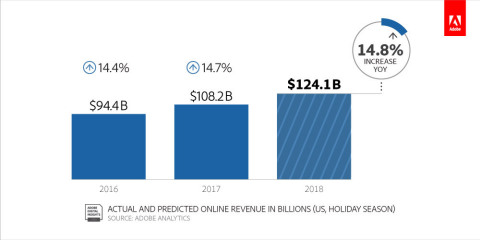

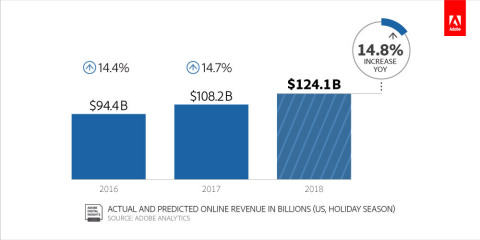

SAN JOSE, Calif.--(BUSINESS WIRE)--Adobe (Nasdaq:ADBE) today released its online shopping predictions for the 2018 holiday season (Nov. 1 through Dec. 31) powered by Adobe Sensei. Based on Adobe Analytics data, Adobe predicts that U.S. online sales will increase 14.8 percent, totaling $124.1 billion, while offline retail spending is expected to increase a modest 2.7 percent*. Cyber Monday will set a new record as the largest- and fastest-growing online shopping day of the year with $7.7 billion in sales, a 17.6 percent increase year over year (YoY). Online sales between 7 p.m. and 10 p.m. Pacific Time on Cyber Monday are expected to drive more revenue than an average full day in 2018, with conversions hitting the highest rate of the year, 7.3 percent, during these golden hours of online retail.

Thanksgiving Day sales are expected to increase by 16.5 percent, generating $3.3 billion. Nearly one out of five dollars this holiday season will be spent between Thanksgiving Day and Cyber Monday, generating $23.4 billion or 19 percent of total online sales. One extra calendar day between Cyber Monday and Christmas Day will give retailers a $284 million boost in sales. A record number of days will hit new revenue milestones, with 36 days surpassing $2 billion compared to just 22 days in 2017. Most anticipated gifts include 4K TVs, retro video games and consoles, as well as toys like Pomsies, Grumblies and Fortnite Monopoly.

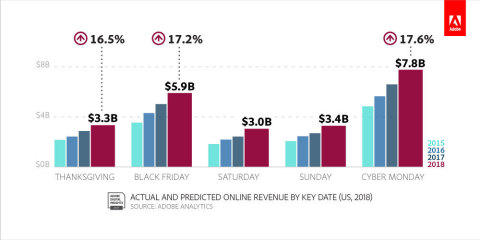

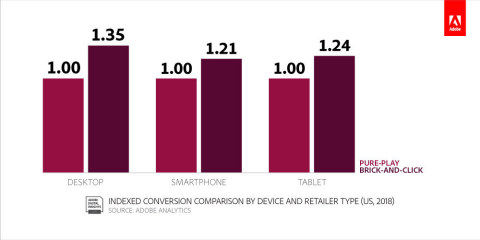

“As online shopping surges with another record-breaking holiday season, the retailers with compelling websites coupled with physical store locations will have the advantage,” said John Copeland, head of Marketing and Customer Insights at Adobe. “Many shoppers want to interact with retailers’ products and the brand in-store, and the ability to pick up online orders in-store within a matter of hours can’t be underestimated.”

Retailers with online and physical footprints are expected to see 28 percent higher conversion online in comparison to retailers lacking a traditional storefront. Adobe Analytics data anticipates shoppers increasingly buying online and picking up items in-store (BOPIS) during the holiday season. BOPIS has increased 119 percent since January 2018 across all retailers and over 250 percent for large retailers**. A survey of over 1,000 U.S. consumers shows nearly half (47 percent) expect to browse in-store for a product they intend to buy online later, jumping to 58 percent among millennials.

Additional predictions include:

- Top-selling products: Adobe predicts one percent of SKUs will drive a record 70 percent of sales during the holiday season, 30 percent more than during the rest of the year. 4K TVs, as well as retro video consoles and games such as Tekken 3, Ridge Racer Type 4 and Final Fantasy VII, are expected to perform well for the second consecutive year. Top toys include Fingerlings, Fortnite Monopoly, Grumblies, Hatchimal Hatchibabies, Jurassic World Jeep Wrangler, LEGO Harry Potter Hogwarts Great Hall set, and Pomsies.

- Best days for deals: Black Friday reigns supreme for discounts on electronics, including tablets (discounted at 33 percent), TVs (22 percent) and computers (16 percent). On the Sunday before Cyber Monday, shoppers will see the best deals on apparel (22 percent), appliances (18 percent) and jewelry (five percent). Cyber Monday will see the largest discounts on toys (19 percent), Giving Tuesday for furniture and bedding (14 percent) and Thanksgiving for sporting goods (13 percent).

- The mobile revenue opportunity: Smartphones continue to gain share as consumers’ preferred devices for online shopping, representing 48.3 percent of visits and 27.2 percent of revenue. Mobile revenue is up 11.6 percent YoY. Yet, completed cart orders happen over 20 percent less on smartphones than desktop, as a result of abandonment from sub-optimal checkout experiences. Closing this gap equates to $9 billion in mobile sales. Tablets are on the decline, making up 8.8 percent of visits (down 30 percent in four years) and just 9.6 percent of sales. Consumers using mobile apps will spend more time browsing and complete sales two times more often than on the web.

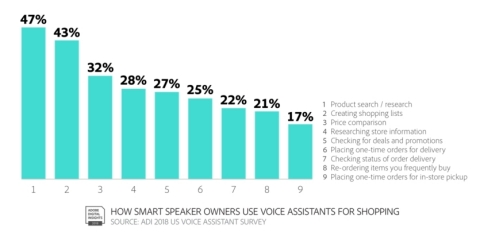

- Emerging shopping trends: Voice-assisted shopping is on the rise, with 21 percent of consumers reporting they are planning to reorder frequently-purchased items and 17 percent placing one-time orders for in-store pickup using their voice activated devices. Adobe expects holiday shoppers to ship and return purchases more often compared to the rest of the year (5 and 18 percent more respectively), and to shop more for experiences like cruises and hotels on Cyber Monday. More consumers will stay home on Thanksgiving Day. Sixty percent report they won’t shop in stores on Thanksgiving Day, up from 40 percent in 2016.

- Top revenue-driving marketing channels: Retailers will be able to capitalize on loyal customers that go directly to their website to make a purchase, with revenue per visit (RPV) rising the most at 36 percent. Search has the second highest RPV growth at 23 percent, followed by helper sites like RetailMeNot (15 percent) and email at 8 percent.

- Social losing value for retailers: Social referral traffic will generate 11 percent less RPV compared to Q4 2016. It is the only marketing channel to see a decline in RPV, despite the increase in referral traffic coming from social. Adobe attributes this to consumers’ weakening trust in social networks. Shoppers are also expected to consult social media sites 25 percent less for gift ideas this year.

Methodology

Adobe leverages Adobe Sensei, Adobe’s artificial intelligence and machine learning technology, to identify retail insights from trillions of data points that flow through Adobe Analytics and Magento Commerce Cloud, part of Adobe Experience Cloud. Adobe Analytics analyzes one trillion visits to U.S. retail sites, 55 million SKUs and 80 of the largest 100 U.S. web retailers*** – more than any other technology company.

Only Adobe’s analysis spans large, medium and small retailers across over 50 merchandise categories, powered by Magento Commerce Cloud, to provide the industry’s most accurate view of online shopping in the U.S. Adobe Experience Cloud manages more than 200 trillion data transactions annually. Companion research is based on a survey of over 1,000 U.S. consumers in October 2018.

Helpful Links

- Adobe Analytics’ 2018 Holiday Shopping Predictions full report

- Supporting CMO.com article

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

*Based on NRF’s 2018 overall retail sales forecast; assumes overall retail grows at the midpoint of the NRF’s range of growth forecasts (4.55 percent)

**Large retailers defined as being among the top 25% of retailers

***Based on the top 100 retailers in the Internet Retailer 2018 top 500 eGuide

© 2018 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in the United States and/or other countries. All other trademarks are the property of their respective owners.