NAPLES, Fla.--(BUSINESS WIRE)--ASG Technologies, the trusted provider of proven solutions for information access, management, and governance for the world’s top enterprises and a portfolio company of Elliott Associates, L.P. and Elliott International, L.P., today sent a letter to the Board of Directors of Mitek Systems, Inc. (NASDAQ: MITK) following up on its recent proposal to acquire the company. The offer, for $10.00 per share in cash, represents a 51% premium on the unaffected closing stock price on October 9, 2018.

According to the letter, “a transaction resulting from the proposal would provide certain, premium value to [Mitek] shareholders and would be superior to the uncertainty and risks inherent in replacing the top two executives at the company and attempting to regain the confidence of investors through a turnaround of operational performance.”

The full text of the letter is as follows:

October 31, 2018

The Board of Directors

Mitek Systems, Inc.

600 B Street, Suite

100

San Diego, CA 92101

Dear Members of the Board:

I am writing to you on behalf of ASG Technologies Group, Inc. (“we” or “ASG”), a portfolio company of Elliott Associates, L.P. and Elliott International, L.P. (together, “Elliott”). As background, ASG is a global provider of mission-critical enterprise software products across several distinct markets, including enterprise content management, systems management tools, data intelligence, and digital workspaces.

For the past five months, ASG has conducted substantial diligence on Mitek Systems, Inc. (together with its subsidiaries, collectively the “Company” or “Mitek”) based on publicly available information, including on its markets served and competitors. Over the past two months, we have had discussions with Mitek’s management team and Board of Directors regarding the best path forward for the Company. While we appreciate the time that the management team and Board have spent with us, we have been disappointed that the Board has been unwilling to engage on our two prior non-binding written acquisition proposals to acquire the Company.

Today, ASG is reaffirming its proposal to acquire Mitek for $10.00 per share in cash, a 51% premium above the unaffected closing price on October 9, 2018. This preliminary, non-binding proposal (the “Proposal”) is outlined in the terms detailed below. We believe a transaction resulting from the Proposal would provide certain, premium value to shareholders and would be superior to the uncertainty and risks inherent in replacing the top two executives at the company and attempting to regain the confidence of investors through a turnaround of operational performance. As an indication of our conviction in the Proposal, Elliott has made a substantial investment in the common stock and economic equivalents of the Company and is now one of Mitek’s largest investors.

We are also aware that several of your largest shareholders are supportive of an exploration of a sale and have communicated this directly to the Board. Several shareholders have expressed disappointment that the Board has failed to engage in acquisition interest at a significant premium, especially in the context of the Company’s current situation. We and those shareholders believe that best-in-class corporate governance would call for the formation of a special committee of the Board and the hiring of advisors to engage with potential acquirers. Based on our understanding to date, the Board has failed to take these necessary steps and has been unwilling to engage.

Our letter today is organized around the following:

- ASG Introduction

- Mitek’s Strategic Fit with ASG

- Mitek’s Performance as a Public Company

- Path Forward

- Details and Financing of the Proposal

- Due Diligence Requirements

- Next Steps

Our team is ready to engage immediately on confirmatory diligence and can move forward on an expedited basis.

ASG Introduction

As a global provider of mission-critical enterprise software products, ASG delivers infrastructure software solutions to over 3,000 customers (including 70% of the Fortune 500) across a wide range of end markets with a focus on several verticals, including financial services, healthcare, government, telecommunications, large retail, and manufacturing. ASG is headquartered in Naples, Florida, with global revenue of approximately $240 million and over 1,000 employees worldwide.

ASG has a strong content repository offering in Mobius, and believes there is an opportunity to build a content services solution suite around this offering by acquiring best-in-class capabilities in areas such as document capture, business process management, robotic process automation, and text analytics, among others. In March 2018, ASG acquired Mowbly, a low-code business process management solution as the first step in building out our content services suite.

Elliott acquired a controlling stake in ASG in April 2017. During the first six months of Elliott’s investment, ASG undertook an extensive market-mapping exercise to identify the highest priority targets within each of the major content services sub-segments mentioned above. That included a considerable amount of time mapping out the document capture market and the major players. We identified document capture, and specifically acquiring one of the leading mobile capture solutions in the market, as a key M&A priority.

Mitek’s Strategic Fit with ASG

We have conducted extensive research to better understand Mitek’s operations and strategy, including working with respected technology, intellectual property, and management consultants to examine the document capture markets and the Company’s relative position in those markets. With the assistance of these consultants, we have evaluated the capabilities and competitive positioning of Mitek’s products, technology, and patents. In addition, we have conducted deep diligence on Mitek’s competitors in both the capture and identity verification market segments. We believe this time- and resource-intensive exercise has given us a strong understanding of the markets in which Mitek participates, as well as a thoughtful appreciation of the Company’s competitive strengths and challenges.

We also believe that Mitek employees will benefit from a combination with ASG. We have a seasoned enterprise software executive team that knows how to grow through product innovation and sales excellence. Mitek employees would join a scale and global company with over 1,000 employees across 40 offices, with ample opportunities for continued career progression and development. We care deeply about our people and invest in their growth, as well as in tangible areas to help them to succeed.

Lastly, we believe Mitek’s customers will benefit from a combination with ASG. We are a global software company with an explicit focus on customer success, and our motto of “big enough to matter, small enough to care” permeates our interactions internally and allows us to have strong relationships with our enterprise customers. These relationships can help accelerate the adoption of Mitek’s identity verification solutions. We strongly believe that the best future for Mitek’s products is as a part of a broader platform at ASG where we can invest behind extending the Company’s identity verification solutions via further automation. We will be able to provide our financial services customers with a compelling, end-to-end information management solution, cross-selling Mitek’s mobile capture offering into our Mobius content repository customer base.

Mitek’s Performance as a Public Company

Since its IPO in 2011, Mitek has enjoyed solid revenue growth and remains the market-share leader in mobile check capture solutions, with over 6,100 financial services customers, 80+ million users, over 2 billion mobile deposits captured, and $1.5 trillion of mobile check deposit transactions processed. From a financial perspective, revenue has grown at a CAGR of 28% since fiscal year 2011. We believe the acquisition of IDchecker in 2015 to expand the Company’s product set into the growing market of identity verification was a great move to diversify Mitek away from its exposure to the secularly declining checking end market, and the more recent acquisition of A2iA added important image analysis capabilities to Mitek’s portfolio. Jim DeBello and the rest of the management team have driven impressive growth at the Company.

However, despite this strong growth, the declining usage of paper checks has resulted in the public markets being unkind to Mitek. In addition, the recent announcement of the upcoming departures of CEO Jim DeBello and CFO Jeff Davison, Mitek’s top two executives, has severely shaken shareholder confidence as evidenced by the recent decline in stock price that was reversed only when the existence of our Proposal was reported in the press. More importantly, the departures create significant operational uncertainty and risk.

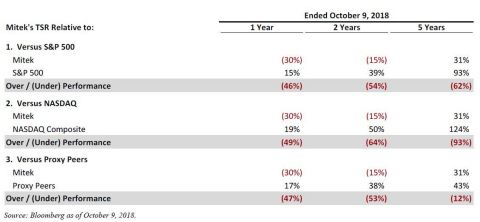

Mitek’s stock price has underperformed all relevant benchmarks over the past 1, 2, and 5-year periods. Despite Mitek’s market position, execution, and leadership over this period, shareholders have not been beneficiaries of outsized shareholder returns.1 See Image 1: Mitek’s TSR Relative to 1, 2, and 5-Year Periods from October 9, 2018 (Source: Bloomberg as of October 9, 2018).

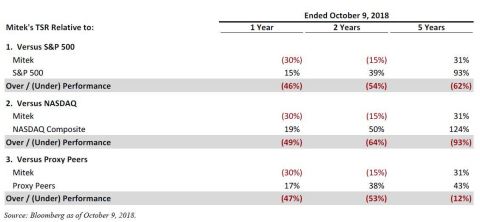

Over the past four years, Mitek’s non-GAAP profit margin has deteriorated significantly. This has been driven by several factors, including elevated investment in R&D and increases in costs associated with the Company’s hosting environment and web services. Despite Mitek’s revenue growing at a rate of over 35% per year since fiscal year 2015, non-GAAP profit margin has declined by 1,600 basis points. See Image 2: Mitek Non-GAAP Profit Margin Since FY’15 (Source: Company filings).

Additionally, the Company has had limited success in building out additional growth vectors in identity verification. Without the proper management team or strategy, we believe that the Company will be a sub-scale player in a hyper-competitive market. We and Elliott have conducted extensive market diligence on document capture, mobile check capture, and identity verification, and have learned that, despite Mitek being regarded as a leader in check capture solutions through strong IP and product capabilities, the Company’s capabilities in identity verification are very early and perceived to not be as robust as those of other fast-growing competitors. Mitek’s sales model is primarily indirect and utilizes system integrators and resellers, making it unlikely for the Company to have sustained success pursuing direct enterprise sales of identity verification.

Path Forward

We believe our Proposal offers shareholders a compelling, premium value and is the best risk-adjusted path forward. We have already completed substantial diligence on the Company and are requesting engagement by the Board to allow us to perform confirmatory diligence on an expedited basis. There are several important factors the Board should take into account, most notably the following:

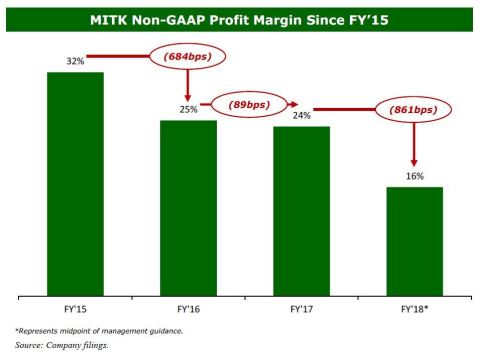

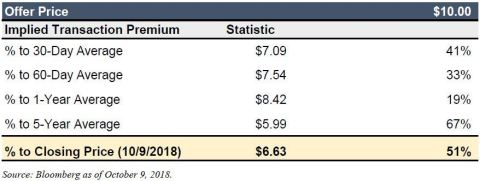

-

A sale at $10.00 per share in cash generates a significant premium

above the average share price for all relevant periods, including a

51% premium over the closing share price the day prior to ASG’s

interest in acquiring Mitek being reported in the press. The

opportunity to secure this level of premium absolutely should be

explored, especially given (1) execution risk with the management

succession plan, (2) future operational risks and increasing

competition in the identity verification and check capture markets,

and (3) over two-thirds of the business is tied to the secularly

declining check deposit capture market. Given these serious and

imminent risks, we strongly believe that Mitek’s shareholders face the

strong possibility of permanent impairment to the value of

their Mitek shares if Mitek chooses to stay public. See Image 3: Offer

Price and Implied Transaction Premiums (Source: Bloomberg as of

October 9, 2018).

The offer represents a price level that Mitek has seldom traded at over the last 5 years, with the stock only closing at or above $10.00 for 1 day in the last calendar year. See Images 4 and 5: Mitek 1-Year Performance and Mitek 5-Year Performance (Source: Capital IQ as of October 9, 2018).

-

Mitek has significantly underperformed against key indices such as the

S&P 500 and NASDAQ Composite over the past 5 years. The historical

volatility in the stock is an area of concern, which we believe is

addressed by providing shareholders certainty of value. See Images 6

and 7: Mitek 1-Year Performance vs. S&P 500 and NASDAQ and Mitek

5-Year Performance vs. S&P 500 and NASDAQ (Source: Capital IQ as of

October 9, 2018).

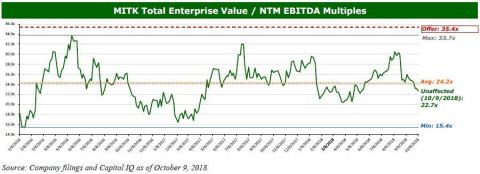

- Our offer represents a purchase multiple of 35.4x NTM EBITDA based on consensus estimates. This represents a significant premium above the average and current multiple over the past 3 years, and eclipses the highest NTM EBITDA multiple at which Mitek has ever traded (33.7x in May 2016). See Image 8: Mitek Total Enterprise Value / NTM EBITDA Multiples (Source: Company filings and Capital IQ as of October 9, 2018).

Details and Financing of the Proposal

We propose to acquire Mitek for $10.00 per share in cash for 100% of the outstanding shares of the Company, representing an enterprise value of approximately $425 million. Our Proposal represents a premium of 51% over the closing stock price the day prior to the publication of news articles regarding ASG’s interest in acquiring Mitek. We believe this Proposal represents a compelling, premium value to shareholders.

We expect that we would finance the acquisition and related fees and expenses with a combination of cash from our balance sheet, debt financing from third-party lenders, and cash equity invested by Elliott and our other shareholders. To secure third-party debt financing, we would anticipate working with our existing lenders to refinance our existing credit facility and put in place an upsized credit facility. We have received financing indications from these banks and are highly confident that we will have fully committed financing in the timeline outlined below.

The equity necessary to complete the acquisition would be funded by ASG’s balance sheet, Elliott, and our other shareholders. Elliott has approximately $35 billion of capital under management and has adequate capital to consummate the acquisition.

ASG’s management team and Board of Directors have been fully briefed on the Proposal and are supportive of ASG moving expeditiously to complete the transaction. As Elliott consists of privately held investment funds over which its affiliates have full discretion, no corporate or shareholder approvals or other extraordinary conditions are required to consummate Elliott’s equity financing for the acquisition.

Lastly, this Proposal is not intended to be legally binding and is subject to, among other things, the negotiation and execution of a mutually satisfactory definitive acquisition agreement containing provisions customary for this type of transaction, regulatory approvals, and satisfactory completion of our due diligence.

Due Diligence Requirements

We believe we can complete our confirmatory due diligence in an expedited manner if we are provided appropriate access to management and information. Given our familiarity with the Company through our extensive public diligence to date, our diligence will be highly targeted.

Prior to the execution of a definitive purchase agreement, we would anticipate completion of the following activities: (i) customary company and financial diligence, including reviews of historical and future prospects for the business; (ii) engaging a leading accounting firm to conduct a confirmatory accounting and tax review; (iii) completion of confirmatory legal due diligence by our legal counsel; and (iv) further evaluation of the Company’s technology platform. We have the ability to consummate the transaction on an accelerated basis, and we are prepared to immediately engage in our final due diligence review of the Company.

Next Steps

We want to thank the Board for considering this Proposal. We are eager to move ahead by signing an NDA and commencing diligence. Please do not hesitate to contact me with questions, and we will look forward to hearing from you soon.

We are confident that a value-maximizing transaction is achievable, and we remain enthusiastic about the opportunity to continue our dialogue with the Company and the Board. I want to thank you for considering our thoughts and proposal and look forward to a constructive dialogue. I am always available to answer any questions you may have.

Sincerely,

Charles Sansbury

Chief Executive Officer

ASG Technologies

Group, Inc.

About ASG Technologies

ASG Technologies Group, Inc. provides global organizations with a modern approach to Digital Transformation to succeed in the Information Economy. ASG is the only solutions provider for both Information Management and IT Systems. ASG’s Information Management solutions enable companies to find, understand, govern and deliver information of any kind, from any source – whether structured or unstructured – through its lifecycle from capture to analysis to consumption. The IT Systems Management solutions empower companies to support traditional and modern digital initiatives, operate their IT infrastructure more efficiently and effectively and reduce the cost of managing and running their internal IT systems landscape. ASG is proud to serve more than 3,000 customers worldwide in 60 countries and in top vertical markets including Healthcare, Financial Services, Insurance and Government. For more information, visit ASG.com or connect with us on LinkedIn, Twitter and Facebook.

_______________________________

1 Note: All stock

performance charts are based on the closing price of $6.63 on October 9,

2018, the day before the Reuters article.