SANTA MONICA, Calif. & SEOUL, South Korea--(BUSINESS WIRE)--A group of investors, led by Dalton Investments (supported by a group of investors) with holdings in select equities listed in Korea today issued the following abridged letter to the Korea National Pension Service and the Government, the National Assembly of the Republic of Korea:

Dear Sirs and Madams,

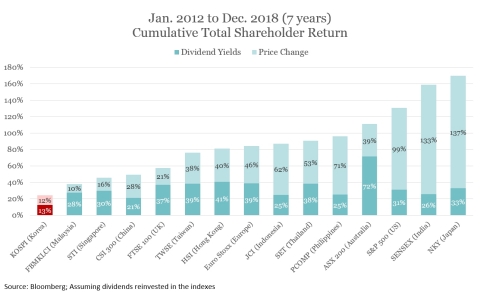

The Korean stock market is one of the worst performing and most undervalued markets in the world. Over the past seven years,1 KOSPI’s2 total shareholder return3 was just 25%4 despite the fact that corporate profits5 increased by 80% over the same seven-year period.

The Korea National Pension Service (“NPS”), which owns approximately 7% of the Korean equities market, and Korean individuals and institutions, which collectively own approximately 70% of the Korean market, have suffered greatly as a result of this sustained underperformance. The issue, however, extends to the entire country of Korea which is facing continuously slowing economic growth and the highest unemployment rate since 2001. While Korean companies have generated a great amount of value, this value has not been effectively transferred to Korean households and the economy.

As a united front, the Korean Government, NPS and individual Korean shareholders and institutions have a tremendous opportunity to improve the Korea Discount and shareholder returns by collectively encouraging public companies to effect much needed change. As such, we urge NPS and the Government of Korea to implement initiatives which will strengthen the governance standards of Korean companies and thereby improve returns across the Korean equities market.

I. Underlying Root Causes

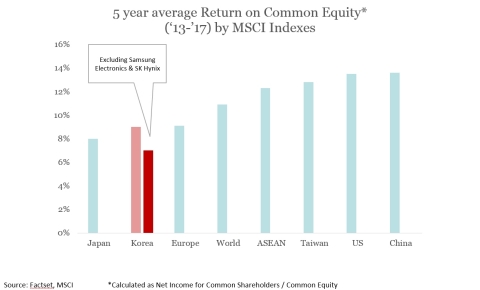

Chronic underperformance in the Korean equities market is driven by a systemic tendency of corporate management teams to pursue misguided capital allocation strategies, which inevitably ignore the interests of minority shareholders. This is clearly borne out by the numbers: The 5-year (’13-’17) average return on equity (“ROE”) for Korean companies is one of the lowest in the world (including both advanced and emerging economies) at 9% (7% excluding Samsung Electronics and SK Hynix)6, despite statistically higher capital expenditure (CapEx) levels in research and development and in businesses overall than any other market.

Korean companies are putting far too little focus on return on capital, risk-adjusted returns and basic minority shareholder interests. The capital expenditure strategies these companies are pursuing yield revenue growth but at what cost? Far too often, companies make investment decisions based on affiliate companies and conglomerates instead of their own shareholders.

We recommend that all capital allocation decisions be measured against the next best alternative (i.e., opportunity cost analysis), including share repurchases and dividend payouts, with an overarching objective to maximize long-term economic profit for all shareholders.

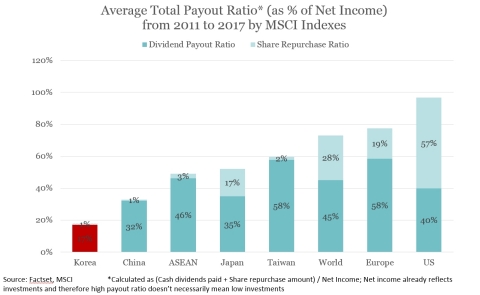

Regarding payouts to shareholders, it has become all too common for Korean companies to accumulate what amounts to a treasure trove of assets, including cash that sits idle and unproductive on balance sheets. Given no better alternative, Korean companies should return this capital to shareholders so that capital can be allocated to other opportunities. Instead, Korean companies hoard cash.

This has resulted in significantly below average payouts. By contrast, for example, Taiwan, a country which is economically similar to Korea, has an average dividend payout ratio of 58% compared to 17% for Korea. Taiwan’s total shareholder return was 3 times more than that of Korea for the past seven years.

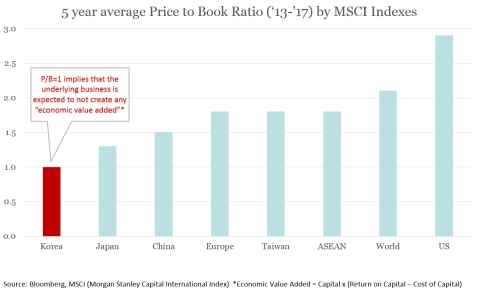

As a result of this mismanagement, Korea’s 5-year (’13-’17) average price to book (“PB”) ratio is one of the lowest in the world, trading below 1.0x,7 which means investors actually expect Korean companies to destroy economic value.

II. How to Fix It / Recommendations

Implementing better capital allocation strategies and aligning management incentives with those of all shareholders could profoundly and positively impact the value of Korean companies and the wealth of countless Korean individual investors. As the largest single shareholder of Korean equities, NPS has the ability to drive and lead this change.

About 17%8 of the portfolio of NPS is allocated to domestic equities, representing approximately $97 billion in investments. While NPS has generated a reasonable annual average return of 5.4%9, it has become difficult to generate high returns in this low interest rate environment. This will become an increasingly important issue as Korea’s rapidly aging society is expected to accelerate the pension fund’s depletion date. If structural changes are not implemented, which enable companies to achieve greater returns, NPS will have to increase the amount individuals contribute from their income to the fund by as much as 12-13% in the long-term and up to 38% in the very long term.10

We believe that the easiest way to ensure the stability and longevity of NPS – and to improve the economic vitality of the country – is to put in place proper governance guidelines that will improve the performance of the Korean equity market. Doing this will benefit retirement pension plans, Korean and foreign institutional and individual investors, as well as the country itself. Therefore, we recommend that NPS:

1. Focus on ensuring that any changes (e.g., payout increase) are measuring up to global standards and are sustainable.

- Most Korean companies improve their payout very gradually, comparing themselves only to Korean peers. The NPS should encourage companies to benchmark their payout policies to global standards.

- The NPS also should encourage changing the compensation and performance structure of the Korean companies’ executives to align their interests with those of all shareholders (including minority shareholders).

2. Actively exercise shareholder rights as a steward of people’s capital.

- Maintaining independence from the Government and other institutions.

- Hiring highly-qualified professionals and experts in the investment field.

- More actively exercising shareholder rights, particularly in light of the severely distorted nature of the Korean equity markets.

3. Focus on overall capital allocation and planning of companies to maximize long-term “economic value added” for all shareholders.

- Pressing companies, as a large shareholder, to focus on maximizing long-term “economic value added.”

- Checking capital allocations that prioritize the interests of affiliates and corporate groups over those of company’s shareholders.

- Reviewing capital efficiency through the separation of actually-employed capital and unemployed capital.

- Assessing the appropriate level of total payout by companies to shareholders.

4. Changes screening metrics that determine target companies for shareholder return improvement.

- Rather than holding fast to whether recent dividend payout ratios or yields meet minimum levels, we recommend NPS focus on a company’s idle cash accumulated over many years as an indicator that it needs to reevaluate its strategies.

5. Encourages its portfolio companies to prioritize share repurchases (including cancellation) over dividends when share prices are materially lower than estimated intrinsic value.

- This could provide lower-risk and higher returns on capital for continuing shareholders.

- Automatically cancel treasury shares when companies pursue buybacks. Repurchasing shares without cancellation should not – and does not – count as a direct return to shareholders.

The Korean Government and National Assembly also have a role to play. Implementing initiatives that encourage better management of companies, and therefore enhanced growth, can dramatically improve the welfare of the country. Specifically, we propose:

1. Better alignment of tax rates to encourage fairer practices.

- For example, reduce income tax rates on dividends to large shareholders to better align to the rest of the world (Korea taxes at 42% whereas Hong Kong and the U.S. tax at 0% and 23.8%11 maximum, respectively). Doing so would encourage management to use dividends, which benefit all shareholders, rather than pursuing inappropriate means to transfer wealth.

- Reduce the estate and gift tax for major shareholders. At a colossal 65% maximum rate, this tax is so high companies are incentivized to keep stock prices low when passing the company onto heirs, thereby hurting all shareholders.

- Reduce taxes on long-term equity investments to encourage Koreans to stay invested in equities longer. This would provide stability to the market overall.

2. Make the electronic voting system and cumulative voting system mandatory and separate the audit committee’s election.

- Adding electronic voting will encourage greater participation from minority shareholders, providing a check on the power of the largest shareholders without infringing on management control or rights.

3. Introduce a mandatory tender offer system that requires a potential buyer to not only make an offer to purchase shares held by the controlling shareholders but also make an offer to purchase shares held by the minority shareholders at the same price.

- Currently, buyers often pay a high premium only for the shares held by the controlling shareholders but then will not acquire shares or only acquire shares held by the minority shareholders at very low prices. This often hurts minority shareholders.

4. Relax certain excessive restrictions on capital allocation in regulated industries.

- For example, provide flexibility for bank financial holdings companies in order to improve payouts to shareholders. These companies are highly undervalued despite strong profitability and reasonable balance sheets. While ROE and capital ratios compare fairly to foreign competitors, valuations are below 50% of foreign peers with an average price to book ratio of just 0.5x.12 Average total payout ratio is estimated to be only approximately one-third of that of their foreign peers. Improving the payout ratio can help these companies unlock value.

5. Encourage automatic investment system for retirement pension as the “default option”

- A default option automatically allocates assets according to a pre-determined asset mix if the subscriber of a retirement pension system does not provide specific instructions for asset allocation. The asset mix can vary based on the subscriber’s years to retirement.

- This could reduce the current, excessively low equity investments due to oversight. The current equity exposure for private retirement pension assets in Korea is below 2%.13

Conclusion

The chronic underperformance of the Korean equities market can be greatly improved if NPS uses its authority to implement stronger standards for capital allocation strategies and incentivizes Korean company management teams to pursue business initiatives that are in the best interests of all shareholders, not just majority shareholders. Capital allocation is resource allocation, and resource allocation must be efficient so that it is able to create more wealth for the country, its companies and people.

If action is not taken now, this problem will only become more pronounced during a period of low growth, fierce competition, high unemployment, aging demographics and greater wealth inequality. As the largest shareholder of Korean equities, NPS has the power to push public companies to adopt better practices.

We remain ready to constructively assist you and make ourselves available to discuss at your convenience.

Sincerely,

Dalton Investments

Supported by (in alphabetical order):

The supporting group agrees with the general messages above but not necessarily with every specific detail or argument.

Brandes Investment Partners

KCGI

Ruane, Cunniff & Goldfarb

Value Partners

The full version of this letter and its accompanying presentation is available online at www.improvekorea.com.

About Dalton Investments

Dalton Investments LLC is a value-focused investment management firm with expertise in Asia equities, global equities and fixed income. Headquartered in Los Angeles, with a subsidiary office in Tokyo, Dalton manages $3.8 billion (November 30, 2018) in actively managed long-only and long/short strategies for pensions, endowments, foundations, financial institutions and family offices.

1 Source: Bloomberg

2 The Korea Composite

Stock Price Index

3 Share price change and dividend yield

4

Source: Bloomberg. Assumes reinvestment of dividends to the index

5

Source: FN Guide; Kiwoom Securities; Operating Profit of KOSPI 200 from

2012 to 2018 (estimate)

6 Source: Factset; Morgan

Stanley Capital International Indexes

7 Source: Factset;

Morgan Stanley Capital International Indexes

8 Source:

Korea National Pension Service

9 Source: Korea National

Pension Service

10 Source: Korea National Pension Service

11

For qualified dividends; the payee must own the stock for a long enough

time, generally 60 days for common stock and 90 days for preferred stock

and the dividend must also be paid by a corporation in the U.S. or with

certain ties to the U.S.

12 Source: Bloomberg

13

Source: Korea Financial Supervisory Service