WASHINGTON--(BUSINESS WIRE)--The boom in U.S. oil and gas production over the past decade has exerted a moderating force on what is a large domestic merchandise trade deficit by helping reduce the country’s net petroleum imports, a new report by business information provider IHS Markit (Nasdaq: INFO) says. Continued U.S. production growth is now on track to make the country a net-exporter of petroleum for the first time since at least 1949.

The total U.S. merchandise trade deficit in 2017 was nearly $250 billion lower than it otherwise would have been if the petroleum (crude oil, refined products and natural gas liquids – petroleum liquids separated out from natural gas and also known as NGLs) trade deficit had remained at its 2007 level, the report finds. IHS Markit projects that the U.S. petroleum trade balance will further improve by roughly $50 billion between 2017 and 2022.1

The findings are part of a new report entitled Trading Places: How the Shale Revolution Has Helped Keep the U.S. Trade Deficit in Check. The report examines the impact of rising U.S. oil, natural gas and chemicals production on the domestic trade merchandise balance and how the U.S. position in energy and chemicals may evolve in coming years.

“The improved U.S. trade position in petroleum has been a counterbalancing force helping to keep the U.S. trade deficit in check over the past decade,” said Daniel Yergin, vice chairman, IHS Markit. “The resurgence of domestic oil and gas production has flipped the trade position of several products along the energy value chain on their heads, while that of other products, such as crude oil, have been significantly reduced.”

U.S. production of liquids (crude oil and natural gas liquids) nearly doubled from about 7 million barrels a day (mbd) in 2007 to 13 mbd in 2017 and 14.8 mbd in the first nine months of 2018. Crude oil alone rose from 5 mbd in 2007 to 9.4 mbd in 2017 and averaging 10.6 mbd in the first 9 months of 2018 -- and hitting 11.2 mbd in October 2018.

This rise, combined with a slight decline in domestic demand, contributed to a sharp fall in U.S. petroleum net imports as a share of total consumption – from a high of 60 percent in 2005 to 19 percent in 2017 and 14 percent in nine months of 2018.2

IHS Markit estimates that the U.S. petroleum trade deficit in dollars fell from about $320 billion in 2007 to about $75 billion in 2017 as net imports declined. During this same time, when the petroleum trade deficit was shrinking dramatically, the trade deficit for non-petroleum merchandise grew by about $230 billion.3

The continued growth of U.S. crude oil and NGL production—along with relatively flat liquids demand—are expected to make the U.S. a net-petroleum exporter by early next decade, the report says. This would be the first time since at least 1949 that the U.S. was not a net petroleum importer.

“The United States moving from net imports to being a net petroleum exporter would be an historic shift, something not achieved since at least the Truman administration,” said David Witte, senior vice president and division head for energy and chemicals at IHS Markit. “It speaks to the profound and continued impact that the U.S. shale boom has had in terms of investment, job creation, manufacturing, GDP and now trade."

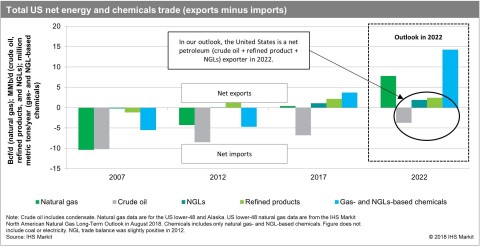

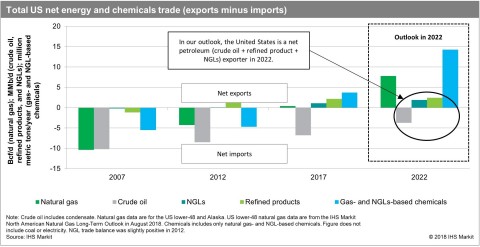

The resurgence of U.S. oil and gas production has already altered the domestic net trade position of a number of energy products over the same 2007-2017 period, the report says. IHS Markit expects exports of these products to continue to rise. They include:

- Refined products: from about 1 mbd of net imports in 2007 to about 2 mbd net exports in 2017 – a positive change of about 3 mbd

- Natural Gas Liquids: from 0.2 mbd net imports in 2007 to 1.1 mbd of net exports in 2017 – a positive change of more than 1 mbd.

- Natural Gas: from 10.4 bcf/d of net imports in 2007 to 0.4 bcf/d of net exports in 2017 – a positive change of nearly 11 bcf/d

- Gas-and NGL-based chemicals: from about 6 MMt/y of net imports in 2007 to about 4 MMt/y of net exports—a positive change of more than 9 MMt/y

- Crude oil: from about 10 mbd of net imports in 2007 to about 7 mbd of imports in 2017 – a positive change of about 3 mbd

The report does caution that trade tensions between the U.S. and its trading partners could introduce new risks and therefore alter the trajectory of global energy trade and energy demand. In particular, the report notes recent frictions with China, which is a growth market for U.S. exports of LNG, crude oil, NGLs and gas- and NGL-based chemicals.

“Overall turmoil in world trade patterns could not only dampen trade along the energy value chain but also affect global economic growth and thus impact demand for the many hydrocarbon and chemical products that depend on economic growth,” said Jeff Meyer, director, oil markets at IHS Markit.

Download the complete report: Trading Places: How the Shale Revolution Has Helped Keep the U.S. Trade Deficit in Check

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2018 IHS Markit Ltd. All rights reserved.

________________________________________________

1 IHS Markit estimates of the impact of changes in U.S.

petroleum volume trade flows on the U.S. merchandise trade balance

include some required assumptions, such as that crude oil is priced at

the WTI price.

2 Data on U.S. petroleum net imports as a

share of consumption are from the U.S. Energy Information Administration

(EIA) Monthly Energy Review, October 2018.

3 The

total merchandise trade balance data used in this calculation are from

the U.S. EIA Monthly Energy Review, October 2018; and the

petroleum trade balance data used are IHS Markit estimates. The total

U.S. merchandise trade deficit was little-changed in the 2007-17 period

($796 billion in 2017 versus $809 billion in 2007, according to the EIA).