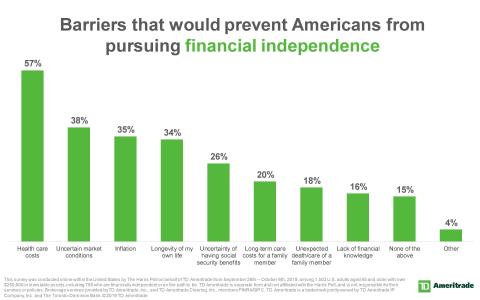

OMAHA, Neb.--(BUSINESS WIRE)--When asked to name barriers to financial independence and early retirement, Americans are less concerned about uncertain market conditions (37 percent) or inflation (35 percent), than they are about healthcare costs (57 percent), according to a new survey conducted for TD Ameritrade, of 1,500 Americans aged 45 and older with $250,000 or more in investable assets.

“While Americans are enjoying longer lifespans1, which may mean covering healthcare expenses and long-term care costs for extended periods of time, they also face the increasing costs of healthcare2,” says Matt Sadowsky, director of retirement and annuities, TD Ameritrade. “The good news is that Americans do recognize that health costs should be a top priority when planning for retirement (44 percent), with 57 percent showing interest in holistic wellness planning, including financial and physical health.”

Health is a motivator to retiring early

- Seven in 10 (72 percent) of those who identify as financially independent say health is a motivator to retiring early

-

Three-quarters (76 percent) of financially independent believe

retiring early will help them live longer

- In fact, only 15 percent of financially independent retirees report being stressed compared to 47 percent of their non-retired counterparts

Covering healthcare costs in retirement

-

An overwhelming majority of Americans (76 percent) point to Medicare

as the best way to pay for healthcare in retirement

- Yet more than half of pre-retirees (61 percent) are not confident that it will cover the bulk of their retirement medical expenses

- Other tools that Americans plan on using to tackle healthcare expenses include: supplemental health insurance (51 percent), health insurance (42 percent), and Social Security (41 percent)

- Forty-six percent of those surveyed are likely to max out their Health Savings Account (HSA) contributions

- Only 19 percent cite long-term care costs for a family member and unexpected costs to care for a family member as top worries about retiring early

“When planning for retirement, it’s important to factor in the healthcare expenses as part of the overall equation,” says Matt Sadowsky. “A comprehensive retirement plan should not only address market risk, it should also include strategies and instruments that help hedge against healthcare and long-term care costs,” Sadowsky concludes.

About TD Ameritrade Holding Corporation

TD Ameritrade

provides investing

services and education to

more than 11 million client accounts totaling approximately $1.2

trillion in assets, and custodial

services to more than 7,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of approximately

900,000 trades per day for our clients, more than a quarter of which

come from mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of 10,000-strong is committed to carrying it forward. Together, we are

leveraging the latest in cutting edge technologies and one-on-one client

care to transform lives, and investing, for the better. Learn more by

visiting TD Ameritrade’s newsroom at www.amtd.com,

or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

About The Harris Poll

The Harris Poll is one of the

longest-running surveys in the U.S., tracking public opinion,

motivations and social sentiment since 1963. It is now part of Harris

Insights & Analytics, a global consulting and market research firm that

strives to reveal the authentic values of modern society to inspire

leaders to create a better tomorrow. We work with clients in three

primary areas; building twenty-first-century corporate reputation,

crafting brand strategy and performance tracking, and earning organic

media through public relations research. Our mission is to provide

insights and advisory to help leaders make the best decisions possible.

The Harris Poll is separate from and not affiliated with TD Ameritrade,

which is not responsible for their services or policies.

About the Retirement & Health Survey

This survey was

conducted online within the United States by The Harris Poll on behalf

of TD Ameritrade from September 28 to October 6, 2018, among 1,503 U.S.

adults aged 45 and older with over $250,000 in investable assets,

including 750 who are financially independent or on the path to be.

“Financial independence” is defined as a state in which an individual or

household has sufficient wealth to live on without having to depend on

income from some form of employment.

1 https://www.census.gov/prod/cen2010/reports/c2010sr-03.pdf

2

https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.2018.05499