SEATTLE--(BUSINESS WIRE)--Today Remitly, the largest independent digital remittance company in North America, announced a dramatic expansion of its global reach and the rollout of new service enhancements that make the process of sending money internationally faster, easier, more transparent, and less costly for immigrant communities around the world.

To date, Remitly has helped over 1 million customers in 13 countries. Today, the company multiplied its presence to 40 countries across Africa, Asia, Europe, the Middle East, and South America, and is now serving nearly 600 send-to-receive corridor combinations. This expansion allows the company to serve an additional $168 billion of the global remittance market.

“Immigrant communities around the world have long suffered from the limitations of antiquated ways of sending money to loved ones internationally,” said Matt Oppenheimer, Remitly CEO, and co-founder. “Our global growth speaks both to the incredible demand for a better way to transfer money internationally, and the trust more and more customers are placing in us every day to help them and their loved ones.”

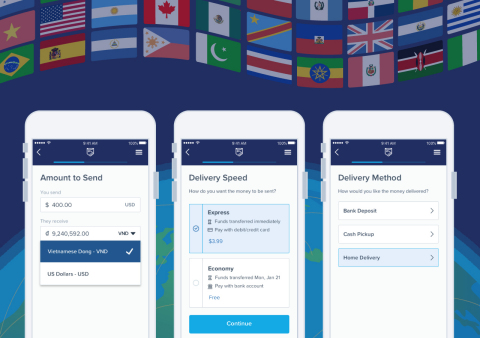

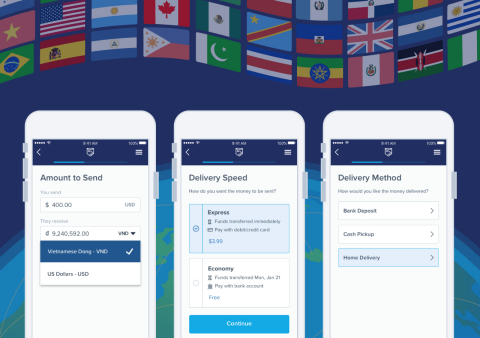

Remitly’s highest priority is to create the best possible experience for immigrant communities and their families around the world who rely on money transfers. Particularly, Remitly’s customers shared the need for more choices in how they send money and how their recipients receive it. The remittance industry has historically lagged in product customization due to the complexity of compliance regulations and the foreign exchange sector. Remitly now offers a growing variety of options in its global platform:

- More Delivery Options. Remitly lets customers choose how they want money delivered to their recipients: Senders can fund transfers with their bank account or card payment and allow recipients to receive funds directly in their bank account or at a cash pickup location. Remitly has also recently added additional delivery options in select countries: mobile wallets such as M-Pesa and home delivery.

- Speed Options. Remitly gives customers the power to send money within minutes with their Express option or customers can get a better rate with Remitly’s Economy option and money can arrive within three business days.

- Dual Currency. Remitly has unlocked the ability for customers to send money in the currency their loved ones need. Once a customer funds a transfer, the money they sent can be picked up in the recipient’s country in USD or local currency. This option is available at cash pickup locations, select bank accounts, or through home delivery.

These custom choices are all backed by Remitly’s Perfect Delivery Promise: an exact date and time that a customer and their recipient can expect their money to arrive. Once the Perfect Delivery Promise is provided to a customer, Remitly tracks the movement of funds as they approach the destination and updates customers each step of the way.

“Immigrant communities have long had sub-par remittance options. They have been disadvantaged by expensive, unreliable financial services, but we’re working hard to change this and have made great strides this year,” added Oppenheimer. “We are excited to continue our work to level the financial services playing field and better support immigrants’ unique needs by giving the best and most flexible options to send and receive money worldwide.”

For more information, please visit www.remitly.com.

About Remitly

Remitly is an independent digital remittance company that transfers over $6 billion in annualized volume through its proprietary global money transfer network across Africa, Asia, Central Europe, and South America. Its reliable and easy-to-use mobile app makes the process of sending money faster, easier, more transparent and less costly by eliminating the forms, codes, agents, extra time and fees typical of the traditional, century-old money transfer process. Remitly is backed by industry-leading investors, World Bank’s International Finance Corporation (IFC), Naspers’ PayU, Silicon Valley Bank, Stripes Group, DFJ, DN Capital, QED Investors, Trilogy Equity Partners, Bezos Expeditions, Founders’ Co-Op, and TomorrowVentures. The company is headquartered in Seattle, with additional offices in London, the Philippines, and Nicaragua. For more information, visit remitly.com.