BOSTON--(BUSINESS WIRE)--Financial wellness programs continue to increase in popularity as a workplace benefit, with a recent Fidelity Investments study1 showing that 90 percent of companies currently offer a financial wellness solution, with another 10 percent considering adding a financial wellness program to their benefits platform. In response to this increasing demand for a more personalized approach to financial wellness, Fidelity Investments today announced a new solution that delivers targeted information to help nearly 20 million workers address the financial challenges most important to them.

Fidelity’s financial wellness solution utilizes innovative technology to help employees assess their financial wellness needs, identify their top financial challenges and then access solutions to take the initial steps to improve their financial health. Many financial wellness solutions take a “one size fits all” approach and simply provide general information without helping employees understand how to take action and create their own personalized plan. However, Fidelity’s new financial wellness solution creates a targeted financial wellness plan that is designed to help meet each employee’s unique financial needs while connecting them with the resources they need to take steps to implement their plan.

“Financial wellness programs are an excellent way to help employees build confidence and improve their overall financial picture, as well as help employers address key workforce priorities, such as retaining top talent – according to Fidelity research, more than half of employees indicated they were more likely to stay with their employer if they had access to more financial help,” said Kevin Barry, president of Workplace Investing, Fidelity Investments. “However, since each person is unique and has a unique set of financial goals and challenges, Fidelity’s financial wellness program provides a personalized experience targeted to the needs of each employee and connects employees with the solutions to help them do it.”

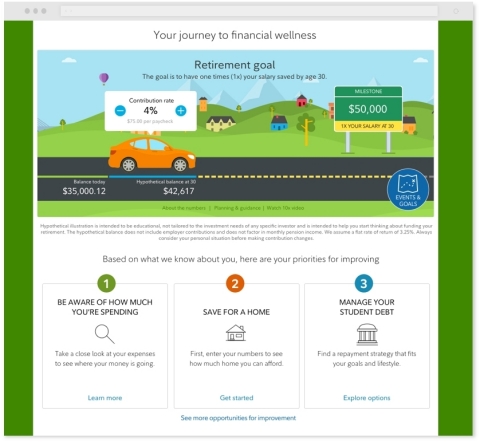

Fidelity’s financial wellness offering, which is available through Fidelity’s NetBenefits employee benefits portal, provides education and guidance on a broad range of financial topics for employees at different stages in their career and as they experience a variety of life events. Following are additional details on the components that are designed to help employees develop a targeted financial wellness solution:

- A “Personalized Action Plan” for each employee. Fidelity’s financial wellness solution will leverage data and information available on each employee to highlight the top areas an employee can consider to improve their financial health. Fidelity’s new financial wellness solution will include information to help employees in over 30 different areas, including employee benefits (workplace savings plans, company stock plans, charitable gift programs), budgeting and debt (student debt, mortgages, emergency savings, debt counseling), saving and investing (college savings, IRAs, annuities, brokerage accounts) and protection (long-term care, estate planning, identity protection, life insurance).

- Financial wellness assessment to develop a personalized plan. Using Fidelity’s Money Checkup, employees are able to generate a personalized financial wellness score by answering questions about their background and lifestyle, as well as saving and spending habits. Individuals can also share how they feel about their financial future, and highlight top financial goals and concerns. This information is used to help employees understand where they stand, set priorities, get educated, and track their progress.

- Employees are connected with tools and solutions to help address their financial wellness needs. Fidelity’s financial wellness solution will connect an employee with tools, information and products that can help them get started and take immediate action to address their top financial challenges. These solutions include online tools and calculators, webinars and informational articles, as well as connect to products from both Fidelity (such as Fidelity Cash Management or Fidelity 529 plans) and third-party2 providers (such as Credible.com® for help with student debt, Money Management International® for credit counseling and debt management and IDNotify® powered by Experian™ for identity protection).

Financial Wellness Plays a Direct Role in an Employee’s Total Well-being

Employers are increasingly recognizing the correlation between financial wellness and health, work and life wellness and the critical role finances play in an individual’s total well-being. A recent study3 from Fidelity Investments found that financial issues were one of the top causes of stress among employees, with saving for the future and paying off debt cited as two of the top financial challenges. Employee debt is also linked to lower productivity at work, and workers with the highest levels of debt have twice the absenteeism of those with the lowest levels of debt and miss an additional full week of work.

Fidelity’s survey also found that financial challenges can lead to health challenges – poor physical health generally correlates to poor financial health, and vice versa.

“Health wellness is intrinsically connected to financial wellness, and our finances can have an impact on our physical health,” continued Barry. “Fidelity’s ‘health meets wealth’ approach reflects our belief that helping an individual improve their health will also help their pocketbook and ultimately contribute to a more focused, engaged and productive employee.”

About Fidelity’s Financial Wellness program

Fidelity

understands employers are looking for help addressing the financial

wellness needs of a broad spectrum of workers, ranging from individuals

with basic financial needs to employees with more complex financial

challenges, and recognize financial wellness can have a direct impact on

workplace productivity, benefits engagement and optimization, and

outcomes to drive workforce management. The Financial Wellness program

demonstrates Fidelity’s commitment to helping address these broad needs

while enabling employers to confidently achieve the outcomes they desire

for their employees and their organization.

About Fidelity Investments

Fidelity’s mission is to inspire

better futures and deliver better outcomes for the customers and

businesses we serve. With assets under administration of $7.4 trillion,

including managed assets of $2.6 trillion as of September 30, 2018, we

focus on meeting the unique needs of a diverse set of customers: helping

more than 28 million people invest their own life savings, 23,000

businesses manage employee benefit programs, as well as providing more

than 13,000 financial advisory firms with investment and technology

solutions to invest their own clients’ money. Privately held for 70

years, Fidelity employs more than 40,000 associates who are focused on

the long-term success of our customers. For more information about

Fidelity Investments, visit https://www.fidelity.com/about.

Links to third-party web sites may be shared in this press release. Those sites are unaffiliated with Fidelity. Fidelity has not been involved in the preparation of the content supplied at the unaffiliated site and does not guarantee or assume any responsibility for its content.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.,

500

Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport

Boulevard, Boston, MA 02110

863536.1.0

© 2018 FMR LLC. All rights reserved.

1 Results from the 9th annual survey on corporate

Health & Well-being from Fidelity Investments® and the

National Business Group on Health® includes responses from

162 jumbo, large and mid-sized organizations. The online survey was

fielded during November and December 2017 among National Business Group

on Health members and clients of Fidelity Investments.

2

All third-party references have been approved and used with permission.

3

Unless otherwise noted, data represents the Fidelity Investments Total

Well-Being Research online survey of 9,315 active Fidelity 401(k) and

403(b) participants from across the United States. The survey was

conducted by Greenwald and Associates, an independent third-party

research firm, on behalf of Fidelity in September 2017.