NEW YORK--(BUSINESS WIRE)--Spotify Technology S.A. (NYSE:SPOT) today reported financial results for the third fiscal quarter of 2018 ending September 30, 2018.

Dear Shareholders,

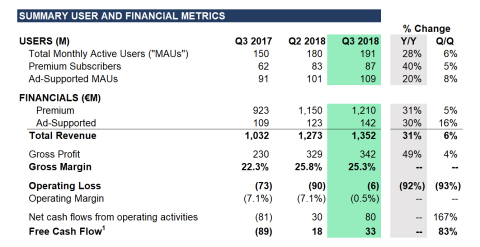

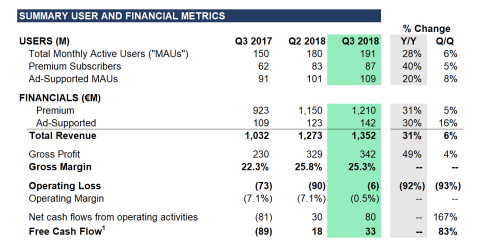

Today Spotify is reporting results for Q3 2018. The quarter was largely in line with our expectations and our guidance range, except that Operating Margin outperformed our forecast.

MONTHLY ACTIVE USERS

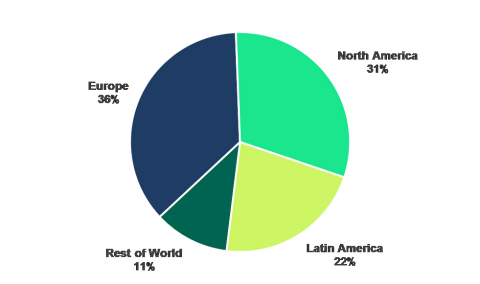

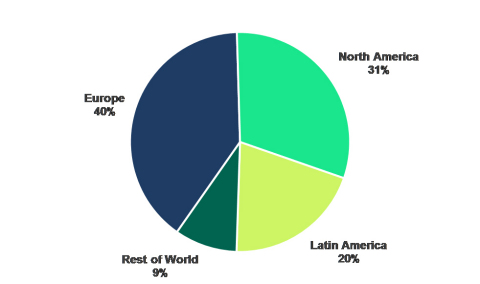

MAUs grew 28% Y/Y to 191 million at the end of Q3. Growth in our emerging regions of Latin America and Rest of World continues to outpace growth in our more established markets.

Ad-Supported MAUs totaled 109 million at the end of the quarter, up 20% Y/Y. Earlier this year we began rolling out a new user interface for our Ad-Supported tier of service, the first major revision since our mobile product was introduced in 2014. We expect this new user interface to drive improvements in engagement and retention.

We continue to work to identify and remove users that we consider to be “fake” from our reported metrics. This includes, but is not limited to, bots and other users who aim to manipulate stream counts for purposes of royalty calculations. Such users are removed from our metrics in a timely fashion once they are discovered. However, some such users may remain in our reported metrics because of the limitations of our ability to identify their accounts.

PREMIUM SUBSCRIBERS

Premium Subscribers totaled 87 million at the end of Q3, up 40% Y/Y. Growth continues to be healthy across our Family and Student plans, and the strong retention characteristics of this base continue to drive churn lower. In Q3 average monthly churn declined 90 bps Y/Y, as it did in Q2. This quarter we offered to verified Student subscribers in the US our first ever multi-partner bundle consisting of Spotify, Hulu, and Showtime for $4.99 per month. In addition, we expanded our 3-for-99¢ intro offer campaign for our Student plan globally during August and September to line up with the back-to-school season.

We also announced several other notable partnerships during Q3:

- Globally, Samsung will integrate Spotify into the setup experience on new phones, and Spotify will be the preferred music partner for Samsung’s multi-device ecosystem.

- In the UK and Ireland, Sky, Europe’s largest pay TV service, will allow users to add Spotify directly to their cable bill.

- In Japan, DAZN, a fast-growing sports subscription streaming service, will partner with Spotify on marketing campaigns promoting Spotify.

FINANCIAL METRICS

Revenue

Total Q3 revenue was €1,352 million, up 31% Y/Y. Excluding the negative impact from foreign exchange rates growth in revenue would have been 33% Y/Y.

Premium revenue was €1,210 million in Q3, up 31% Y/Y. On an F/X neutral basis, Premium revenue was up 34% Y/Y.

Average revenue per user (“ARPU”) was €4.73 in Q3. This represents a 6% Y/Y decline, a significant improvement from the 12% Y/Y ARPU decline we reported in Q2. Family and Student plan growth has caused a reduction in ARPU. The marginal downward pressure on ARPU has moderated as the installed base of Family and Student plan subscribers has grown. However, subscriber growth in low ARPU regions like Latin America, Southeast Asia, and other newly launched markets could add incremental downward pressure on ARPU. Changes in foreign exchange rates also contributed to the Y/Y decline in ARPU. Excluding the impact of changes in foreign exchange rates ARPU would have declined 4% Y/Y.

Ad-Supported revenue of €142 million re-accelerated its Y/Y growth in Q3 by 10 bps to 30% as compared with Q2’s Y/Y growth. This was a result of changes we made to our data policies in late Q2 to improve our ability to measure performance and show advertising effectiveness. While we did see changes in F/X rates in a number of markets, on a consolidated basis there was no material variance in the F/X neutral growth rate of Ad-Supported revenue.

Ad-Supported revenue growth was due primarily to Y/Y growth in our US direct channel of 32% and global growth in our programmatic channel of 44%. Direct sold ad revenue accounted for 78% of total Q3 Ad-Supported revenue. Demand in the US remains strong and is expected to outstrip our available inventory in Q4.

Last quarter we said that we expected our Programmatic and self-serve products to become a significant portion of our Ad-Supported revenue. If we’re successful in achieving this shift in revenue mix, then we also expect to achieve significant operating leverage in the ad sales business, increasing our operating margins. Last quarter we reported on our new automated self-serve platform, Ad Studio, which is live in the US, UK, Canada, and Australia. Ad Studio revenues are still quite small, but we’re seeing exponential growth, so expect to hear more about this product in future quarterly updates.

Gross Margin

Gross Margin was 25.3% in Q3, up from 22.3% in Q3 2017, and slightly lower than Q2. As we have previously discussed, Gross Margins are seasonally lower in Q1 and Q3 resulting from the costs of the major seasonal promotional campaigns we typically run in Q2 and Q4 each year. A majority of the expense of these promotional subscribers is absorbed following the quarter of intake onto the platform. As long as we maintain this promotional campaign cycle we would expect this seasonal pattern to continue.

Premium Gross Margin was 26.1% in Q3, down from 26.9% in Q2, but up from 22.9% in Q3 2017. Ad-Supported Gross Margin was 18.6% in Q3, up from 16.3% in Q2 and 17.0% in Q3 2017.

Ad-Supported Gross Margins are relatively strong in our top five markets and relatively weak in our 60 other markets, including newly launched markets. As these markets grow, we believe margins should too. Our Ad-Supported Gross Margin does not show the same seasonality as our Premium Gross Margin and has tended to increase quarterly during the calendar year.

Spotify for Artists

We launched several critical tools on our Spotify for Artists platform this quarter with the aim of making our two-sided marketplace more robust. On September 20, we announced the beta test of our direct upload feature which allows DIY and independent artists to upload their content straight to Spotify. Direct upload has been one of the most consistently requested features from artists over the years. These new tools provide an easy way for creators to get their content onto our platform, reach new and existing fans, and most importantly, get compensated for their work. These tools are in limited beta in the US, and we hope to expand the program further in the near future.

In addition to direct upload, we also launched a playlist submission feature in July, which enables artists, labels, and their teams to submit unreleased music directly to our editorial team for consideration for inclusion on our O&O playlists. Since then, more than 67,000 artists and labels have submitted content, and over 10,000 artists have been added to our playlists for the first time. Following the results of this beta test, we decided to open this feature to all creators in October. More than 30% of consumption on the platform continues to happen through these types of playlists. Today, approximately 250,000 creators and their teams use Spotify for Artists on a monthly basis.

Separately, we continue to invest in podcasts and other forms of spoken word audio entertainment. We signed an exclusive deal with Joe Budden to bring his self-titled podcast to Spotify on September 12. Since that time, The Joe Budden Podcast has become the #1 podcast on the platform and engagement has been increasing. Our overall market share of podcasts globally continues to grow, and we intend to continue to invest in exclusive and original content on this front through Q4 and beyond.

Operating Expenses / Income (Loss)

Operating expenses totaled €348 million in Q3, resulting in a total Operating Loss of €6 million, better than the low end of our guidance range. Operating Margin of (0.5%) is an improvement of more than 650 bps Y/Y.

Operating margin improvement in Q3 was largely due to shortfalls in hiring, which have continued into Q4. However, we intend to accelerate the pace of investment in R&D and Content in 2019 in order to capitalize on near-term and long-term growth opportunities. If we are successful in accelerating our investments in R&D and Content, these investments are likely to reduce our operating margins for the foreseeable future. We expect to provide guidance for 2019 as part of the Q4 2018 earnings report.

As of September 30, we had 4,040 full-time employees and contractors globally. Research & Development continues to make up the greatest share of hiring, accounting for more than 40% of headcount additions.

IFRS 16

Starting January 1, 2019, we will be adopting a new leasing standard as dictated by IFRS 16. In essence, certain leases which were held on the books as operating leases will be treated as capital leases going forward. Certain leases will be reclassified as assets and liabilities on the balance sheet which will yield increased depreciation and interest expense, offset by a reduction in rental expense. This will have a positive, albeit minimal, impact on Gross Margin, and a much more significant impact on Operating Margin. We will provide additional information on the impact of these changes when they go into effect next year.

Free Cash Flow

We generated €80 million in Net cash flows from operating activities and €33 million in Free Cash Flow in Q3. We maintain positive working capital dynamics, and our goal is to sustain and grow Free Cash Flow excluding the impact of capital expenditures associated with the build-out of new and existing offices in New York, London, Los Angeles, Stockholm, and Boston, among others. We paid out approximately €50 million associated with our office builds during the third quarter. We continue to anticipate these projects to cost more than €275 million and be substantially complete by the end of 2019.

At the end of the quarter we held €1.8 billion in cash and cash equivalents, restricted cash, and short term investments.

OUTLOOK

These forward-looking statements reflect Spotify’s expectations as of November 1, 2018 and are subject to substantial uncertainty. For the fourth quarter we are expecting:

- Total Monthly Active Users (“MAU”): 199-206 million, up 24-29% Y/Y

- Total Premium Subscribers: 93-96 million, up 30-36% Y/Y

- Total Revenue: €1.35-€1.55 billion, up 18-35% Y/Y. This includes a negative impact of approximately €20 million from foreign exchange rates; excluding this impact, up 20-37% Y/Y

- Gross Margin: 24.0-26.0%, lowered by 50 bps from prior guidance as a result of the impact of Google Home in Q4 (see below)

- Operating Profit/Loss: €15-(€35) million

GOOGLE HOME

Yesterday we announced a partnership with Google where Spotify will offer Google Home Mini speakers to Family plan master account holders in the US during the holiday season. We anticipate that this partnership will have an adverse impact of approximately 50 bps on our Gross Margin profile in Q4. This impact is baked into our guidance range above and accounts for all of the reduction in Gross Margin guidance provided previously.

TME INVESTMENT

As previously disclosed, we own shares of Tencent Music Entertainment Group (“TME”) which are classified on our balance sheet as a long term investment. During Q3, TME filed a Registration Statement publicly with the SEC, which contained objective evidence that required a mark to market adjustment of the fair value of our TME investment. The revaluation resulted in the recognition of a portion of the value of our net operating loss carryforwards for tax purposes, which resulted in Net Income for the first time in our operating history.

While TME has filed to go public in the US, their listing has not yet occurred. The value of our investment is held at a price per share of $6.52, which is the most recently estimated fair value of ordinary shares disclosed in TME’s publicly filed Registration Statement. Any deviation from this price at quarter end would trigger additional fair market value adjustments.

EARNINGS QUESTION & ANSWER SESSION

The Company will host a live question and answer session starting at 8 a.m. ET today on investors.spotify.com. Daniel Ek, our Co-Founder and CEO, and Barry McCarthy, our Chief Financial Officer, will be on hand to answer questions submitted to ir@spotify.com and via the live chat window available through the webcast. Participants also may join using the listen-only conference line:

Participant Toll Free Dial-In Number: (866) 393-4306

Participant

International Dial-In Number: (734) 385-2616

Conference ID 4243529

Use of Non IFRS Measures

This shareholder letter includes references to the non-IFRS financial measures of EBITDA and Free Cash Flow. Management believes that EBITDA and Free Cash Flow are important metrics because they present measures that approximate the amount of cash generated that is available to repay debt obligations, make investments, and for certain other activities that excludes certain infrequently occurring and/or non-cash items. However, these measures should be considered in addition to, not as a substitute for or superior to, net income, operating income, or other financial measures prepared in accordance with IFRS. This shareholder letter also includes references to the non-IFRS financial measures of Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect. Management believes that Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect are important metrics because they present measures that facilitate comparison to our historical performance. Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect should be considered in addition to, not as a substitute for or superior to, Revenue, Premium revenue, Ad-Supported revenue or other financial measures prepared in accordance with IFRS.

Forward Looking Statements

We would like to caution you that this letter to shareholders contains “forward-looking statements” as defined in Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with the safe harbor provisions. Such forward-looking statements involve significant risks, uncertainties and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections, including but not limited to the following known material factors: our ability to attract prospective customers and to retain existing customers; our dependence upon third-party licenses for sound recordings and musical compositions; our ability to comply with the many complex license agreements to which we are a party; our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; our lack of control over the providers of our content and their effect on our access to music and other content; our ability to accurately estimate the amounts payable under our license agreements; the limitations on our operating flexibility due to the minimum guarantees required under certain of our license agreements; our ability to obtain accurate and comprehensive information about music compositions in order to obtain necessary licenses or perform obligations under our existing license agreements; potential breaches of our security systems; risk associated with unauthorized access of our software and services and manipulation of stream counts and customer accounts; assertions by third parties of infringement or other violations by us of their intellectual property rights; risks related to our status as a foreign private issuer; dilution resulting from additional share issuances; the concentration of voting power among our founders who have and will continue to have substantial control over our business; tax-related risks; unanticipated changes relating to competitive factors in our industry; ability to hire and retain key personnel; changes in legislation or governmental regulations affecting us; international, national or local economic, social or political conditions; conditions in the credit markets; risks associated with accounting estimates, currency fluctuations and foreign exchange controls; and such other risks as set forth in our filings with the United States Securities and Exchange Commission.

We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent required by law.

|

Interim condensed consolidated statement of operations (Unaudited) (in € millions, except share and per share data) |

||||||||||||||

| Three months ended | Nine months ended | |||||||||||||

|

September 30,

2018 |

June 30,

2018 |

September 30,

2017 |

September 30,

2018 |

September 30,

2017 |

||||||||||

| Revenue | 1,352 | 1,273 | 1,032 | 3,764 | 2,941 | |||||||||

| Cost of revenue | 1,010 | 944 | 802 | 2,810 | 2,374 | |||||||||

| Gross profit | 342 | 329 | 230 | 954 | 567 | |||||||||

| Research and development | 135 | 143 | 98 | 393 | 273 | |||||||||

| Sales and marketing | 146 | 173 | 138 | 457 | 394 | |||||||||

| General and administrative | 67 | 103 | 67 | 241 | 191 | |||||||||

| 348 | 419 | 303 | 1,091 | 858 | ||||||||||

| Operating loss | (6) | (90) | (73) | (137) | (291) | |||||||||

| Finance income | 10 | 41 | 14 | 66 | 82 | |||||||||

| Finance costs | (85) | (343) | (219) | (582) | (429) | |||||||||

| Share in (losses)/earnings of associate | (1) | — | — | (1) | 1 | |||||||||

| Finance income/(costs) - net | (76) | (302) | (205) | (517) | (346) | |||||||||

| Loss before tax | (82) | (392) | (278) | (654) | (637) | |||||||||

| Income tax (benefit)/expense | (125) | 2 | — | (134) | 2 | |||||||||

| Net income/(loss) attributable to owners of the parent | 43 | (394) | (278) | (520) | (639) | |||||||||

|

Earnings/(loss) per share attributable to owners

of the parent |

||||||||||||||

| Basic | 0.24 | (2.20) | (1.84) | (2.96) | (4.24) | |||||||||

| Diluted | 0.23 | (2.20) | (1.84) | (2.96) | (4.24) | |||||||||

| Weighted-average ordinary shares outstanding | ||||||||||||||

| Basic | 180,510,524 | 179,077,124 | 151,289,732 | 175,835,503 | 150,840,515 | |||||||||

| Diluted | 188,120,122 | 179,077,124 | 151,289,732 | 175,835,503 | 150,840,515 | |||||||||

|

Interim condensed consolidated statement of financial position (in € millions) |

|||||||

|

September 30,

2018 |

December 31,

2017 |

||||||

| (Unaudited) | |||||||

| Assets | |||||||

| Non-current assets | |||||||

| Property and equipment | 135 | 73 | |||||

| Intangible assets including goodwill | 173 | 162 | |||||

| Investment in associate | — | 1 | |||||

| Long term investments | 1,589 | 910 | |||||

| Restricted cash and other non-current assets | 65 | 54 | |||||

| Deferred tax assets | 11 | 9 | |||||

| 1,973 | 1,209 | ||||||

| Current assets | |||||||

| Trade and other receivables | 359 | 360 | |||||

| Income tax receivable | 2 | — | |||||

| Short term investments | 669 | 1,032 | |||||

| Cash and cash equivalents | 1,095 | 477 | |||||

| Other current assets | 35 | 29 | |||||

| 2,160 | 1,898 | ||||||

| Total assets | 4,133 | 3,107 | |||||

| Equity and liabilities | |||||||

| Equity | |||||||

| Share capital | — | — | |||||

| Other paid in capital | 3,783 | 2,488 | |||||

| Other reserves | 758 | 177 | |||||

| Accumulated deficit | (2,947 | ) | (2,427 | ) | |||

| Equity attributable to owners of parent | 1,594 | 238 | |||||

| Non-current liabilities | |||||||

| Convertible notes | — | 944 | |||||

| Accrued expenses and other liabilities | 78 | 56 | |||||

| Provisions | 8 | 6 | |||||

| Deferred tax liabilities | 2 | 3 | |||||

| 88 | 1,009 | ||||||

| Current liabilities | |||||||

| Trade and other payables | 384 | 341 | |||||

| Income tax payable | 3 | 9 | |||||

| Deferred revenue | 240 | 216 | |||||

| Accrued expenses and other liabilities | 1,064 | 881 | |||||

| Provisions | 49 | 59 | |||||

| Derivative liabilities | 711 | 354 | |||||

| 2,451 | 1,860 | ||||||

| Total liabilities | 2,539 | 2,869 | |||||

| Total equity and liabilities | 4,133 | 3,107 | |||||

|

Interim condensed consolidated statement of cash flows (Unaudited) (in € millions) |

||||||||||||

| Three months ended | Nine months ended | |||||||||||

|

September 30,

2018 |

June 30,

2018 |

September 30,

2017 |

September 30,

2018 |

September 30,

2017 |

||||||||

| Operating activities | ||||||||||||

| Net income/(loss) | 43 | (394) | (278) | (520) | (639) | |||||||

| Adjustments to reconcile net loss to net cash flows | ||||||||||||

| Depreciation of property and equipment | 4 | 4 | 12 | 17 | 35 | |||||||

| Amortization of intangible assets | 3 | 2 | 3 | 7 | 6 | |||||||

| Share-based payments expense | 24 | 23 | 18 | 65 | 51 | |||||||

| Finance income | (10) | (41) | (14) | (66) | (82) | |||||||

| Finance costs | 85 | 343 | 219 | 582 | 429 | |||||||

| Income tax (benefit)/expense | (125) | 2 | — | (134) | 2 | |||||||

| Share in losses/(earnings) of associate | 1 | — | — | 1 | (1) | |||||||

| Other | (6) | (3) | (2) | (8) | 1 | |||||||

| Changes in working capital: | ||||||||||||

|

(Increase)/decrease in trade receivables

and other assets |

(29) | 12 | (39) | (2) | (66) | |||||||

| Increase/(decrease) in trade and other liabilities | 86 | 78 | (15) | 234 | 252 | |||||||

| Increase in deferred revenue | 5 | 7 | 10 | 21 | 34 | |||||||

| (Decrease)/increase in provisions | (3) | (4) | 1 | (10) | 47 | |||||||

| Interest received | 3 | 2 | 4 | 15 | 13 | |||||||

| Net income tax (paid)/received | (1) | (1) | — | (8) | 2 | |||||||

| Net cash flows from/(used in) operating activities | 80 | 30 | (81) | 194 | 84 | |||||||

| Investing activities | ||||||||||||

| Purchases of property and equipment | (49) | (5) | (9) | (60) | (15) | |||||||

| Purchases of short term investments | (54) | (444) | (237) | (769) | (904) | |||||||

| Sales and maturities of short term investments | 279 | 451 | 257 | 1,160 | 843 | |||||||

| Change in restricted cash | 2 | (7) | 1 | (9) | (35) | |||||||

| Other | (22) | (12) | (1) | (44) | (45) | |||||||

| Net cash flows from/(used in) investing activities | 156 | (17) | 11 | 278 | (156) | |||||||

| Financing activities | ||||||||||||

| Proceeds from issuance of ordinary shares | — | — | — | 4 | — | |||||||

| Proceeds from exercise of share options | 50 | 57 | 2 | 146 | 22 | |||||||

| Other | (1) | (2) | (2) | (3) | (4) | |||||||

| Net cash flow from financing activities | 49 | 55 | 9 | 147 | 27 | |||||||

| Net increase in cash and cash equivalents | 285 | 68 | (61) | 619 | (45) | |||||||

| Cash and cash equivalents at beginning of the period | 810 | 733 | 732 | 477 | 755 | |||||||

| Net exchange gains/(losses) on cash and cash equivalents | — | 9 | (3) | (1) | (42) | |||||||

| Cash and cash equivalents at period end | 1,095 | 810 | 668 | 1,095 | 668 | |||||||

|

Reconciliation of IFRS to Non-IFRS Results (Unaudited) (in € millions, except percentages) |

||||||||||||

| Three months ended | Nine months ended | |||||||||||

|

September 30,

2018 |

September 30,

2017 |

September 30,

2018 |

September 30,

2017 |

|||||||||

| IFRS revenue | 1,352 | 1,032 | 3,764 | 2,941 | ||||||||

| Foreign exchange effect on 2018 revenue using 2017 rates | 24 | 200 | ||||||||||

| Revenue excluding foreign exchange effect | 1,376 | 3,964 | ||||||||||

| IFRS revenue year-over-year change % | 31 | % | 28 | % | ||||||||

|

Revenue excluding foreign exchange effect year-over-year

change % |

33 | % | 35 | % | ||||||||

| IFRS Premium revenue | 1,210 | 923 | 3,397 | 2,655 | ||||||||

| Foreign exchange effect on 2018 Premium revenue using 2017 rates | 24 | 178 | ||||||||||

| Premium revenue excluding foreign exchange effect | 1,234 | 3,575 | ||||||||||

| IFRS Premium revenue year-over-year change % | 31 | % | 28 | % | ||||||||

|

Premium revenue excluding foreign exchange effect year-over-year

change % |

34 | % | 35 | % | ||||||||

| IFRS Ad-Supported revenue | 142 | 109 | 367 | 286 | ||||||||

| Foreign exchange effect on 2018 Ad-Supported revenue using 2017 rates | — | 22 | ||||||||||

| Ad-Supported revenue excluding foreign exchange effect | 142 | 389 | ||||||||||

| IFRS Ad-Supported revenue year-over-year change % | 30 | % | 28 | % | ||||||||

|

Ad-Supported revenue excluding foreign exchange effect year-over-year

change % |

30 | % | 36 | % | ||||||||

|

EBITDA (Unaudited) (in € millions) |

|||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||

|

September 30,

2018 |

June 30,

2018 |

September 30,

2017 |

September 30,

2018 |

September 30,

2017 |

|||||||||||

| Net income/(loss) attributable to owners of the parent | 43 | (394) | (278) | (520) | (639) | ||||||||||

| Finance (income)/costs - net | 76 | 302 | 205 | 517 | 346 | ||||||||||

| Income tax (benefit)/expense | (125) | 2 | — | (134) | 2 | ||||||||||

| Depreciation and amortization | 7 | 6 | 15 | 24 | 41 | ||||||||||

| EBITDA | 1 | (84) | (58) | (113) | (250) | ||||||||||

|

Free Cash Flow (Unaudited) (in € millions) |

|||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||

|

September 30,

2018 |

June 30,

2018 |

September 30,

2017 |

September 30,

2018 |

September 30,

2017 |

|||||||||||

| Net cash flows from/(used in) operating activities | 80 | 30 | (81) | 194 | 84 | ||||||||||

| Capital expenditures | (49) | (5) | (9) | (60) | (15) | ||||||||||

| Change in restricted cash | 2 | (7) | 1 | (9) | (35) | ||||||||||

| Free Cash Flow | 33 | 18 | (89) | 125 | 34 | ||||||||||

| 1 Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS Measures” and “Reconciliation of IFRS to Non-IFRS Results” for additional information. |