BOSTON--(BUSINESS WIRE)--5G smartphones will carry wholesale costs of more than $750 when they are introduced in 2019, translating to retail prices of as much as $1,000 or more. According to a series of newly published reports from the Strategy Analytics Device Technologies practice, 5G device prices will decline at a much slower pace compared to 3G and 4G handsets. Subsidies will be necessary to make 5G smartphones affordable to the mass market.

The report 5G’s Dirty Little Secret: Subsidies Must Return (available to clients here) concludes:

- 5G is not a panacea for the industry ills whether one is an operator or a device vendor. There is a lot of hard work, experimentation and failure likely over the next 5 years.

- There is every reason to think that the transition to 5G will result in a reordering of the current list of top smartphone makers just as happened with 2G, 3G and 4G.

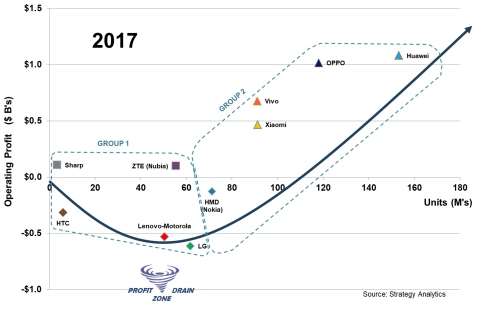

- Vendors must strive to be global and minimize market specific SKUs where possible, building from a global platform or be local, focused and niche. The profit drain zone is positioned at the bottom of the U-curve with volume between 40 and 60M where profits are almost impossible to realize.

- Lenovo-Motorola, LG, and ZTE to name a few are in perilous positions and must carefully execute a pragmatic 5G strategy or risk surging losses.

- Samsung and Huawei each have challenges to maintain growth with 5G due to their limited presence in China and USA respectively.

Senior Analyst Ville-Petteri Ukonaho commented “5G has many more risks than rewards for most vendors in the short term. We believe caution about the speed of 5G ramp up and slope of the price/performance curve for devices is critical. Unlike current generation smartphones, 5G devices will require a number of changes in order to provide the best performance, including new chipsets and additional antennas. 5G devices will be the most complex and expensive ever.”

Ken Hyers, Director of Emerging Device Technologies agrees “It requires magical thinking to expect that consumers are going to rush to buy 5G smartphones that are bigger, and more expensive than any phone that they’ve ever bought before. Only 9% of Chinese customers, for example, buy phones whose wholesale prices start at US$500 and up. Without scale from China to drive device prices lower, can 5G forecasts from operators and device vendors really live up to their lofty ambitions? Slower uptake is a real threat unless someone closes the gap to 4G performance.”

David Kerr, SVP adds “The history of the mobile industry teaches us that with every transition from one wireless generation to the next at least one top vendor has found itself wrong-footed by the transition and has seen its market share collapse (i.e. Motorola and Nokia). Could Huawei be the next? Or will Samsung’s lack of presence in China see it vulnerable?”

Additional insights on the 5G market available include:

- Global 5G Smartphone Wholesale ASP & Revenue Forecast: 2018 to 2025 (link)

- Global 5G Handset Forecast: 2015 to 2023 (link)

About Strategy Analytics

Strategy Analytics, Inc. provides the competitive edge with advisory services, consulting and actionable market intelligence for emerging technology, mobile and wireless, digital consumer and automotive electronics companies. With offices in North America, Europe and Asia, Strategy Analytics delivers insights for enterprise success.