on meeting the unique needs of a diverse set of

customers: helping more than 30 million people invest their own life

savings, 22,000 businesses manage employee benefit programs, as well as

providing more than 13,500 financial advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for more than 70 years, Fidelity employs more than 40,000 associates who

are focused on the long-term success of our customers. For more

information about Fidelity Investments, visit https://www.fidelity.com/about.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

880461.1.0

©2019 FMR LLC. All rights reserved.

1 Estimate based on a hypothetical couple retiring in 2019,

65-years-old, with life expectancies that align with Society of

Actuaries' RP-2014 Healthy Annuitant rates with Mortality Improvements

Scale MP-2016. Actual assets needed may be more or less depending on

actual health status, area of residence, and longevity. Estimate is net

of taxes. The Fidelity Retiree Health Care Costs Estimate assumes

individuals do not have employer-provided retiree health care coverage,

but do qualify for the federal government’s insurance program, Original

Medicare. The calculation takes into account cost-sharing provisions

(such as deductibles and coinsurance) associated with Medicare Part A

and Part B (inpatient and outpatient medical insurance). It also

considers Medicare Part D (prescription drug coverage) premiums and

out-of-pocket costs, as well as certain services excluded by Original

Medicare. The estimate does not include other health-related expenses,

such as over-the-counter medications, most dental services and long-term

care.

2 With respect to federal taxation only.

Contributions, investment earnings, and distributions may or may not be

subject to state taxation. The triple tax advantages are only applicable

if the money is used to pay for Qualified Medical Expenses as described

in IRS Publication 969.

3 Devenir Research 2018 Year-End

HSA Market & Statistics Trends, February 2019

4

Fidelity recordkept data of HSAs as of January 31, 2019