DES MOINES, Iowa--(BUSINESS WIRE)--Nearly all American millennials (94 percent) plan on making financial resolutions in 2019, according to new data from Principal Financial Group®. As the year winds down, more Americans are reflecting on where they busted their budgets in 2018, and importantly, what they’re committed to correcting in 2019.

2018 budget busters and blunders

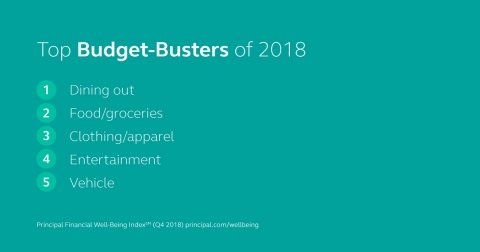

Food broke the bank for

Americans in 2018, taking the top two spots on the list of

budget-busters. Dining out (29 percent) and food/groceries (27 percent)

led the way, while clothing/apparel (21 percent), entertainment (17

percent) and vehicle expenses (17 percent) also made discernible dents.

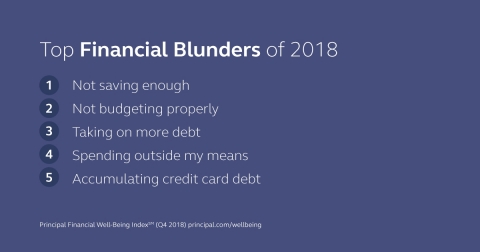

At the same time, Americans cite their biggest financial blunder as not saving enough (22 percent) in 2018, followed by not budgeting properly (11 percent). Other top blunders include:

- Taking on more debt (10 percent)

- Spending outside their means (9 percent)

- Accumulating credit card debt (9 percent)

“There’s no one-size-fits all magic bullet for spending versus saving. However, the more we can think about spending and saving instead of spending or saving, the better off people will be,” said Jerry Patterson, senior vice president of retirement and income solutions at Principal®. “Taking a hard look at where we missed the mark and committing to making the right changes is a key step for 2019 well-being.”

Americans are optimistic moving forward

In spite of these

blunders, optimism comes from a fresh start in financial New Year’s

resolutions. The top in 2019 overall include:

- To save more each month (46 percent)

- Reduce spending each month (38 percent)

- Pay off credit card debt (29 percent)

- Build an emergency fund (24 percent)

- Save more for retirement (21 percent)

“The new year is a chance for new opportunities and a clean slate. The challenge will be taking those good intentions and making them last into February and beyond,” added Patterson.

2019 concerns are familiar

More than half of those surveyed

(56 percent) are optimistic about the economy in 2019. However, the new

year isn’t without worry. The top concern is health care instability (40

percent), with about half (49 percent) of Baby Boomers having the

highest level of uneasiness. Other burdens include fluctuating gas (37

percent) and food prices (36 percent), political uncertainty (28

percent) and wages (23 percent).

“While Americans are feeling optimistic, they remain cautious about things that seem out of their control,” said Patterson. “The fact is we’ll never be able to control all the variables in our lives, but we can do smart, simple things to set ourselves up for success and help us better weather any possible storms.”

Methodology

The Holiday Spending & 2019 Outlook results come

from an online CARAVAN survey of 1,004 U.S. consumers over the age of

18. The survey was conducted by Engine from November 8–11, 2018.

Completed interviews are weighted by five variables: age, gender,

geographic region, race, and education to ensure reliable and accurate

representation of the total U.S. population (18 years of age and older).

Each respondent is assigned a single weight derived from the

relationship between the actual proportion of the population based on

U.S. Census data with a specific combination of the five variables

listed above. All sample surveys and polls may be subject to multiple

sources of error including but limited to sampling error, coverage

error, error associated with nonresponses, error associated with

question wording and response options, and post-survey weighting and

adjustments.

Principal helps people and companies around the world build, protect and advance their financial well-being through retirement, insurance and asset management solutions that fit their lives. Our employees are passionate about helping clients of all income and portfolio sizes achieve their goals – offering innovative ideas, investment expertise and real-life solutions to make financial progress possible. To find out more, visit us at principal.com.

Principal, Principal and symbol design and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group.